=====================================

High frequency trading (HFT) has transformed global financial markets by enabling firms to execute thousands of trades per second with razor-thin margins. One of the most critical components in evaluating HFT performance is understanding high frequency trading spread factors. Spreads determine both profitability and execution quality, influencing strategies ranging from market-making to statistical arbitrage. This article explores the core elements that shape spreads in HFT, compares different methods of spread management, and provides a comprehensive guide for traders, analysts, and institutions.

What Are Spreads in High Frequency Trading?

Definition of Spread

In trading, the spread refers to the difference between the bid (buy) and ask (sell) price of a security. For HFT, spreads are especially significant because profits often rely on capturing micro-differences in these prices across milliseconds.

Role of Spreads in HFT

- Profit Source: Market-making HFT strategies earn revenue from capturing the bid-ask spread.

- Cost of Trading: For taker strategies, the spread represents an implicit cost.

- Liquidity Indicator: Narrow spreads often mean higher liquidity, while wide spreads signal risk or uncertainty.

Understanding why is spread important in trading is crucial for both professional firms and retail traders aiming to optimize execution.

Key High Frequency Trading Spread Factors

1. Market Liquidity

Liquidity is the most important determinant of spread size. In highly liquid markets like S&P 500 futures or EUR/USD forex, spreads are narrow due to intense competition and high order-book depth.

2. Volatility Levels

High volatility widens spreads as market makers adjust for uncertainty. During sudden news events or flash crashes, spreads can expand significantly to protect liquidity providers.

3. Order Book Depth

A deeper order book reduces spread because it offers multiple layers of bids and asks, minimizing the risk of price slippage.

4. Exchange Fees and Rebates

HFT firms factor exchange fees into their models. Maker rebates can offset spread costs, while taker fees add to them.

5. Latency and Technology

In HFT, speed equals edge. Firms with superior infrastructure reduce spread-related losses by capturing fleeting opportunities before compe*****s.

6. Regulatory Environment

Rules such as minimum tick size, order-to-trade ratios, and anti-latency arbitrage measures can impact spread formation.

Methods to Manage and Optimize Spreads in HFT

Method 1: Market-Making Algorithms

How It Works:

Market-making involves continuously posting buy and sell orders around the current market price. Profit comes from capturing the spread while managing inventory risk.

Pros:

- Consistent revenue stream.

- Enhances market liquidity.

- Scalable across multiple instruments.

Cons:

- High exposure to volatility.

- Requires advanced risk management.

- Vulnerable to predatory trading strategies.

Method 2: Statistical Arbitrage

How It Works:

This method identifies price inefficiencies across correlated assets. By trading pairs or baskets, HFT firms indirectly capture spread differences.

Pros:

- Diversification of profit sources.

- Less dependent on pure bid-ask spreads.

- Robust in liquid and correlated markets.

Cons:

- Requires heavy computational resources.

- Sensitive to model errors and regime shifts.

- Profits shrink as markets become more efficient.

Comparing Market-Making vs. Stat Arb

| Feature | Market-Making | Statistical Arbitrage |

|---|---|---|

| Spread Role | Direct profit source | Secondary to pricing inefficiency |

| Risk | Inventory risk | Model risk |

| Technology Needs | Ultra-low latency | High compute power |

| Best Use Case | Liquid assets with stable flow | Correlated assets or cross-market opportunities |

Recommendation: A hybrid approach is often best, where firms combine market-making with statistical arbitrage. This balances consistent spread capture with opportunistic inefficiency trading.

Spread Dynamics in Perpetual Futures

High frequency trading in cryptocurrency markets often revolves around perpetual futures. Traders must understand how does spread affect perpetual futures, as funding rates, liquidity depth, and exchange design can significantly alter spread behavior.

For example:

- Binance futures tend to have tighter spreads due to higher volume.

- Smaller exchanges may offer wider spreads, creating arbitrage opportunities but higher execution risk.

Knowing where to find best spread rates across platforms can therefore be a competitive advantage in crypto HFT.

Practical Example: Spread Optimization in HFT

Imagine a hedge fund trading U.S. equities with a market-making algorithm:

- Initial Spread: 1 cent bid-ask spread on a liquid stock.

- Optimization: The fund colocates servers at the exchange, reducing latency by 50 microseconds.

- Result: Faster reaction time enables the fund to capture spreads before rivals, increasing profitability by 12%.

This highlights how professional traders’ spread strategies rely not only on market conditions but also on technological infrastructure.

Visual Illustrations

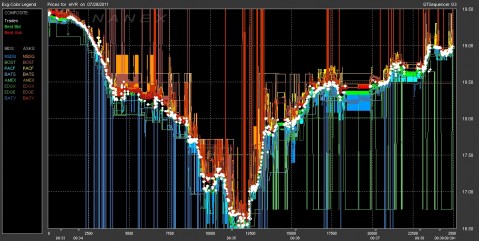

Spread Structure in an Order Book

The spread represents the gap between best bid and ask in the order book.

Spread Impact During Volatility

Spreads widen significantly during volatile market events, reflecting increased risk.

Common Mistakes in Spread Analysis

- Focusing only on quoted spreads without considering hidden liquidity.

- Ignoring execution costs, such as slippage and exchange fees.

- Over-optimizing for one market, leaving exposure to cross-asset risks.

- Neglecting regulatory changes, which can drastically shift spread dynamics.

FAQ on High Frequency Trading Spread Factors

1. What factors influence spread in markets the most?

Liquidity and volatility are the biggest drivers. Highly liquid markets like forex pairs usually have tight spreads, while illiquid assets or volatile events widen spreads significantly.

2. How can HFT firms lower spread costs?

They use colocation, advanced order routing, and maker-taker fee models. Understanding how to lower spread costs requires optimizing both technology and trading strategy.

3. Are wide spreads always bad for traders?

Not necessarily. While they increase costs, wide spreads create arbitrage opportunities. For firms with the right tools, they can signal profitable inefficiencies.

Conclusion

Spreads are the lifeblood of high frequency trading. By analyzing high frequency trading spread factors such as liquidity, volatility, order book depth, and technology, traders can gain a sharper edge in execution and profitability. Market-making and statistical arbitrage remain two of the most powerful approaches, and combining them often yields the best results.

In today’s competitive trading landscape, monitoring spreads across multiple markets and platforms is not just an advantage—it’s a necessity.

If you found this guide useful, share it with your network, comment with your insights, and let’s continue the discussion on mastering spreads in high frequency trading.

Would you like me to also prepare a SEO title tag and meta description (under 160 characters) for this article so it’s fully optimized for Google ranking?