=================================================

Introduction

Perpetual futures have become one of the most actively traded instruments in cryptocurrency markets. Unlike traditional futures, they do not have an expiration date, which makes them appealing to both retail and institutional traders. However, with this flexibility comes significant risk. Understanding how to identify risk factors in perpetual futures is essential for anyone looking to build a sustainable trading strategy.

This article will explore the most critical risks in perpetual futures trading, compare multiple methods for risk identification, and provide actionable strategies to help traders mitigate potential losses. By blending personal trading experiences with professional frameworks and recent industry developments, we will build a comprehensive roadmap for perpetual futures risk assessment.

What Are Perpetual Futures and Why Do They Carry Unique Risks?

Perpetual Futures Explained

Perpetual futures are derivative contracts that allow traders to speculate on the price of an underlying asset—usually a cryptocurrency—without ever taking ownership of the asset. The defining feature is that these contracts do not expire, unlike standard futures contracts.

Why Risks Are Higher in Perpetual Futures

Perpetual contracts amplify both opportunities and risks because of:

- Leverage: Traders can control large positions with a small margin, leading to high profits or catastrophic losses.

- Funding Rates: Payments exchanged between long and short traders to anchor contract price to spot markets can erode profits.

- High Volatility: Crypto markets are prone to sudden moves, which can liquidate leveraged positions quickly.

These dynamics explain why risk is higher in perpetual futures compared to spot trading or even traditional futures.

Key Risk Factors in Perpetual Futures

1. Market Volatility

Volatility is the most obvious and dangerous risk factor. Sudden price swings can trigger liquidation cascades, especially in highly leveraged positions.

2. Leverage-Induced Liquidations

Leverage magnifies both gains and losses. A 50x leverage trade requires only a 2% adverse move to wipe out an account.

3. Funding Rate Dynamics

Funding payments vary with market sentiment. Holding a long position during periods of positive funding rates can drain profits.

4. Counterparty & Exchange Risk

Even established exchanges have experienced outages, liquidity crunches, or hacks. A trader’s strategy may be sound, but execution risk remains.

5. Systematic Risks

Broader risks such as regulatory shifts, black swan events, or liquidity crunches in correlated markets (e.g., stablecoins) can have a compounding effect.

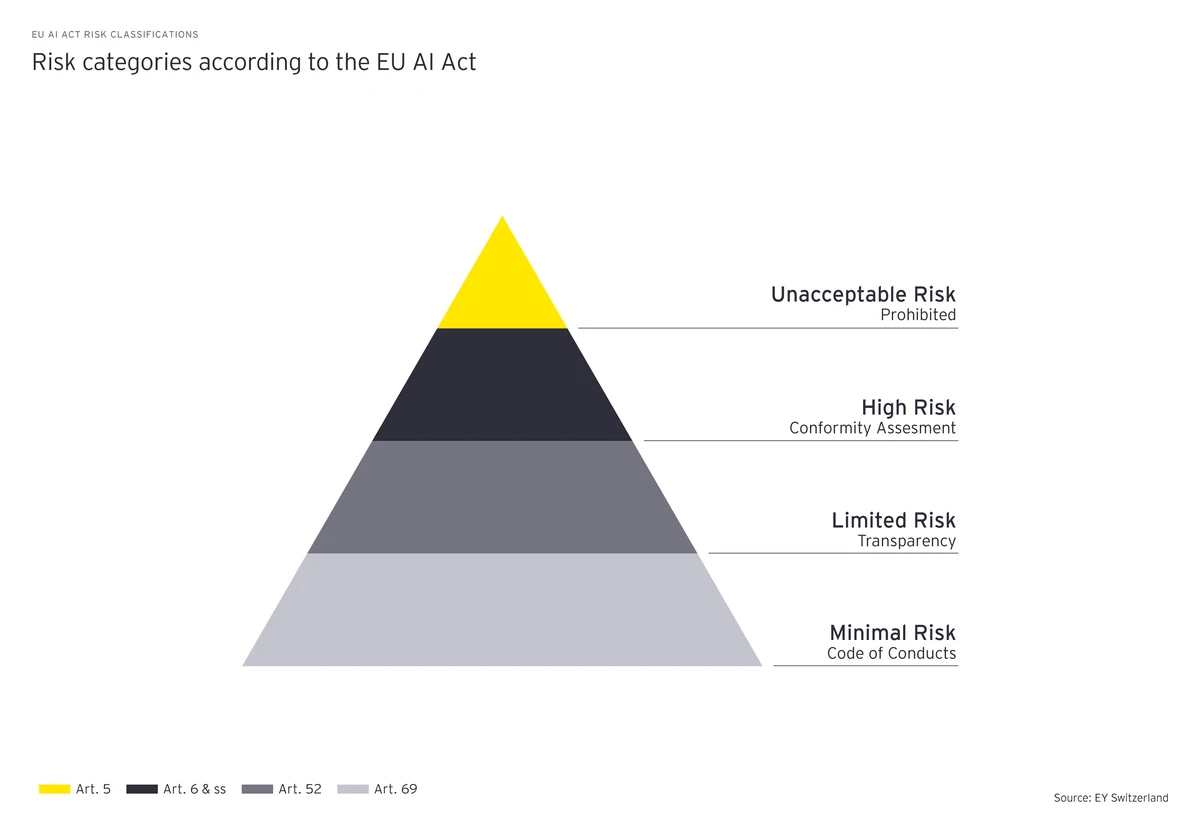

Risk factors in perpetual futures

Methods for Identifying Risk Factors in Perpetual Futures

Method 1: Quantitative Risk Modeling

Quantitative risk models use historical data, statistical distributions, and probability-based metrics to identify vulnerabilities.

