=================================================

Backtesting is the backbone of quantitative finance, allowing traders and institutional investors to validate strategies before deploying them in live markets. For institutions managing billions in assets, choosing the right backtesting platforms for institutional investors can mean the difference between consistent alpha generation and costly missteps. This article explores the essentials of institutional-grade backtesting, compares different approaches, highlights industry trends, and provides actionable insights for investors seeking robust solutions.

Why Backtesting Platforms Matter for Institutional Investors

The Institutional Context

Institutional investors face unique challenges:

- Large Trade Sizes: Execution slippage can erode alpha if not accounted for.

- Multi-Asset Portfolios: Strategies often span equities, futures, options, and fixed income.

- Regulatory Compliance: Transparency and auditability are mandatory.

- Operational Risks: Complex backtesting environments must be secure, scalable, and resilient.

Unlike retail traders, institutions need platforms that integrate advanced analytics, realistic market simulation, and robust data management. As explored in why backtesting is essential in perpetual futures, rigorous validation ensures strategies align with both performance goals and compliance requirements.

Key Features of Institutional Backtesting Platforms

1. Realistic Market Simulation

- Tick-level data to replicate intraday price movements.

- Order book reconstruction for testing liquidity-sensitive strategies.

- Transaction cost modeling including fees, slippage, and market impact.

2. Scalability and Speed

- Parallel computing for running thousands of simulations.

- Cloud-based infrastructure to scale with institutional needs.

3. Integration with Quant Libraries

- APIs and SDKs for custom modeling.

- Compatibility with Python, R, and C++ environments.

4. Risk Analytics and Stress Testing

- Scenario analysis across multiple macroeconomic conditions.

- Monte Carlo simulations for tail-risk assessment.

5. Compliance and Reporting

- Built-in audit trails.

- Automated report generation for internal and regulatory review.

Backtesting workflow used by institutional investors

| Category | Definition / Purpose | Key Features | Approaches | Strengths | Weaknesses | Practical Use Cases | Industry Trends |

|---|---|---|---|---|---|---|---|

| Institutional Backtesting | Validates strategies before live deployment for large-scale investors | Tick-level data, multi-asset support, regulatory compliance, realistic simulation | In-house platforms, third-party solutions | Customization, proprietary edge, fast implementation | High cost, long development, limited vendor flexibility | Hedge funds, pension funds, sovereign wealth funds, investment banks | Cloud-native, AI-powered, blockchain-integrated, real-time backtesting |

| In-House Platforms | Proprietary backtesting engines tailored to firm strategies | Full control, integrates with internal systems | Custom coding and infrastructure | Complete customization, keeps proprietary strategies private | High upfront cost, requires quant teams, slow development | Sensitive, high-value strategies | Often combined with third-party tools for hybrid approach |

| Third-Party Solutions | Ready-made backtesting platforms from vendors | Pre-integrated market data, APIs, rapid deployment | QuantConnect, Bloomberg Backtesting, AlgoTrader | Faster setup, lower initial cost, access to data | Limited customization, vendor lock-in, data licensing costs | Prototyping strategies, general testing | Hybrid use with in-house systems recommended |

| Perpetual Futures Backtesting | Evaluates futures strategies including funding and liquidity effects | High-frequency tick data, funding payment modeling, stress tests | Simulation across exchanges and volatility regimes | Robust evaluation of P&L and risks | Complex modeling, needs high-quality data | Hedge funds, crypto-native institutions | Increasing use of AI and cloud for scalability |

| Risk & Compliance | Ensures regulatory adherence and mitigates operational risks | Audit trails, reporting, scenario analysis, stress testing | Integrated into platforms | Reduces execution and compliance risks | Implementation complexity | Multi-asset portfolios, institutional execution | Continuous validation and monitoring |

| Hybrid Approach | Combines in-house and third-party tools for optimal efficiency | Flexible, scalable, proprietary protection | Partial in-house, partial vendor integration | Balances speed, control, and scalability | Requires careful integration | High-value and experimental strategies | Expected to dominate future institutional workflows |

Approach A: In-House Built Platforms

Some institutions develop proprietary backtesting engines tailored to their trading strategies.

