=====================================================================

Introduction

Perpetual futures have become one of the most dominant instruments in global derivatives trading. Their 24⁄7 nature, built-in funding mechanisms, and deep liquidity make them attractive for both institutional and professional traders. However, success in this market demands systematic precision. The best quantitative strategy for professional perpetual futures traders is not a one-size-fits-all model but rather a combination of robust frameworks that balance risk, return, and execution efficiency.

In this guide, we’ll dive into the foundations of quantitative strategies for perpetual futures, explore multiple methods, compare their strengths and weaknesses, and highlight a framework that professionals can adopt for consistent performance. Drawing from both practical experience and the latest industry trends, this article provides an actionable roadmap for traders seeking to scale their edge in perpetual futures.

Why Perpetual Futures Require a Quantitative Strategy

Constant Market Exposure

Unlike traditional futures with expirations, perpetual contracts trade continuously. This requires constant monitoring and models that adapt dynamically.

Complex Funding Mechanism

The periodic funding rate incentivizes price alignment with the spot market. A strong quantitative strategy can exploit mispricings created by these adjustments.

High Competition

From prop firms to hedge funds, perpetual futures markets are dominated by advanced algorithms. Without quantitative rigor, manual trading quickly falls behind.

Volatility and Leverage

Perpetual futures often offer high leverage, amplifying both profits and risks. Only disciplined strategies rooted in quantitative analysis can withstand this environment.

Category Details

Importance of Quantitative Strategy Perpetual futures require systematic strategies due to constant exposure, complex funding, competition, and volatility

Core Elements of a Strategy Signal generation, risk management, execution algorithms, performance monitoring

Leading Strategy 1: Statistical Arbitrage Identifies mispricings between correlated assets, market-neutral, works in volatility

Statistical Arbitrage Advantages Market-neutral, reduces risk, works in volatile conditions

Statistical Arbitrage Disadvantages Requires precision, profit margins thin, susceptible to structural breaks

Leading Strategy 2: Trend-Following Detects trends using technical indicators, captures large directional moves

Trend-Following Advantages High profit potential, simple to implement, leverages liquidity

Trend-Following Disadvantages Prone to whipsaws, requires risk controls, strategy saturation risk

Strategy Comparison Statistical Arbitrage: market-neutral, smaller profits, high complexity; Trend-Following: directional, larger profits, moderate complexity

Recommendation Combine both strategies for best results: statistical arbitrage for stability, trend-following for growth

Advanced Enhancements Machine learning, high-frequency execution, regime detection models

Best Practices for Professional Traders Robust backtesting, capital allocation discipline, continuous optimization, infrastructure investment

Development Process Start with hypothesis, test historically, optimize, paper trade, ensure diversification

FAQ: Reliable Strategy Hybrid of statistical arbitrage and trend-following is most effective

FAQ: Capital Needed \(50,000–\)200,000 for retail, millions for institutional setups

FAQ: Avoiding Overfitting Use out-of-sample testing, walk-forward optimization, validate with multiple datasets

- Signal Generation – Identifying predictive patterns through technical indicators, statistical analysis, or machine learning.

- Risk Management – Position sizing, stop-losses, and exposure controls.

- Execution Algorithms – Minimizing slippage and transaction costs.

- Performance Monitoring – Backtesting, forward testing, and real-time optimization.

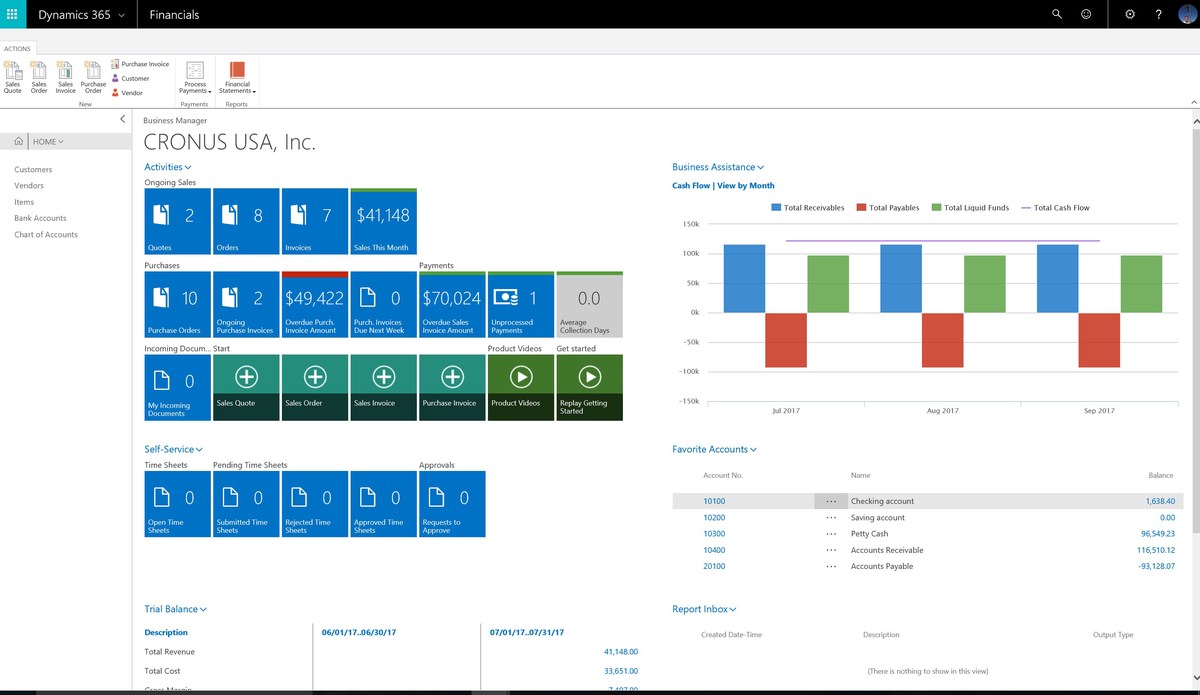

Quantitative trading workflow for perpetual futures

Two Leading Quantitative Strategies for Professional Traders

1. Statistical Arbitrage

Overview:

