=======================================================

Automated trading has rapidly become a cornerstone of modern financial markets, particularly in the fast-paced world of cryptocurrency derivatives. Among these, perpetual futures stand out for their popularity due to continuous trading, leverage opportunities, and absence of expiry dates. For both professional and retail traders, the question is no longer whether to automate, but how to automate trading with API for perpetual futures.

This article provides a complete, SEO-optimized guide covering API fundamentals, strategies, benefits, risks, and implementation. Whether you are a beginner exploring automation or an advanced developer building complex systems, this guide will help you structure your journey.

Understanding Perpetual Futures and APIs

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the price of assets (like Bitcoin or Ethereum) without expiry. Unlike traditional futures, perpetual contracts use a funding rate mechanism to keep the price aligned with the spot market.

- Key Advantages: No expiration date, high liquidity, and leverage options.

- Key Risks: High volatility, funding costs, and liquidation risks.

What Is an API in Trading?

API (Application Programming Interface) is a set of protocols that enables software applications to communicate with trading platforms. With APIs, traders can:

- Access real-time market data

- Place and manage orders programmatically

- Automate risk management

- Build custom trading bots

For deeper insight, traders can check How to use API for perpetual futures trading?, which explains practical integration from both a technical and strategic perspective.

Why Automate Perpetual Futures with API?

Advantages of Automation

- Speed & Precision – APIs allow execution in milliseconds.

- Consistency – Eliminates emotional decision-making.

- Scalability – One bot can monitor multiple markets simultaneously.

- 24⁄7 Trading – Perfectly suited for crypto’s non-stop environment.

Potential Drawbacks

- Technical Complexity – Requires coding and debugging skills.

- Over-Optimization Risk – Backtested models may fail in real markets.

- Security Risks – Poor API key management can lead to unauthorized access.

For a more technical angle, explore Where to get reliable API documentation for perpetual futures?, which helps developers access official references and security best practices.

Two Main Methods to Automate Perpetual Futures with API

1. Using Pre-Built Trading Bots with API Integration

Many platforms offer bots that connect directly to exchanges via API keys. These bots allow traders to automate strategies without extensive coding knowledge.

Advantages

- Easy setup, beginner-friendly

- User-friendly dashboards

- Access to multiple pre-configured strategies

Disadvantages

- Limited customization

- Subscription fees

- Potential for strategy overuse (many traders using the same bot)

Example: A retail trader links their Binance account to a third-party trading bot using an API key. The bot automatically executes grid trading on perpetual futures pairs.

2. Building Custom Algorithms with Direct API Access

Advanced traders and developers often build custom trading systems using exchange-provided APIs. This involves coding in Python, JavaScript, or C++, integrating trading signals, and deploying the bot on servers.

Advantages

- Full control over strategy

- Ability to optimize performance

- Integration of advanced indicators and risk parameters

Disadvantages

- Requires programming skills

- Higher setup and maintenance costs

- Greater responsibility for testing and security

Example: A hedge fund builds a Python-based trading engine that executes momentum strategies on perpetual futures, with custom risk controls and dynamic position sizing.

Step-by-Step Guide: Automating Trading with API

Step 1: Choose a Reliable Exchange

Select an exchange that offers a stable and well-documented API (e.g., Binance Futures, Bybit, OKX).

Step 2: Generate API Keys

- Go to account settings

- Create API keys with trading permissions

- Restrict IP addresses for better security

Step 3: Connect API to Your System

Use libraries such as:

- CCXT (Python/JavaScript): Simplifies exchange integration

- WebSocket APIs: For real-time data streaming

- REST APIs: For placing/canceling orders

Step 4: Define Trading Strategies

Common strategies for perpetual futures include:

- Grid Trading (buy low, sell high in ranges)

- Momentum/Trend Following

- Arbitrage Between Exchanges

Step 5: Implement Risk Management

- Stop-loss orders

- Position sizing

- Funding fee optimization

Step 6: Backtest Before Deployment

Run strategies on historical data to measure:

- Win rate

- Maximum drawdown

- Profit-to-loss ratio

Step 7: Monitor and Optimize

- Set alerts for abnormal activity

- Track performance metrics in real time

- Adjust parameters periodically

Practical Case Study

A European retail trader wanted to automate perpetual futures trading without deep coding knowledge. They opted for a bot platform, connecting via API to Binance. Initially, the bot performed grid trading with small profits but often overtraded during volatile spikes.

Later, the trader shifted to a custom-built Python bot using CCXT. By applying ATR-based stop-loss and machine learning models for volatility prediction, the bot achieved a 25% improvement in risk-adjusted returns compared to the pre-built option.

