The concept of isolated margin is increasingly shaping modern trading strategies across crypto, forex, and derivatives markets. Traders worldwide are looking for isolated margin expert opinions to better understand how to manage risk, maximize leverage, and stay competitive in volatile conditions. This in-depth article provides professional insights, real-world experiences, and actionable methods to help both beginners and advanced traders master isolated margin trading.

Understanding Isolated Margin and Its Importance

Isolated margin is a trading mechanism that allows traders to allocate a specific amount of capital to a single position. Unlike cross margin—where the entire account balance backs all open positions—isolated margin confines the risk to a predetermined amount, protecting the rest of your funds if the market moves unfavorably.

Key Characteristics of Isolated Margin

- Fixed Capital Allocation: Only the margin assigned to a particular trade is at risk.

- Independent Position Control: Losses in one position do not impact other open trades.

- Enhanced Risk Management: Ideal for traders seeking to limit exposure on high-volatility assets.

For new investors, understanding how isolated margin works is crucial to navigating leveraged markets like crypto futures or perpetual swaps.

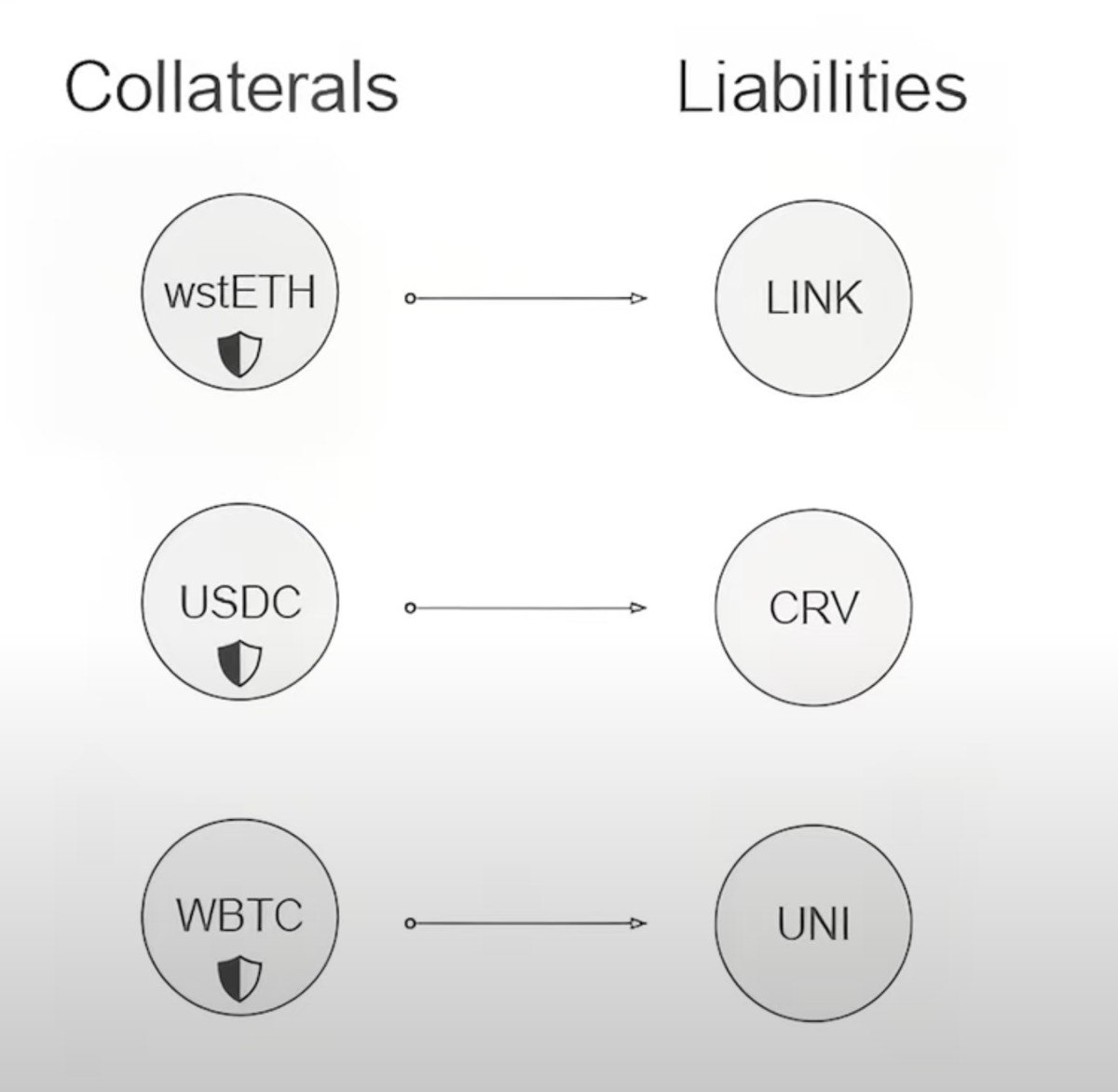

Comparison between isolated and cross margin trading highlighting risk containment.

Expert Insights on Isolated Margin

Industry professionals consistently emphasize isolated margin as a powerful risk management tool. According to seasoned traders, the ability to limit downside while maintaining leverage creates a balanced environment for both aggressive and conservative strategies.

