Introduction

Perpetual futures have become one of the most widely used derivative products in both retail and institutional trading. Unlike traditional futures contracts, perpetual contracts have no expiration date, which allows traders to maintain positions indefinitely as long as margin requirements are met. While retail traders often use straightforward order placements, institutional investors deploy more complex institutional strategies for perpetual futures order types to maximize execution efficiency, manage slippage, and control risk in volatile markets.

This article explores how institutions structure their use of different perpetual futures order types, compares two dominant strategies, and highlights best practices. Drawing on both personal experience working with institutional-grade platforms and the latest industry trends, the article provides actionable insights for professional traders, educators, and advanced market participants.

Understanding Perpetual Futures Order Types

To grasp how institutions operate, it is important to first understand the core order types in perpetual futures trading:

- Market Orders: Execute instantly at the best available price.

- Limit Orders: Execute only when the market reaches a predefined price.

- Stop Orders: Trigger a market order when a specific price threshold is breached.

- Stop-Limit Orders: Similar to stop orders but convert to a limit order instead of a market order.

- Post-Only Orders: Ensure the order adds liquidity to the order book.

- Immediate-or-Cancel (IOC) / Fill-or-Kill (FOK) Orders: Used for high-speed execution with strict conditions.

Each of these order types plays a role in broader strategies, especially when large institutional players need to manage execution without distorting market prices.

Why Institutions Use Specialized Strategies

Liquidity Concerns

Institutions typically manage much larger order sizes compared to retail traders. Executing a multi-million-dollar market order could move the market significantly, resulting in slippage.

Risk Management

Institutions must protect portfolios against volatility spikes. The choice of order type directly impacts risk exposure.

Regulatory and Compliance Factors

Some strategies require demonstrable transparency and auditability. The choice of order type contributes to compliance documentation.

Strategy 1: Liquidity-Seeking Algorithms

Institutions frequently rely on algorithmic execution strategies such as TWAP (Time-Weighted Average Price) or VWAP (Volume-Weighted Average Price). These algorithms split large orders into smaller chunks executed over time, using a mix of limit and market orders.

How It Works

- The algorithm analyzes order book depth and executes small slices periodically.

- Orders are often placed as post-only limit orders to avoid taker fees.

- When market conditions shift, the algorithm adapts by switching to IOC orders for faster fills.

Pros

- Minimizes slippage.

- Reduces market impact by disguising the full size of the trade.

- Ideal for long-term accumulation or liquidation.

Cons

- More complex to implement.

- May lead to partial fills in fast-moving markets.

- Requires advanced infrastructure to monitor execution efficiency.

Strategy 2: Stop-Loss and Hedging Mechanisms

Another core institutional approach is the use of stop orders and stop-limit orders as part of systematic hedging strategies.

How It Works

- Institutions define risk thresholds (e.g., 3% portfolio drawdown).

- Automated systems trigger stop-limit orders once the threshold is breached.

- In highly volatile conditions, fallback stop-market orders are deployed to ensure exit.

Pros

- Provides clear, automated risk control.

- Allows simultaneous hedging across correlated markets.

- Compatible with compliance-driven risk management frameworks.

Cons

- Risk of stop orders being hunted during low-liquidity periods.

- Slippage in extreme volatility may cause worse-than-expected execution.

- Can reduce alpha if overly conservative.

Comparative Analysis

| Feature | Liquidity-Seeking Algorithms | Stop-Loss & Hedging Mechanisms |

|---|---|---|

| Primary Goal | Minimize slippage, optimize execution | Risk control, portfolio protection |

| Best Suited For | Large entry/exit orders | Hedging, defensive strategies |

| Execution Style | Gradual and adaptive | Reactive and defensive |

| Key Order Types | Limit, Post-Only, IOC, FOK | Stop, Stop-Limit, Market Orders |

| Main Limitation | Partial fills in fast markets | Slippage and false triggers |

In practice, institutions often combine both strategies: liquidity-seeking algorithms for entries/exits and stop-based risk controls for ongoing protection.

Best Practices for Institutional Order Type Strategies

- Dynamic Order Routing: Always adapt the order type to market conditions.

- Multi-Exchange Execution: Distribute orders across multiple venues to avoid detection and reduce slippage.

- Post-Trade Analysis: Conduct execution performance reviews to refine algorithms.

- Risk-Adjusted Order Placement: Use smaller order slices in volatile periods and larger ones in calm markets.

