======================================================

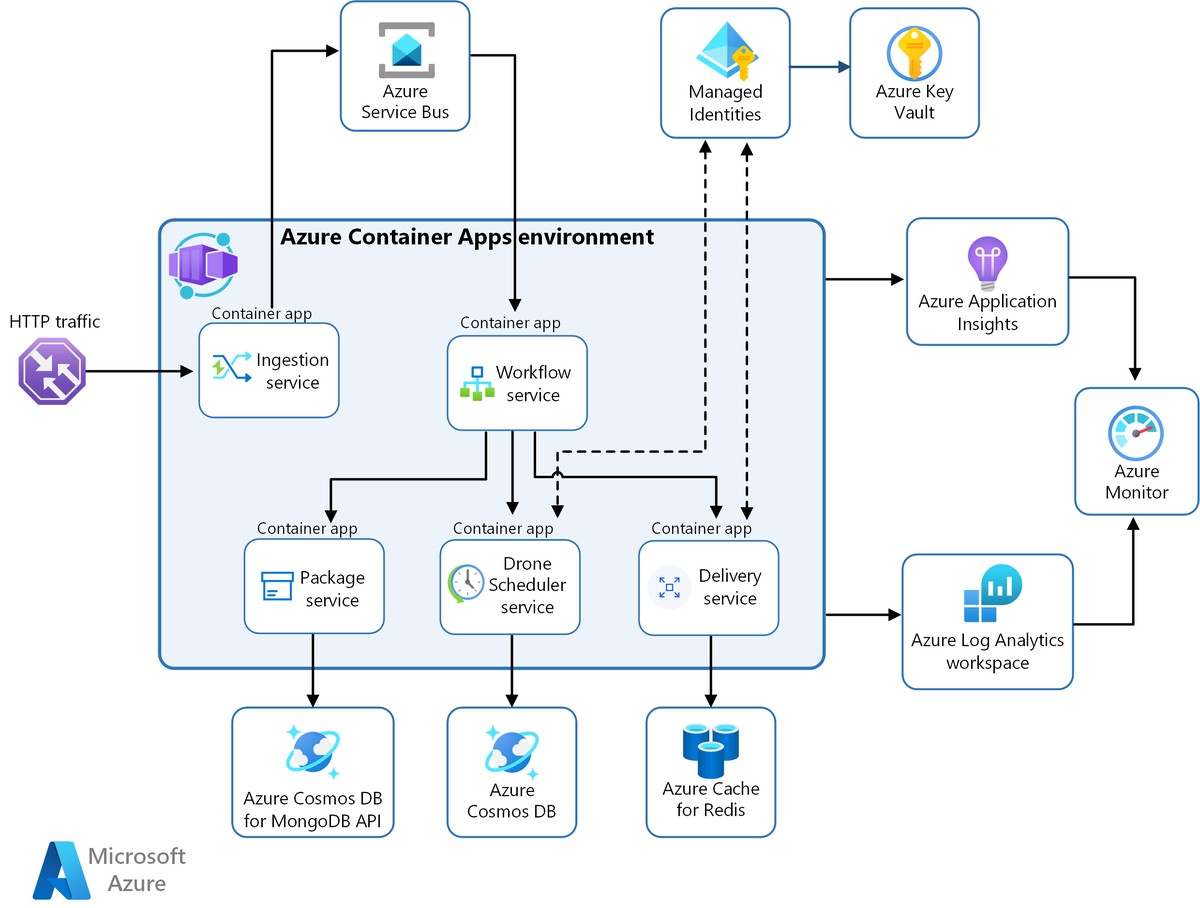

Introduction

In modern markets, algorithmic trading dominates order flow. The very speed and automation that power quantitative trading systems can also amplify risks, particularly during extreme volatility. Circuit breakers—mechanisms that halt or slow trading after sharp price movements—play a crucial role in market stability. For algorithmic traders, understanding circuit breaker considerations for algorithmic traders is not just about compliance; it is essential for survival, risk control, and strategy optimization.

This guide explores how circuit breakers work, their implications for algorithmic systems, and the strategies traders can use to navigate them. Drawing on industry insights, regulatory frameworks, and personal trading experience, we’ll compare multiple approaches, highlight real-world examples, and offer actionable recommendations for both professional and beginner quants.

Circuit breakers help stabilize markets when volatility threatens liquidity and order book structure.

What Are Circuit Breakers?

