========================================================

Tracking position performance is a crucial aspect of trading and investment strategies, whether you’re dealing with stocks, options, or futures. Properly tracking your position allows you to assess the effectiveness of your trading decisions, minimize risks, and optimize returns. This article will provide you with a detailed guide on how to track position performance efficiently. By the end of this article, you’ll be equipped with the knowledge to implement various tracking methods that suit your trading style.

What is Position Performance Tracking?

Position performance tracking refers to the process of monitoring and evaluating the performance of a specific position or trade over time. It helps traders assess how well their investments are performing relative to their expectations, market conditions, and risk parameters.

Key Components of Position Performance Tracking:

- Entry Price: The price at which a position is opened.

- Exit Price: The price at which the position is closed.

- Profit and Loss (P&L): The financial result from the position, typically measured in currency units.

- Risk-Reward Ratio: The potential reward relative to the risk taken on a position.

- Holding Period: The length of time the position is held before being closed.

Why is Tracking Position Performance Important?

Tracking position performance is vital for several reasons:

- Risk Management: By evaluating how a position is performing in real-time, you can make adjustments to stop losses or take profits, thus reducing potential risks.

- Strategy Evaluation: Consistent performance tracking allows you to identify successful strategies and improve less effective ones.

- Learning Tool: Reviewing past trades and positions helps you learn from mistakes and refine your trading approach over time.

- Improved Decision-Making: Real-time performance tracking ensures that decisions are based on the latest data, leading to more informed and effective trading choices.

Different Methods for Tracking Position Performance

There are several ways to track position performance, each with its pros and cons. Below, we discuss two of the most common methods: manual tracking and automated tracking.

Manual Tracking

Manual tracking involves recording and analyzing your position performance by hand, typically using spreadsheets or other manual tools. Traders note down the entry and exit points, along with the associated profits and losses. This method is suitable for beginners or those who prefer to maintain full control over their analysis.

How to Implement Manual Tracking

- Record Entry and Exit Points: For each position, make a note of the entry price and exit price.

- Calculate P&L: Subtract the entry price from the exit price to determine the profit or loss.

- Track Other Metrics: Depending on your trading strategy, you may want to track metrics such as the risk-reward ratio or the percentage change in position value.

- Evaluate Trade Performance: After closing a position, assess whether the trade met your objectives and if adjustments could have been made.

Advantages:

- Full Control: You have complete control over the data and can tailor your tracking system to your needs.

- Cost-Effective: It doesn’t require any specialized software or subscriptions.

Disadvantages:

- Time-Consuming: Tracking every position manually can be tedious and time-intensive, especially for active traders.

- Error-Prone: Mistakes can happen when entering data manually, leading to inaccurate performance analysis.

