===========================================================

Introduction: Understanding Spread and Its Impact

What is Spread in Trading?

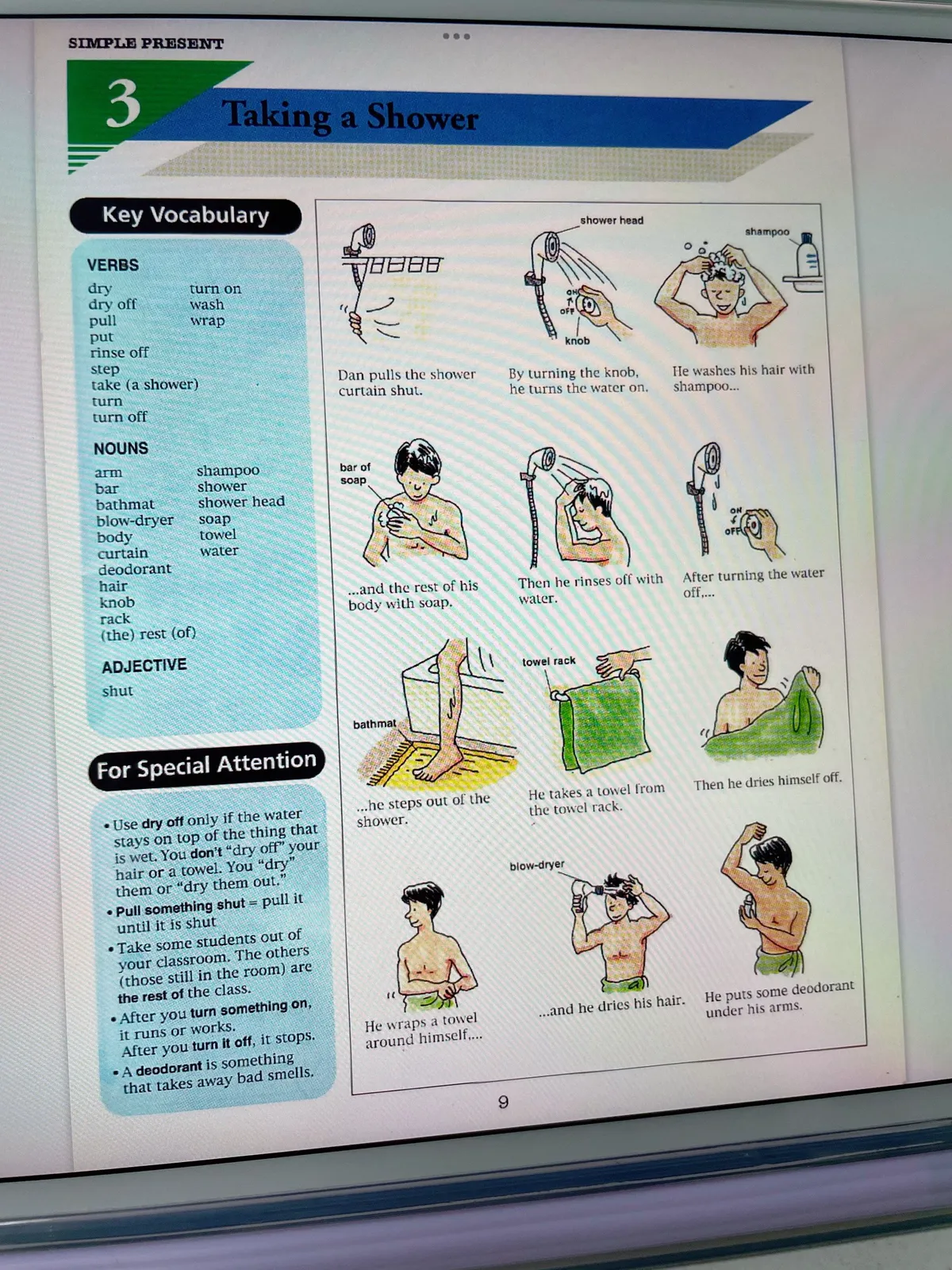

In financial markets, the spread is the difference between the bid price (buying price) and ask price (selling price) of an asset. Spread costs directly impact trading profits, as every trade must overcome this difference to become profitable.

Spreads are particularly significant in perpetual futures, forex, and crypto markets, where high-frequency trading and leveraged positions amplify costs.

Internal Link Integration: For detailed calculations, see How to calculate spread in perpetual futures, which explains the step-by-step methodology used by professional traders to quantify and manage spread costs.

Why Lowering Spread Costs Matters

- Maximize profits: Narrower spreads reduce the cost of entering and exiting trades.

- Enhanced strategy efficiency: Lower spreads allow more frequent trading without excessive friction.

- Risk management: Spread can act as a hidden cost affecting stop-loss placement and risk/reward calculations.

