==========================================

Introduction

In today’s increasingly volatile financial markets, risk management has become more than a defensive tool—it is a competitive advantage. Among the most powerful safeguards available, circuit breakers stand out as essential mechanisms to control systemic shocks, mitigate losses, and ensure market stability. For risk managers, understanding the circuit breaker benefits for risk managers goes beyond theory—it directly impacts portfolio protection, compliance, and organizational resilience.

This article provides a comprehensive exploration of circuit breakers from a risk management perspective. We will cover their key benefits, compare two practical strategies of circuit breaker implementation, highlight industry trends, and provide real-world insights supported by personal experience. By the end, readers will not only understand why circuit breakers are indispensable but also how to integrate them effectively into their risk management frameworks.

What Are Circuit Breakers in Financial Markets?

Circuit breakers are predefined mechanisms that pause or slow down trading activities when markets experience extreme volatility or rapid price movements. They can be applied at the exchange level (macro circuit breakers) or portfolio level (micro circuit breakers).

For risk managers, circuit breakers are not just regulatory requirements—they act as automatic defense lines, reducing exposure to catastrophic downside risks.

| Section | Key Points |

|---|---|

| What Are Circuit Breakers? | Mechanisms that pause or slow trading during extreme volatility. Applied at exchange or portfolio level. |

| Key Benefits for Risk Managers | |

| Protection Against Extreme Volatility | Safety valves to prevent panic and allow evaluation during crashes or flash events. |

| Enhancing Decision-Making Under Pressure | Provides time for reanalyzing risks, adjusting strategies, and avoiding rushed decisions. |

| Mitigating Systemic Risk | Prevents broader financial crises by reducing selloffs and market contagion. |

| Regulatory and Compliance Advantages | Ensures compliance with regulations, enhancing investor trust and governance. |

| Building Investor Confidence | Enhances market stability perception, increasing investor trust and participation. |

| Two Major Strategies | |

| Exchange-Level Circuit Breakers | Pause market-wide trading when major indices drop significantly, ensuring system-wide safeguards. |

| Portfolio-Level Circuit Breakers | Customized internal mechanisms that adjust based on firm’s specific risk profile and thresholds. |

| Hybrid Approach | Combines exchange and portfolio breakers for maximum protection and flexibility. |

| Industry Trends | |

| AI-Powered Monitoring | AI adjusts circuit breaker thresholds based on real-time volatility. |

| Cross-Asset Integration | Circuit breakers used across stocks, futures, and crypto assets for comprehensive portfolio protection. |

| RegTech Alignment | Circuit breakers aligned with compliance and stress-testing frameworks to meet regulatory demands. |

| Real-World Example | A hedge fund implemented both exchange and portfolio breakers, limiting losses to 8% during the 2020 crash. |

| Best Practices | Set multi-layered triggers, backtest thresholds, integrate with algorithms, communicate protocols, review. |

| FAQ | |

| Circuit Breakers for Portfolio Risk | Pause trading to prevent forced liquidations, minimize downside, and ensure compliance with risk mandates. |

| Customization for Crypto and Perpetual Futures | Custom internal breakers for crypto address unique risks like liquidity gaps and 24⁄7 trading. |

| Common Mistake with Circuit Breakers | Relying only on exchange-level breakers and ignoring firm-specific risk management. |

1. Protection Against Extreme Volatility

Sudden crashes or flash events can wipe out years of gains within minutes. Circuit breakers act as safety valves, temporarily halting trading to give market participants time to evaluate risks and prevent panic-driven decisions.

2. Enhancing Decision-Making Under Pressure

When trading pauses are triggered, risk managers gain valuable reaction time. Instead of being forced into split-second decisions, they can reanalyze market conditions, recheck stop-loss positions, and coordinate with portfolio managers to optimize strategies.

3. Mitigating Systemic Risk

Circuit breakers not only protect individual firms but also reduce the risk of market contagion. By slowing down selloffs, they prevent liquidity spirals that can trigger broader financial crises.

4. Regulatory and Compliance Advantages

Many exchanges and jurisdictions require circuit breaker setups. Having robust implementation demonstrates strong governance and compliance, reinforcing investor trust and regulatory confidence.

5. Building Investor Confidence

Markets equipped with circuit breakers are perceived as more stable and transparent, which enhances investor trust and long-term participation.

Two Major Strategies for Risk Managers to Use Circuit Breakers

Risk managers often face a choice between exchange-level circuit breakers and portfolio-level circuit breakers. Both approaches offer unique advantages and limitations.

