==================================

The spot market represents the backbone of global trading, providing immediate execution and settlement of assets. With growing demand for innovative spot market exploration, traders, analysts, and institutions are seeking advanced techniques to optimize trading strategies, minimize risk, and gain competitive advantages. This comprehensive guide delves into modern approaches, compares methods, and offers actionable insights for both retail and professional traders.

Understanding the Spot Market

The spot market, also known as the cash market, is where financial instruments like stocks, commodities, or cryptocurrencies are traded for immediate delivery. Unlike derivatives, transactions settle “on the spot,” providing transparency and liquidity.

Why the Spot Market is Important for Traders

Spot trading enables traders to:

- Access real-time pricing and liquidity.

- Hedge derivative positions efficiently.

- Execute arbitrage strategies between exchanges.

Understanding why spot market is important for traders helps participants make informed decisions about allocation and timing, especially when paired with futures or perpetual contracts.

Key Trends Driving Innovative Spot Market Exploration

Innovation in the spot market is fueled by technology, data analytics, and algorithmic trading. Key trends include:

- Algorithmic Spot Trading: Automating buy/sell decisions based on real-time indicators.

- Data-Driven Decision Making: Using quantitative analysis to predict price movements.

- Integration with Futures Markets: Leveraging spot market insights for derivative strategies.

- Blockchain and Tokenization: Increasing transparency and accessibility in digital asset markets.

Strategy 1: Quantitative Spot Market Analysis

Description

Quantitative methods allow traders to analyze historical and real-time data to identify trends, volatility patterns, and arbitrage opportunities.

Techniques

- Statistical Arbitrage: Identifying pricing inefficiencies across assets.

- Predictive Modeling: Machine learning models forecast short-term price movements.

- Risk Metrics Calculation: Using value-at-risk (VaR) and other metrics to manage exposure.

Advantages

- Enables data-driven decisions.

- Reduces emotional trading errors.

- Scalable across multiple assets and exchanges.

Drawbacks

- Requires access to high-quality datasets.

- Complex modeling can demand substantial computational resources.

