=========================================================

Modifying a limit order is a crucial skill for traders across all markets, especially in fast-paced environments like cryptocurrency, stocks, and perpetual futures. Understanding how to adjust your limit orders effectively can improve execution efficiency, minimize slippage, and optimize profits. This comprehensive guide explores the strategies, best practices, and real-world applications for modifying limit orders.

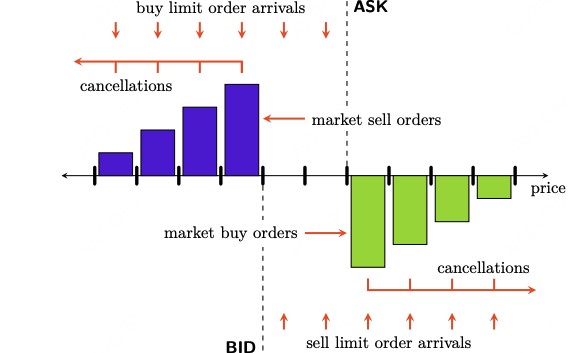

Understanding Limit Orders

What Is a Limit Order?

A limit order is a type of order to buy or sell an asset at a specified price or better. Unlike market orders, which execute immediately at the current market price, limit orders allow traders to control entry and exit points with precision.

- Buy Limit Order: Executes at the limit price or lower.

- Sell Limit Order: Executes at the limit price or higher.

Benefits of Using Limit Orders

- Precise price control

- Reduced risk of unfavorable execution

- Better alignment with trading strategies

Image:

Limit orders allow traders to set specific price points for executing trades.

Internal Link: For beginners, a beginner’s limit order tutorial provides step-by-step guidance on setting and managing these orders.

Why Modify a Limit Order?

Market Conditions Change

Market volatility can cause the initially set limit price to be suboptimal. Modifying the order allows traders to respond to sudden price swings.

Strategy Adjustments

Adjusting limit orders can help implement dynamic strategies, such as scaling in or out of positions, improving risk management, or capturing more favorable price points.

Reducing Slippage

By adjusting the limit price according to market conditions, traders can minimize the difference between the expected execution price and the actual price.

Methods to Modify Limit Orders

Method 1: Manual Modification

Traders can manually adjust limit orders through their trading platforms.

Steps:

- Navigate to the active orders section.

- Select the limit order to modify.

- Adjust the price or quantity.

- Confirm the changes.

Advantages:

- Full control over each order

- Immediate response to market changes

Disadvantages:

- Time-consuming for high-frequency trading

- Requires constant monitoring

Method 2: Automated Adjustments

Advanced trading platforms allow automated modification of limit orders based on predefined conditions.

Features:

- Algorithmic triggers based on price movement

- Conditional order adjustments for volatility

Advantages:

- Saves time for active traders

- Reduces human error

Disadvantages:

- Requires understanding of automation tools

- May involve setup complexity

Image:

Automated limit order adjustments help traders manage orders efficiently in volatile markets.

Internal Link: Traders can explore how to optimize limit orders to leverage automation and strategy integration.

Best Practices for Modifying Limit Orders

Timing Is Key

Adjust your orders during high liquidity periods to reduce execution risk.

Align With Strategy

Ensure modifications are consistent with your overall trading plan, whether for scalping, day trading, or long-term positions.

Risk Management

- Avoid over-modifying, which can result in missed opportunities or unintended exposure.

- Keep track of cumulative order changes to prevent excessive trading costs.

Advanced Strategies

Strategy 1: Incremental Price Adjustment

Adjust the limit order gradually based on price trends rather than making a single large adjustment.

Benefits:

- Reduces impact on the order book

- Maintains strategic flexibility

**Strategy 2: Conditional Order Linking

Link limit order modifications to market indicators such as RSI, moving averages, or volume thresholds.

Benefits:

- More dynamic and adaptive to market behavior

- Supports automated trading setups

Tools and Platforms

- Perpetual Futures Platforms: Allow flexible modification and real-time monitoring

- Trading APIs: Enable automated order adjustments

- Charting Software: Helps determine optimal modification points

Image:

Advanced platforms and APIs facilitate efficient limit order management for professional traders.

FAQ: Modifying Limit Orders

Q1: Can I modify a limit order after partial execution?

A1: Yes, many platforms allow modification of the remaining unfilled portion. This ensures you can adjust your strategy without affecting executed trades.

Q2: How often should I adjust limit orders?

A2: Frequent adjustments are beneficial in volatile markets but should align with your overall strategy to avoid unnecessary trading costs.

Q3: Are automated modifications safer than manual adjustments?

A3: Automated modifications reduce human error and save time, but they require proper setup and monitoring to ensure the rules align with market conditions.

Conclusion

Modifying a limit order is a critical skill for effective trading. By combining manual adjustments with automation, traders can respond to market volatility, improve execution efficiency, and enhance profitability. Following best practices, using advanced tools, and applying strategic modifications ensures that traders can maximize the advantages of limit orders.

Engage With Us: Share your experiences with limit order modifications, strategies, and platform preferences in the comments, and forward this guide to fellow traders to improve collective trading skills.