==================================================================

Understanding the dynamics of sell walls is crucial for traders, especially those participating in perpetual futures markets. A sell wall represents a significant concentration of sell orders at a specific price level, often signaling potential resistance that could influence market sentiment, liquidity, and price action. In this comprehensive guide, we will explore the mechanics of sell walls, their impact on both retail and professional traders, and actionable strategies to navigate them effectively.

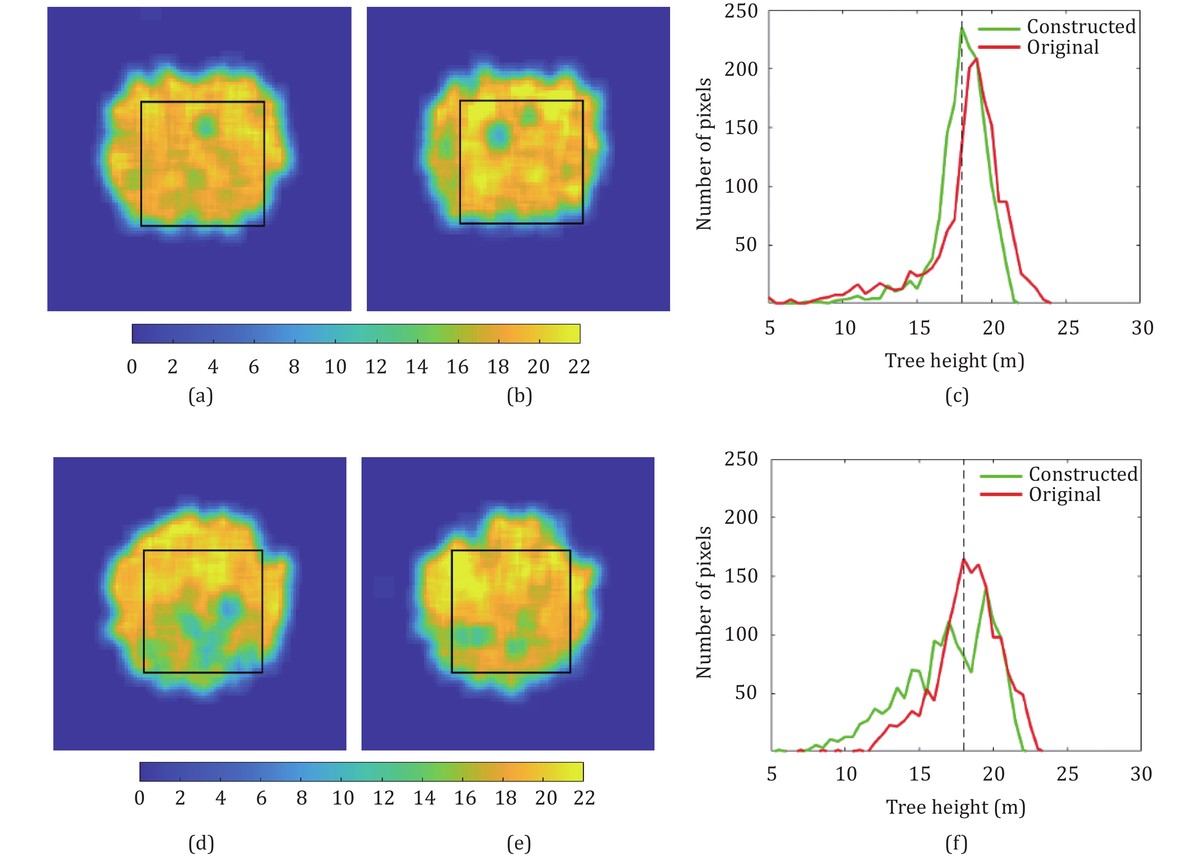

What Is a Sell Wall?

Definition and Core Concept

A sell wall occurs when a large number of sell orders are placed at a specific price point on the order book. This cluster of orders can create a psychological and technical resistance level, making it difficult for the price to rise above the wall.

Example in Perpetual Futures Markets

In perpetual futures trading, sell walls can affect leverage positions and funding rates. For instance, if a prominent sell wall exists above the current market price, leveraged traders may hesitate to initiate long positions, anticipating limited upward momentum.

Sell wall illustrated on a perpetual futures order book.

