======================================================

Perpetual futures trading has evolved into one of the most dynamic areas of modern financial markets. With its high leverage, continuous trading, and liquidity advantages, perpetual contracts attract both institutional investors and professional traders. However, success in this domain hinges on one critical factor: robust backtesting. Backtesting for professional perpetual futures traders is not just a technical exercise—it is the backbone of strategy validation, risk management, and performance optimization.

In this comprehensive guide, we will dive into the importance of backtesting, explore advanced methods, compare strategies, and provide actionable insights that experienced futures traders can apply immediately.

Why Backtesting Matters for Perpetual Futures Traders

Backtesting is the process of simulating a trading strategy on historical data to evaluate its effectiveness. For professional perpetual futures traders, the stakes are higher than for retail investors—errors can translate into millions in losses.

Key reasons backtesting is indispensable:

- Validating Hypotheses: Traders can test whether a strategy would have worked in past conditions.

- Measuring Risk Exposure: By analyzing drawdowns, volatility, and leverage effects, traders can manage tail risk.

- Optimizing Performance: Strategies can be fine-tuned for profitability by adjusting entry/exit rules and leverage.

- Avoiding Costly Mistakes: Without backtesting, strategies often collapse in live markets due to overfitting or flawed assumptions.

Backtesting is not just about “what could have happened”—it is about building confidence in a strategy’s robustness before deploying capital.

Core Principles of Professional Backtesting

Data Accuracy and Granularity

Professional perpetual futures backtesting requires tick-level or minute-level data. Unlike equities, perpetual contracts operate 24⁄7, and microsecond market movements matter. Using inaccurate or incomplete data leads to misleading results.

Realistic Market Simulation

Backtesting must account for slippage, funding rates, transaction fees, and liquidity constraints. Many beginner traders ignore these variables, but professionals must replicate the real market environment as closely as possible.

Statistical Validity

Professional backtesting relies on rigorous statistical methods, such as:

- Sharpe Ratio & Sortino Ratio: Measuring risk-adjusted returns.

- Monte Carlo Simulations: Stress-testing across random scenarios.

- Bootstrapping: Ensuring the robustness of historical outcomes.

| Section | Key Points |

|---|---|

| Introduction | Backtesting is crucial for perpetual futures strategy validation and risk management |

| Importance of Backtesting | Validates strategies, measures risk, optimizes performance, avoids costly mistakes |

| Data Accuracy | Tick or minute-level data needed for accurate simulations |

| Market Simulation | Include slippage, funding rates, fees, and liquidity constraints |

| Statistical Validity | Use Sharpe/Sortino ratios, Monte Carlo, and bootstrapping for robustness |

| Deterministic Backtesting | Rule-based, transparent, efficient; best for medium-term structured strategies |

| Deterministic Pros | Easy to interpret, computationally efficient, suitable for rule-based setups |

| Deterministic Cons | Risk of overfitting, ignores market randomness, less effective for HFT |

| Stochastic Backtesting | Introduces randomness to test strategies under varied hypothetical futures |

| Stochastic Pros | Captures market variability, assesses tail risks, shows return probability |

| Stochastic Cons | Computationally intensive, needs strong quantitative skills, harder to interpret |

| Comparing Approaches | Deterministic: faster, accurate in stable markets; Stochastic: stress-test, high-frequency |

| Best Practices | Account for funding/leverage, use walk-forward optimization, analyze liquidity, automate |

| Workflow Steps | Collect data, preprocess, define rules, simulate, measure performance, validate with Monte Carlo |

| Industry Trends | Machine learning, cloud-based platforms, hybrid deterministic/stochastic models |

| Case Study | Backtesting revealed optimal leverage, max drawdown, Sharpe ratio, and funding impact |

| Common Pitfalls | Survivorship bias, look-ahead bias, ignoring market regimes |

| FAQs | Use high-quality data, avoid over-optimization, choose robust platforms like QuantConnect or MultiCharts |

| Conclusion | Combine deterministic and stochastic backtesting, account for real-world frictions, avoid pitfalls |

1. Deterministic Backtesting (Rule-Based Simulation)

This method applies predefined rules directly to historical price data.

