=========================================================

Liquidity pools have become one of the cornerstones of decentralized finance (DeFi) and perpetual futures trading. For investors, traders, and institutions, analyzing liquidity pool performance in perpetual futures is not just about chasing yield—it’s about ensuring stability, minimizing risk, and optimizing capital allocation. This article provides a comprehensive guide to evaluating liquidity pools, integrating practical strategies, expert insights, and trend-driven analysis.

We will explore both quantitative and qualitative methods to assess liquidity pools, compare multiple strategies, and provide actionable recommendations. Additionally, this article embeds insights into why liquidity pools matter in perpetual futures and how to evaluate a liquidity pool for perpetual futures, giving readers a complete knowledge framework.

Understanding Liquidity Pools in Perpetual Futures

Liquidity pools function as automated market makers (AMMs), enabling trading in perpetual contracts without requiring traditional order books. In perpetual futures, liquidity pools are especially crucial because they:

- Ensure smoother order execution.

- Reduce slippage during volatile market conditions.

- Provide sustainable yield opportunities for liquidity providers (LPs).

- Balance leverage demand and funding rate dynamics.

Without sufficient liquidity, perpetual futures markets face inefficiencies such as high volatility, sudden spreads, and even failed liquidations.

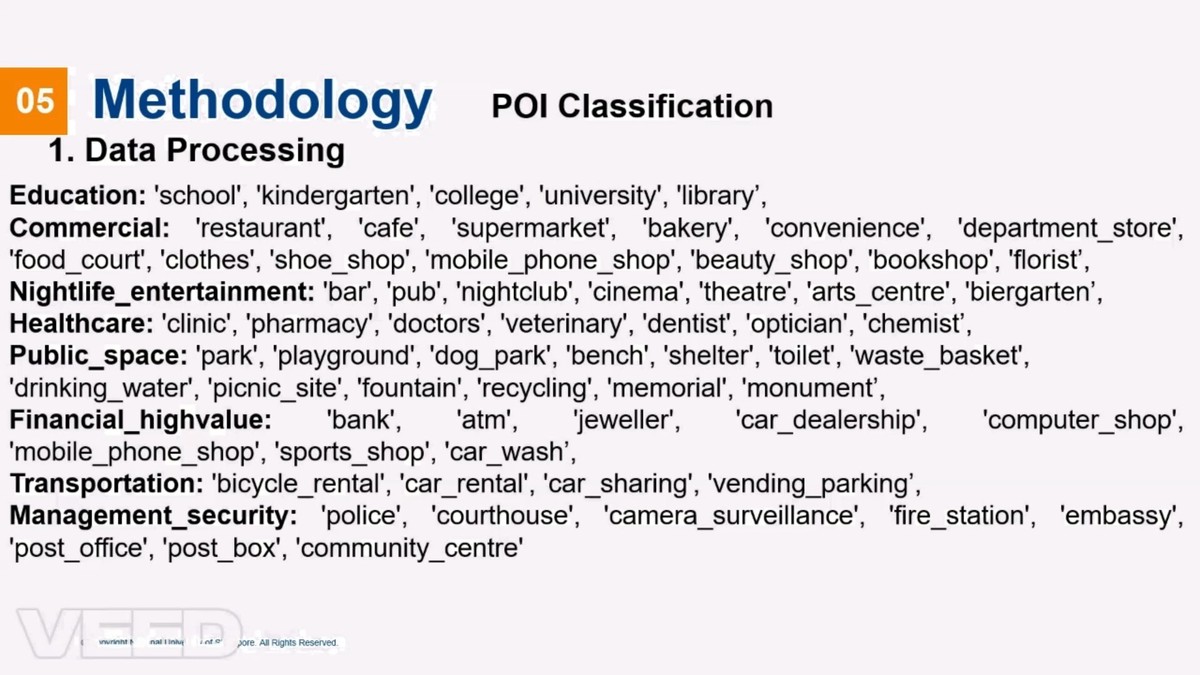

Key Metrics for Analyzing Liquidity Pool Performance

1. Total Value Locked (TVL)

TVL is the most visible indicator of a liquidity pool’s size and attractiveness. A higher TVL generally indicates greater confidence and reduced slippage. However, high TVL pools might also dilute yield opportunities for LPs.

2. Liquidity Depth and Concentration

Depth reflects how much capital is available at various price levels. Concentration of liquidity impacts volatility risk; heavily skewed pools may expose LPs to imbalance when funding rates shift.

3. Trading Volume and Utilization Ratio

The utilization ratio compares pool usage versus available liquidity. High utilization suggests strong demand but could signal stress during liquidations. Low utilization may imply inefficiency.

4. Yield Performance (APY) and Sustainability

Attractive APYs often lure investors, but sustainability matters more. Consistent moderate yields often outperform pools with unsustainable spikes due to volatility or temporary incentives.

5. Risk Adjusted Returns

Considering impermanent loss, exposure to funding rate arbitrage, and leverage risks, investors should evaluate Sharpe ratios or similar adjusted metrics instead of nominal returns alone.