How Sell Walls Form

Market Psychology and Behavioral Factors

Sell walls often form due to market participants’ expectations of price resistance. Large holders, or “whales,” may place substantial sell orders to protect profits, discourage aggressive buying, or signal market sentiment.

Technical Triggers

Algorithmic trading bots often contribute to sell walls. When specific price thresholds are triggered, bots automatically generate sell orders, reinforcing the wall. Understanding these triggers is essential for traders analyzing market depth.

Methods to Analyze Sell Wall Impact

Advanced Sell Wall Analysis Techniques for Traders

- Order Book Depth Analysis

Traders monitor the cumulative volume at each price level to identify strong resistance points. Deep sell walls can indicate significant market hesitation.

- Volume Weighted Average Price (VWAP) Integration

Integrating sell wall data with VWAP can help estimate potential price reversals and better time entry and exit points.

Analyzing sell walls through order book depth visualization.

How Sell Wall Influences Perpetual Futures Trading

Sell walls impact perpetual futures in several ways:

- Price Action Resistance: The price often struggles to break through large sell walls, creating a temporary plateau.

- Liquidity Management: Traders must account for available liquidity, as sell walls can delay order execution.

- Funding Rate Considerations: The existence of sell walls affects market sentiment, potentially impacting funding rates and leveraged positions.

Strategies to Navigate Sell Walls

Strategy 1: Incremental Positioning

Traders can mitigate the impact of sell walls by scaling in gradually. Instead of executing a single large order, multiple smaller trades can avoid significant slippage.

Strategy 2: Counteracting with Momentum Indicators

Combining sell wall analysis with momentum indicators like RSI or MACD can reveal whether the market has sufficient buying power to overcome the resistance.

Comparing Strategies

| Strategy | Pros | Cons |

|---|---|---|

| Incremental Positioning | Reduces slippage | Slower execution |

| Momentum Indicators | Confirms breakout potential | Requires precise timing |

Monitoring and Predicting Sell Walls

Tools and Resources

- Sell Wall Detection Software for Quantitative Trading: Advanced platforms analyze real-time order book data to identify emerging sell walls.

- Historical Sell Wall Patterns: Tracking past sell wall formations helps predict potential resistance levels.

Key Metrics

- Cumulative Sell Volume: The total volume at the price level indicating wall strength.

- Order Flow Velocity: Measures how quickly the sell wall is being filled or canceled.

- Duration of Wall: How long the wall persists can indicate trader intentions.

Case Studies of Sell Wall Effects in Futures Markets

Example 1: Retail Trader Reaction

A sudden large sell wall caused retail traders to panic-sell, triggering a minor price dip before professional traders absorbed the liquidity and pushed the market higher.

Example 2: Institutional Investor Tactics

Institutions strategically place sell walls to manage market sentiment, prevent excessive bullish momentum, and optimize entry for long-term positions.

Case study visualization of sell wall influence on price.

Best Practices for Traders

- Always Monitor Order Book Depth: Knowing where sell walls exist can prevent unwanted slippage and losses.

- Combine Technical Indicators: Sell walls should not be analyzed in isolation; integrate with volume, momentum, and trend indicators.

- Use Risk Management: Always account for the potential breakout or removal of sell walls to minimize risk.

FAQ: Sell Wall Insights

1. How do I identify a sell wall in perpetual futures?

To identify a sell wall, analyze the order book for unusually large clusters of sell orders at a specific price. Monitoring cumulative volume and order book depth helps highlight these resistance points.

2. Why do sell walls form in perpetual futures markets?

Sell walls typically form due to large holders managing risk, algorithmic trading bots reacting to thresholds, or strategic positioning by institutional traders. They reflect psychological and technical resistance.

3. How should traders react to a sell wall?

Traders can react by scaling into positions incrementally, using momentum indicators to confirm potential breakouts, and implementing strict risk management to account for market fluctuations.

Conclusion

Understanding the intricacies of sell walls is essential for any serious perpetual futures trader. By combining order book analysis, momentum indicators, and risk management strategies, traders can navigate the market more effectively. Monitoring sell walls not only informs decision-making but also enhances the ability to anticipate price movements, ensuring a strategic advantage in volatile markets.

Encourage discussion and share your insights! Comment below on how you handle sell walls in your trading, or share this guide with your trading community to spread knowledge.