========================================================================

Introduction

Perpetual futures have become one of the most dynamic financial instruments in modern trading. Unlike traditional futures contracts, they do not have an expiration date, making them highly attractive for both retail and institutional investors. With the increasing complexity of trading environments, algorithm adoption for perpetual futures analysts has moved from being an optional enhancement to a necessity. Algorithms allow analysts to manage risks, identify arbitrage opportunities, and implement systematic trading strategies with precision.

This guide explores how perpetual futures analysts can effectively adopt algorithms, examines different strategies, compares their pros and cons, and provides actionable insights for optimizing long-term success. It combines personal industry experience, recent innovations, and practical methods that align with the latest quantitative trading trends.

Understanding Algorithm Adoption in Perpetual Futures

The Role of Algorithms in Perpetual Futures

Algorithms are essentially coded sets of rules that automate the process of trading perpetual futures. They process market data in real-time, execute trades instantly, and help analysts reduce emotional biases. For perpetual futures, where funding rates, volatility, and leverage play crucial roles, algorithms ensure faster reaction to dynamic market conditions.

Why Algorithm Adoption Matters

- Speed – Markets can shift in milliseconds, making human decision-making inefficient.

- Accuracy – Algorithms reduce manual entry errors and ensure consistent strategy execution.

- Scalability – Analysts can track multiple assets and markets simultaneously.

- Risk Control – Predefined stop-loss and risk thresholds protect portfolios from extreme volatility.

For these reasons, why algorithms are essential in perpetual futures is not just theoretical—it directly impacts profitability, efficiency, and long-term market sustainability.

| Section | Key Points |

|---|---|

| Introduction | Perpetual futures lack expiration; algorithms help manage risk and strategy. |

| Role of Algorithms | Automate trades, reduce emotional bias, react to funding, volatility, leverage. |

| Importance | Speed, accuracy, scalability, and risk control are critical for profitability. |

| Rule-Based Strategies | Use predefined conditions; easy, transparent, suitable for risk-averse analysts. |

| Rule-Based Pros/Cons | Pros: simple, predictable; Cons: less flexible, depends on market stability. |

| Machine Learning Algorithms | Learn from historical data; detect hidden patterns and optimize continuously. |

| ML Pros/Cons | Pros: adaptable, discovers complex patterns; Cons: resource-heavy, risk of overfitting. |

| Hybrid Strategies | Combines rule-based triggers with ML optimization for balanced performance. |

| Hybrid Pros/Cons | Pros: flexible, resilient, scalable; Cons: resource-intensive, complex. |

| Strategy Comparison | Rule: low adaptability, high risk control; ML: high profit potential; Hybrid: balanced. |

| Practical Steps | Define objectives, choose algorithm type, test/backtest, monitor/adjust. |

| Advanced Use Cases | Risk arbitrage, momentum strategies, market-making for profit and stability. |

| Emerging Trends | AI reinforcement learning, cross-asset arbitrage, cloud-based trading. |

| FAQ Insights | Main challenge: balance speed/accuracy; beginners start with rule-based; humans still needed. |

| Conclusion | Algorithm adoption ensures precise execution, better risk management, higher profitability. |

1. Rule-Based Algorithmic Strategies

Rule-based strategies rely on predefined conditions. Analysts set criteria such as moving averages, funding rate signals, or volatility thresholds. When conditions are met, the algorithm executes trades automatically.

Pros:

- Easy to implement with basic coding skills.

- Transparent and predictable.

- Suitable for risk-averse analysts.

Cons:

- Limited flexibility in highly volatile markets.

- Performance depends heavily on market regime stability.

Example: A rule-based algorithm might short perpetual futures when the funding rate exceeds 0.05% and long when it falls below -0.05%.

2. Machine Learning-Driven Algorithms

Machine learning (ML) introduces adaptability by allowing algorithms to learn from historical data and continuously optimize themselves. Analysts use ML to detect hidden patterns in order flow, funding rate cycles, or price volatility.

Pros:

- Dynamic adaptation to changing market conditions.

- Ability to discover complex, non-linear patterns.

- Potentially higher profitability in the long term.

Cons:

- Requires large datasets and advanced infrastructure.

- Higher risk of overfitting models to past data.

- Demands continuous monitoring and retraining.

Example: A machine learning algorithm might use historical BTC perpetual futures data to predict short-term funding rate shifts and optimize leverage positioning accordingly.

3. Hybrid Algorithm Strategies

Hybrid strategies combine rule-based approaches with machine learning, offering the best of both worlds. Analysts can use rule-based triggers for risk management while letting machine learning models fine-tune entry and exit signals.

Pros:

- Balanced approach with flexibility and risk control.

- Greater resilience in volatile markets.

- Scalability across multiple asset classes.

Cons:

- Requires significant resources to maintain.

- Complexity increases the chance of technical errors.

Comparing Strategies: Which Works Best?

| Strategy Type | Adaptability | Complexity | Risk Management | Profit Potential |

|---|---|---|---|---|

| Rule-Based | Low | Low | High | Moderate |

| Machine Learning-Driven | High | High | Medium | High |

| Hybrid | Medium-High | Medium-High | High | High |

From personal experience and industry observation, hybrid approaches often provide the most balanced results for perpetual futures analysts. While rule-based strategies are excellent for beginners, and ML-driven systems shine in advanced contexts, hybrid adoption ensures long-term sustainability.

Practical Steps for Algorithm Adoption

Step 1: Define Your Trading Objectives

Clarify whether your focus is on risk management, scalping profits, or long-term arbitrage.

