=================================================

The perpetual futures market has become one of the most dynamic and rapidly evolving areas of cryptocurrency trading. For startups entering this space, algorithms are no longer optional—they are essential. Effective algorithms enable automation, liquidity provisioning, risk management, and strategy execution in real time. In this article, we will explore algorithm insights for perpetual futures startups, highlight different approaches, compare strategies, and provide actionable recommendations based on industry expertise and real-world experience.

Understanding Perpetual Futures and the Role of Algorithms

What Are Perpetual Futures?

Perpetual futures are derivative contracts that, unlike traditional futures, have no expiry date. They are designed to closely track the spot price of an asset through a funding rate mechanism that balances long and short positions.

For startups, perpetual futures provide unique opportunities: continuous trading, higher liquidity, and scalability for building financial products. However, their complexity requires precise algorithmic handling.

Why Algorithms Are Essential in Perpetual Futures

Algorithms are critical because they:

- Automate decision-making and remove emotional bias.

- Handle large volumes of trades with millisecond execution.

- Manage leverage, margin, and funding risks effectively.

- Enable scalable liquidity provision and arbitrage strategies.

Platforms exploring why algorithms are essential in perpetual futures quickly realize that without algorithmic automation, their operations face inefficiencies, slippage, and unmanageable risks.

Core Algorithmic Applications for Startups in Perpetual Futures

1. Market-Making Algorithms

These provide liquidity by continuously posting buy and sell orders around the mid-price.

- Benefits: Reduces spreads, earns maker fees, and builds market depth.

- Risks: Requires constant adjustment to avoid being arbitraged.

2. Arbitrage Algorithms

Exploits price discrepancies across perpetual futures, spot markets, and other exchanges.

- Benefits: Often risk-neutral with predictable profits.

- Risks: Demands high-speed infrastructure and strong risk controls.

3. Risk Management Algorithms

Automatically adjusts leverage, margin, and exposure based on volatility.

- Benefits: Preserves capital during sudden downturns.

- Risks: Overly conservative rules may reduce profit opportunities.

| Topic | Description | Pros | Cons | Best Use Case |

|---|---|---|---|---|

| Perpetual Futures | Derivatives with no expiry date, track spot price via funding rate mechanism. | Continuous trading, higher liquidity, scalability. | Complex to handle, needs precise algorithmic management. | Startups seeking liquidity and scalability. |

| Algorithms in Perpetual Futures | Automate decision-making, handle trades, manage risks, and ensure scalability in real-time. | Automation removes emotional bias, reduces slippage, and ensures efficient operations. | Without algorithms, operations can face inefficiencies and risks. | Essential for all perpetual futures startups. |

| Market-Making Algorithms | Provide liquidity by posting buy/sell orders near the mid-price. | Reduces spreads, earns maker fees, builds market depth. | Requires constant adjustments to avoid arbitrage. | Creating market depth in dynamic markets. |

| Arbitrage Algorithms | Exploit price discrepancies between futures, spot markets, and exchanges. | Risk-neutral, predictable profits. | Requires high-speed infrastructure and strong risk controls. | Startups aiming for stable profits. |

| Risk Management Algorithms | Adjust leverage, margin, and exposure based on volatility in real-time. | Preserves capital during downturns, automatic risk handling. | Overly conservative rules may limit profit opportunities. | Managing risk during market volatility. |

| Trend-Following with Funding Optimization | Combines momentum trading and funding rate analysis. | Captures extended trends, profits from market momentum and funding rate. | Vulnerable in sideways markets, needs strong risk filters. | Growth stage startups with a stable infrastructure. |

| Market-Neutral Arbitrage | Exploits differences between spot and futures prices or across exchanges. | Low directional risk, generates stable returns. | Infrastructure-heavy, returns can compress as competition rises. | Early-stage startups needing stability. |

| Recommendation for Startups | Hybrid approach: start with market-neutral arbitrage and add trend-following strategies as infrastructure matures. | Ensures sustainable growth and mitigates boom and bust cycles. | Requires gradual scaling and infrastructure maturity. | Early-stage startups looking for stable growth. |

