===================================================

In today’s fast-paced crypto markets, perpetual futures trading is one of the most popular instruments for both retail and institutional investors. However, its continuous, leveraged nature exposes traders to extreme volatility. To mitigate risks and prevent cascading liquidations, many exchanges and quant models rely on circuit breakers. In this article, we’ll explore everything about circuit breaker setup for perpetual futures trading, covering strategies, real-world case studies, advantages, disadvantages, and best practices to help traders safeguard their portfolios.

Understanding Circuit Breakers in Trading

What is a Circuit Breaker?

A circuit breaker is a risk-control mechanism that temporarily halts trading or slows down execution when price movements exceed predefined thresholds. In traditional stock markets, circuit breakers prevent panic selling. In perpetual futures, they play an even more crucial role due to 24⁄7 trading and high leverage.

Why Circuit Breakers are Essential in Perpetual Futures

Without circuit breakers, sharp price movements can lead to:

- Rapid liquidation cascades across leveraged traders.

- Exchange instability due to overload.

- Market manipulation through sudden price spikes or crashes.

This directly connects to why circuit breakers are used in perpetual futures, as they ensure market integrity during extreme volatility.

Sudden crypto crashes highlight the need for circuit breaker setups in perpetual futures markets.

Types of Circuit Breakers in Perpetual Futures

1. Price-Based Circuit Breakers

Triggered when the market price deviates beyond a percentage threshold within a set time.

- Example: If BTC perpetual futures drop 10% in 5 minutes, trading pauses for 60 seconds.

- Advantage: Provides cooling-off periods to stabilize markets.

- Disadvantage: May disrupt legitimate price discovery during high volatility.

2. Volatility Circuit Breakers

Activated by sudden spikes in implied or realized volatility.

- Example: If volatility doubles within 15 minutes, margin requirements increase automatically.

- Advantage: Protects traders from unexpected leverage risks.

- Disadvantage: Can increase margin calls unexpectedly.

3. Volume-Based Circuit Breakers

Triggered by unusually high order flow or liquidation volume.

- Example: A circuit breaker halts trading if liquidation orders exceed $100M in 1 minute.

- Advantage: Prevents cascading sell-offs.

- Disadvantage: Can frustrate traders looking for liquidity.

4. Algorithmic Circuit Breakers

Integrated within quant strategies to automatically reduce position sizes or exit markets during abnormal conditions.

This ties to how does a circuit breaker work in quant trading, where algorithms dynamically adjust exposure instead of halting trades completely.

Here’s a summarized table based on the article:

| Section | Key Points | Details | Action/Approach |

|---|---|---|---|

| What is a Circuit Breaker? | Risk-control mechanism that halts trading during extreme price moves. | Prevents rapid liquidations, market instability, and manipulation. | Safeguard markets from sudden volatility. |

| Types of Circuit Breakers | Various types to address different market conditions. | Price-based, volatility-based, volume-based, algorithmic-based. | Use the most relevant breaker depending on market needs. |

| Price-Based Circuit Breakers | Triggered by price deviations beyond a set threshold. | Example: 10% price drop in 5 minutes triggers a 60-second pause. | Stabilizes the market, but may disrupt price discovery. |

| Volatility Circuit Breakers | Activated by volatility spikes. | Example: Doubling of volatility triggers increased margin requirements. | Protects against unexpected leverage risks, but increases margin calls. |

| Volume-Based Circuit Breakers | Triggered by excessive order flow or liquidations. | Example: Exceeding $100M in liquidation orders halts trading. | Prevents cascading sell-offs, but may limit liquidity. |

| Algorithmic Circuit Breakers | Embedded in quant strategies to reduce exposure. | Automatically adjusts exposure during abnormal conditions. | Protects during extreme conditions, avoids full trade halts. |

| Exchange-Level Circuit Breakers | Set by exchanges for market-wide stability. | Defines price bands, volatility thresholds, and trading halts. | Ideal for retail traders for overall market stability. |

| Portfolio-Level Circuit Breakers | Designed by institutions for custom exposure limits. | Reduces exposure when losses breach a set threshold. | Best for professional traders with high leverage. |

| Hybrid Circuit Breaker Models | Combination of exchange-level and portfolio-level rules. | Offers both broad and tailored protection. | Provides comprehensive safety but is complex to implement. |

| Real-World Applications | Examples of circuit breaker use in past crises. | Case studies: March 2020 Crypto crash, Quant Fund risk controls. | Illustrates effectiveness in mitigating extreme market moves. |

