For crypto traders seeking to maximize returns while managing risk, isolated margin has become an essential tool. This guide provides a comprehensive look at isolated margin, including its mechanics, strategies, and practical applications for both beginner and experienced crypto enthusiasts. By the end of this article, you’ll understand how to use isolated margin effectively, compare strategies, and manage associated risks.

Understanding Isolated Margin

What is Isolated Margin?

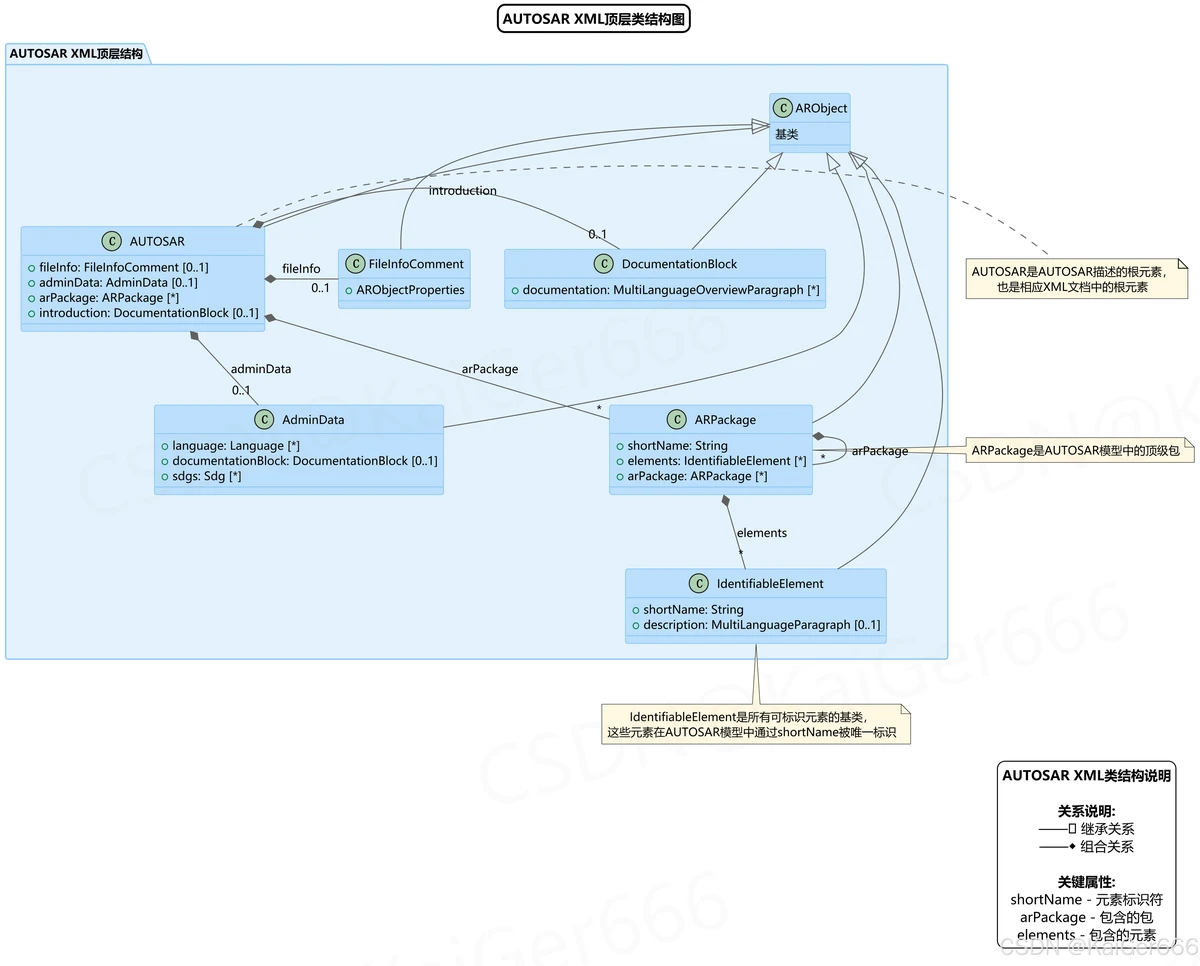

Isolated margin refers to a trading mechanism where the margin assigned to a particular position is segregated from the trader’s overall account balance. Unlike cross margin, where losses on one position can draw from the entire account, isolated margin limits the potential loss to the allocated amount.

Key Features:

- Position-specific margin allocation

- Limited risk exposure

- Flexible adjustment of margin per position

This system is particularly beneficial for crypto enthusiasts who want precise control over their leveraged trades.

Illustration showing isolated margin versus cross margin exposure.

