=================================================

Introduction

The perpetual futures market has transformed how traders engage with leverage in cryptocurrency trading. Unlike traditional futures contracts, perpetuals do not have expiry dates, making them highly attractive to both retail and institutional investors. However, the complexity of managing leverage in these markets requires innovative strategies that balance risk and reward effectively.

In this article, we explore innovative leverage methods for perpetual markets, compare traditional and modern approaches, and highlight actionable solutions that traders can implement. By blending professional experience with current industry trends, we provide a comprehensive guide designed to help traders manage leverage more effectively in perpetual markets.

Why Leverage Matters in Perpetual Futures

Leverage amplifies both gains and losses. In perpetual markets, traders can access leverage ratios ranging from 2x to over 100x, depending on the exchange. This flexibility opens doors to enhanced profitability but also increases liquidation risks.

Leverage is especially significant in perpetual swaps because these instruments are tied closely to the underlying spot market. High leverage without proper risk control can lead to rapid losses. This is why how to balance leverage and risk in perpetual swaps remains one of the most critical challenges for traders.

Traditional vs. Innovative Leverage Approaches

Traditional Methods

Fixed Leverage Ratios

Many traders stick to static leverage levels (e.g., 5x, 10x). This approach simplifies decision-making but lacks adaptability.- Pros: Easy to implement, predictable risk.

- Cons: Ignores market volatility, can lead to overexposure in high-risk periods.

- Pros: Easy to implement, predictable risk.

Cross vs. Isolated Margin

- Cross margin uses the entire account balance to cover margin requirements, reducing liquidation risk for one trade but increasing exposure to overall portfolio risk.

- Isolated margin limits risk to a specific position but requires active monitoring.

- Cross margin uses the entire account balance to cover margin requirements, reducing liquidation risk for one trade but increasing exposure to overall portfolio risk.

Innovative Methods

Dynamic Leverage Adjustments

Traders adjust leverage based on volatility indicators (e.g., ATR, Bollinger Bands). For example, reducing leverage during volatile markets and increasing leverage in stable conditions.- Pros: Enhances flexibility, aligns risk with market conditions.

- Cons: Requires automation or disciplined manual adjustments.

- Pros: Enhances flexibility, aligns risk with market conditions.

Volatility-Weighted Leverage

By tying leverage ratios to volatility metrics, traders ensure that exposure reduces when markets are unpredictable.- Pros: Protects capital during extreme volatility.

- Cons: May limit profits in strong trending markets.

- Pros: Protects capital during extreme volatility.

Algorithmic Leverage Scaling

With algorithmic trading systems, leverage automatically scales up or down based on pre-set conditions (trend confirmation, liquidity depth, or funding rates). This method aligns well with advanced traders and institutions.

