In modern trading, particularly in derivatives and cryptocurrency markets, understanding isolated margin is essential for analysts and professional traders. Isolated margin offers precision in risk management, enabling traders to allocate margin to specific positions without affecting the rest of their account balance. This comprehensive guide explores isolated margin, its applications, strategies, and best practices, providing analysts with critical insights for risk-aware trading.

Understanding Isolated Margin

What Is Isolated Margin?

Isolated margin is a margin allocation method where funds are assigned to a specific position rather than being shared across multiple positions. This approach allows traders to manage risk on a per-trade basis.

- Example: If a trader allocates $500 as isolated margin for a BTC perpetual contract, only that $500 is at risk. Losses in this position cannot draw from other positions or the trader’s overall account balance.

How Isolated Margin Works

- Traders select the isolated margin mode on their trading platform.

- The system calculates margin requirements for the selected position.

- Profit and loss (PnL) are contained within the allocated margin, limiting risk exposure.

Resources like How to use isolated margin in perpetual futures? provide step-by-step instructions for practical implementation.

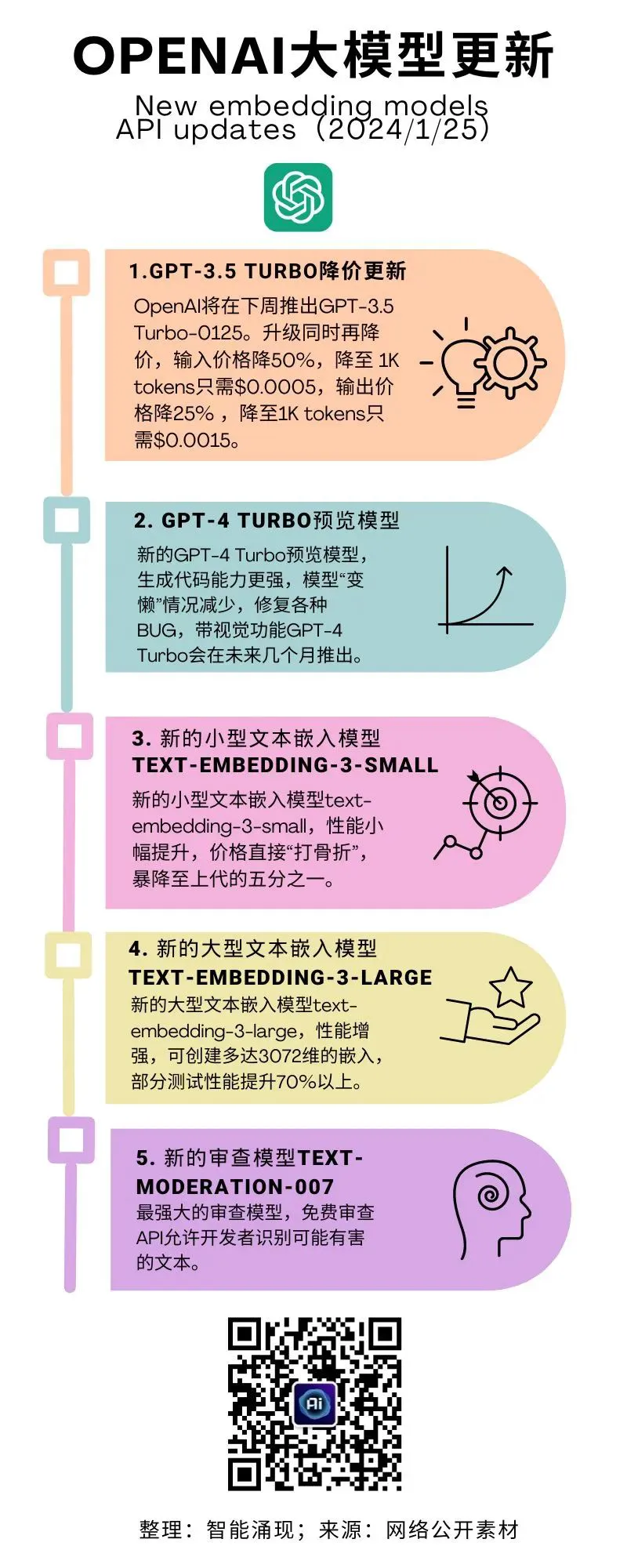

Comparison of isolated margin and cross margin highlighting risk containment and leverage flexibility.

Benefits of Isolated Margin for Analysts

Risk Containment

Analysts appreciate that isolated margin ensures a single position’s risk is capped, preventing cascading liquidations across multiple positions.

Enhanced Leverage Control

- Traders can fine-tune leverage for each position without affecting other trades.

- Enables more precise strategy testing and performance analysis.

Strategic Allocation

- Isolated margin allows allocation of funds according to position confidence or market volatility.

- Analysts can prioritize high-probability trades while limiting exposure to experimental or speculative positions.

Strategies Using Isolated Margin

1. Conservative Risk Management Strategy

Approach

- Allocate minimal margin to highly volatile positions.

- Use stop-loss orders and real-time monitoring to prevent liquidation.

Advantages

- Limits losses to specific positions.

- Protects the overall portfolio from market shocks.

Disadvantages

- May reduce potential profits on positions with low allocated margin.

2. Aggressive Leverage Strategy

Approach

- Assign higher isolated margin to positions with high-confidence signals.

- Apply maximum allowable leverage on selected trades.

Advantages

- Potential for high returns in trending markets.