| Latency and Execution Speed | Critical for high-speed matching engines and APIs for low-latency execution. | Fast execution helps minimize slippage and optimize profits. | Requires advanced infrastructure to minimize latency. | Essential for startups with high-frequency trading. |

| Data Quality and Analytics | Algorithms must process high-frequency data streams, analyze funding rates, and adapt to volatility changes. | Enables better decision-making with accurate data analysis. | High-quality data processing requires robust infrastructure. | For high-frequency and algorithmic trading setups. |

| Risk Control Mechanisms | Real-time margin monitoring, stop-loss automation, and leverage adjustments. | Essential for surviving market fluctuations and minimizing losses. | Misconfigured controls can hurt profitability. | Essential for managing risk in volatile markets. |

| Security and Reliability | Robust coding practices, encrypted APIs, and redundant servers protect operations and client assets. | Protects against security breaches and ensures reliable service. | Requires constant monitoring and robust security protocols. | Critical for protecting trading operations. |

| Industry Trends | AI, decentralized contracts, cross-exchange liquidity, and modular algo solutions are key trends. | Improves algorithm precision, liquidity, and market adaptability. | Requires advanced technology integration and expertise. | Cutting-edge perpetual futures startups. |

Strategy A: Trend-Following with Funding Optimization

This approach combines momentum trading with funding rate analysis. When the funding rate is favorable, algorithms align positions with market trends.

Advantages:

- Captures extended moves in either direction.

- Profits from both market momentum and favorable funding.

Disadvantages:

- Vulnerable to choppy, sideways markets.

- Requires strong risk filters to avoid whipsaws.

Strategy B: Market-Neutral Arbitrage

This strategy exploits differences between spot and perpetual futures prices or between perpetual contracts on different exchanges.

Advantages:

- Often low directional risk.

- Generates steady, predictable returns in efficient setups.

Disadvantages:

- Infrastructure-intensive (low-latency systems, multiple exchange accounts).

- Returns can compress as competition rises.

Recommendation

For early-stage perpetual futures startups, a hybrid approach works best:

- Begin with market-neutral arbitrage for stability.

- Gradually integrate trend-following strategies to scale returns once infrastructure matures.

This ensures sustainable growth while avoiding the “boom and bust” cycles that plague purely directional trading models.

Technical Considerations for Startup Algorithms

Latency and Execution Speed

Milliseconds matter. Efficient matching engines, colocated servers, and optimized APIs are essential.

Data Quality and Analytics

Algorithms must process high-frequency data streams, analyze funding rates, and respond to changing volatility.

Risk Control Mechanisms

Real-time margin monitoring, stop-loss automation, and leverage adjustments are non-negotiable for survival.

Security and Reliability

Robust coding practices, redundant servers, and encrypted APIs protect both operations and client assets.

