===============================================

Introduction

Perpetual futures have emerged as one of the most important trading instruments in modern financial markets, especially for hedge funds that require flexibility, leverage, and efficient capital allocation. Unlike traditional futures contracts with expiry dates, perpetual futures have no maturity, making them uniquely attractive for long-term hedging and speculative strategies. However, the hedge fund use of perpetual futures order types is not uniform—it varies significantly depending on risk appetite, liquidity needs, and alpha generation models.

In this article, we will explore how hedge funds leverage different perpetual futures order types, compare at least two different trading approaches, highlight their advantages and disadvantages, and recommend optimized strategies. We will also integrate practical experiences, institutional insights, and the latest industry developments.

Understanding Perpetual Futures

What Are Perpetual Futures?

Perpetual futures are derivative contracts designed to mimic spot market prices while allowing leveraged trading without expiration. They use funding rates to balance long and short positions, ensuring that prices remain close to the underlying asset.

Why Hedge Funds Use Perpetual Futures

- Leverage & Capital Efficiency: Hedge funds can amplify exposure with less capital.

- Hedging: Useful for offsetting risks in spot and options portfolios.

- Liquidity: Perpetual futures are often more liquid than dated futures.

- Flexibility: No need to roll contracts as with quarterly futures.

Key Perpetual Futures Order Types

Hedge funds must carefully select order types to balance execution speed, slippage, and market impact.

1. Market Orders

- Definition: Immediate execution at the best available price.

- Advantages: Fast execution, useful during volatility.

- Disadvantages: Higher slippage risk, unsuitable for large positions.

2. Limit Orders

- Definition: Executes only at the specified price or better.

- Advantages: Better control over entry/exit price, useful for scaling strategies.

- Disadvantages: Risk of non-execution in fast-moving markets.

3. Stop Orders

- Definition: Triggered once a specified price is reached, turning into a market order.

- Advantages: Essential for stop-loss protection and trend following.

- Disadvantages: Can lead to unfavorable fills in thin liquidity.

4. Conditional Orders

- Definition: Orders that execute only when specific conditions are met.

- Advantages: Allows complex strategies such as breakout and mean reversion.

- Disadvantages: Complexity increases execution risk if poorly calibrated.

Two Hedge Fund Strategies Using Perpetual Futures Order Types

Strategy A: High-Frequency Hedging with Market & Conditional Orders

Hedge funds engaged in high-frequency trading (HFT) often rely on market and conditional orders to capture micro-opportunities.

Strengths:

- Fast execution reduces latency arbitrage risk.

- Conditional orders allow dynamic hedging based on volatility spikes.

- Fast execution reduces latency arbitrage risk.

Weaknesses:

- Higher transaction costs due to frequent executions.

- Vulnerable to slippage in low-liquidity periods.

- Higher transaction costs due to frequent executions.

Strategy B: Risk-Adjusted Positioning with Limit & Stop Orders

Macro hedge funds and systematic managers frequently use limit and stop orders to manage exposure.

Strengths:

- Limit orders reduce slippage and improve entry precision.

- Stop orders act as a risk management tool against drawdowns.

- Limit orders reduce slippage and improve entry precision.

Weaknesses:

- Delayed execution may result in missed opportunities.

- Stop orders can trigger prematurely during volatility clusters.

- Delayed execution may result in missed opportunities.

Recommended Hybrid Approach

The optimal strategy for many hedge funds is a hybrid system combining conditional, limit, and stop orders. By dynamically adjusting execution style based on market conditions, hedge funds can:

- Use limit orders for structured entries.

- Deploy conditional stop orders for downside protection.

- Switch to market orders during high-liquidity bursts.

This combination allows both cost efficiency and robust risk management.

Institutional Considerations

Execution Algorithms and Smart Order Routing

Hedge funds rarely rely on manual order placement. Instead, they implement algorithmic execution systems that optimize based on liquidity pools, depth of market, and volatility forecasts.

This is closely related to how to choose the right order type for perpetual futures, since algorithms often decide dynamically whether a market, limit, or stop order is more efficient in a given situation.

Risk Management Integration

Perpetual futures order types also align with how to minimize risk with order types in perpetual futures, especially when funds must hedge large directional exposure. For instance, stop orders and trailing stop-losses are essential to avoid catastrophic losses during market crashes.