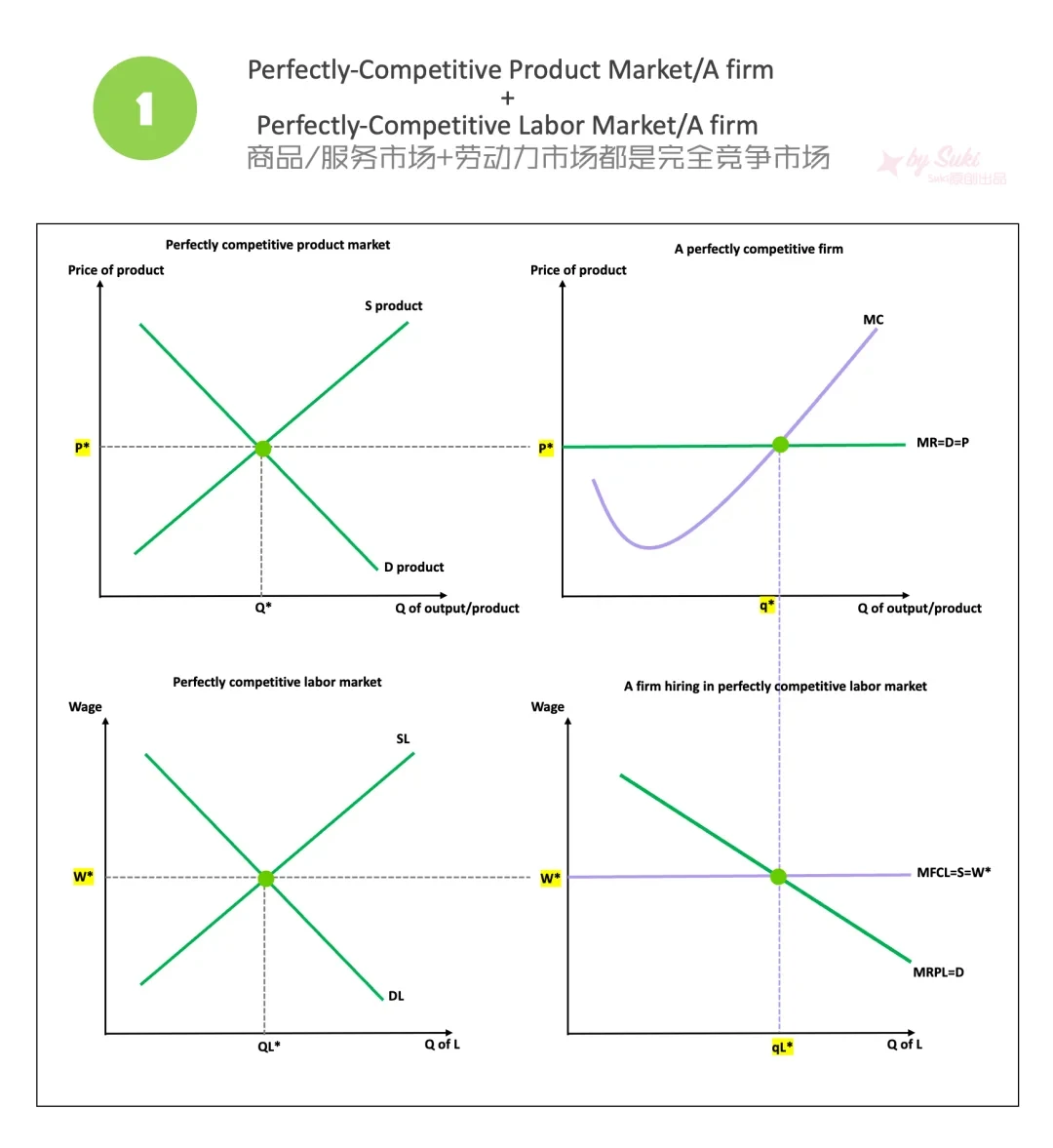

Dynamic leverage scaling based on volatility indicators

Comparing Innovative Methods

| Method | Ideal For | Advantages | Limitations |

|---|---|---|---|

| Fixed Leverage | Beginners | Simple, predictable | Poor adaptability |

| Dynamic Leverage Adjustments | Intermediate traders | Flexible, reduces risk in volatility | Requires monitoring/automation |

| Volatility-Weighted Leverage | Risk-conscious investors | Strong capital protection | Misses opportunities in low-volatility phases |

| Algorithmic Leverage Scaling | Professional traders, quants | Precise, automated, scalable | Technical expertise required |

Recommendation: For most traders, dynamic leverage adjustments offer the best balance between innovation and practicality. Professionals with access to algo systems should consider algorithmic scaling for optimal performance.

Practical Implementation in Perpetual Markets

Step 1: Analyze Market Conditions

Use volatility metrics (ATR, VIX proxies, implied volatility) to understand market risk before applying leverage.

Step 2: Apply Tiered Leverage

Set leverage tiers:

- Low leverage (2x–3x) in volatile markets.

- Medium leverage (5x–10x) in trending markets.

- Higher leverage (15x+) only in exceptional setups with strong confirmation.

Step 3: Incorporate Risk Management

Pair leverage strategies with stop-losses, funding rate monitoring, and diversification. This ties into how to manage risks with leverage in perpetual contracts, ensuring sustainability over time.

Step 4: Backtest and Optimize

Before deploying, test strategies on historical data. Platforms like Bybit, Binance Futures, and QuantConnect allow paper trading or simulations.

Case Study: Dynamic Leverage in Crypto Perpetuals

A retail trader applied a volatility-weighted leverage strategy on Bitcoin perpetual futures. By reducing leverage to 3x during high volatility and increasing to 8x in stable trends, the trader improved their risk-adjusted returns by 20% compared to a fixed 10x leverage approach.

Risk-adjusted performance improvement from volatility-based leverage

Advanced Industry Trends in Perpetual Market Leverage

AI-Driven Leverage Optimization

Machine learning models analyze market conditions in real-time and adjust leverage dynamically for optimal exposure.

Institutional Adoption

Hedge funds and professional traders are deploying algorithmic leverage scaling, integrating it with portfolio-level risk systems.

Retail-Friendly Tools

Exchanges are launching built-in risk control mechanisms (auto-reduce leverage, liquidation protection), giving retail traders safer ways to experiment with leverage.

FAQs

1. What is the safest leverage level in perpetual markets?

The safest leverage depends on your trading style and risk appetite. For beginners, sticking to 2x–3x is advisable. Professional traders using advanced risk management may safely use higher leverage.

2. How do funding rates affect leveraged perpetual positions?

Funding rates are periodic payments between long and short traders. High funding rates can erode leveraged positions if held too long. Incorporating funding rate analysis into leverage decisions is crucial.

3. Can innovative leverage methods eliminate liquidation risk?

No method can fully eliminate liquidation risk. However, dynamic and volatility-weighted approaches significantly reduce the probability of forced liquidations by aligning leverage with market conditions.

Conclusion

Innovative leverage methods for perpetual markets provide traders with more control, flexibility, and sustainability. From dynamic leverage adjustments to algorithmic scaling, traders now have tools to balance profitability with capital protection.

For traders asking “Where to find best leverage strategies for perpetual trading”, the key lies in understanding both traditional and modern approaches, backtesting rigorously, and choosing a method that aligns with personal risk tolerance.

Roadmap of leverage innovation in crypto perpetual markets

Call to Action

If you found this guide useful, share it with your trading community. Comment below with your experiences in using leverage—what methods you prefer, what challenges you face, and how you’ve adapted. Together, we can refine innovative approaches for safer and more profitable perpetual market trading.