This strategy identifies temporary mispricings between correlated assets, such as BTC perpetual futures versus spot BTC or ETH perpetual futures versus BTC perpetual futures.

How It Works:

- Detect cointegration between pairs or baskets.

- Enter long/short positions when spreads deviate from historical mean.

- Exit when spreads revert.

Advantages:

- Market-neutral, reducing exposure to directional risk.

- Works well in volatile conditions.

- Proven strategy used by institutional traders.

Disadvantages:

- Requires sophisticated execution to avoid slippage.

- Profit margins can be thin—scalability depends on capital and infrastructure.

- Susceptible to structural breaks when relationships change.

2. Trend-Following with Risk Controls

Overview:

Trend-following strategies identify directional momentum in perpetual futures and ride large moves.

How It Works:

- Use moving averages, MACD, or breakout systems to detect trends.

- Apply strict stop-losses and trailing exits.

- Scale position sizes with volatility-adjusted risk.

Advantages:

- High profit potential during strong market moves.

- Simple to implement and widely understood.

- Leverages perpetual futures’ liquidity to enter/exit effectively.

Disadvantages:

- Prone to whipsaws in sideways markets.

- Requires robust risk controls to avoid large drawdowns.

- Strategy saturation can reduce edge if many traders follow similar signals.

Comparison of the Two

| Feature | Statistical Arbitrage | Trend-Following |

|---|---|---|

| Market Bias | Market-neutral | Directional |

| Profit Margin | Thin, frequent | Larger, less frequent |

| Risk | Lower but requires precision | Higher, mitigated by risk controls |

| Complexity | High (requires modeling skills) | Moderate (can start simple) |

Recommendation:

For professional perpetual futures traders, combining both strategies often yields the best results. A statistical arbitrage core strategy can provide stable, market-neutral returns, while trend-following overlays capture large directional opportunities.

Advanced Quantitative Enhancements

Machine Learning Integration

- Use Random Forest or Gradient Boosting for signal optimization.

- Train models on funding rate shifts, order flow imbalances, and volatility clusters.

High-Frequency Execution

- Apply smart order routing across multiple exchanges.

- Use latency-optimized execution to reduce slippage.

Regime Detection Models

- Switch strategies depending on market regime (trend vs range).

- Bayesian models or Hidden Markov Models can classify environments in real time.

Backtesting results for quantitative strategies

Best Practices for Professional Traders

- Robust Backtesting: Always evaluate strategies across multiple timeframes and market cycles. Related insight: understanding how to backtest a quantitative strategy for perpetual futures ensures reliability before live deployment.

- Capital Allocation Discipline: Avoid overleveraging; professional traders allocate risk per trade systematically.

- Continuous Optimization: Incorporate ongoing research to adapt to evolving market structures.

- Infrastructure Investment: Low-latency servers, API connectivity, and redundancy systems are essential for execution.

Related Insight: How to Develop a Quantitative Strategy for Perpetual Futures

For professionals, development begins with hypothesis formulation, followed by historical testing, parameter optimization, and paper trading before live execution. Integrating portfolio-level considerations ensures diversification across strategies and instruments.

By combining theory with robust testing, traders avoid overfitting and develop strategies that stand the test of time.

FAQs on Quantitative Strategies in Perpetual Futures

1. What is the most reliable quantitative strategy for perpetual futures?

There is no single “best” strategy—it depends on trader objectives, risk appetite, and infrastructure. However, a hybrid of statistical arbitrage for stability and trend-following for growth is highly effective.

2. How much capital is needed to deploy professional quantitative strategies?

For retail professionals, \(50,000–\)200,000 can be sufficient with disciplined risk controls. For institutional-grade setups, millions are required due to infrastructure and scalability needs.

3. How do I avoid overfitting when backtesting?

- Use out-of-sample testing.

- Apply walk-forward optimization.

- Validate with multiple datasets (different exchanges).

Overfitting is one of the biggest risks in quant trading, especially in perpetual futures where conditions evolve rapidly.

Conclusion

The best quantitative strategy for professional perpetual futures traders is a blend of robust market-neutral approaches like statistical arbitrage and scalable directional systems like trend-following. Success requires not only model design but also rigorous backtesting, disciplined execution, and continuous adaptation to market changes.

With professional infrastructure and a data-driven mindset, perpetual futures traders can achieve consistent performance while minimizing risks.

If you found this article insightful, share it with fellow traders, comment with your experiences, or ask questions for future deep dives. Your engagement strengthens the trading community and helps refine collective knowledge.

Would you like me to expand this into a full whitepaper-style resource (with code snippets for backtesting statistical arbitrage and trend-following in Python) so professionals can directly implement these strategies?