Step 2: Choose the Right Algorithm Type

For new analysts, rule-based systems are ideal, while professionals may move toward machine learning or hybrid adoption.

Step 3: Test and Backtest

Before deploying an algorithm live, analysts should backtest strategies against historical data. This process reveals flaws, overfitting risks, and profitability potential.

Step 4: Monitor and Adjust

Algorithms require constant monitoring, especially in perpetual futures markets where leverage risks can escalate quickly. Analysts should adopt dashboards for real-time risk tracking.

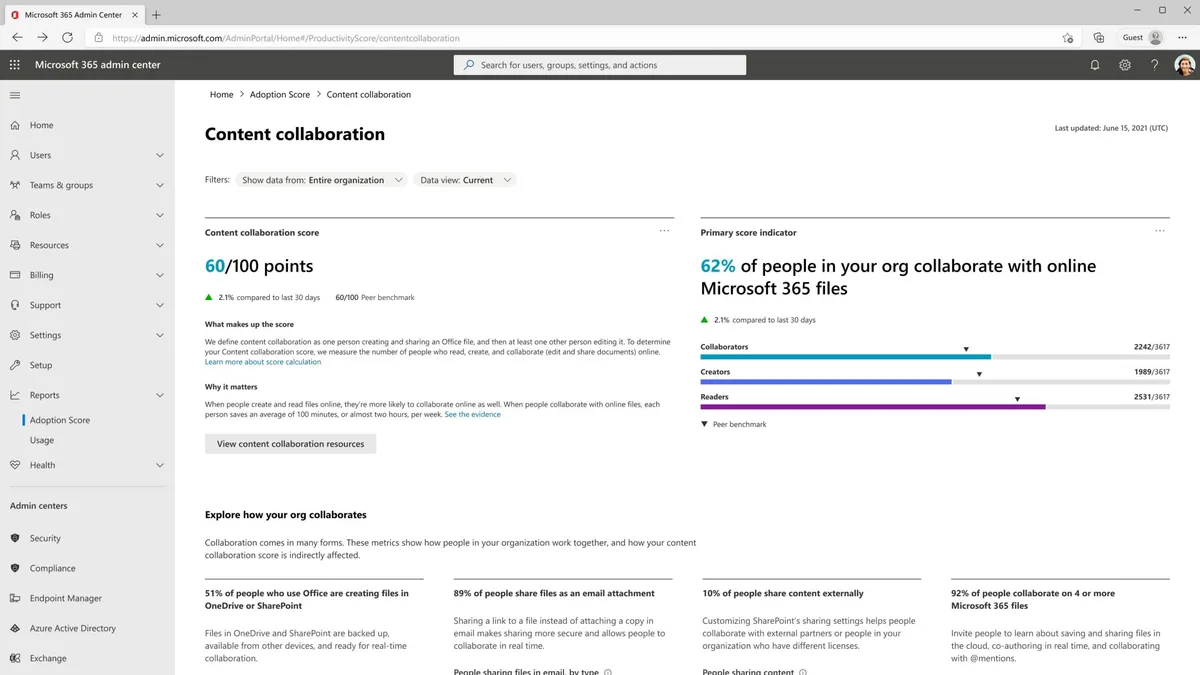

Visual Insights

Algorithm adoption workflow in perpetual futures trading

Advanced Use Cases in Perpetual Futures

Risk Arbitrage

Algorithms help analysts exploit differences in funding rates across exchanges. By simultaneously going long on one exchange and short on another, analysts can lock in profit.

Momentum Strategies

Algorithms detect sharp momentum moves in perpetual futures contracts and automatically capitalize on rapid shifts.

Market-Making

Through algorithm adoption, perpetual futures analysts can place both buy and sell orders, profiting from bid-ask spreads while managing inventory risk.

These applications demonstrate how to use algorithm for perpetual futures not only to increase profits but also to stabilize long-term trading practices.

Emerging Trends in Algorithm Adoption

- AI-Powered Reinforcement Learning – Analysts are increasingly experimenting with reinforcement learning to improve execution efficiency.

- Cross-Asset Arbitrage – Algorithms now integrate perpetual futures with spot, options, and ETFs for multi-market strategies.

- Cloud-Based Trading Infrastructure – Remote algorithm deployment ensures scalability and real-time optimization.

Such trends highlight the evolving landscape of algorithm-based solutions, paving the way for innovative algorithm applications in perpetual futures.

FAQ: Common Questions for Perpetual Futures Analysts

1. What is the biggest challenge in adopting algorithms for perpetual futures?

The main challenge lies in balancing speed and accuracy. While algorithms can process massive amounts of data, they require proper calibration to avoid overtrading or mismanaging leverage in volatile conditions.

2. How can beginners start using algorithms in perpetual futures?

Beginners should start with simple rule-based algorithms. Open-source platforms like Python with libraries such as CCXT or Backtrader provide accessible entry points without requiring large capital investments.

3. Do algorithms eliminate the need for human analysts?

No. Algorithms enhance analyst efficiency but cannot fully replace human judgment. Market anomalies, regulatory changes, and unforeseen macroeconomic events still require human intervention.

Conclusion

Algorithm adoption for perpetual futures analysts is no longer optional—it is a cornerstone of modern trading. By comparing rule-based, machine learning, and hybrid strategies, analysts can identify approaches best suited for their trading goals. With proper implementation, continuous monitoring, and the integration of emerging technologies, algorithm adoption ensures more precise execution, stronger risk management, and improved profitability.

If you found this guide useful, share it with your colleagues, join the discussion below, and help spread insights into algorithm adoption in perpetual futures trading. Together, we can enhance trading efficiency across the global market.