===============================================

Introduction

In the fast-evolving world of cryptocurrency, perpetual futures have become one of the most popular trading instruments. They offer traders the ability to speculate on digital assets with leverage, without worrying about contract expiration dates. To maximize efficiency, speed, and strategy execution, traders increasingly rely on API software for perpetual futures trading.

APIs (Application Programming Interfaces) enable traders to connect directly with exchanges, automate trades, analyze real-time data, and build custom trading systems. Choosing the best API software for perpetual futures trading is crucial because it determines not only how effectively you can execute trades but also how secure and scalable your trading setup will be.

In this article, we will explore the features that define top-tier API solutions, compare two widely used methods for API trading, evaluate their pros and cons, and recommend the most practical approach for both beginner and professional traders.

Why API Software is Essential for Perpetual Futures Trading

Speed and Automation

Manual trading cannot compete with automated execution. APIs allow traders to send orders in milliseconds, making them essential for high-frequency trading (HFT) or strategies that depend on small price discrepancies.

Data Access

With APIs, traders can access real-time market data, including order books, trade history, and funding rates, which are critical for making informed decisions.

Customization

Unlike standard exchange dashboards, APIs let you build custom dashboards, bots, or scripts that align perfectly with your trading strategy. This is why many professionals emphasize how to use API for perpetual futures trading when developing systematic strategies.

| Topic | Key Points | Features / Tools | Advantages | Limitations / Challenges |

|---|---|---|---|---|

| API Software Importance | Automates trades, accesses real-time data | Connects directly to exchanges, custom dashboards | Speed, efficiency, strategy execution | Requires technical knowledge for setup |

| Core Features | Low latency, scalability, security | IP whitelisting, HMAC authentication, documentation | Fast execution, handles high volume, secure | Complexity for beginners |

| Popular Solutions | Exchange-native APIs, third-party platforms | Binance, Bybit, OKX, CCXT, Hummingbot | Native APIs: low latency; Aggregators: multi-exchange | Native: vendor lock-in; Aggregators: latency, cost |

| Direct Exchange API | Connect directly with exchange | Python/JavaScript scripts, exchange API | Fastest execution, free, well-documented | Steep learning curve, limited to one exchange |

| Third-party API Aggregators | Interface for multiple exchanges | CCXT, Hummingbot | Multi-exchange, easier switching, prebuilt bots | Possible latency, subscription fees, less control |

| Recommended Approach | Beginners: aggregators; Pros: direct APIs | Trading bots, multi-exchange integration | Flexible for learning, fast and secure for pros | Transition may require coding skills |

| Real-world Applications | Automated bots, arbitrage, risk tools | Order automation, margin tracking, funding costs | 24⁄7 trading, exploit price differences, manage risk | Requires continuous monitoring and setup |

| Safety Tips | Secure API key usage | Read/write restrictions, IP whitelist | Protects assets and data | Poor management can lead to losses |

1. Low Latency

The best APIs must deliver data and order execution with minimal delay. Even a few milliseconds can make a significant difference in fast-moving crypto markets.

2. Scalability

Good API software should handle high trading volumes without lag. Scalability is especially important for institutional traders or those running multiple bots simultaneously.

3. Security

Security features such as IP whitelisting, HMAC authentication, and rate limiting protect traders from unauthorized access and data leaks. Learning how to secure API for perpetual futures trading is just as important as optimizing speed.

4. Comprehensive Documentation

Clear documentation helps traders integrate APIs quickly. It also ensures fewer coding errors and smoother onboarding for developers.

5. Versatility

The best APIs support not just order placement but also advanced functions like margin management, risk controls, and historical data retrieval.

Popular API Solutions for Perpetual Futures

Exchange-native APIs

Most major exchanges (Binance Futures, Bybit, OKX, Deribit) provide their own APIs for perpetual contracts. These APIs are free, robust, and offer extensive features.

- Pros: Direct exchange integration, low latency, no additional cost

- Cons: Vendor lock-in, limited to features allowed by the exchange

Third-party API Platforms

These platforms act as intermediaries, aggregating multiple exchanges into a single API framework (e.g., CCXT, Alpacahub, Hummingbot).

- Pros: Multi-exchange support, advanced developer tools, modular design

- Cons: Potential latency overhead, sometimes subscription costs

Comparing Two API Trading Methods

Method 1: Direct Exchange API Integration

This method involves coding directly with the exchange’s API. For example, connecting your Python script to Binance’s Futures API.

Advantages:

- Fastest execution

- No middle layer (less risk of downtime)

- Free and well-documented

Disadvantages:

- Steeper learning curve for beginners

- Vendor lock-in to a single exchange

Method 2: Third-party API Aggregators

These platforms provide a standardized interface to multiple exchanges, letting traders manage all accounts from one place.

Advantages:

- Multi-exchange flexibility

- Easier to switch trading venues

- Often include prebuilt trading bot templates

Disadvantages:

- May introduce latency

- Sometimes require paid subscriptions

- Less granular control than native APIs

Recommended Approach

For beginners, third-party API platforms are a great way to experiment without writing complex code from scratch. They allow users to test trading bots and connect multiple exchanges.