Definition and Purpose

A circuit breaker is a predefined mechanism in trading platforms and exchanges that temporarily halts or slows trading when price changes exceed certain thresholds. These thresholds can be set for:

- Single securities (e.g., limit-up/limit-down rules in equities)

- Index levels (e.g., S&P 500 wide market halts)

- Derivatives and perpetual futures (through dynamic funding and liquidation pauses)

Their goal is to prevent panic-driven collapses, allow market participants to reassess positions, and restore orderly conditions.

How Do They Apply to Algorithmic Traders?

For algorithms, circuit breakers can mean:

- Orders canceled or rejected mid-execution.

- Delays in market data streams.

- Sudden gaps when trading resumes.

Understanding these dynamics allows quants to design resilient models that anticipate disruptions instead of being blindsided by them.

| Section | Key Points | Impact on Algorithms | Strategies / Tools | Pros | Cons |

|---|---|---|---|---|---|

| Definition & Purpose | Halts/slows trading after sharp moves | Cancels orders, delays data, gaps | Single security, index, derivatives breakers | Stabilizes markets | Interrupts executions |

| Importance | Risk control, compliance, strategy tuning | Prevents flash crashes, avoids penalties | Adjust liquidity models | Enhances stability | Requires adaptation |

| Key Considerations | Thresholds, liquidity, positions, infrastructure | Predefined levels, widened spreads, exposure risk | Threshold awareness, fail-safes | Anticipates halts | Complex setup |

| Threshold Awareness | 7%,13%,20% S&P, crypto dynamic pauses | Avoid blind execution | Programmed thresholds | Prevents errors | Varies by exchange |

| Market Liquidity | Liquidity vanishes during halts | Wide spreads post-resume | Exploit inefficiencies post-halt | Profit chances | Slippage risk |

| Position Management | Positions locked during halts | Exposure increases | Stop-loss proxies | Risk containment | Limited exit options |

| Infrastructure Preparedness | Latency, data sync, fail-safes | Handle congestion & resets | Suspend/throttle modules | System resilience | Tech intensive |

| Strategy 1: Conservative | Full shutdown during halt | Avoid chaotic reopenings | Capital preservation | Defensive & safe | Missed opportunities |

| Strategy 2: Adaptive | Trade post-halt volatility | Market making, momentum bursts | High profit potential | Offensive approach | Higher slippage risk |

| Perpetual Futures | Prevent cascading liquidations | Must align with exchange docs & APIs | Integration in crypto algos | Protects exchanges | Requires extra setup |

| Advanced Integration | Smart routing, stress tests, dynamic risk | Shift flow, test halt scenarios | Risk dashboards, backtesting | Increases robustness | Complex development |

| Case: Flash Crash 2010 | No breaker awareness worsened crash | Shutdown protocols fared better | Risk controls crucial | Loss prevention | Lack of adaptation = losses |

| Case: March 2020 | Multiple halts tested systems | Adaptive re-entry gained profits | Gradual engagement | Profit capture | High stress conditions |

| FAQ: Effects | Breakers disrupt liquidity & execution | Suspend, reduce, shift strategies | Breaker-aware triggers | Strategy flexibility | Requires fast response |

| FAQ: Biggest Risk | Trapped positions during halts | Exposure rises | Stop-loss alternatives | Protect capital | Sudden reversals |

| FAQ: Automation | Breakers can be coded in | Threshold triggers, auto-shutdown | Integrated models | Real-time response | Programming complexity |

| FAQ: Learning | Exchange docs, filings, studies | Understand breaker mechanics | Regulatory research | Deep technical insight | Time investment |

| Conclusion | Breakers = essential model variables | Combine shutdown & adaptive engagement | Hybrid strategy | Protects & profits | Needs careful design |

Risk Containment

Without circuit breakers, flash crashes—driven by runaway algorithms or cascading liquidations—could destabilize entire markets. For quants, circuit breakers act as “safety nets” that prevent strategies from spiraling out of control.

Regulatory Compliance

Ignoring circuit breaker rules can lead to order rejections, penalties, or even blacklisting from exchanges.

Strategy Adjustments

When circuit breakers are triggered, liquidity and spreads change dramatically. Algorithmic models that don’t account for these conditions can incur large slippage or failed fills.

Algorithmic strategies must integrate real-time monitoring of circuit breaker triggers.

Key Circuit Breaker Considerations for Algorithmic Traders

1. Threshold Awareness

Each exchange has unique thresholds. For instance:

- U.S. equities have 7%, 13%, and 20% S&P 500 circuit breaker levels.

