===================================================

Introduction

In the rapidly evolving landscape of financial research, backtest perpetual futures strategies for academics has become an essential area of focus. Academic researchers, quantitative analysts, and advanced finance students increasingly turn to backtesting as a way to validate hypotheses, assess risk management approaches, and develop innovative strategies in derivative markets. Unlike traditional stock trading, perpetual futures present unique challenges—such as funding rates, continuous contract structures, and 24⁄7 market behavior—that make rigorous backtesting indispensable.

This article provides an in-depth guide for academics who want to build robust frameworks for testing perpetual futures strategies. We’ll explore methodologies, highlight tools, discuss challenges, and compare different approaches. Drawing from both academic research and practical industry insights, the goal is to provide a comprehensive resource for scholars and practitioners alike.

Why Backtesting Matters for Academics

Ensuring Research Rigor

Backtesting allows academics to ground theoretical models in real-world market conditions. It bridges the gap between abstract financial theories and actual market data, providing empirical validation.

Contribution to Literature

Academic journals and conferences increasingly expect empirical testing as part of research contributions. Publishing a paper without demonstrating robust backtesting can significantly weaken credibility.

Student Learning and Pedagogy

In educational settings, backtesting is a powerful teaching tool. Graduate students in finance, economics, and data science use backtesting to gain hands-on experience with how to perform backtesting in perpetual futures, strengthening their understanding of quantitative finance.

| Topic | Description |

|---|---|

| What are Bollinger Bands? | Three lines: middle (SMA), upper (middle + 2×SD), lower (middle - 2×SD) that reflect market volatility. |

| Why Bollinger Bands Matter | Measure volatility, identify overbought/oversold conditions, highlight trends and reversals. |

| Volatility Impact | Wide bands signal high volatility; narrow bands suggest market consolidation. |

| Band Squeeze | Narrow bands signal potential breakout or strong price movement. |

| Mean Reversion Strategy | Buy at lower band, sell at upper band; effective in range-bound markets but ineffective in trends. |

| Breakout Trading Strategy | Buy above upper band or sell below lower band; works well in trending markets but prone to whipsaws. |

| Best Strategy for Market Type | Mean reversion for range-bound markets, breakout trading for trending markets. |

| Multi-Band Analysis | Using multiple Bollinger Bands (e.g., 1 SD, 2 SD) for stronger confirmation. |

| Timeframe Adaptation | Short-term traders use 5–15 min charts, swing traders use daily or weekly charts. |

| Integration with Futures | Applying Bollinger Bands in futures trading to analyze volatility and momentum. |

| Avoid Bands Alone | Combine with RSI, MACD, or volume for better accuracy. |

| Adjust Parameters | Modify Bollinger Band settings for different stocks and market conditions. |

| Watch for False Signals | Wait for confirmation to avoid false breakouts. |

| Risk Management with Bands | Use bands for dynamic stop-loss levels to manage risk. |

| Personal Experience | Combining RSI with Bollinger Bands improved trading accuracy by filtering false signals. |

| Industry Trends | Algorithmic trading, AI enhancements, and cross-market use in crypto and forex. |

| Beginner Suitability | Yes, but pair with other indicators for reliability. |

| Predicting Price Movements | No, they provide probability-based insights, not exact predictions. |

| Biggest Mistake with Bands | Assuming upper band = sell and lower band = buy, ignoring market trends. |

| Pro Trader Use | Professionals use multi-indicator strategies and adjust settings based on volatility. |

Continuous Contracts vs. Expiry

Unlike traditional futures, perpetual futures never expire. This requires careful handling of rolling windows, funding rate calculations, and liquidity adjustments.

Data Availability

Historical data for perpetual futures may not be as readily accessible as equities or traditional futures. Understanding where to find perpetual futures backtesting tools and reliable data sources is essential for research.

Overfitting Risks

Academics must be cautious not to design strategies that only work in-sample. Proper out-of-sample testing and cross-validation techniques are critical.

Methods of Backtesting Perpetual Futures

Method 1: Historical Data Replay

This method involves replaying historical tick or candle data to simulate how a strategy would have performed.

