================================================

The rise of perpetual futures has created a dynamic environment where hedge funds are increasingly reliant on Application Programming Interfaces (APIs) to execute trades, manage risk, and optimize strategies. With institutional-grade infrastructure, hedge funds demand speed, accuracy, and flexibility—qualities that APIs deliver better than manual trading systems.

In this comprehensive guide, we will explore how hedge funds leverage API for perpetual futures trading, compare multiple strategies, evaluate the pros and cons, and provide practical insights grounded in industry experience. By the end, you will understand not only the technical integration but also the best practices that drive success in institutional-level futures trading.

Why Hedge Funds Use API for Perpetual Futures

APIs allow hedge funds to connect directly with exchanges, automate workflows, and gain access to real-time market data. This creates several key advantages:

- Latency Reduction: Faster trade execution reduces slippage.

- Automation: Complex strategies can run 24⁄7 without human intervention.

- Scalability: APIs support high-frequency trades and large volumes.

- Risk Management: Built-in controls monitor positions, margin, and liquidation risk.

Insight: Without APIs, hedge funds would struggle to compete in today’s ultra-fast derivatives markets.

Core Features of APIs in Perpetual Futures Trading

1. Real-Time Market Data

APIs deliver live order books, tick-by-tick updates, and historical candlestick data, essential for building quantitative models.

2. Order Execution

Hedge funds can use APIs to submit, amend, and cancel orders programmatically. Advanced routing ensures trades hit the market with minimal slippage.

3. Account Management

Through API calls, funds monitor balances, open positions, unrealized P&L, and margin requirements in real time.

4. Risk Controls

Stop-loss, take-profit, and liquidation safeguards can be automated via APIs, ensuring discipline in volatile markets.

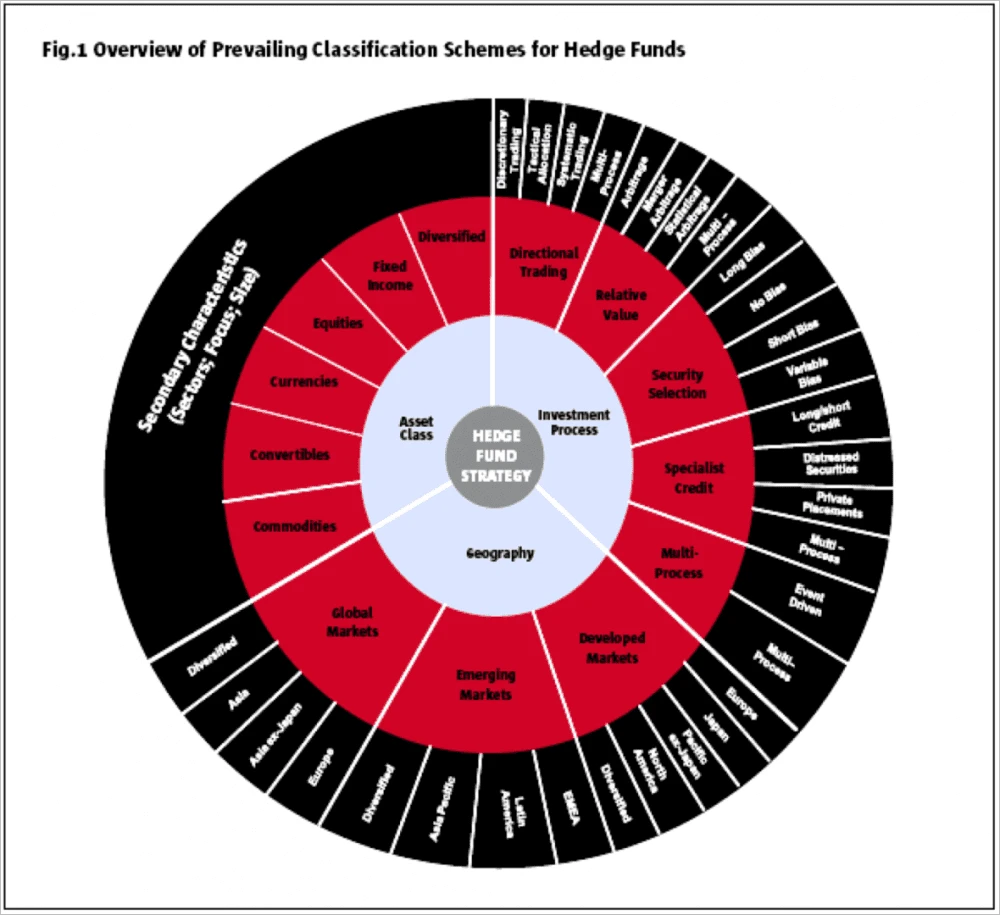

Illustration of how APIs streamline hedge fund operations in perpetual futures trading.