- Crypto perpetual futures often employ dynamic liquidation pauses.

Algorithms must be programmed with these limits to avoid blind execution attempts.

2. Impact on Market Liquidity

When a circuit breaker halts trading, liquidity evaporates. Upon resumption, spreads often widen, creating both risks and opportunities.

- Risk: Orders may execute at disadvantageous prices.

- Opportunity: Algorithms can capitalize on inefficiencies if designed for post-halt volatility.

3. Position Management

Positions held during a halt cannot be exited. This creates exposure risk, especially for leveraged traders. Effective stop-loss proxies must be embedded within the algorithm.

4. Infrastructure Preparedness

- Latency handling: Be ready for order congestion when markets reopen.

- Data synchronization: Ensure real-time feeds align with exchange resets.

- Fail-safe modules: Implement triggers to suspend or throttle algorithms when breakers activate.

Comparing Two Circuit Breaker Strategies

Strategy 1: Conservative Shutdown Protocol

This approach instructs algorithms to halt trading entirely once a circuit breaker activates.

- Advantages: Preserves capital, avoids chaotic re-openings.

- Disadvantages: Misses post-halt opportunities, overly defensive.

Strategy 2: Adaptive Volatility Exploitation

Algorithms stay active post-halt, seeking to exploit volatility through wide-spread market making or momentum bursts.

- Advantages: Potential for high profits in volatile environments.

- Disadvantages: Elevated risk of slippage, execution errors, or divergence from intended models.

Best Practice: Hybrid approaches work best. Begin with a conservative shutdown, then gradually re-engage with smaller position sizes as liquidity normalizes.

Circuit breakers create both defensive needs and offensive opportunities depending on strategy design.

Circuit Breakers in Perpetual Futures

Algorithmic crypto traders must pay special attention to how circuit breakers apply in perpetual futures. For those asking why circuit breakers are used in perpetual futures, the main reason is to protect against cascading liquidations that can wipe out entire exchanges.

Additionally, learning where to find circuit breaker information for perpetual futures—typically in exchange documentation, developer APIs, or compliance notes—is essential for proper algorithmic setup.

Advanced Circuit Breaker Integration for Algorithmic Traders

Smart Order Routing

Integrate circuit breaker awareness into order-routing logic. If one venue halts, redirect flow to correlated markets with ongoing liquidity.

Stress Testing Algorithms

Backtest strategies on historical circuit breaker events (e.g., March 2020 COVID crash). Test how halts affect latency, spreads, and stop-loss execution.

Dynamic Risk Adjustments

Adjust leverage, margin, and exposure based on the likelihood of approaching breaker thresholds.

Risk dashboards can track circuit breaker thresholds across multiple markets in real time.

Real-World Case Studies

Flash Crash of 2010

Algorithms without breaker awareness exacerbated the crash, wiping out billions in minutes. Traders with conservative shutdown protocols fared far better.

March 2020 Equity Halts

Four consecutive trading halts in U.S. equities tested algorithmic resilience. Adaptive strategies that re-engaged cautiously earned significant returns during rebounds.

FAQ (Frequently Asked Questions)

1. How do circuit breakers affect algorithmic trading decisions?

Circuit breakers disrupt liquidity and execution. Algorithms must adapt by suspending trading, reducing exposure, or shifting strategies post-halt.

2. What’s the biggest risk for algorithmic traders during a circuit breaker event?

The inability to exit positions during the halt. This creates exposure risk, especially if the market resumes in the opposite direction.

3. Can circuit breakers be integrated into trading models automatically?

Yes. Developers can program breaker-aware triggers, incorporating thresholds, auto-shutdown protocols, and post-halt adaptive models directly into trading platforms.

4. Where can traders study circuit breaker mechanics?

Exchange documentation, regulatory filings, and academic studies on how does a circuit breaker work in quant trading provide the best technical detail.

Conclusion

For algorithmic traders, circuit breakers are not just regulatory guardrails—they are essential variables that must be integrated into every trading model. By combining awareness of thresholds, risk management, infrastructure preparedness, and adaptive strategies, quants can transform breaker events from threats into opportunities.

The optimal approach blends conservative shutdowns with calculated post-halt engagement, ensuring capital protection while still capturing volatility-driven profits.

Call to Action

Have you ever experienced a trading halt with your algorithm? Share your experience in the comments below. If you found this article useful, share it with fellow traders to build collective awareness of circuit breaker best practices.

Circuit breakers are integral to market stability and should be a core consideration in every algorithmic trading strategy.