Pros:

- Complete customization.

- Proprietary edge kept in-house.

- Seamless integration with existing infrastructure.

Cons:

- High upfront and maintenance costs.

- Requires dedicated quant engineering teams.

- Longer development cycles.

Approach B: Third-Party Backtesting Solutions

Vendors such as QuantConnect, Bloomberg Backtesting, and AlgoTrader offer ready-made solutions.

Pros:

- Faster implementation.

- Access to pre-integrated market data.

- Lower initial cost compared to building in-house.

Cons:

- Limited customization for unique strategies.

- Potential vendor lock-in.

- Data licensing costs can be high.

Best Recommendation: A hybrid approach. Institutions often adopt third-party solutions for prototyping while maintaining an in-house system for sensitive, high-value strategies. This balance ensures flexibility, scalability, and proprietary control.

Backtesting Platforms for Perpetual Futures

Perpetual futures are particularly popular among hedge funds and crypto-native institutional investors. The need for robust backtesting platforms for institutional investors extends to these derivative products. As noted in how to analyze backtesting results for futures, institutions must evaluate performance not only on P&L but also on funding rate impacts, volatility regimes, and liquidity shifts.

Key requirements for perpetual futures backtesting:

- High-frequency tick data across exchanges.

- Accurate modeling of funding payments.

- Stress-testing for liquidation risks.

Example of perpetual futures backtesting dashboard

Practical Use Cases of Backtesting Platforms

Hedge Funds

- Deploy machine learning-driven strategies validated on terabytes of historical data.

- Test cross-exchange arbitrage in crypto and FX.

Pension Funds

- Simulate long-term risk-adjusted returns under multiple macroeconomic conditions.

- Evaluate the impact of ESG factors on performance.

Sovereign Wealth Funds

- Test global asset allocation strategies.

- Integrate scenario analysis for geopolitical shocks.

Investment Banks

- Backtest client-facing execution algorithms.

- Benchmark internal strategies against market data.