| Aspect | Key Points |

|---|---|

| Definition | APIs enable automated, high-frequency trading for hedge funds |

| Purpose | Optimize positions, improve efficiency, minimize risk in perpetual futures |

| Perpetual Futures Overview | Derivatives with no expiry; trade 24⁄7; suitable for long and short positions |

| API Roles | Real-time data, automation, order execution, decision-making |

| Key Features of APIs | Low latency, reliability, security, comprehensive data feeds |

| Popular API Providers | Binance, Kraken, BitMEX, FTX |

| Benefits | Enhanced speed, precision, customization, risk management |

| Best Practices | Robust security, constant monitoring, algorithm optimization |

| Common Challenges | Latency issues, integration complexity, security risks |

| Optimization Tips | Minimize latency, secure APIs, backtest algorithms, update systems regularly |

| Recommended for Beginners | Binance API, Kraken API with user-friendly interfaces and documentation |

Strategy 1: High-Frequency Arbitrage via APIs

Hedge funds often deploy APIs to exploit price discrepancies between perpetual futures contracts across multiple exchanges.

How it Works:

- API scans order books across platforms.

- When a spread exceeds transaction costs, the system buys on the cheaper exchange and sells on the more expensive one.

Pros:

- Generates low-risk profits.

- Ideal for hedge funds with robust infrastructure.

Cons:

- Requires extremely low latency connections.

- Profits per trade are small, relying on high frequency.

Strategy 2: Algorithmic Trend-Following with APIs

Another effective strategy is using APIs to automate algorithmic trading models that follow market momentum.

How it Works:

- APIs collect market data.

- Quantitative models identify breakout or mean-reversion signals.

- Orders are placed instantly using API calls.

Pros:

- Higher return potential compared to arbitrage.

- Works across diverse markets, not just exchange spreads.

Cons:

- Higher market risk, as it depends on predictive accuracy.

- Requires ongoing model optimization.

Comparing the Two Strategies

| Feature | Arbitrage with API | Trend-Following with API |

|---|---|---|

| Risk Level | Low (market-neutral) | Medium-High |

| Infrastructure Demand | Very High | Medium |

| Return Potential | Steady but modest | Higher, but volatile |

| Best Use Case | Large funds with HFT setups | Funds seeking alpha |

Recommendation: Hedge funds should not rely solely on one method. A hybrid approach, using API-driven arbitrage for stable returns and trend-following for higher upside, often yields the most resilient portfolio.

How API Improves Perpetual Futures Trading Strategies

The role of APIs extends beyond simple execution—they enhance strategy development and optimization. Hedge funds use APIs to:

- Backtest models on historical datasets.

- Deploy trading bots that adjust positions in real time.

- Optimize strategies with machine learning models that process API-fed data.

This explains why API is essential for perpetual futures, especially for institutional investors competing in markets where milliseconds matter.

Security Considerations for Hedge Funds Using APIs

APIs provide unmatched advantages, but security is non-negotiable for hedge funds. Key safeguards include:

- IP Whitelisting: Restricting access to approved servers.

- Encryption: Secure data transmission using SSL/TLS protocols.

- API Key Management: Rotating keys regularly to prevent unauthorized access.

- Rate Limiting: Avoiding overuse that may trigger exchange bans.

Security measures hedge funds implement for API-based futures trading.

Challenges Hedge Funds Face with APIs

- Exchange Reliability: Downtime or throttling can disrupt trades.

- Latency Variations: Not all exchanges provide equal infrastructure.

- Integration Costs: Building API-driven systems requires significant upfront investment.

- Regulatory Compliance: Funds must ensure API-driven trades comply with jurisdictional rules.

Best Practices for Hedge Funds Using APIs

- Partner with exchanges offering institutional-grade APIs.

- Prioritize redundancy, ensuring backup systems handle downtime.

- Use real-time monitoring dashboards to track API performance.

- Train internal teams on API error handling and fail-safes.

- Regularly audit API performance against benchmark standards.

FAQ: API for Hedge Funds in Perpetual Futures

1. How to use API for perpetual futures trading effectively?

Hedge funds should start with sandbox environments provided by exchanges. Test API connections, order routing, and latency before going live. Once stable, gradually scale volume and complexity.

2. What is the biggest advantage of API for hedge funds in perpetual futures?

The key advantage is automation with precision. APIs allow hedge funds to execute complex trades instantly, reducing emotional bias and human error. This enables consistent, scalable trading strategies.

3. Are APIs suitable for smaller hedge funds?

Yes, but smaller funds should begin with managed API solutions or third-party providers to avoid large infrastructure costs. Over time, developing in-house API systems becomes more cost-effective.

Conclusion: APIs as a Cornerstone for Hedge Fund Success

For hedge funds, APIs are no longer optional—they are the backbone of perpetual futures trading. From arbitrage strategies that exploit inefficiencies to algorithmic trend-following models that generate alpha, APIs provide the speed, scalability, and security required in today’s markets.

The future belongs to funds that can integrate APIs intelligently, combining advanced technology with robust risk management.

If you found this guide insightful, share it with your network of financial professionals. What strategies do you think hedge funds should prioritize when deploying APIs for perpetual futures trading? Let’s start a discussion in the comments.

Would you like me to also prepare a step-by-step API integration checklist for hedge funds, formatted as a downloadable PDF, so readers can use it as a practical implementation tool?