Illustration of bid-ask spread and its impact on trade profitability

Factors Influencing Spread

Market Liquidity

High liquidity assets typically have tighter spreads due to competitive order books, whereas illiquid markets experience wider spreads.

Trading Volume

Instruments with high daily trading volume allow for better execution prices, reducing the spread cost for both retail and institutional traders.

Platform and Broker Differences

- Exchange selection: Spreads vary across exchanges; some charge a fixed spread, while others follow market-driven spreads.

- Broker fees: Certain brokers add a markup, increasing the effective spread.

Volatility

High volatility can widen spreads, as market makers hedge against rapid price movements.

Visual representation of liquidity, volume, and volatility influence on spread

Method 1: Strategic Trading Approaches

Choosing High-Liquidity Assets

Focusing on assets with tight bid-ask spreads reduces transactional costs. For example, major crypto pairs like BTC/USDT generally have tighter spreads than less-traded altcoins.

Optimal Trade Timing

- Execute trades during peak market hours when liquidity is highest.

- Avoid low-volume periods such as holidays or off-hours in forex markets.

Limit Orders vs. Market Orders

- Limit orders can be set at preferred prices to avoid paying wider spreads.

- Market orders prioritize speed over cost and may encounter higher spreads, particularly in volatile markets.

Internal Link Integration: Retail traders can refer to Retail traders spread optimization tips to learn practical methods of reducing trading costs using these approaches.

Pros and Cons

Pros:

- Directly reduces trading costs

- Enhances profit margins for frequent trades

- Directly reduces trading costs

Cons:

- Limit orders may not execute immediately

- Requires market monitoring and patience

- Limit orders may not execute immediately

Method 2: Technical and Algorithmic Solutions

Spread Monitoring and Analytics

Utilize tools to track spread changes in real-time, enabling traders to enter positions during favorable conditions.

Automated Trading Systems

Algorithmic solutions can:

- Execute trades at optimal spread conditions

- Adjust order sizes dynamically to minimize costs

- Integrate with risk management protocols to prevent slippage

Arbitrage Opportunities

Traders can exploit cross-exchange spread differences by simultaneously buying at lower spreads and selling where spreads are higher.

Pros and Cons

Pros:

- Reduces human error and emotional trading

- Efficient in high-frequency or multi-market trading

- Reduces human error and emotional trading

Cons:

- Requires technical expertise and initial capital investment

- Algorithm performance may deteriorate under extreme volatility

- Requires technical expertise and initial capital investment

Example of automated spread monitoring and execution system

Practical Tips to Reduce Spread Costs

Diversify Exchanges and Platforms

Access multiple trading platforms to compare spread fees and execute trades where costs are lowest.

Monitor Market Conditions

Stay informed about volatility, liquidity, and macroeconomic news that affect spreads.

Optimize Trade Size

Large orders may incur wider spreads due to limited order book depth. Breaking trades into smaller increments can reduce costs.

Fee Structure Awareness

Consider brokers or exchanges offering volume-based discounts or rebates for limit orders.

Advanced Techniques

Hedging Strategies

Hedge positions across correlated assets to offset potential spread cost losses.

Spread Compression Tactics

Professional traders can use pair trading, statistical arbitrage, or market-making strategies to benefit from spread compression opportunities.

Real-Time Analytics Integration

Deploy dashboards that combine liquidity, volume, and volatility metrics to optimize trade execution continuously.

Dashboard displaying real-time spread and liquidity metrics

FAQ: Lowering Spread Costs

1. Can spreads be eliminated entirely?

No, spreads are inherent to market mechanics. However, traders can minimize costs by choosing high-liquidity assets, using limit orders, and timing trades strategically.

2. How does high-frequency trading influence spreads?

High-frequency trading often narrows spreads by increasing market liquidity, but it requires sophisticated algorithms and low-latency connections to benefit from these reductions.

3. What role do brokers play in spread costs?

Brokers may charge additional markup or fees on spreads. Traders should compare platforms and fee structures to ensure optimal cost efficiency.

4. Are there tools to monitor spreads effectively?

Yes, many exchanges provide real-time spread analytics and third-party dashboards, allowing traders to dynamically adjust strategies based on current market conditions.

Conclusion

Lowering spread costs is essential for enhancing profitability and efficiency in modern trading. By combining strategic trading practices, such as selecting high-liquidity assets and using limit orders, with advanced algorithmic tools for spread monitoring, traders can significantly reduce transactional friction.

Maintaining awareness of market conditions, broker fees, and trading timing ensures that spreads remain a manageable cost rather than a drag on profits. Sharing experiences and strategies within trading communities further enhances collective knowledge and enables more cost-efficient trading practices.

Engage with the trading community: share your favorite spread reduction techniques, comment on insights, and help others optimize their trading efficiency!