Expert Perspective 1: Capital Preservation

Professional analysts highlight that isolated margin protects long-term portfolios:

“Allocating isolated margin allows traders to compartmentalize risk. A single market shock won’t drain your entire account, which is vital in unpredictable crypto markets.”

— Ethan Liu, Derivatives Market Analyst

Expert Perspective 2: Strategic Leverage

Others focus on flexibility:

“Isolated margin empowers traders to experiment with leverage without jeopardizing unrelated positions. It’s perfect for tactical trades or short-term market bets.”

— Maria Gonzales, Senior Crypto Strategist

Core Strategies for Isolated Margin Trading

To leverage isolated margin effectively, traders can adopt multiple strategies. Below are two proven approaches with different risk profiles.

1. Conservative Risk Management Strategy

This method focuses on capital preservation by using low leverage and strict position sizing.

How It Works

- Assign small, fixed amounts of margin to each trade.

- Use 1x–3x leverage to reduce liquidation risk.

- Monitor stop-loss levels carefully to maintain isolation.

Pros

- Lowers the chance of catastrophic loss.

- Ideal for beginners and risk-averse investors.

Cons

- Limits profit potential compared to higher leverage plays.

2. Aggressive High-Leverage Strategy

Advanced traders may use isolated margin to maximize gains on high-conviction trades.

How It Works

- Allocate a defined portion of capital to a single position.

- Apply leverage of 10x or more for short-term opportunities.

- Use technical analysis and automated stop-loss triggers.

Pros

- Potential for significant profits in volatile markets.

- Risk is confined to the allocated margin.

Cons

- Higher chance of liquidation if market moves unexpectedly.

- Requires experience and constant monitoring.

A risk/reward chart showing different isolated margin strategies.

Isolated Margin in Modern Markets

Isolated margin is especially popular in crypto trading platforms such as Binance, Bybit, and OKX. Its appeal extends to forex and commodities, where traders can protect capital while using leverage.

Emerging Trends

- AI-Driven Risk Controls: Trading bots now integrate isolated margin settings to automatically adjust leverage in real time.

- Institutional Adoption: Hedge funds increasingly use isolated margin for algorithmic strategies to limit risk on individual trades.

For hands-on learning, many traders explore Isolated margin strategies for beginners to understand platform-specific configurations and backtesting techniques.

Comparison: Isolated Margin vs Cross Margin

| Feature | Isolated Margin | Cross Margin |

|---|---|---|

| Risk Level | Limited to allocated margin | Higher (entire account balance) |

| Position Independence | Yes | No |

| Best Use Case | Short-term trades, high volatility | Long-term positions, hedging |

| Liquidation Impact | Only affects the isolated position | Can drain entire account balance |

Expert Recommendation: For new traders, isolated margin provides a safer entry point into leveraged markets.

Setting Up Isolated Margin: Step-by-Step

Select a Trading Pair

Choose assets with high liquidity, such as BTC/USDT or ETH/USDT.Activate Isolated Margin Mode

Platforms like Binance offer simple toggles under trade settings. Beginners often ask where to find isolated margin settings, which can usually be located in the leverage configuration menu.Allocate Margin

Decide the exact capital to risk. Start small to test strategies.Adjust Leverage

Select a leverage level based on your risk tolerance and market volatility.

A sample trading platform interface showing isolated margin configuration.

Risk Management Tips from Experts

Even with isolated margin, risk control remains essential. Professional traders recommend:

- Diversifying Positions: Avoid allocating large capital to a single trade.

- Monitoring Market Volatility: Use real-time analytics and alerts.

- Regularly Rebalancing Margin: Adjust as positions move or market conditions change.

Advanced users often explore Isolated margin risk management strategies to refine their approach.

Personal Experience: Lessons from the Field

As a trader with over five years of crypto futures experience, I’ve found isolated margin indispensable during high-volatility events like the 2020 Bitcoin halving. By isolating capital on high-leverage positions, I avoided account-wide liquidation while capitalizing on sharp price movements. The key takeaway: disciplined margin allocation turns potential chaos into opportunity.

FAQs: Expert Answers to Common Questions

1. Is isolated margin safer than cross margin?

Yes. Isolated margin limits potential losses to the margin allocated for each position. This provides a strong safety net, especially for new traders in volatile markets.

2. How do I calculate isolated margin requirements?

Most platforms provide calculators. Input trade size, leverage, and asset volatility to determine the required margin. As a rule of thumb, higher leverage reduces the required margin but increases liquidation risk.

3. Can isolated margin be used in perpetual futures?

Absolutely. Isolated margin is particularly effective in perpetual futures because it protects against rapid funding rate changes and sudden market swings.

4. What is the best leverage for beginners?

Experts recommend starting with 2x–3x leverage to balance potential profits with manageable risk. Gradually increase leverage as you gain experience.

Conclusion: Expert Recommendations for Traders

Isolated margin is more than just a trading feature—it’s a disciplined approach to risk management. By combining isolated margin expert opinions with careful strategy design, traders can:

- Limit exposure during volatile conditions.

- Experiment with higher leverage safely.

- Gain independence over each trading position.

Whether you are a beginner seeking safer leverage or a professional aiming to fine-tune high-risk trades, isolated margin offers the flexibility and protection needed in today’s fast-moving markets.

If you found these expert insights valuable, share this article with fellow traders or leave a comment below. Your experiences and questions help build a stronger, more informed trading community!