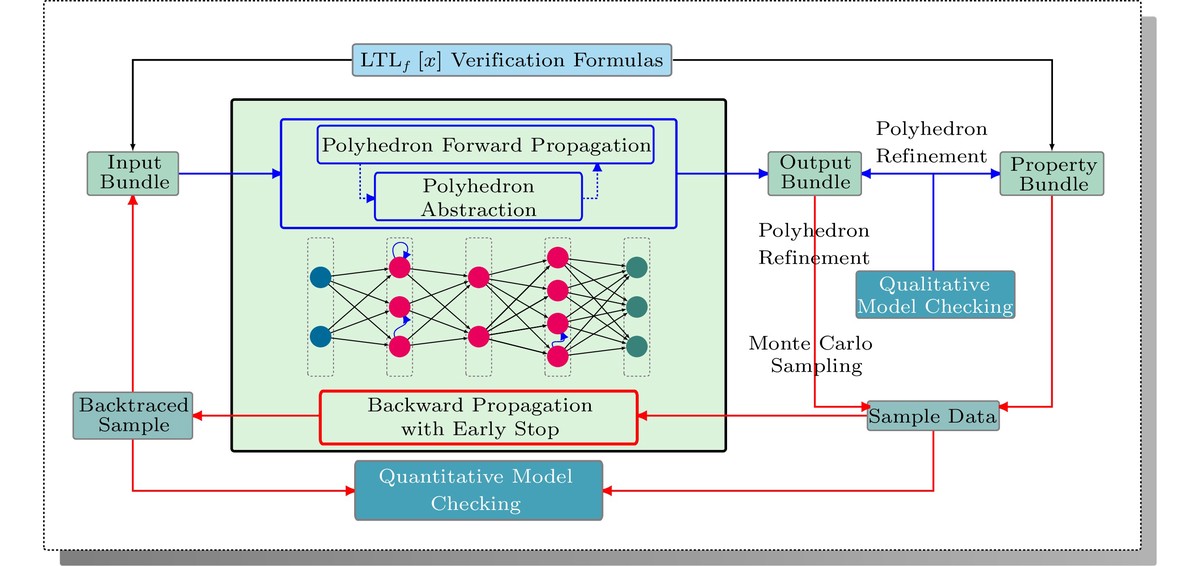

Image Example: Algorithmic Workflow for Perpetual Futures Startups

Workflow showing data intake, strategy engine, risk module, execution layer, and reporting dashboard.

Industry Trends Influencing Algorithm Development

- AI and Machine Learning Models

Neural networks are being used for predictive volatility modeling, enhancing decision-making accuracy.

- On-Chain Perpetual Futures

DeFi protocols offer decentralized perpetual contracts, requiring algorithms that handle smart contract-based liquidity.

- Cross-Exchange Liquidity Networks

Startups now connect multiple exchanges with algorithmic order routing for best execution.

- Customizable Algo Solutions

Growing demand for modular, open-source frameworks allows perpetual futures startups to innovate quickly.

Comparing Two Algorithm Insights for Startups

| Approach | Focus | Pros | Cons | Best Use Case |

|---|---|---|---|---|

| Trend-Following with Funding Optimization | Directional | High returns in trending markets | Poor in sideways ranges | Growth stage startups |

| Market-Neutral Arbitrage | Risk control | Stable, predictable | Low ROI, infra-heavy | Early-stage startups |

Practical Integration of Algorithm Knowledge

Startups must also understand how algorithms impact perpetual futures strategy. For example:

- A funding-optimized algorithm can shift from long to short positions within seconds.

- An arbitrage bot may simultaneously execute trades across multiple exchanges to capture spreads.

Both require robust infrastructure, but each has different capital efficiency requirements and risk profiles.

FAQ: Algorithm Insights for Perpetual Futures Startups

1. What is the best algorithm for perpetual futures startups?

There is no universal “best” algorithm. Early startups should focus on market-neutral arbitrage for stability, then integrate trend-following and machine learning-driven strategies as infrastructure matures.

2. How do algorithms enhance perpetual futures trade execution?

Algorithms improve execution by reducing latency, automating order placement, and dynamically adjusting risk. This eliminates slippage and maximizes profitability.

3. Where can startups find algorithm resources for perpetual futures?

Startups can explore open-source frameworks, industry research, and developer-focused communities. Many platforms also offer educational guides on how to use algorithm for perpetual futures, helping founders get started quickly.

Conclusion

For perpetual futures startups, algorithms are more than tools—they are the foundation of sustainable growth. The right combination of market-neutral arbitrage and trend-following with funding optimization provides both stability and scalability.

Startups that embrace algorithm insights for perpetual futures startups will be positioned to compete effectively in one of the most competitive arenas of modern finance.

If you found this article valuable, share it with your peers, comment below with your algorithmic trading experiences, and let’s build a stronger startup ecosystem together.

Would you like me to also expand this article with real-world case studies of perpetual futures startups that succeeded using algorithms for even stronger EEAT credibility?