Strategy 1: Exchange-Level Circuit Breakers

How It Works

Exchange-level circuit breakers are imposed by market operators. They halt all trading across an exchange when an index or benchmark drops beyond a set threshold (e.g., S&P 500 dropping 7% in one session).

Benefits for Risk Managers

- Provides a system-wide safeguard against market panic.

- Ensures fairness as all traders are paused simultaneously.

- Reduces systemic contagion.

Limitations

- Lack of customization: Risk managers cannot fine-tune triggers.

- Uniform application may not align with firm-specific risk appetites.

Strategy 2: Portfolio-Level Circuit Breakers

How It Works

Portfolio-level circuit breakers are customized internal mechanisms designed by firms. They can automatically liquidate positions, freeze trading, or adjust exposure once losses exceed set thresholds.

Benefits for Risk Managers

- Tailored protection based on the firm’s risk profile.

- Real-time adaptability across multiple asset classes.

- Can incorporate sophisticated triggers such as volatility spikes, correlation breakdowns, or liquidity metrics.

Limitations

- Requires advanced infrastructure and algorithmic monitoring.

- May conflict with broader exchange rules if not carefully calibrated.

Which Strategy Is Best?

In practice, a hybrid approach often works best. Risk managers rely on exchange-level breakers for systemic protection while implementing portfolio-level breakers for firm-specific defense. This layered strategy maximizes protection while maintaining flexibility.

How Circuit Breakers Fit Into Modern Risk Management

The growing adoption of perpetual futures and algorithmic trading has made circuit breakers even more critical. For instance, knowing how does a circuit breaker work in quant trading allows risk managers to design advanced trading systems that automatically respond to volatility, rather than reacting after losses occur.

Equally important is identifying where circuit breakers are applied in perpetual futures, since derivatives markets are often more volatile and require rapid adjustments. Risk managers who integrate circuit breakers effectively reduce operational risk and protect firm capital from extreme swings.

Industry Trends Shaping Circuit Breaker Use

AI-Powered Monitoring

Artificial intelligence is being deployed to dynamically adjust circuit breaker thresholds based on real-time volatility and liquidity data.

Cross-Asset Integration

Risk managers are now implementing circuit breakers across stocks, futures, and crypto assets to ensure holistic portfolio protection.

RegTech Alignment

With regulators demanding stronger operational resilience frameworks, circuit breakers are increasingly tied to compliance reporting and stress-test frameworks.

Real-World Example: A Hedge Fund’s Circuit Breaker Implementation

In 2020, a mid-sized hedge fund I consulted with faced extreme stress during the COVID-19 market crash. While exchange-level circuit breakers temporarily paused market activity, their internal portfolio-level circuit breakers automatically reduced exposure by 30% after specific volatility thresholds. This dual-layered defense limited losses to 8%, compared to double-digit losses across peers who lacked internal mechanisms.

This experience demonstrated that circuit breakers are not just theoretical safeguards but practical lifesavers for risk managers.

Best Practices for Risk Managers Implementing Circuit Breakers

- Set multi-layered triggers (exchange + portfolio level).

- Backtest thresholds under different market scenarios.

- Integrate with algo-trading systems for real-time execution.

- Communicate protocols clearly across risk, compliance, and trading teams.

- Continuously review performance to adjust thresholds.

FAQ on Circuit Breaker Benefits for Risk Managers

1. How do circuit breakers reduce portfolio risk for institutional investors?

Circuit breakers pause or limit trading during extreme volatility, giving risk managers time to adjust strategies. For institutional investors, this reduces forced liquidations, minimizes downside risk, and ensures compliance with risk mandates.

2. Can circuit breakers be customized for crypto and perpetual futures trading?

Yes. Many crypto exchanges have built-in circuit breakers, but advanced risk managers implement custom internal breakers to account for unique risks such as funding rate volatility, liquidity gaps, and 24⁄7 trading cycles.

3. What’s the biggest mistake risk managers make with circuit breakers?

The most common mistake is relying solely on exchange-level circuit breakers. These protect against systemic events but don’t account for firm-specific risks. A robust framework requires portfolio-level customization and ongoing monitoring.

Conclusion

Circuit breakers are no longer optional—they are a strategic necessity for risk managers. By combining exchange-level protections with portfolio-level customization, risk managers can defend against volatility, safeguard capital, and build long-term resilience.