- Isolated margin prevents the entire account from being wiped out if a trade fails.

Disadvantages

- Requires accurate market analysis; misjudged positions may result in significant losses.

- Higher stress on monitoring positions continuously.

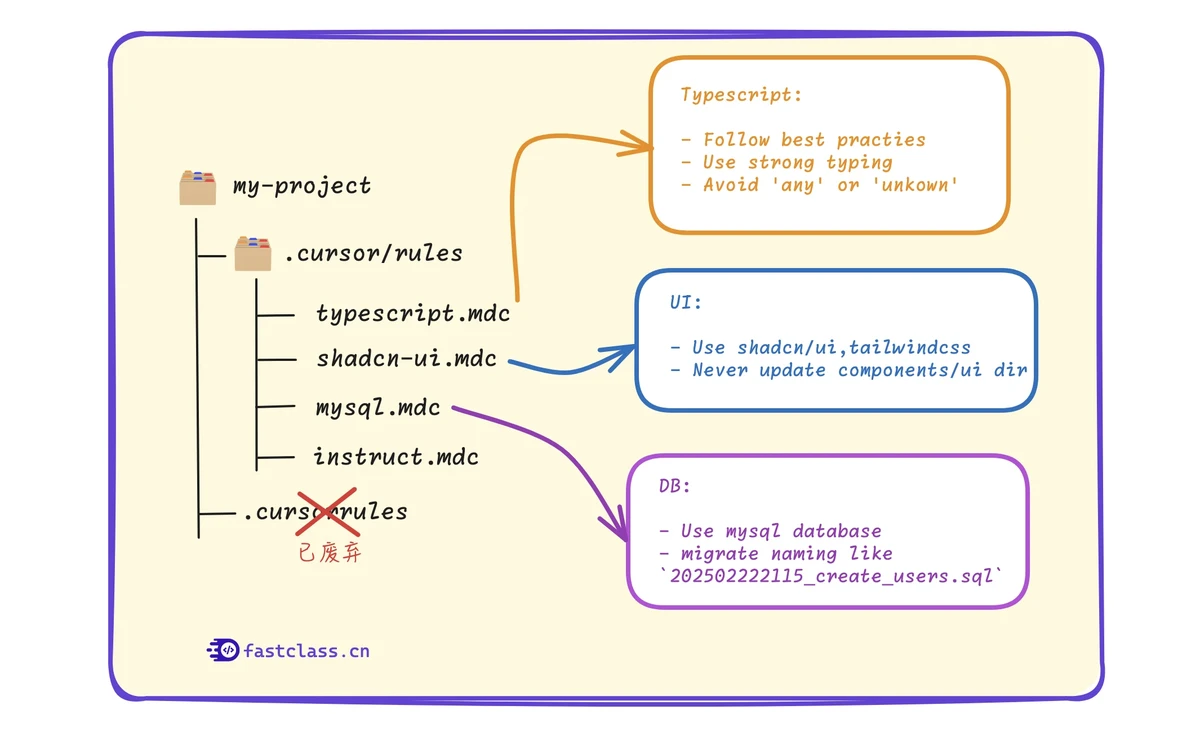

Illustration of how isolated margin can be allocated differently for multiple positions to optimize risk and reward.

Implementation Tips for Analysts

Setting Up Isolated Margin

- Evaluate each trade’s risk profile.

- Assign margin based on volatility, confidence level, and trading strategy.

- Use platform tools to monitor margin utilization and liquidation risk.

Calculating Margin Requirements

- Platforms often provide built-in isolated margin calculation tools.

- Analysts can manually compute requirements:

$\( \text{Required Margin} = \frac{\text{Position Size}}{\text{Leverage}} \)$

Monitoring and Adjustment

- Regularly adjust isolated margin as market conditions change.

- Analysts can use dashboards to track PnL and liquidation probabilities per position.

Common Isolated Margin Mistakes

- Over-Allocation: Assigning too much margin to a single position increases risk.

- Neglecting Liquidation Risk: Failing to monitor PnL may result in unexpected liquidation.

- Ignoring Market Volatility: High-volatility assets require more cautious margin allocation.

Professional insights from Isolated margin tips for professional traders emphasize proactive monitoring and diversification to mitigate these risks.

FAQ

1. How does isolated margin differ from cross margin?

Answer: In cross margin, all positions share available funds. Losses in one position can affect others, potentially triggering account-wide liquidation. Isolated margin confines risk to individual positions, protecting the remainder of the account.

2. Can isolated margin improve leverage efficiency?

Answer: Yes. By assigning isolated margin, traders can optimize leverage per position. High-confidence trades can receive higher leverage without jeopardizing other positions, balancing risk and reward.

3. How do analysts calculate isolated margin requirements?

Answer: Analysts calculate isolated margin using:

\[ \text{Margin Required} = \frac{\text{Position Size}}{\text{Leverage}} \]

Adjustments may be made for maintenance margin and market volatility to avoid liquidation. Many platforms provide calculators and tools to simplify this process.

Conclusion

For analysts and professional traders, understanding isolated margin key points is essential for precise risk management and strategic trading. Isolated margin allows for controlled exposure, tailored leverage, and optimized portfolio allocation. By combining conservative and aggressive strategies, using monitoring tools, and leveraging platform resources, analysts can maximize potential gains while minimizing risk.

Engage with this content by sharing your isolated margin strategies, commenting on best practices, and discussing insights with fellow analysts to enhance collective expertise.