==============================================

Introduction

Leverage is one of the most defining features of perpetual futures trading. It allows traders to control large positions with relatively small capital, amplifying both profits and losses. However, leverage does more than just magnify outcomes—it directly influences perpetual futures pricing dynamics, liquidity flows, and funding rate behaviors.

Understanding how leverage impacts perpetual futures pricing is essential for professional traders, risk managers, and even retail investors entering the derivatives market. This article will explore the mechanics of leverage, analyze how it affects pricing, discuss two advanced strategies, compare their advantages and disadvantages, and provide practical guidance on managing risks. By the end, readers will gain actionable insights into leveraging effectively while maintaining long-term trading sustainability.

The Role of Leverage in Perpetual Futures

What Is Leverage in Perpetual Contracts?

Leverage enables traders to open positions larger than their initial margin. For instance, with 10x leverage, a trader with \(1,000 can control \)10,000 worth of BTC perpetual contracts. Exchanges typically offer leverage ranging from 1x to over 100x, depending on risk parameters and liquidity.

Why Leverage Matters for Pricing

Perpetual futures are designed to track the spot market price of an asset. However, when traders employ high leverage, the market often experiences short-term price dislocations, largely due to:

- Increased liquidation cascades from margin calls.

- Amplified volatility caused by aggressive leveraged entries and exits.

- Shifts in funding rates, as leverage usage affects the balance between long and short positions.

As highlighted in Why leverage matters in perpetual futures trading, the more aggressively leverage is used, the more it contributes to short-term mispricing and market inefficiencies.

How Leverage Impacts Perpetual Futures Pricing

Liquidation Mechanics

Exchanges enforce liquidation rules to protect against insolvency. When many traders use high leverage, even small market moves can trigger mass liquidations, creating rapid price swings in perpetual contracts compared to the spot price.

Funding Rate Distortions

The funding rate keeps perpetual futures prices anchored to the spot market. If most traders pile into leveraged longs, the funding rate rises, making it costly to hold long positions. Conversely, when shorts dominate, funding rates turn negative. These fluctuations directly impact perpetual pricing.

Market Depth and Slippage

Leverage affects liquidity provision. When too many traders rely on extreme leverage, order book depth becomes thin, making perpetual prices more sensitive to large trades, thus deviating from spot.

Strategy 1: High-Leverage Scalping

How It Works

Scalping with leverage involves opening short-term, high-frequency trades to capitalize on small price movements. Traders often use leverage between 20x–50x, aiming for fast entries and exits within minutes.

Advantages

- Amplified returns on small moves.

- Useful in high-liquidity environments with narrow spreads.

- Efficient for traders with strong discipline and technical skills.

Disadvantages

- Extremely high risk of liquidation.

- Reliance on near-perfect execution.

- Stressful and capital-intensive due to high monitoring requirements.

Strategy 2: Moderate-Leverage Swing Trading

How It Works

Swing traders use lower leverage (3x–10x) to hold positions for days or weeks, relying on technical patterns and market fundamentals. They focus on sustainable pricing moves rather than short-term volatility.

Advantages

- Lower liquidation risk compared to scalping.

- Captures medium-term trends aligned with perpetual futures pricing.

- Easier to combine with risk management tools such as stop-loss orders.

Disadvantages

- Requires patience and higher margin capital.

- Returns are smaller compared to high-leverage strategies.

- Exposure to prolonged funding rate costs.

Comparing the Two Strategies

| Factor | High-Leverage Scalping | Moderate-Leverage Swing Trading |

|---|---|---|

| Risk Level | Extremely High | Moderate |

| Profit Potential | Very High (short-term) | Medium (trend-based) |

| Capital Requirement | Lower margin but riskier | Higher margin, safer |

| Best For | Advanced day traders | Professionals with long-term focus |

Recommendation: While high-leverage scalping offers quick profits, it exposes traders to liquidation risks. Moderate-leverage swing trading balances profitability with sustainability and is generally the best practice for professionals aiming to preserve capital.

Risk Management in Leverage-Driven Pricing

Position Sizing

Traders should never allocate all capital to high-leverage trades. Professionals recommend using 1–2% of total equity per position when trading with leverage.

Stop-Loss and Take-Profit

Disciplined risk management with automated stop-losses prevents liquidation and protects against funding rate shocks.

Balancing Leverage and Risk

As discussed in How to balance leverage and risk in perpetual swaps, traders must adjust leverage based on volatility. Using lower leverage during high volatility reduces the probability of liquidation cascades and stabilizes returns.