Advantages:

- Directly tests strategy robustness under actual market conditions.

- Captures extreme events like flash crashes or funding spikes.

Drawbacks:

- Requires large, high-quality datasets.

- Computationally intensive for high-frequency strategies.

Method 2: Monte Carlo Simulation

Monte Carlo methods use randomized simulations based on historical statistical distributions to model potential market outcomes.

Advantages:

- Helps test strategies under a wide variety of hypothetical conditions.

- Useful for stress-testing and risk modeling.

Drawbacks:

- Less realistic than historical replay.

- Requires strong statistical assumptions.

Which Method Works Best?

From experience, a hybrid approach is most effective. Begin with historical data replay to validate strategies under real-world conditions, then use Monte Carlo simulations to stress-test for robustness in rare events. This dual approach helps academics strike a balance between empirical accuracy and theoretical modeling.

A framework combining historical replay with Monte Carlo simulation for robust academic research

Tools and Platforms for Academic Researchers

Open-Source Libraries

Python-based tools such as Backtrader, Zipline, and QuantConnect provide flexible frameworks for perpetual futures backtesting. Researchers can modify code to fit academic experiments.

Proprietary Platforms

Commercial solutions like Trading Technologies and Bloomberg Terminal offer robust datasets and analytics, though access costs may be prohibitive for universities.

Academic-Industry Collaboration

Many universities partner with exchanges or trading firms to gain access to high-quality perpetual futures datasets, enabling richer research.

Analyzing Results in Academic Research

Statistical Validity

Beyond profit and loss, academics focus on Sharpe ratios, Sortino ratios, and drawdowns. This ensures a multidimensional evaluation of strategy performance.

Replicability

A key academic standard is replicability. Researchers must provide sufficient detail in methodologies and data sources to allow others to reproduce their findings.

Publication Readiness

High-quality backtesting results form the backbone of publishable research. Demonstrating clear robustness in results increases the likelihood of acceptance in peer-reviewed finance journals.