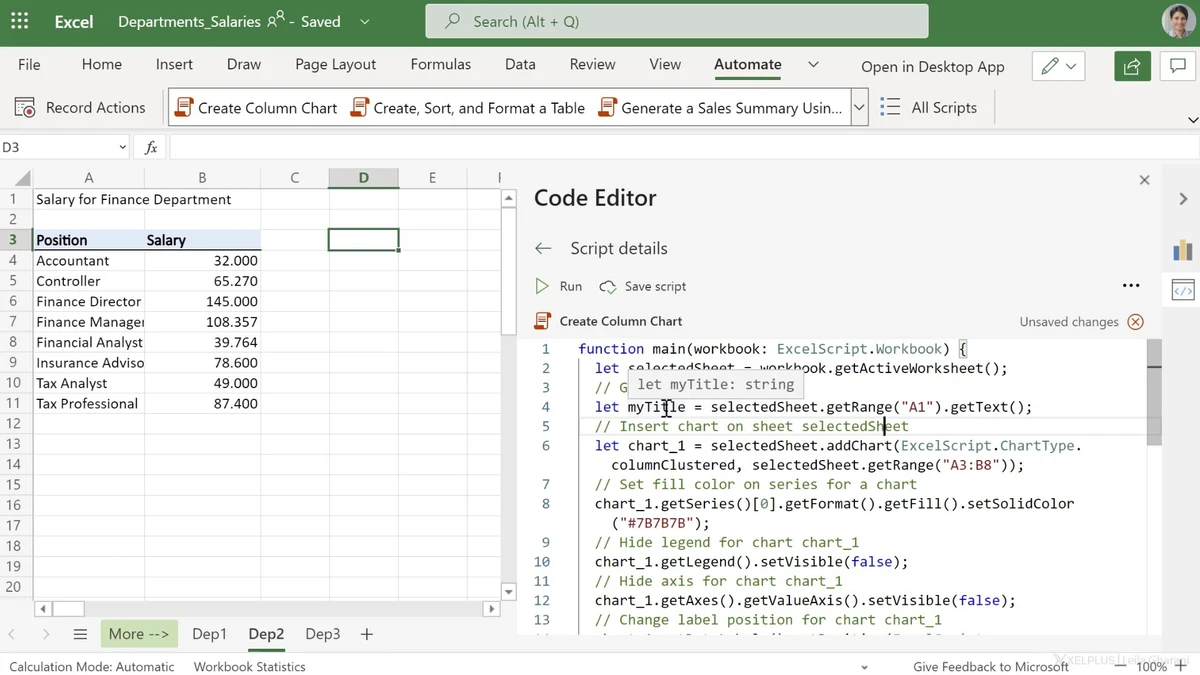

Visual Insights

A simple overview of API integration within automated trading systems.

Funding rate mechanism keeps perpetual futures aligned with the spot price.

Common Mistakes to Avoid

- Not Securing API Keys – Never share keys; always use restricted permissions.

- Skipping Backtests – Running a strategy live without validation often leads to losses.

- Over-Leverage – Perpetual futures already carry high risks; excessive leverage accelerates liquidations.

- Ignoring Latency – Slow execution can ruin high-frequency strategies.

Recommendations: Best Approach

- Beginners: Start with pre-built bots and gradually move to custom development.

- Advanced Traders/Institutions: Build custom APIs for flexibility, integrate robust risk management, and optimize latency.

- Security Priority: Always secure API keys and use IP restrictions.

FAQ: Automating Perpetual Futures Trading with API

1. Do I need coding skills to automate perpetual futures trading with API?

Not necessarily. Beginners can use pre-built bots connected via API keys. However, advanced automation requires programming knowledge, especially in Python or JavaScript.

2. How secure is trading with API?

APIs are safe if used properly. Always restrict API keys to specific permissions (e.g., no withdrawals), enable two-factor authentication, and whitelist IP addresses.

3. Which is better: pre-built bots or custom API solutions?

- Pre-Built Bots: Easier, faster setup, but limited customization.

- Custom API Solutions: Require coding skills but provide full flexibility and optimization. For long-term professional trading, custom APIs are superior.

Conclusion

Learning how to automate trading with API for perpetual futures empowers traders to leverage the speed, precision, and scalability of modern technology. While pre-built bots are ideal for beginners, custom-built API solutions provide unmatched flexibility and control.

If you’re serious about trading, start small, backtest extensively, and evolve your strategy with market experience.

Now it’s your turn: Have you tried automating your perpetual futures trades with APIs? Share your experiences in the comments below and forward this guide to fellow traders who might benefit. Let’s build smarter, safer, and more efficient trading systems together.

Would you like me to also generate a meta title & meta description (SEO snippet) for this article so it’s fully optimized for Google search rankings?