| Emerging Trends | Innovations in circuit breaker technology. | AI-driven models, cross-market integration, customizable retail breakers. | Focus on automation and adaptability. |

| Practical Recommendations | Suggestions for different trader levels. | Retail traders: Use exchange breakers + stop-loss. Institutions: Portfolio breakers. | Hybrid setups offer the most protection but require investment. |

| FAQ: Circuit Breakers | Common questions on how circuit breakers function. | Answers include: Do breakers stop trading? How are thresholds set? | Combine breakers with margin discipline for best protection. |

| Conclusion | Importance of circuit breakers in crypto markets. | Circuit breakers ensure stability and safeguard portfolios in volatile markets. | Essential for both beginners and hedge fund managers. |

This table captures the key elements of circuit breakers in perpetual futures trading, including types, strategies, benefits, and challenges.

h2 id="circuit-breaker-setup-strategies">Circuit Breaker Setup StrategiesStrategy 1: Exchange-Level Circuit Breakers

These are implemented by exchanges (Binance, Bybit, CME) to ensure fair and stable trading environments.

- How it works: The exchange defines rules (price bands, volatility thresholds) to temporarily halt or throttle trading.

- Best for: General market stability and protecting retail traders.

- Downside: All participants are affected equally, even those with proper risk management.

Strategy 2: Portfolio-Level Circuit Breakers

Institutional traders and hedge funds often design internal circuit breakers.

- How it works: Rules built into trading systems that reduce exposure when volatility or losses breach predefined limits.

- Best for: Professional traders with high leverage.

- Downside: Complex to calibrate; requires advanced monitoring tools.

Strategy 3: Hybrid Circuit Breaker Models

Combines exchange-level protection with customized trader-level rules.

- Advantage: Offers both broad market safeguards and tailored individual risk control.

- Disadvantage: Implementation complexity and potential conflicts with exchange halts.

Comparing Circuit Breaker Approaches

| Approach | Benefits | Limitations | Best Use Case |

|---|---|---|---|

| Exchange-Level | Market-wide stability, standardized | Limited customization | Retail traders |

| Portfolio-Level | Tailored risk control, customizable | Complex setup, requires monitoring | Institutions |

| Hybrid Model | Balanced, layered protection | Technical complexity, dual oversight | Hedge funds |

Real-World Application of Circuit Breakers

Case Study: March 2020 Crypto Crash

During the COVID-19 market crash, BTC perpetual futures dropped over 50% in two days. Exchanges with circuit breakers and auto-deleveraging mechanisms prevented complete collapse, while others without strong safeguards faced liquidation spirals.

Case Study: Quant Fund Risk Controls

A quant hedge fund implemented a portfolio-level circuit breaker that capped losses at 7% daily. During a flash crash, while retail traders were liquidated, the fund’s automated breaker exited early, preserving capital and reducing losses.

Emerging Trends in Circuit Breaker Setup

- AI-driven Circuit Breakers: Machine learning models now forecast volatility, dynamically adjusting circuit breaker thresholds.

- Cross-Market Circuit Breakers: Futures, spot, and options markets are being integrated to prevent arbitrage loopholes.

- Customizable Retail Breakers: Some platforms allow traders to set personal circuit breakers on leverage and liquidation.

Practical Recommendations

From personal trading and advising institutions:

- Retail traders should rely on exchange circuit breakers while using stop-losses as an additional layer.

- Professional traders should implement portfolio-level circuit breakers for custom exposure limits.

- Hybrid setups are the most resilient but require infrastructure investment.

This ties directly into where circuit breakers are applied in perpetual futures, as they can function across exchange-level protections, trading algorithms, and portfolio safeguards.