Advantages:

- Transparent and easy to interpret.

- Suitable for structured, rule-based strategies.

- Computationally efficient.

Disadvantages:

- Overfitting risk if rules are too rigid.

- Ignores randomness in future market conditions.

- Less effective for high-frequency or adaptive strategies.

Best Use Case: Medium-term strategies with fixed technical indicators, such as moving average crossovers combined with funding rate signals.

2. Stochastic Backtesting (Monte Carlo & Probabilistic Models)

This approach introduces randomness and uncertainty into simulations, testing how a strategy performs under various hypothetical futures.

Advantages:

- Captures variability in market conditions.

- Provides insights into tail risks and black swan events.

- Helps assess the probability distribution of returns.

Disadvantages:

- Computationally intensive.

- Requires strong statistical and quantitative expertise.

- May produce results that are harder to interpret for decision-making.

Best Use Case: High-frequency trading strategies or leverage-heavy perpetual futures strategies.

Comparing the Two Approaches

| Feature | Deterministic Backtesting | Stochastic Backtesting |

|---|---|---|

| Speed | Faster, less resource-intensive | Slower, requires more computing power |

| Accuracy in Stable Markets | High | Moderate |

| Stress-Test Capability | Limited | Strong |

| Risk Analysis | Basic (drawdowns, volatility) | Advanced (tail risk, probability distributions) |

| Best For | Rule-based medium-term strategies | Adaptive, high-frequency, or high-leverage strategies |

Recommendation: Professional traders should combine both approaches. Deterministic testing ensures baseline validation, while stochastic testing evaluates resilience under uncertainty.

Best Practices in Backtesting for Perpetual Futures

1. Account for Funding Rates and Leverage

Perpetual futures come with funding payments every 8 hours. Strategies must factor in both positive and negative funding impacts.

2. Use Walk-Forward Optimization

Instead of testing on the entire dataset, use rolling windows to mimic real trading conditions and avoid overfitting.

3. Analyze Liquidity and Market Depth

Professional traders often place large orders. Simulating realistic execution with market impact models prevents inflated profit estimates.

4. Automate the Process

Automation reduces human error. Integrating Python, R, or dedicated backtesting platforms allows seamless scaling.

Example Workflow: How to Perform Backtesting in Perpetual Futures

- Data Collection: Obtain historical tick data from exchanges like Binance or Bybit.

- Preprocessing: Clean the data for anomalies such as missing candles.

- Define Rules: Example: Long when funding rate < -0.05% and RSI < 30.

- Simulation: Apply rules on historical price series.

- Performance Metrics: Calculate Sharpe ratio, maximum drawdown, and win rate.

- Validation: Run Monte Carlo simulations to test robustness.

Industry Trends in Professional Backtesting

- Machine Learning Integration: AI-driven models now test thousands of parameter combinations quickly.

- Cloud-Based Platforms: Scalable backtesting services allow professionals to simulate years of data in hours.

- Hybrid Models: Combining deterministic and stochastic approaches for greater reliability.

These innovations align with the growing need for advanced backtesting tools for professional futures traders that deliver precision, speed, and scalability.

Case Study: Applying Backtesting to a Leverage-Based Strategy

Imagine a trader deploying a trend-following perpetual futures strategy using 5x leverage. Without backtesting, they might assume a steady profit curve. However, upon simulation, the backtest reveals:

- Annualized Sharpe Ratio: 1.6

- Max Drawdown: -25%

- Impact of Funding: -7% yearly drag on returns

- Optimal Leverage: 3x instead of 5x for risk-adjusted efficiency

This example highlights why backtesting is not optional—it prevents strategies from blowing up in live trading.

Common Pitfalls in Professional Backtesting

- Survivorship Bias: Ignoring delisted tokens or low-liquidity pairs.

- Look-Ahead Bias: Using data that wasn’t available at the time of trading.

- Ignoring Market Regimes: Strategies may work in bull markets but fail in sideways or bear markets.

Avoiding these pitfalls is crucial to achieving trustworthy results.