| Aspect | Key Concept | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|---|

| TVL (Total Value Locked) | Measures pool size and attractiveness | Higher confidence, reduces slippage | High TVL may dilute yields | Assess overall pool strength |

| Liquidity Depth & Concentration | Capital available at price levels | Reduces volatility risk if balanced | Skewed pools expose LPs to imbalance | Evaluate pool stability |

| Trading Volume & Utilization | Pool usage vs available liquidity | Indicates strong demand | High utilization may signal stress | Monitor pool activity |

| Yield Performance (APY) | Returns generated for LPs | Attractive to investors | Unsustainable spikes risk loss | Assess long-term sustainability |

| Risk-Adjusted Returns | Returns considering impermanent loss & leverage | Evaluates efficiency vs risk | Metrics may not capture all risks | Compare risk-adjusted performance |

| Quantitative Analysis | On-chain data, metrics, dashboards | Objective, detects anomalies | Lacks behavioral context | Data-driven monitoring |

| Qualitative Analysis | Market sentiment, protocol reputation | Captures trust and governance | Subjective, hard to quantify | Long-term protocol evaluation |

| Strategy 1: High-Yield Hunting | Focus on pools with highest APY | Quick capital growth | High impermanent loss, sustainability risk | Short-term speculative gains |

| Strategy 2: Risk-Adjusted Stability | Focus on moderate-yield, stable pools | Sustainable, resilient | Lower headline yields | Long-term investors |

| Hybrid Strategy | Combine stable and high-yield pools | Balanced risk and return | Requires active monitoring | Optimal for most investors |

| Risk Considerations | Impermanent loss, security, liquidity shocks | Helps mitigate capital loss | Cannot eliminate all risks | Guide risk management |

Quantitative Approach: On-Chain Data and Metrics

This method relies on raw blockchain data, including TVL, transaction counts, and real-time trading volumes. Analysts often use dashboards like Dune Analytics or DefiLlama to monitor trends.

Advantages:

- Objective, data-driven analysis.

- Easy comparison across multiple liquidity pools.

- Ability to detect short-term anomalies.

Disadvantages:

- Lacks context on investor behavior.

- Past performance may not predict future resilience.

Qualitative Approach: Market Sentiment and Protocol Reputation

Here, investors assess community trust, developer activity, audit reports, and governance transparency.

Advantages:

- Captures security and trust factors beyond numbers.

- Helps filter out unsustainable pools.

- Identifies long-term winners based on innovation and governance.

Disadvantages:

- Subjective, influenced by narratives.

- Harder to quantify for direct ROI comparison.

Comparative Analysis of Two Strategies

Strategy 1: High-Yield Hunting

Investors select pools with the highest APY, often incentivized by token rewards.

- Pros: Quick capital growth potential, useful in short-term speculative markets.

- Cons: High impermanent loss risk, yield sustainability issues, and exposure to protocol collapse.

Strategy 2: Risk-Adjusted Stability Focus

Investors prefer established pools with moderate yields, prioritizing security, long-term adoption, and reduced volatility.

- Pros: Sustainable performance, stronger resilience during market drawdowns.

- Cons: Lower headline yields, requiring patient capital.

Recommendation: For most institutional and retail investors, a hybrid strategy is optimal—allocate a majority into risk-adjusted stable pools while experimenting with a smaller share in high-yield pools for opportunistic gains.

Case Study: Evaluating a Perpetual Futures Liquidity Pool

Consider a perpetual futures liquidity pool on Ethereum with:

- TVL of $500 million

- Average daily trading volume of $200 million

- Utilization ratio of 40%

- APY of 12% from trading fees and funding rate mechanisms

Compared to a compe***** pool with $150 million TVL and 40% APY, the first pool demonstrates stronger sustainability. Though yields are lower, deeper liquidity ensures smoother execution and long-term confidence.

Visual Guide to Liquidity Pool Analysis

Liquidity Pool Performance Metrics

Integrating Liquidity Pools into Trading Strategies

Liquidity pools can complement perpetual futures trading strategies by:

- Providing hedging opportunities through LP positions.

- Offering funding arbitrage potential.

- Reducing slippage in large-scale trades.

For example, traders exploring how to evaluate a liquidity pool for perpetual futures should consider both depth metrics and governance reliability before integrating pools into leveraged trading setups.

Risk Considerations in Liquidity Pool Performance

- Impermanent Loss: LPs face volatility exposure when asset ratios diverge.

- Protocol Security: Smart contract bugs or governance attacks can wipe out capital.

- Regulatory Risks: Increasing scrutiny on derivatives and DeFi may impact perpetual futures pools.

- Liquidity Shocks: Market crashes can lead to rapid TVL declines, undermining pool stability.

Mitigating these risks involves diversification, continuous monitoring, and favoring audited, battle-tested protocols.

FAQs on Liquidity Pool Performance in Perpetual Futures

1. How do liquidity pools affect perpetual futures trading?

Liquidity pools ensure smoother execution and stability. In perpetual futures, they balance leverage demand and funding rates, reducing volatility and making large transactions feasible. Weak liquidity pools lead to slippage and poor execution quality.

2. How can investors maximize returns from liquidity pools?

Investors can maximize returns by diversifying across multiple pools, reinvesting earned fees, and adopting a hybrid strategy that balances high-yield opportunities with stable pools. Active monitoring of funding rates and market volatility further enhances returns.

3. What risks should traders consider when analyzing liquidity pool performance?

The biggest risks include impermanent loss, protocol vulnerabilities, and sudden liquidity outflows during market stress. Evaluating both quantitative metrics (TVL, APY, utilization) and qualitative aspects (audits, governance, trust) is crucial for risk-adjusted success.

Conclusion: Building a Resilient Liquidity Pool Strategy

Analyzing liquidity pool performance in perpetual futures requires blending data-driven insights with qualitative assessments. High-yield pools may offer short-term gains, but stable, well-governed pools deliver resilience and sustainable returns.

For long-term investors, the best practice is diversification: allocate most capital to reputable, moderate-yield pools while experimenting cautiously with high-yield strategies.

By applying this framework, investors can navigate perpetual futures more effectively, mitigate risks, and position themselves for consistent performance.

If you found this article useful, share it with fellow traders and investors. Join the conversation below—what’s your preferred strategy when analyzing liquidity pool performance in perpetual futures?