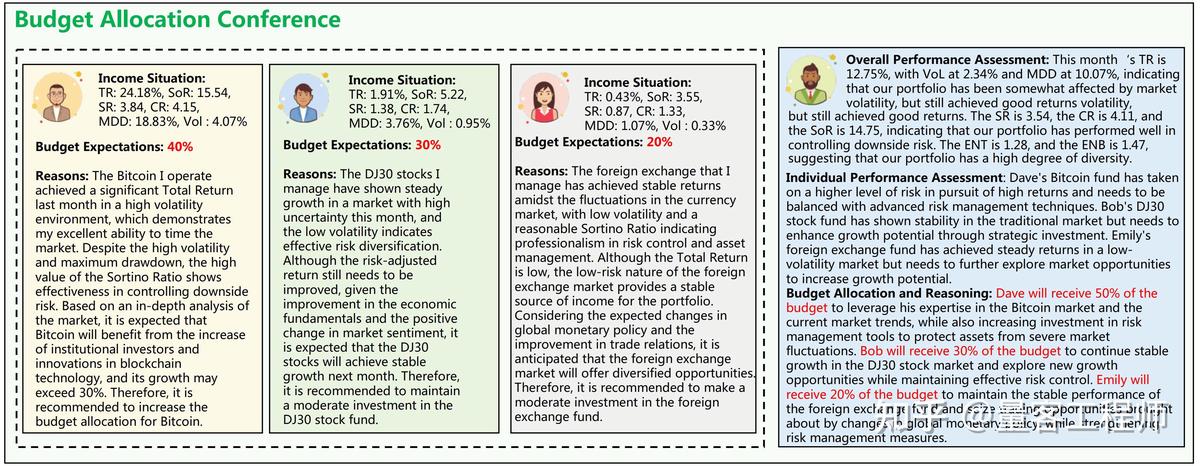

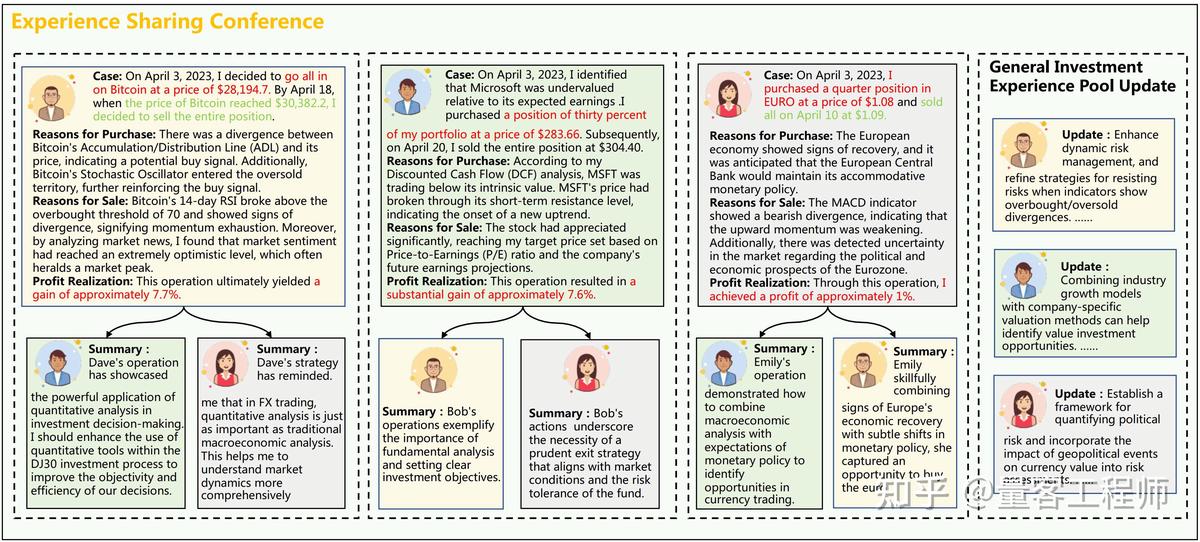

Visual Representation

Comparison of execution efficiency across market, limit, stop, and conditional orders in hedge fund strategies.

Current Trends in Hedge Fund Use of Perpetual Futures

- AI-Driven Execution: Machine learning models analyze order book imbalances to select optimal order types.

- Cross-Exchange Arbitrage: Hedge funds execute different order types across exchanges for spread capture.

- DeFi Adoption: On-chain perpetual futures introduce smart contract–based conditional orders.

- Risk Overlay Systems: Institutions are increasingly embedding stop-loss frameworks into execution algorithms.

FAQ (Frequently Asked Questions)

1. Why do hedge funds prefer perpetual futures over traditional futures?

Hedge funds prefer perpetual futures because they eliminate the need to roll contracts, provide higher liquidity, and allow continuous hedging. This reduces operational complexity and slippage compared to quarterly futures.

2. What is the most common order type hedge funds use in perpetual futures?

There is no single dominant order type—usage depends on strategy. However, limit orders are widely favored for execution efficiency, while stop orders are essential for institutional risk management. Market orders are typically reserved for urgent entry/exit situations.

3. How do hedge funds manage slippage and execution risk in perpetual futures?

They deploy execution algorithms that adapt order types dynamically, splitting large orders into smaller tranches and routing across liquidity venues. Conditional orders also help reduce exposure to sudden volatility.

Conclusion

The hedge fund use of perpetual futures order types is a critical determinant of execution quality, risk control, and overall strategy performance. By understanding the strengths and limitations of market, limit, stop, and conditional orders, hedge funds can design tailored execution frameworks that optimize both alpha generation and capital protection.

In practice, a hybrid approach combining limit precision, stop protection, and conditional flexibility offers the most balanced results. As algorithmic execution and DeFi innovation continue to advance, hedge funds will increasingly rely on adaptive order type strategies to stay competitive.

If you found this analysis insightful, share it with your network and join the discussion—what order type strategies do you think are most effective in perpetual futures trading?

Would you like me to also prepare an SEO-optimized meta description (around 160 characters) and title tag for this article so you can use it directly for publishing?