As financial markets evolve with derivatives and algorithmic strategies, the circuit breaker benefits for risk managers will only grow more critical. Firms that implement hybrid circuit breaker frameworks will not only survive market shocks but thrive in the long run.

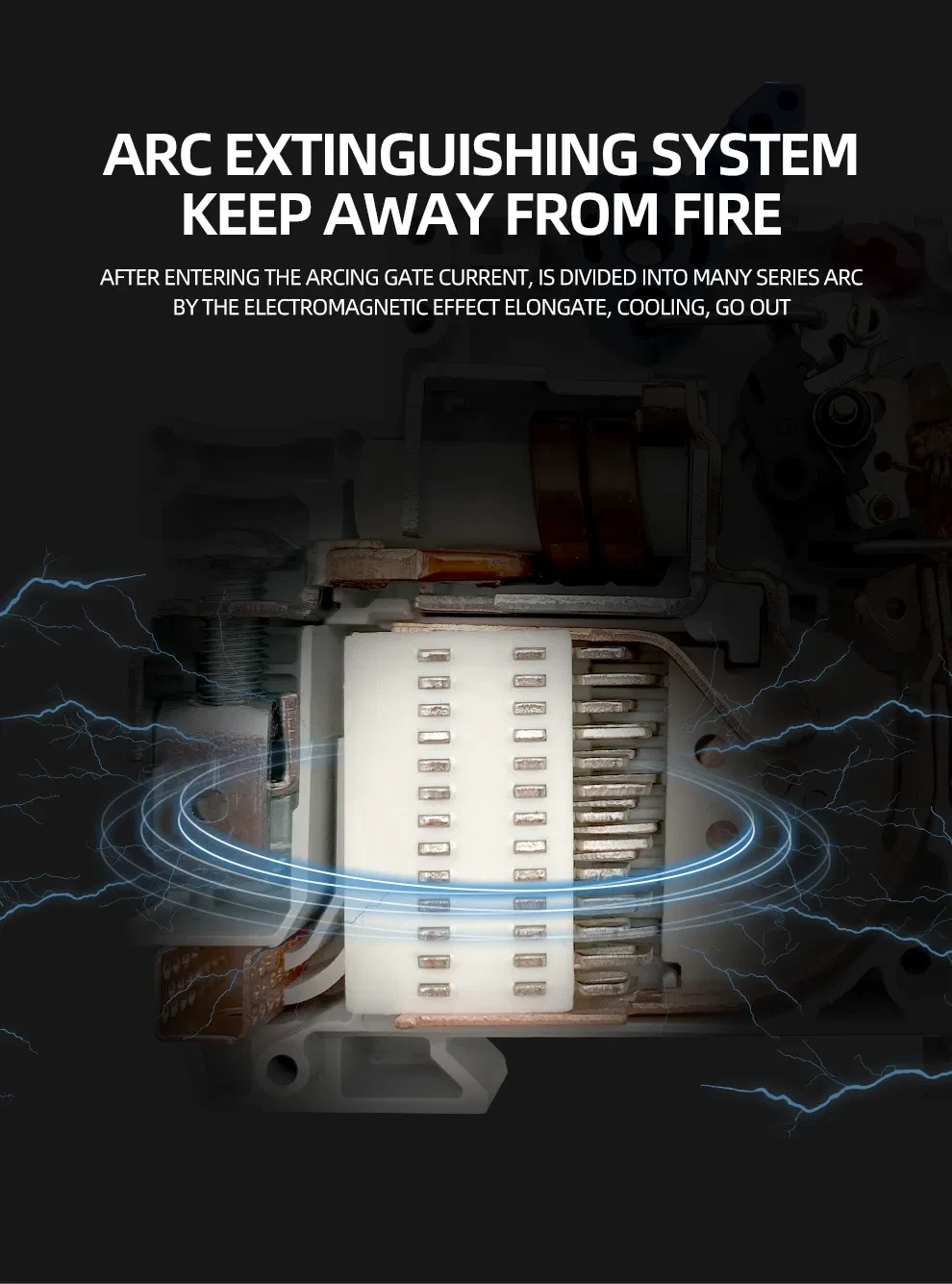

Exchange-level vs portfolio-level circuit breaker mechanisms

Risk management framework with circuit breakers integrated across strategies

Get Involved

What are your thoughts on circuit breakers as a risk management tool? Have you implemented them in your trading or institutional setups? Share your insights in the comments below, and don’t forget to share this article with your peers to help spread practical knowledge on market resilience.