=======================================================

The rise of perpetual futures in crypto and traditional derivatives markets has transformed the way traders approach risk management. Unlike spot markets, perpetual contracts have no expiry, which means traders must continuously monitor and manage unrealized PnL (Profit and Loss). Without proper control, unrealized PnL swings can quickly lead to liquidation, overexposure, or missed profit opportunities.

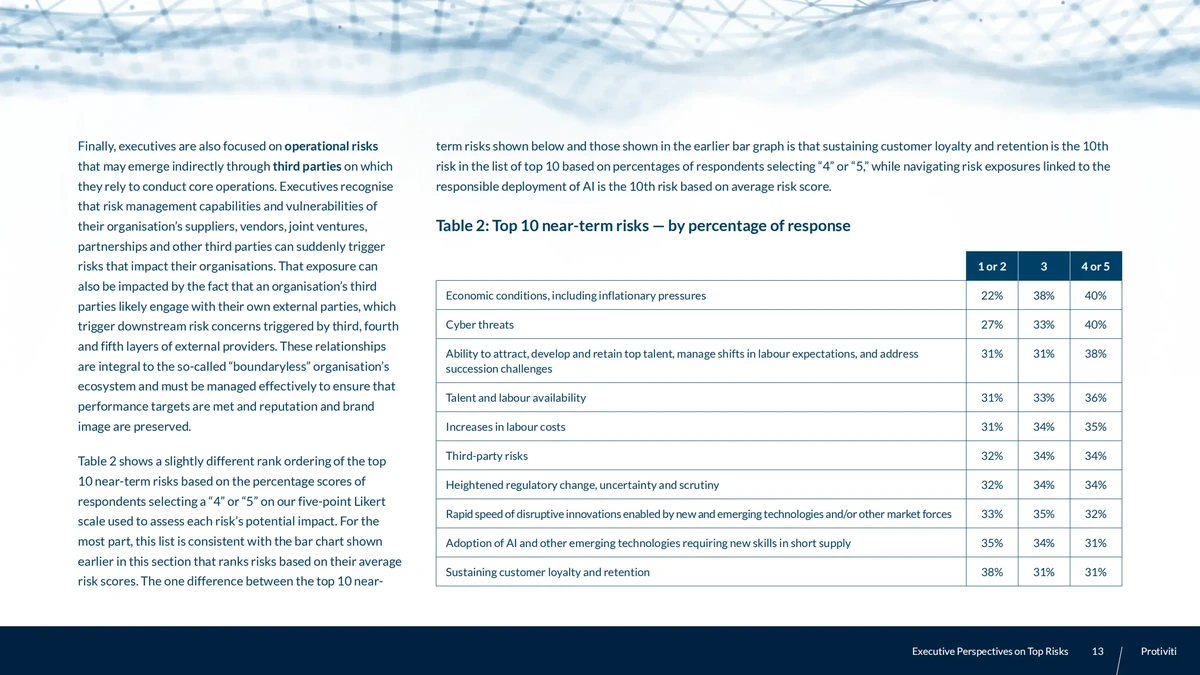

This article offers a comprehensive exploration of how to manage unrealized PnL risks in perpetual futures, including detailed strategies, pros and cons of each method, industry trends, real-world insights, and frequently asked questions.

Understanding Unrealized PnL in Perpetual Futures

What is Unrealized PnL?

Unrealized PnL refers to the floating profit or loss of an open position, calculated based on the current market price relative to the entry price. It is “unrealized” because the position has not been closed yet.

For example, if you go long 1 BTC perpetual at \(25,000 and the price rises to \)26,000, your unrealized PnL is +\(1,000. Conversely, if the price drops to \)24,000, your unrealized PnL is -$1,000.

Why Unrealized PnL Matters

Unrealized PnL directly impacts:

- Margin balance: Determines available collateral.

- Liquidation risk: High unrealized losses increase liquidation probability.

- Decision-making: Helps traders decide when to close, hedge, or adjust positions.

As emphasized in why unrealized PnL matters for perpetual futures traders, monitoring it is critical for both short-term day traders and long-term investors.

Key Risks of Unrealized PnL in Perpetual Futures

- Liquidation Risk – A rapid market move against a leveraged position can erase margin.

- Psychological Bias – Traders may hold onto losses too long or take profits too early.

- Funding Rate Costs – Unrealized losses combined with negative funding can amplify risks.

- Overexposure – Unrealized PnL can tempt traders into scaling positions beyond safe levels.

Strategies for Managing Unrealized PnL Risks

1. Active Stop-Loss and Take-Profit Systems

One of the most straightforward ways to manage unrealized PnL risks is by implementing automated stop-loss and take-profit orders.

How It Works

- Stop-loss: Closes losing positions before they reach dangerous levels.

- Take-profit: Secures profits without requiring constant monitoring.

Pros

- Reduces emotional bias.

