=========================================================================

Optimizing strategies to minimize trading fees is crucial for investors seeking to maximize returns, especially in high-frequency or leveraged markets such as perpetual futures. Fees, even if small per transaction, can accumulate rapidly and erode profits over time. This guide explores practical approaches, advanced techniques, and actionable steps for traders to reduce costs without compromising strategy performance.

Understanding Trading Fees

Trading fees encompass the costs incurred when buying, selling, or holding financial instruments. For perpetual futures, fees may include maker/taker fees, funding fees, withdrawal fees, and exchange commissions.

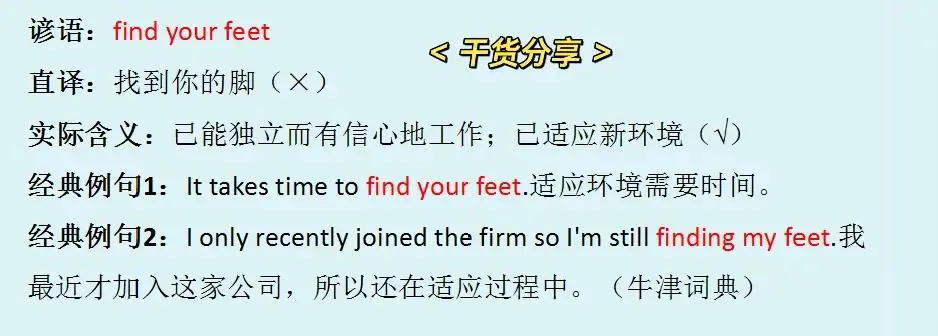

Types of Trading Fees

- Maker Fees: Charged when placing limit orders that add liquidity to the market.

- Taker Fees: Applied when executing orders that remove liquidity.

- Funding Fees: Periodic payments exchanged between long and short positions in perpetual contracts.

- Withdrawal Fees: Costs associated with moving assets off exchanges.

Understanding these fee structures is essential because small inefficiencies in execution can have a compounding effect on profitability.

Visualization of fee types in perpetual futures trading.

Strategies to Reduce Trading Fees

1. Choose the Right Exchange

Step 1: Compare Exchanges

Not all exchanges charge the same fees. Look for platforms offering:

- Competitive maker/taker fees.

- Tiered fee discounts based on trading volume.

- Low funding and withdrawal fees.

Step 2: Evaluate Fee Impact on Strategy

Calculate the cumulative fees over a typical trading period. For high-frequency strategies, even a 0.01% difference per trade can lead to significant savings.

Step 3: Negotiate or Leverage VIP Programs

Many exchanges provide reduced fees for large traders or members of VIP programs, making volume-based discounts highly valuable.

2. Optimize Order Placement

Limit Orders vs Market Orders:

- Limit Orders often have lower fees (maker fees).

- Market Orders may incur higher taker fees.

Using maker orders strategically allows traders to add liquidity, thus minimizing transaction costs while also potentially capturing rebates offered by the exchange.

Execution Timing:

Analyze liquidity patterns to avoid trading during low-volume periods, which can result in higher slippage and unintended taker fees.

3. Implement Fee-Aware Trading Algorithms

For quantitative traders, incorporating fee structures into algorithmic logic can drastically improve net returns. Strategies include:

- Simulating transaction costs during backtesting.

- Dynamic order splitting to minimize slippage and taker fees.

- Smart routing across multiple exchanges for best execution.

Example of fee-aware trading logic in algorithmic systems.

Advanced Techniques for Fee Minimization

Volume-Based Fee Discounts

Many platforms reward higher trading volumes with tiered fee reductions. Strategies:

- Consolidate trading activity to reach higher tiers faster.

- Monitor volume thresholds to optimize cost-effectiveness.

Fee Arbitrage Opportunities

Some traders use exchange fee differences to their advantage by moving positions between exchanges with lower fees for similar products. This requires careful management to avoid additional withdrawal or transfer costs.

Using Stablecoin Pairs for Funding Fees

Funding fees on perpetual futures vary across pairs. Selecting trading pairs with lower funding rates reduces cost without altering core strategy performance.

Practical Implementation Steps

- Track Historical Fees: Monitor past trading to identify the costliest transactions.

- Integrate Fee Calculators: Tools like where to find the lowest trading fees can assist in planning trades.

- Simulate Strategy Net Returns: Incorporate fees into backtesting to evaluate true profitability.

- Adjust Trading Frequency: Reduce unnecessary trades to limit cumulative fees, especially for high-frequency strategies.

- Audit Exchange Policies Regularly: Fee structures and promotions may change, requiring adaptation.

Comparative Analysis of Strategies

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Exchange selection | Immediate fee reduction | Limited by personal access or regional restrictions |

| Maker order usage | Reduces taker fees, rebates possible | May delay execution if order not filled |

| Algorithmic fee integration | Optimizes net returns | Requires advanced programming and testing |

| Funding fee selection | Lowers periodic costs | Limited to available pairs with favorable rates |

Recommended Approach

Combining multiple strategies produces the most effective fee optimization:

- Select low-fee exchanges and participate in VIP programs.

- Prioritize limit orders and avoid unnecessary market orders.

- Integrate fee-aware logic into algorithmic models.

- Monitor cumulative costs to identify further optimization opportunities.

Pro Tip: Understanding how to reduce perpetual futures trading fees allows traders to make informed platform choices while maximizing profits.

FAQ

1. How can beginner traders minimize fees effectively?

Beginner traders should focus on using exchanges with transparent fee structures, prioritize maker orders, and avoid frequent small trades that accumulate high taker fees.

2. Why do fees impact profitability significantly in high-frequency trading?

Even minimal per-trade fees can compound over thousands of trades, drastically reducing net returns. Integrating fee awareness into algorithmic strategies ensures realistic profitability assessments.

3. Are there tools to help optimize fees across platforms?

Yes, platforms and third-party services offer fee comparison calculators. Tools that simulate net returns including fees are invaluable for strategy planning and evaluation.

Conclusion

Optimizing strategies to minimize fees is a critical aspect of modern trading, particularly in perpetual futures and high-frequency environments. By carefully selecting exchanges, using efficient order types, and integrating fee awareness into algorithms, traders can significantly enhance net profitability. Continuous monitoring, adaptation to changing fee structures, and strategic planning ensure sustained cost efficiency while maintaining robust trading performance.

Engage with the community: Share your experiences in fee optimization, discuss best practices, or forward this guide to colleagues aiming to improve their trading efficiency.