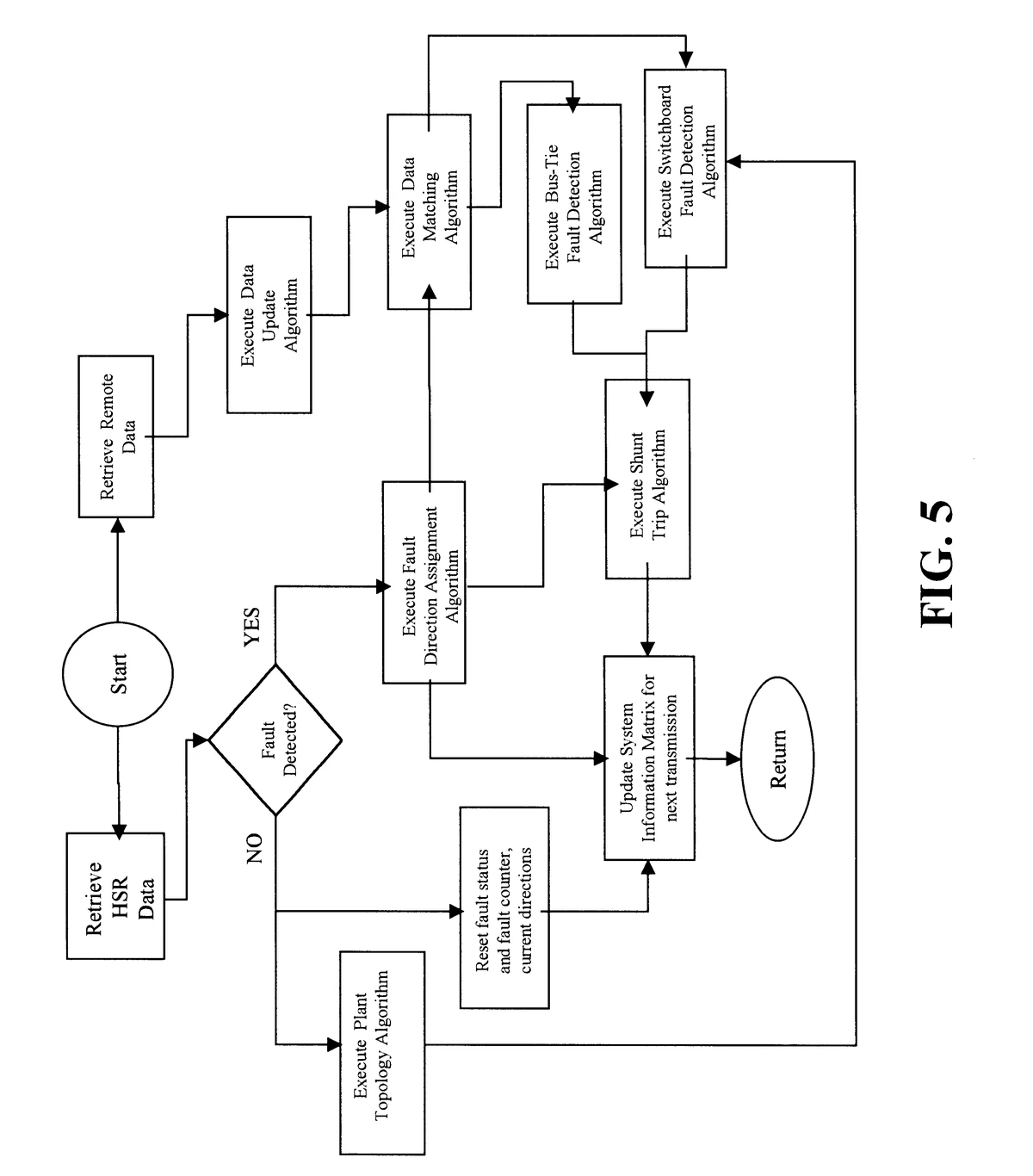

Circuit breakers can be designed at multiple levels: exchange, portfolio, and algorithmic.

FAQ: Circuit Breaker Setup for Perpetual Futures

1. Do circuit breakers stop me from trading during volatility?

Yes, exchange-level circuit breakers can temporarily halt trading. However, portfolio-level breakers don’t stop trading entirely—they reduce your exposure or exit trades to protect capital.

2. How are circuit breaker thresholds determined?

Exchanges use historical volatility, order book depth, and liquidity analysis. Traders using portfolio-level breakers often set limits based on Value-at-Risk (VaR), maximum drawdown tolerance, or daily loss caps.

3. Can circuit breakers prevent liquidation in perpetual futures?

Not always. Circuit breakers mitigate market-wide cascades but cannot guarantee individual accounts won’t be liquidated. Traders should combine breakers with margin discipline and stop-loss orders.

Conclusion

A robust circuit breaker setup for perpetual futures trading is essential to manage volatility, prevent systemic collapse, and safeguard portfolios. Both exchange-level mechanisms and portfolio-level strategies have unique strengths, but hybrid models offer the most resilient protection in today’s unpredictable crypto environment.

Whether you’re a beginner or a hedge fund manager, circuit breakers should be part of your trading toolkit.

If you found this guide valuable, share it with fellow traders, drop a comment with your own experiences, and let’s build a safer crypto trading environment together.

Would you like me to create a step-by-step visual guide (infographic) on how to configure circuit breakers for both retail and institutional trading setups? That could serve as a practical quick-reference tool.