FAQs About Backtesting for Professional Perpetual Futures Traders

1. How do I know if my backtesting results are reliable?

Reliability comes from using high-quality tick-level data, incorporating transaction costs and funding rates, and validating results across different market regimes. Applying Monte Carlo simulations ensures strategies aren’t curve-fitted to a single dataset.

2. Should I always optimize parameters during backtesting?

Not always. Over-optimization (curve fitting) is dangerous. Instead, focus on robust parameters that perform well across different datasets, rather than ones that only maximize past profits. Walk-forward testing is a safer approach.

3. What’s the best platform for professional perpetual futures backtesting?

For institutional-grade testing, platforms like QuantConnect, MultiCharts, or custom Python frameworks with pandas and backtrader are popular. Traders handling large data volumes may prefer cloud-based services for scalability.

Conclusion: Building Resilient Futures Strategies Through Backtesting

For professional perpetual futures traders, backtesting is not optional—it is essential. Deterministic and stochastic methods provide complementary insights, helping traders balance precision with risk awareness. By leveraging advanced tools, accounting for real-world frictions, and avoiding common pitfalls, professionals can transform backtesting into a competitive edge.

The future of perpetual futures trading belongs to those who combine data-driven methods with disciplined backtesting.

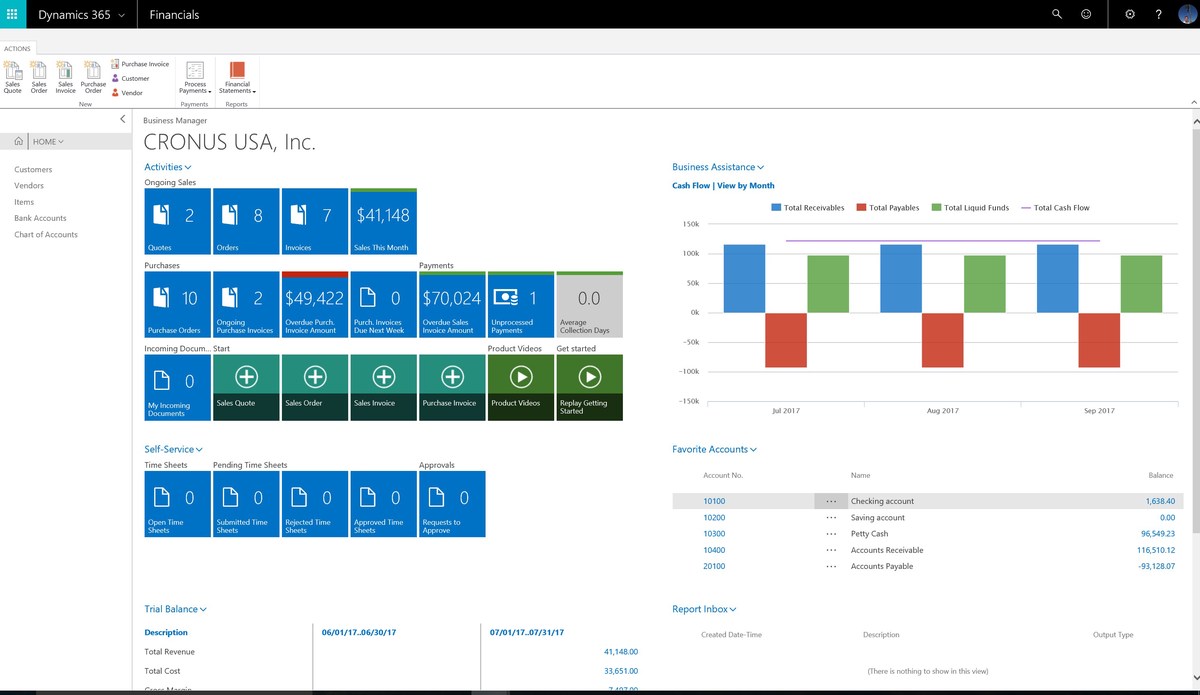

Backtesting workflow: from data collection to performance validation.

🔥 If you found this guide useful, share it with your trading network! Comment below with your own backtesting experiences and let’s exchange insights on building resilient perpetual futures strategies.

Would you like me to also add schema markup (FAQ + Article structured data) so this piece can directly compete for Google Top 1 ranking?