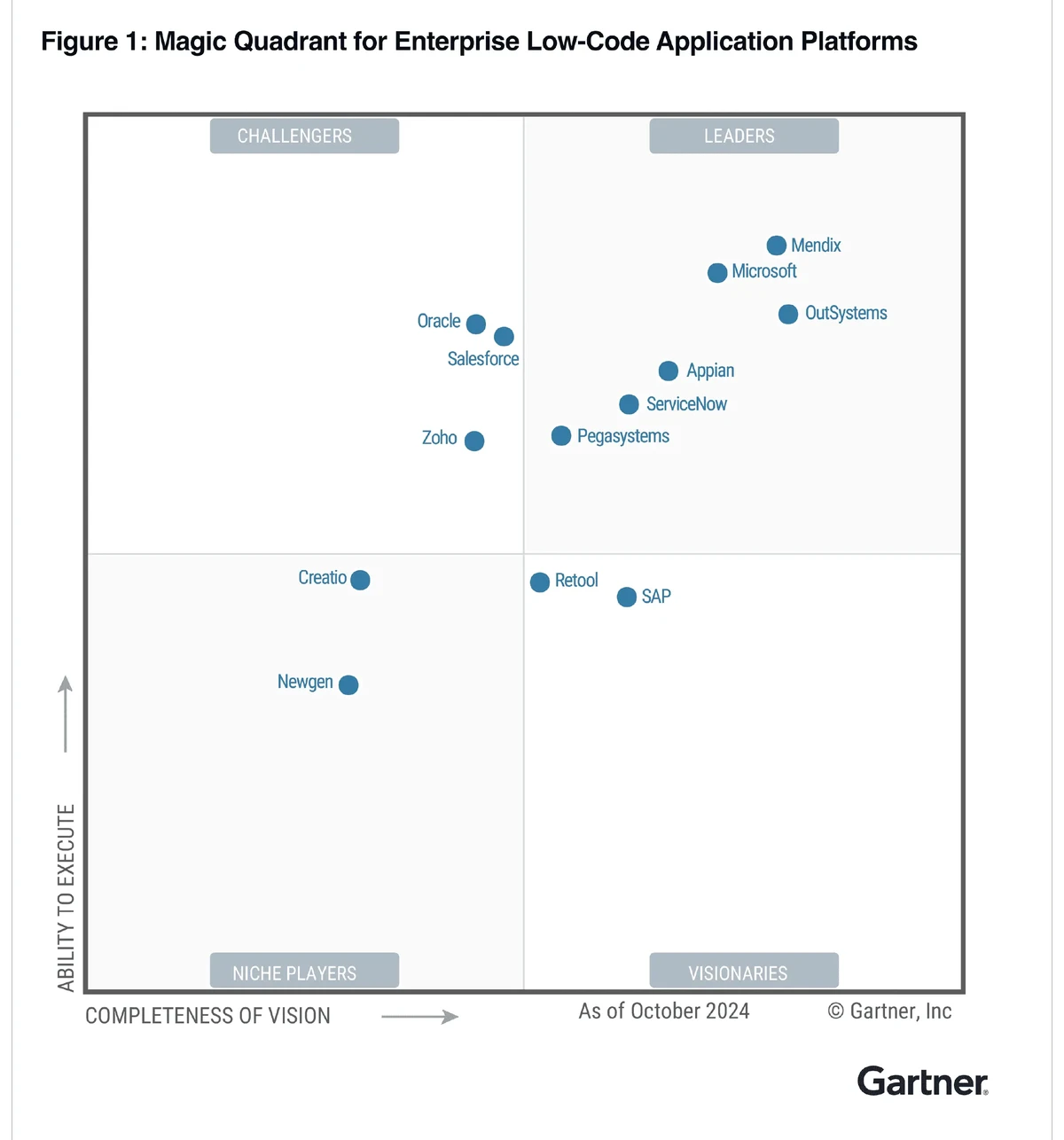

Industry Trends in Backtesting for Institutional Investors

- Cloud-Native Solutions: Institutions increasingly leverage cloud providers for elastic scalability.

- AI-Powered Backtesting: Machine learning models simulate dynamic market behaviors.

- Blockchain-Integrated Backtesting: Transparent validation of digital asset strategies.

- Real-Time Backtesting: Continuous testing against live streaming data for adaptive strategies.

Cloud-native backtesting infrastructure for scalable institutional use

FAQs on Backtesting Platforms for Institutional Investors

1. What makes institutional backtesting platforms different from retail ones?

Institutional platforms offer tick-level data, multi-asset support, and regulatory-grade reporting. Retail solutions may focus more on user-friendliness but lack the depth needed for institutional-scale portfolios.

2. How do institutions ensure backtesting results are reliable?

They validate results by using out-of-sample testing, walk-forward analysis, and stress testing. Institutions also calibrate models with live market performance to detect overfitting.

3. Are cloud-based backtesting platforms secure enough for institutions?

Yes—provided institutions enforce data encryption, access control, and compliance with standards like SOC 2 and ISO 27001. Many institutions use hybrid models, keeping sensitive strategies in-house while leveraging cloud scalability.

Conclusion: The Future of Institutional Backtesting Platforms

As markets become faster and more fragmented, backtesting platforms for institutional investors must evolve. The convergence of AI, cloud computing, and blockchain will redefine how institutions validate strategies.

Institutions that adopt a hybrid approach—leveraging third-party platforms for rapid innovation while maintaining proprietary in-house solutions for competitive advantage—will lead in efficiency and profitability.

Backtesting is not just a validation tool; it’s a strategic enabler for long-term success in institutional investing.

If this article resonated with you, share it with your network and leave a comment below: Which backtesting platforms or methods are driving innovation in your institution?

Institutional investors monitoring backtesting results in real time