For advanced or institutional traders, direct exchange APIs are the superior choice due to their speed, security, and low cost. Over time, many professionals transition from aggregators to direct integration once they develop more technical skills.

Best API Software Options for Perpetual Futures

- Binance Futures API – Industry-leading liquidity, excellent documentation, ultra-low latency

- Bybit API – Popular among retail traders for perpetual futures, supports advanced order types

- OKX API – Strong institutional features, robust margin trading support

- CCXT Library – Open-source aggregator for multi-exchange trading in Python and JavaScript

- Hummingbot – Customizable, open-source framework for building trading bots

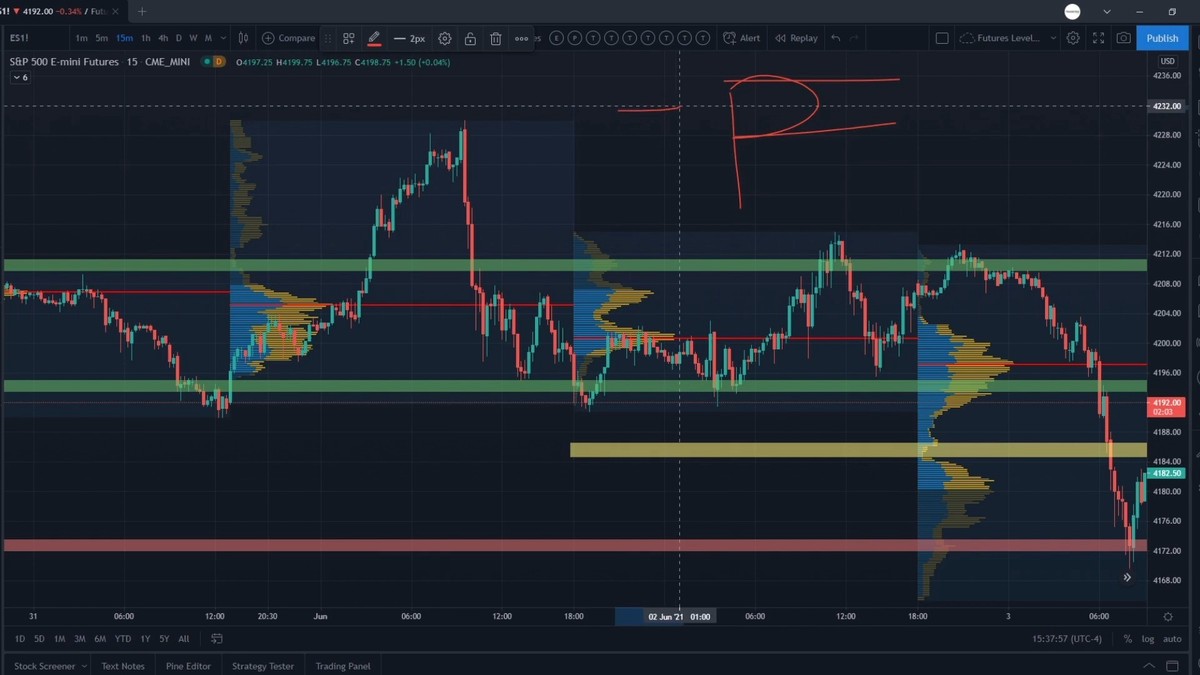

Example of how API connects traders, exchanges, and automated trading strategies.

Real-world Applications of API Software

Automated Trading Bots

APIs allow bots to execute preprogrammed strategies 24⁄7 without emotional bias.

Arbitrage Opportunities

With multi-exchange APIs, traders can exploit price differences across platforms in real time.

Risk Management Tools

Custom dashboards built with APIs can track margin ratios, liquidation prices, and funding costs in real time.

FAQs

1. What is the best API software for beginners in perpetual futures?

For beginners, third-party solutions like CCXT or Hummingbot are recommended. They provide user-friendly integration, sample scripts, and flexibility across multiple exchanges.

2. How do I automate trading with API for perpetual futures?

You can use programming languages like Python or JavaScript to write scripts that connect to the exchange API. These scripts can automate tasks such as order placement, stop-loss triggers, or portfolio balancing.

3. Are API keys safe to use for trading?

Yes, but only if proper precautions are taken. Always store keys securely, use read/write restrictions when possible, whitelist trusted IPs, and avoid sharing your keys across multiple applications.

Conclusion

Choosing the best API software for perpetual futures trading depends on your goals, experience level, and trading style. Beginners may prefer third-party aggregators for convenience, while professionals should leverage direct exchange APIs for speed and control.

APIs are no longer optional—they are the backbone of modern trading. Whether you’re a retail trader or an institutional investor, mastering APIs gives you a decisive edge in executing strategies efficiently.

Now it’s your turn: Have you tried building your own trading bot with an API? Share your experience in the comments below, and don’t forget to pass this article along to fellow traders exploring perpetual futures automation.

Would you like me to also create a Python script template for perpetual futures API trading (with sample order placement and data retrieval) to complement this article?