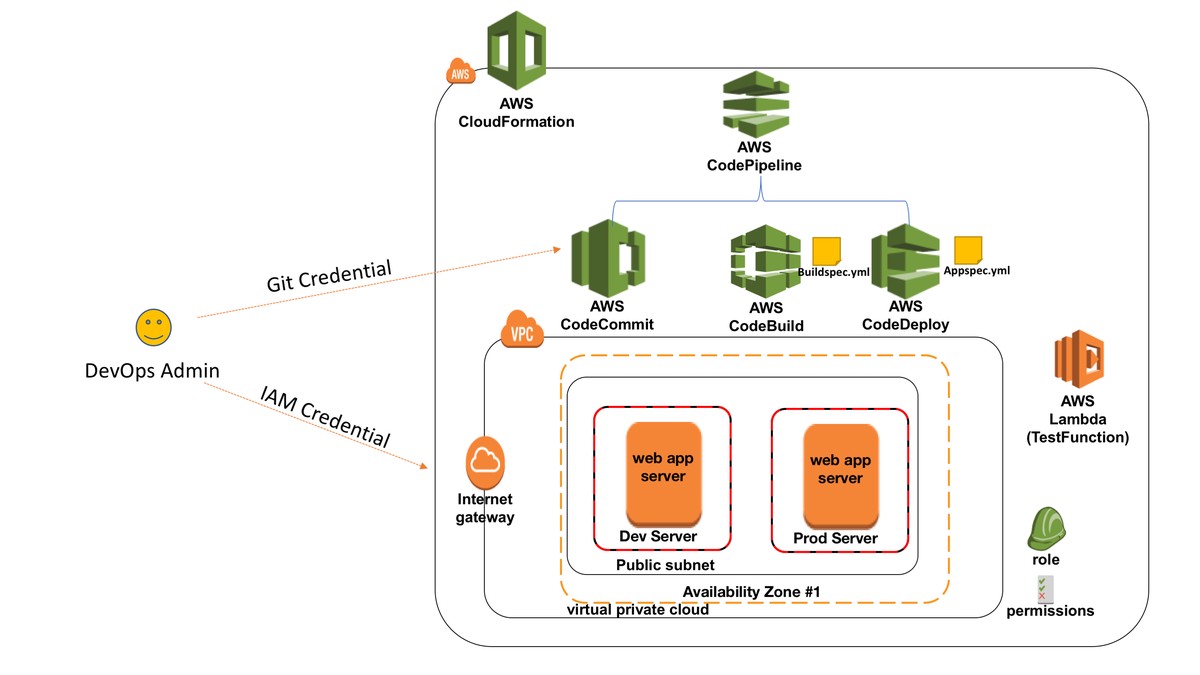

Visual Insights

Leverage amplifies volatility and directly influences perpetual futures pricing through liquidations, funding rates, and order book depth.

Frequently Asked Questions (FAQ)

1. How does leverage directly influence perpetual futures prices?

Leverage accelerates liquidations and shifts funding rates, causing perpetual futures to deviate from spot prices more frequently. When many traders use excessive leverage, even minor spot movements can trigger cascading liquidations, amplifying price volatility.

2. What is the safest leverage level for perpetual futures?

There is no universal safe level, but professionals typically use 3x–5x leverage for sustainable trading. Retail traders often misuse leverage at 50x–100x, which almost always results in liquidation.

3. How do professional traders manage risks with leverage?

They apply strict position sizing, diversify across assets, use stop-loss orders, and monitor funding rates to avoid unnecessary costs. Many also automate risk management with trading bots to reduce human error.

Conclusion

Leverage is a double-edged sword in perpetual futures. While it enables traders to maximize exposure, it also magnifies risks and directly affects pricing mechanisms through liquidations, funding rates, and liquidity depth.

Traders must choose strategies wisely—high-leverage scalping for short-term opportunities or moderate-leverage swing trading for long-term sustainability. The key is managing risks effectively, ensuring that leverage enhances rather than destroys trading performance.

If this article helped you understand how leverage impacts perpetual futures pricing, share it with fellow traders, comment with your experience, and join the discussion on best practices for leverage in crypto derivatives.

Would you like me to also include a mathematical example showing how 10x, 50x, and 100x leverage shift perpetual futures liquidation prices compared to spot? That could add strong quantitative value for professionals.