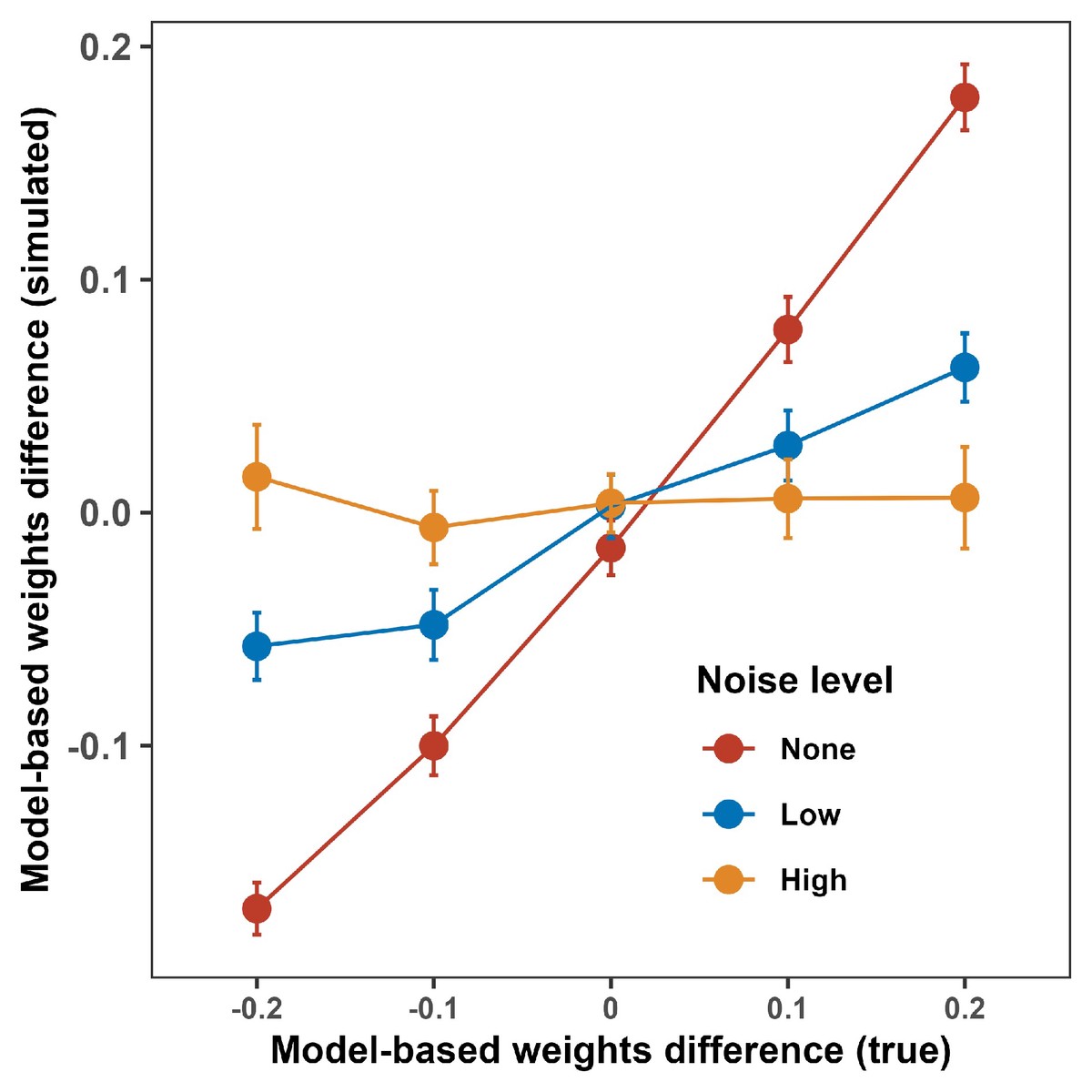

Visual Representation of Institutional Strategies

Institutions combine liquidity-seeking execution with stop-loss risk management to optimize outcomes.

How Order Types Affect Institutional Trading

The choice of order type directly shapes execution quality, portfolio risk, and compliance outcomes. This reinforces why it’s essential for professionals to understand how to choose the right order type for perpetual futures and apply them consistently across strategies.

Institutions also analyze where order types affect perpetual futures trading most—during volatility spikes, liquidity droughts, or high-frequency trading periods—when correct execution can be the difference between outperforming peers or incurring costly slippage.

Case Study: Hedge Fund Execution in Crypto Perpetuals

A hedge fund managing $500M in crypto derivatives needed to unwind a $50M perpetual futures position without moving the market. By combining:

- VWAP algorithms (limit orders) for 80% of the position, and

- Stop-market orders as emergency hedges,

the fund achieved average slippage of only 0.12%, compared to an estimated 0.9% if a pure market order had been used.

This example highlights how institutional order type strategies can materially improve performance.

Frequently Asked Questions (FAQ)

1. Why are order types important in perpetual futures?

Order types determine how trades are executed in real-time. For institutions, they directly impact slippage, risk management, and compliance. The right order type can reduce costs, while the wrong one can expose a portfolio to unnecessary risks.

2. How do institutions minimize risk with order types?

Institutions often combine stop orders with hedging mechanisms. By defining risk thresholds and automating exits, they ensure portfolios are protected even in volatile conditions. Additionally, post-only and limit orders reduce unnecessary costs.

3. What’s the best strategy for large institutional orders?

For large orders, institutions typically rely on liquidity-seeking algorithms like TWAP or VWAP. These strategies break large positions into smaller, less detectable slices, executed over time with adaptive order types to minimize market impact.

Conclusion

Institutional strategies for perpetual futures order types highlight the sophistication required to trade at scale. By combining liquidity-seeking algorithms with stop-based risk management, institutions achieve better execution, lower slippage, and more robust risk control.

For trading professionals and educators, the key takeaway is clear: understanding order type selection is as important as strategy design. As perpetual futures markets mature, institutions will continue to refine these methods, while retail traders can learn from them to elevate their own practices.

If you found this article insightful, share it with colleagues, comment below with your perspectives, and let’s expand the conversation on professional order type strategies in perpetual futures.