Why Isolated Margin Matters

- Risk Management: Isolated margin ensures that losses are contained to a single position, protecting the broader portfolio.

- Leverage Control: Traders can adjust leverage on each position independently.

- Flexibility for Strategy: It allows for targeted risk-taking without affecting other holdings.

Integration Tip: Learn how to use isolated margin in perpetual futures to optimize leveraged trading while minimizing account-wide exposure.

Isolated Margin Mechanics

Setting Up an Isolated Margin Position

- Select the Trading Pair: Choose the crypto pair you wish to trade.

- Enable Isolated Margin Mode: On your trading platform, select “Isolated Margin” for the specific position.

- Allocate Margin: Decide how much capital to dedicate to the trade.

- Adjust Leverage: Set leverage according to your risk tolerance and market outlook.

Key Considerations:

- Margin allocation should reflect both capital availability and risk appetite.

- Monitor margin usage regularly to avoid liquidation.

Calculating Margin Requirements

- Initial Margin: The amount required to open a position.

- Maintenance Margin: The minimum required to keep the position active.

- Liquidation Price: Automatically calculated based on leverage and allocated margin.

Example:

A \(1,000 allocation with 5x leverage allows a \)5,000 position. If the price moves unfavorably, only the $1,000 margin is at risk, not the broader account.

Visual example of how isolated margin controls risk per position.

Strategies for Using Isolated Margin

Strategy 1: Short-Term Swing Trading

Overview: Isolated margin is ideal for swing traders who capitalize on short-term price movements.

Steps:

- Identify high-probability short-term trades using technical analysis.

- Allocate margin specifically for each swing position.

- Apply moderate leverage to maximize returns while controlling risk.

- Close positions based on predetermined profit targets or stop-loss levels.

Pros:

- Enhanced control over individual trades

- Risk limited to allocated margin

- Flexibility to manage multiple trades simultaneously

Cons:

- Requires active monitoring

- Margin mismanagement can lead to forced liquidation

Strategy 2: Hedging Long-Term Positions

Overview: Use isolated margin to hedge long-term holdings against volatility.

Steps:

- Identify a long-term holding susceptible to market swings.

- Open a short position on the same asset using isolated margin.

- Adjust margin and leverage to balance potential losses and gains.

- Maintain the hedge until market conditions stabilize.

Pros:

- Protects long-term positions without risking additional capital

- Enables strategic risk management

Cons:

- Limited upside on hedged positions

- Requires careful calculation of margin and leverage

Demonstrates hedging a long-term position using isolated margin to manage risk.

Comparing Isolated vs Cross Margin

| Feature | Isolated Margin | Cross Margin |

|---|---|---|

| Risk Exposure | Limited to allocated margin | Can affect entire account |

| Leverage Flexibility | Adjustable per position | Single leverage across account |

| Risk Management Complexity | Easier for individual trades | More complex, account-wide risk |

| Best Use Case | Short-term and targeted trades | Broad portfolio management |

Recommendation: For crypto enthusiasts focused on precise risk control, isolated margin is preferred, especially in volatile markets.

Risk Management with Isolated Margin

Key Principles

- Set Stop-Loss Orders: Protect allocated margin by defining automatic exit points.

- Monitor Positions Frequently: Volatility in crypto markets requires daily oversight.

- Limit Leverage: High leverage increases both profit and liquidation risk.

- Diversify Across Positions: Allocate isolated margin to multiple trades to reduce concentrated exposure.

Pro Tip: Platforms often provide alerts for margin levels—use these to avoid unexpected liquidations.

FAQ

1. How is isolated margin different from cross margin?

Isolated margin limits risk to the specific position, whereas cross margin uses the full account balance to maintain positions. This makes isolated margin ideal for controlling potential losses.

2. Can beginners use isolated margin safely?

Yes. Beginners can start with small allocations and low leverage. Using isolated margin allows beginners to experiment while keeping potential losses contained to the position’s margin.

3. How do I calculate my liquidation price in isolated margin?

Most platforms provide automated calculations based on allocated margin and leverage. Understanding the relationship between initial margin, maintenance margin, and leverage helps anticipate liquidation levels.

Conclusion

Isolated margin offers crypto enthusiasts a powerful tool for risk-controlled leveraged trading. By allocating margin per position, traders can:

- Protect their overall account

- Enhance short-term trading strategies

- Hedge long-term holdings efficiently

Best Practices:

- Start with low leverage and gradually increase exposure

- Monitor positions actively

- Combine isolated margin with sound risk management

Engage with this guide, implement controlled isolated margin strategies, and share your results with the crypto trading community to enhance collective knowledge and trading success.