- Ensures disciplined execution.

Cons

- May trigger on short-term volatility (“stop hunting”).

- Requires careful calibration.

2. Dynamic Hedging with Opposite Positions

Hedging allows traders to reduce exposure without closing positions. For example, if you’re long BTC perpetuals, you can open a short in another correlated contract (e.g., ETH or an options hedge).

How It Works

- Offset unrealized losses in one position with gains in another.

- Adjust hedge ratios dynamically depending on volatility.

Pros

- Provides flexibility without closing positions.

- Useful in high-volatility environments.

Cons

- Increases transaction costs.

- Requires continuous monitoring.

3. Margin and Leverage Adjustment

Unrealized PnL risks can be managed by carefully adjusting leverage and margin.

How It Works

- Reduce leverage to lower liquidation risk.

- Add margin when unrealized losses accumulate to buy more time for recovery.

Pros

- Straightforward to apply.

- Helps maintain position stability.

Cons

- Requires available capital.

- Adding margin to losing trades may worsen overall losses if the market doesn’t recover.

4. Partial Position Scaling

Instead of holding one large open position, traders can scale in and out of positions gradually.

How It Works

- Close part of the position when unrealized PnL hits targets.

- Keep the remainder to ride potential trends.

Pros

- Locks in profits early.

- Reduces volatility exposure.

Cons

- May leave profits on the table if the market trends strongly.

- Increases execution complexity.

Comparing Two Key Strategies

| Strategy | Best Use Case | Advantages | Limitations |

|---|---|---|---|

| Active Stop-Loss/Take-Profit | Short-term traders, day trading | Disciplined, automated, reduces bias | Vulnerable to stop hunting |

| Dynamic Hedging | Professional & institutional | Flexible, protects positions in volatility | Higher fees, requires expertise |

Recommendation: For retail traders, stop-loss and take-profit systems are most practical, while dynamic hedging is more suitable for experienced traders with larger portfolios.

How Unrealized PnL Affects Trading Strategy in Perpetual Futures

Understanding the impact of unrealized PnL is essential. For instance, high unrealized profits may tempt a trader to hold longer, but in perpetual contracts, funding rates and volatility can erode profits if left unmanaged.

This connects with how unrealized PnL affects trading strategy in perpetual futures, where traders must integrate unrealized values into broader portfolio risk controls.

Industry Trends in Managing Unrealized PnL Risks

- Automated Risk Management Tools – Exchanges and third-party platforms now offer real-time risk dashboards.

- AI-Driven Hedging – Algorithms dynamically adjust hedge ratios based on volatility forecasts.

- Cross-Margining Systems – Allow unrealized PnL from one position to offset risks in another market.

- Institutional-Grade Risk Practices – Funds now apply advanced techniques for managing unrealized PnL in perpetual futures, including VaR (Value at Risk) models and stress testing.

Real-World Case Study

A professional crypto trading desk running \(50 million in BTC perpetuals integrated dynamic hedging with ETH options to offset unrealized drawdowns. During a market crash, while their long BTC positions showed -\)8 million unrealized PnL, their ETH options hedge gained +$7.5 million, reducing net exposure and avoiding liquidation.

This example highlights the importance of proactive hedging over reactive liquidation management.

Visual Insight

Illustration of unrealized PnL swings in a volatile perpetual futures market.

FAQ: Managing Unrealized PnL Risks in Perpetual Futures

1. Should I always close positions when unrealized PnL turns negative?

Not necessarily. Negative unrealized PnL doesn’t always mean you should close the trade. The decision depends on your leverage, risk tolerance, and market outlook. Instead of panic closing, consider adjusting leverage or using hedges.

2. How can I minimize liquidation risk from unrealized losses?

The best practices include lowering leverage, setting stop-losses, maintaining sufficient margin, and using hedges. Monitoring positions through real-time dashboards is also critical to avoid sudden liquidation.

3. Is it better to hedge or use stop-losses for managing unrealized PnL?

It depends on your trading style. Stop-losses are simple and effective for short-term traders, while hedging works better for professionals who want to stay exposed to markets without closing positions.

Conclusion: Building a Sustainable Risk Management Framework

Managing unrealized PnL risks in perpetual futures is not about eliminating risk entirely—it’s about controlling it intelligently. Whether through stop-loss systems, dynamic hedging, or margin adjustments, the goal is to protect capital while maintaining exposure to opportunities.

For most retail traders, disciplined stop-loss and take-profit strategies remain the most practical solution. For advanced investors, integrating hedges and institutional-grade models offers superior protection.

By mastering these techniques, traders can avoid costly liquidation events, improve long-term performance, and build resilience in volatile markets.

If you found this article useful, share it with your trading network or drop a comment with your experiences managing unrealized PnL risks in perpetual futures. Let’s continue the conversation and help more traders thrive in this challenging but rewarding market.