Automated Tracking

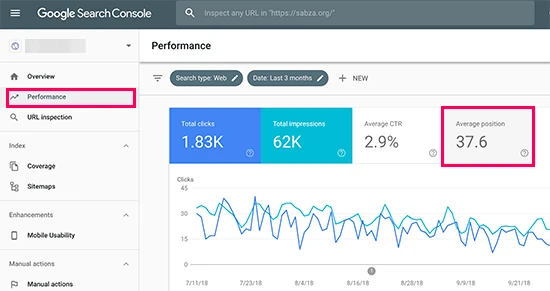

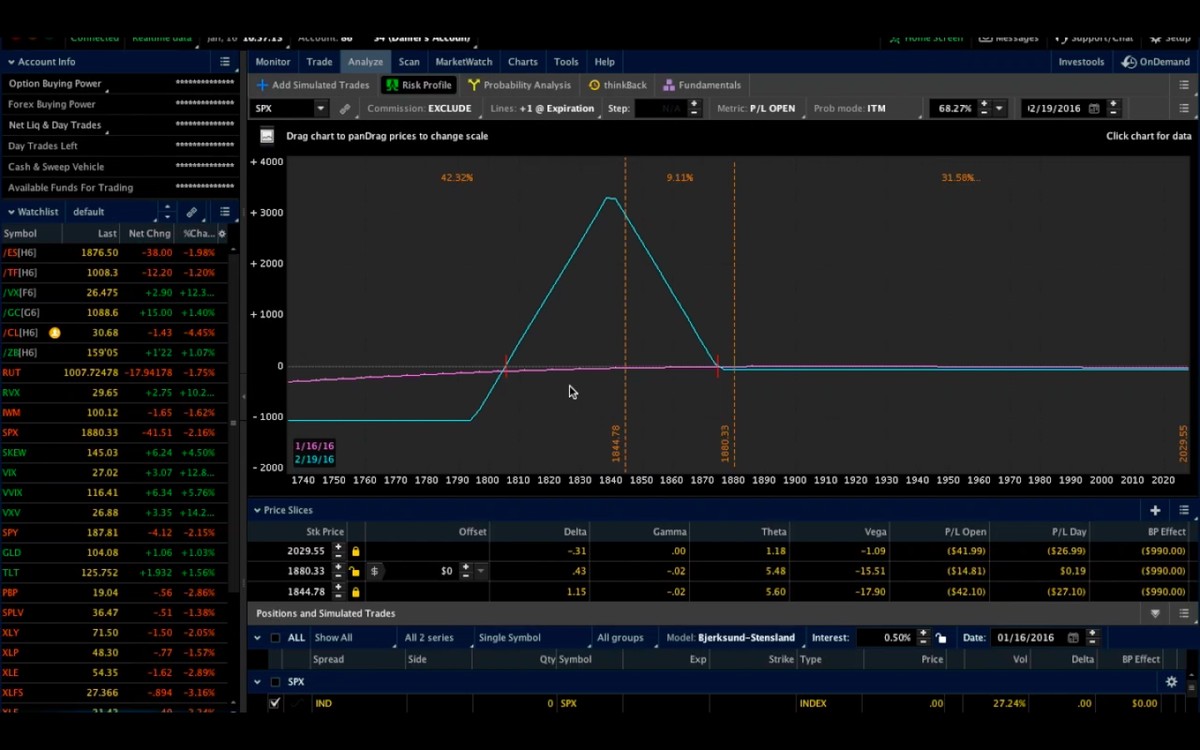

Automated tracking uses trading software or platforms to automatically track and evaluate the performance of your positions. Many modern trading platforms provide tools that integrate with brokerage accounts to track positions in real-time. These platforms can automatically calculate your P&L, risk-reward ratios, and other key metrics.

How to Implement Automated Tracking

- Connect to Your Brokerage Account: Most platforms allow integration with your brokerage account to pull in position data automatically.

- Set Up Alerts and Reports: Many platforms allow you to set performance alerts or generate automated performance reports.

- Track Advanced Metrics: Automated systems often allow you to track a variety of metrics, such as volatility, Sharpe ratio, and beta, to help assess your position’s risk-adjusted return.

Advantages:

- Time-Saving: Automated tracking saves a significant amount of time since it pulls data in real-time.

- Accuracy: Reduces human error and provides more precise performance metrics.

- Advanced Metrics: Access to more advanced performance metrics and risk analysis tools.

Disadvantages:

- Dependence on Software: You are dependent on the software or platform you are using, which may have limitations or bugs.

- Costs: Some advanced tracking tools may require subscription fees or come with additional costs.

How to Analyze Position Risk

Tracking performance isn’t just about assessing profits and losses; it’s also essential to evaluate the risks associated with your positions. Analyzing position risk allows you to make adjustments to minimize losses and ensure your portfolio remains well-balanced.

Key Risk Metrics to Monitor:

- Value-at-Risk (VaR): This metric calculates the potential loss in the value of an asset or portfolio over a specified period.

- Beta: Beta measures the volatility of a position relative to the market. A beta of 1 means the position moves in line with the market, while a beta greater than 1 indicates higher volatility.

- Drawdown: This is the maximum loss from the peak to the trough of an asset’s value during a specific period.

- Volatility: The standard deviation of returns, which helps to gauge how much the price of the asset fluctuates.

How to Use Risk Metrics

- Stop-Loss Orders: Use stop-loss orders to automatically close a position once it reaches a certain level of loss, limiting risk.

- Position Sizing: Adjust your position size based on the level of risk you’re willing to take on a particular trade.

How to Track Position Performance Using Tools

There are several tools and software available to track position performance effectively. These tools provide both manual and automated tracking features, offering real-time analytics, historical data, and comprehensive reports.

Recommended Tools for Position Performance Tracking:

- TradingView: A popular platform that offers both charting tools and real-time position tracking features.

- MetaTrader 4⁄5: These platforms provide comprehensive performance tracking, including trade history, P&L, and risk metrics.

- Excel/Google Sheets: For those who prefer a manual approach, Excel or Google Sheets offers customization options to track performance manually.

FAQ (Frequently Asked Questions)

1. How can I track the performance of multiple positions at once?

Most trading platforms, like MetaTrader or TradingView, allow you to track the performance of multiple positions in real-time. These platforms aggregate all your positions and display key metrics such as total P&L, portfolio risk, and overall performance.

2. Is it necessary to track every single position?

Tracking every position may not be necessary if you’re using a long-term investment strategy, but for active traders, especially in day trading or high-frequency trading, it is crucial to track each position to evaluate performance accurately and make real-time decisions.

3. How can I optimize my position size for better performance?

Position sizing can be optimized by calculating the risk associated with each trade. You can use tools like the Kelly Criterion or risk-to-reward ratios to determine the optimal size for each position. Regularly reviewing your position size ensures that you’re not overexposing your portfolio to unnecessary risk.

Conclusion

Tracking position performance is an essential part of any trading strategy. Whether you prefer manual tracking or automated tools, the key is to consistently monitor and assess your positions. By utilizing advanced metrics and regularly reviewing your performance, you can refine your strategies, minimize risk, and optimize returns. Investing in the right tools and systems will give you the edge needed to succeed in the fast-paced world of trading.

Remember, tracking position performance is not just about looking at the profits—it’s also about understanding the risks and improving your decision-making process for future trades. Start tracking your positions today, and watch your trading performance improve.

For further reading, you may want to check out how to open a position in perpetual futures and why manage your position in quant trading to deepen your understanding of position management techniques.