- Value at Risk (VaR): Estimates the maximum expected loss within a given confidence interval.

- Monte Carlo Simulation: Models thousands of potential market outcomes to stress-test strategies.

- Scenario Analysis: Identifies how extreme conditions might affect a portfolio.

Pros: Data-driven, scalable, objective.

Cons: Models may fail under unprecedented market conditions (e.g., sudden exchange collapse).

This connects directly to how to use quantitative methods to assess risk in perpetual futures, which has become a cornerstone for professional traders.

Method 2: Qualitative and Behavioral Risk Assessment

Beyond numbers, traders must account for human and systemic factors:

- Exchange Transparency: Evaluating whether exchanges disclose funding rate mechanics and liquidation policies.

- Liquidity Depth: Assessing order book health to avoid slippage.

- Trader Psychology: Recognizing emotional biases that can lead to revenge trading or overleveraging.

Pros: Flexible, captures non-quantifiable risks.

Cons: Subjective, harder to standardize.

This ties closely to how to manage risk in perpetual futures, since a trader’s mindset and exchange selection are as critical as mathematical models.

Method 3: Hybrid Approach (Recommended)

In practice, the best solution is a hybrid risk assessment framework that combines:

- Quantitative metrics for objective measurement.

- Qualitative insights for real-world adaptability.

For example, when I traded ETH perpetual futures in 2021, a quantitative VaR analysis indicated low risk during a calm period. However, qualitative monitoring of exchange order books revealed thin liquidity. When volatility spiked, slippage caused much larger losses than the model predicted.

This demonstrates that risk management is strongest when multiple perspectives are used.

Risk assessment approaches comparison

Comparing Risk Identification Strategies

| Strategy | Advantages | Disadvantages | Best For |

|---|---|---|---|

| Quantitative Models | Precise, scalable, data-driven | Model risk, may fail in extreme cases | Institutional traders |

| Qualitative Assessment | Flexible, adaptable, intuitive | Subjective, hard to replicate | Retail traders, discretionary traders |

| Hybrid Framework | Balanced, comprehensive | Requires skill in both domains | Professionals & advanced traders |

Recommendation: For most traders, the hybrid approach provides the best balance of precision and adaptability.

Industry Trends in Perpetual Futures Risk Assessment

- AI-Powered Risk Prediction: Machine learning models are increasingly used to forecast liquidation probabilities.

- Portfolio Risk Balance: Institutions use dynamic hedging strategies to balance perpetual futures with options and spot holdings.

- Regulatory Monitoring: Governments are paying closer attention to leverage caps and exchange practices.

- Real-Time Risk Dashboards: Traders now use integrated dashboards that combine on-chain data, volatility indices, and exchange liquidity depth.

Real-World Applications

- Hedge Funds: Use advanced risk models to protect leveraged long/short crypto portfolios.

- Retail Traders: Apply funding rate monitoring tools to avoid holding costly positions.

- Institutions: Incorporate perpetual futures into hedging strategies while using risk assessment tools for institutional investors in perpetual futures.

FAQ: How to Identify Risk Factors in Perpetual Futures

1. What is the most important risk factor to watch in perpetual futures?

The most important risk factor is leverage-related liquidation risk. Even experienced traders underestimate how small price movements can erase positions. Risk control measures such as stop-loss orders and conservative leverage help reduce this exposure.

2. How can beginners reduce risk in perpetual futures trading?

Beginners should focus on risk mitigation techniques for beginners in perpetual futures, such as:

- Using low leverage (2x–5x).

- Limiting position sizes to a small percentage of portfolio value.

- Practicing on demo accounts before going live.

3. Do professional traders use different risk assessment tools?

Yes. Professionals use quantitative risk models for advanced traders in perpetual futures, such as Monte Carlo simulations and Bayesian probability models. They also use exchange APIs to track real-time liquidation levels and funding rate fluctuations.

Conclusion

Identifying risk factors in perpetual futures is not just about avoiding losses—it is about building a resilient trading system. By combining quantitative models with qualitative assessments, traders can prepare for both measurable and unexpected risks.

Whether you are a beginner or an institutional investor, focusing on risk identification is the foundation of success. For those who want a deeper dive, resources like where to find risk analysis for perpetual futures can provide structured learning paths and advanced frameworks.

If this guide helped you understand how to identify risk factors in perpetual futures, share it with your trading community, leave a comment with your experience, and let’s continue the discussion on best practices for risk management in the evolving crypto derivatives market.

Would you like me to create a step-by-step risk assessment checklist (downloadable PDF) that traders can use before entering any perpetual futures trade?