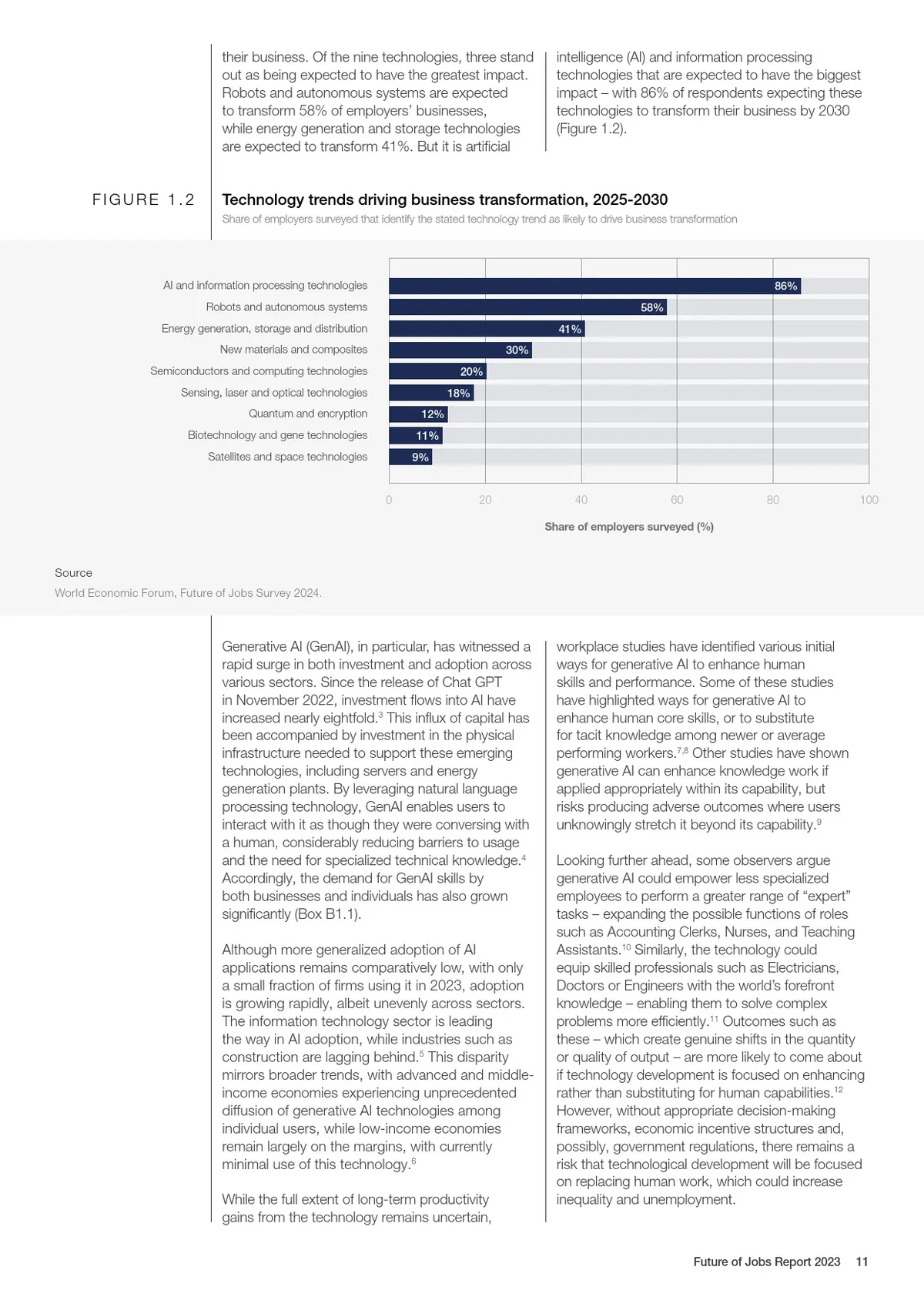

Industry Trends Relevant to Academics

Increasing Focus on Machine Learning

Machine learning models are being applied to perpetual futures strategies, requiring new backtesting frameworks capable of handling large feature sets.

Real-Time Academic Experimentation

With cloud computing, academics now run real-time backtests across multiple scenarios, greatly expanding the scale and speed of research.

Integration of Funding Rate Analysis

Since funding rates are unique to perpetual futures, modern backtests must incorporate them to accurately capture costs and strategy profitability.

Visualization of Sharpe ratios and drawdown analysis in academic backtesting

FAQs

1. Why should academics backtest perpetual futures strategies instead of using theoretical models only?

Because perpetual futures involve unique market mechanics like funding rates and continuous trading, theoretical models alone often fail to capture real dynamics. Backtesting ensures that strategies are not just theoretically sound but also practically viable.

2. What data sources are recommended for academic backtesting?

Academics should use exchange-provided APIs (e.g., Binance, Bybit) for high-frequency data, combined with institutional databases like Refinitiv or Bloomberg for broader context. Open-source communities also provide valuable datasets for testing.

3. How can students avoid overfitting when backtesting?

Students should separate datasets into training, validation, and testing periods. Using walk-forward analysis and cross-validation techniques ensures strategies generalize beyond the initial sample.

Conclusion

For academics, the ability to backtest perpetual futures strategies is a cornerstone of credible financial research. By combining historical replay with Monte Carlo simulations, researchers can build strategies that withstand both real-world and hypothetical conditions. With proper tools, rigorous methodology, and an emphasis on replicability, backtesting transforms abstract financial models into actionable insights.

As perpetual futures continue to grow in popularity, the role of academic research in shaping the understanding of these instruments will become even more critical.

Final Thoughts – Share & Collaborate

Backtesting isn’t just a technical process—it’s an intellectual journey that connects theory with practice. Whether you are a graduate student, professor, or quant researcher, your insights into perpetual futures can contribute to a broader understanding of modern markets.

👉 How do you approach perpetual futures backtesting in your research? Share your experiences in the comments below, and don’t forget to share this article with colleagues and fellow academics!