Quantitative Spot Market Analysis Dashboard

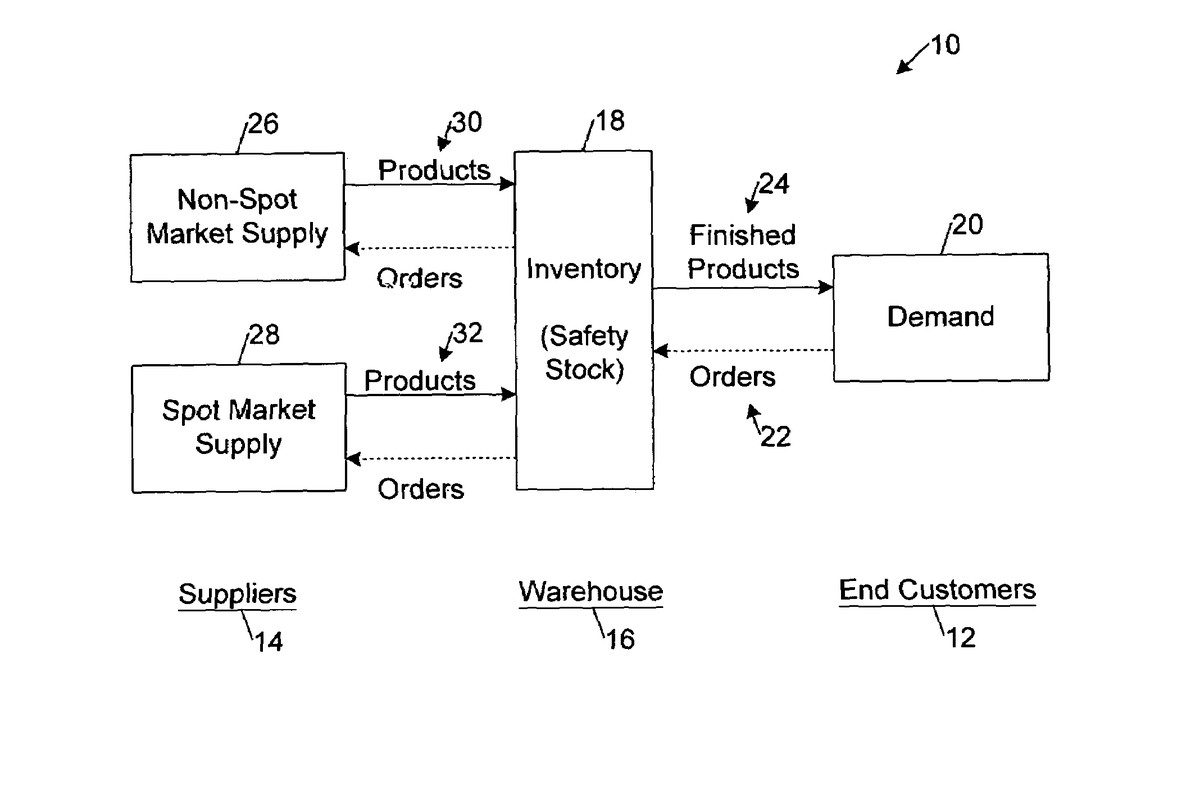

Strategy 2: Integration with Perpetual Futures

Description

Using spot market insights to optimize derivative strategies is a key innovation. Traders monitor spot prices to adjust positions in perpetual futures contracts dynamically.

Techniques

- Hedging: Spot positions offset futures exposure to reduce risk.

- Basis Trading: Exploiting the difference between spot and futures prices.

- Liquidity Monitoring: Using spot market depth to predict futures volatility.

Advantages

- Enhances predictive accuracy for derivatives.

- Reduces arbitrage risk.

- Provides real-time feedback for strategy adjustment.

Drawbacks

- Requires sophisticated execution systems.

- Spot-futures misalignment can create temporary losses.

Comparing Quantitative Analysis and Spot-Futures Integration

| Approach | Advantages | Drawbacks | Best Use Case |

|---|---|---|---|

| Quantitative Spot Analysis | Data-driven insights, scalable | Requires high-quality data and computing | Retail and institutional algorithmic trading |

| Spot-Futures Integration | Hedging, predictive accuracy | Complex execution, temporary basis risk | Professional traders managing derivatives |

Recommendation: A hybrid approach combining quantitative analysis with derivative integration maximizes efficiency, minimizes risk, and leverages real-time opportunities.

Implementing Innovative Practices

Advanced Trading Platforms

Modern spot market platforms offer advanced analytics, AI-driven signals, and API access for automated trading. These tools allow traders to integrate custom models and implement strategies at scale.

Risk Management Solutions

Effective exploration requires robust risk management, including stop-loss protocols, exposure limits, and scenario testing. Using how to minimize risk in spot market techniques ensures capital preservation in volatile conditions.

Training and Education

For traders and analysts, understanding where to learn quantitative analysis for futures provides foundational skills applicable to spot market exploration, enhancing predictive accuracy and strategic implementation.

Visualizing Spot Market Innovation

Spot Market Data Visualization

FAQ: Innovative Spot Market Exploration

1. How can beginners effectively trade in the spot market?

Start with small positions on highly liquid assets. Focus on learning market dynamics, reading order books, and understanding price action before deploying advanced quantitative strategies.

2. What role does data analysis play in spot trading?

Data analysis is critical for predicting trends, identifying arbitrage opportunities, and minimizing risk. Quantitative solutions allow traders to process large datasets efficiently and make informed decisions.

3. How do spot markets influence derivative trading?

Spot prices act as a reference for futures and options pricing. Real-time spot data helps adjust derivative positions, manage basis risk, and optimize hedging strategies.

Conclusion

Innovative spot market exploration empowers traders to leverage technology, data analytics, and market integration for better performance. By combining quantitative analysis with spot-futures integration, traders can optimize strategies, minimize risk, and capture real-time opportunities.

Share this guide with your trading community, and comment below with your experiences or strategies. Engaging in discussion helps improve collective understanding and promotes innovation in spot market trading.