========================================================

Perpetual futures are among the most actively traded instruments in crypto and derivatives markets. Their design, which avoids expiry dates and leverages funding rates to balance long and short positions, makes them attractive for traders seeking flexibility and leverage. However, trading perpetual futures effectively requires more than intuition—it demands algorithmic precision. This article explores comprehensive algorithm strategies for perpetual futures, offering in-depth insights, practical methods, and guidance tailored for both professional and retail traders.

We’ll analyze different algorithmic frameworks, compare their pros and cons, and recommend the most effective paths for sustainable trading success.

Understanding Perpetual Futures in Algorithmic Context

Perpetual futures, unlike traditional futures, do not expire. Instead, their prices are tethered to spot markets through funding mechanisms. Algorithms provide traders with the edge needed to handle high volatility, complex funding rate dynamics, and liquidity fragmentation across exchanges.

Why Algorithms Are Essential in Perpetual Futures

Algorithms are indispensable because they:

- Remove emotional biases in trading.

- Execute trades faster than manual operations.

- Continuously optimize strategies based on live market data.

- Handle risk management and drawdown prevention systematically.

In fact, one of the core advantages of automation is ensuring risk discipline—a necessity in highly leveraged perpetual futures.

Core Algorithm Strategies for Perpetual Futures

Below are some of the most effective comprehensive algorithm strategies used by professional traders.

1. Market-Making Algorithms

Market-making algorithms provide liquidity by posting buy and sell orders on both sides of the order book. The algorithm profits from the spread and rebates offered by exchanges.

Advantages:

- Generates consistent returns during sideways markets.

- Reduces slippage by improving liquidity.

- Capitalizes on small inefficiencies across exchanges.

Disadvantages:

- Exposed to inventory risk if the market trends strongly in one direction.

- Requires high-frequency infrastructure and co-location for speed.

Best Use Case: Market-making works best for traders with access to robust infrastructure and the ability to hedge positions across multiple venues.

2. Trend-Following Algorithms

Trend-following algorithms identify strong market movements and ride them. They use indicators such as moving averages, breakout systems, and momentum scores.

Advantages:

- Highly effective in strong bull or bear markets.

- Reduces overtrading by waiting for clear signals.

- Scales well across multiple assets.

Disadvantages:

- Whipsaw losses in ranging markets.

- Requires adaptive risk management to avoid deep drawdowns.

Best Use Case: Trend-following algorithms suit swing traders or funds targeting directional momentum opportunities.

3. Arbitrage Algorithms

Arbitrage strategies exploit price discrepancies between perpetual futures and spot markets, or between perpetual contracts on different exchanges.

Common Types:

- Funding Rate Arbitrage: Capture yield when funding rates diverge significantly between exchanges.

- Cross-Exchange Arbitrage: Exploit price spreads between Binance, Bybit, OKX, and others.

- Cash-and-Carry Arbitrage: Long spot while shorting futures to lock in funding payments.

Advantages:

- Provides relatively low-risk returns.

- Works well in volatile markets with pricing inefficiencies.

Disadvantages:

- Requires significant capital for profitability.

- Risks include execution delays, liquidation during volatility, or exchange downtime.

Best Use Case: Arbitrage suits institutional traders with access to API connectivity, fast execution, and diversified exchange accounts.

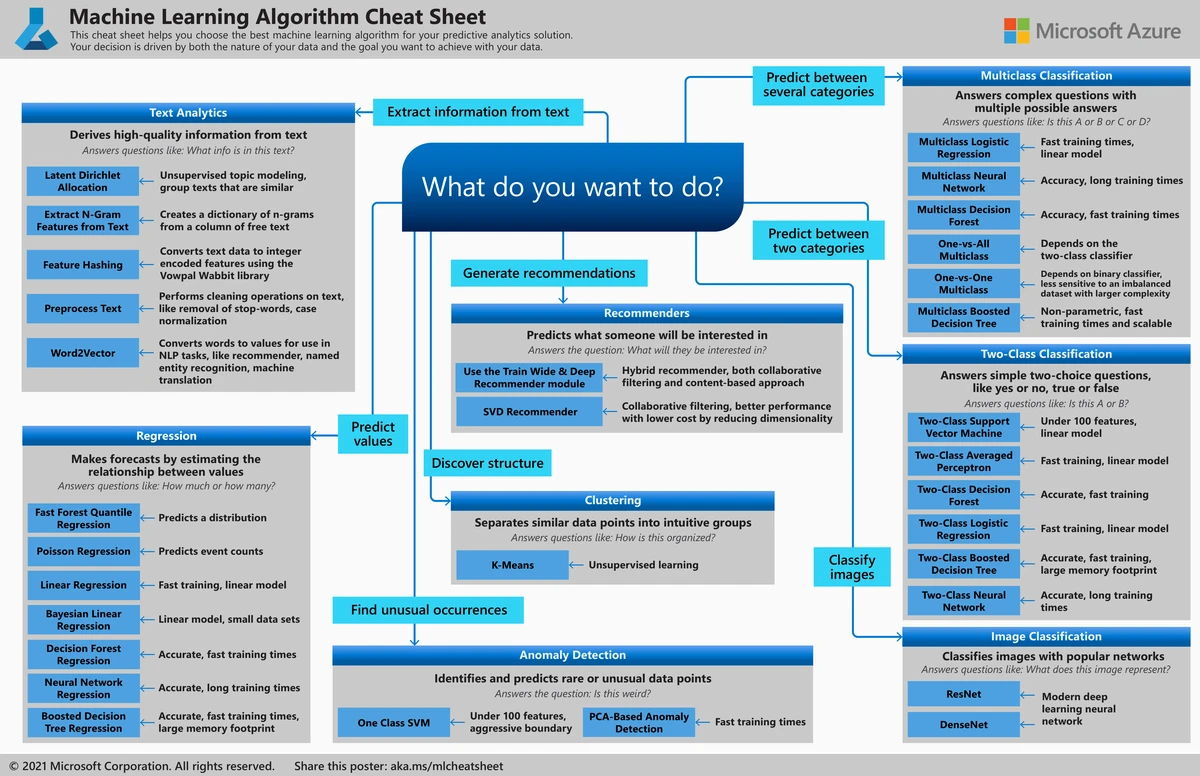

4. Machine Learning-Driven Algorithms

Machine learning (ML) strategies leverage historical and live data to predict short-term price movements, funding rate cycles, and volatility regimes.

Techniques Used:

- Neural networks for price forecasting.

- Reinforcement learning for adaptive strategy optimization.

- Natural language processing (NLP) for news-driven sentiment analysis.

Advantages:

- Learns and adapts to changing market conditions.

- Can integrate multiple factors: price, volume, funding, sentiment.

Disadvantages:

- Requires large datasets and computing resources.

- Risk of overfitting if not carefully validated.

Best Use Case: Advanced ML models are ideal for proprietary trading firms and hedge funds with data science teams.

Comparing Strategies: Which One Is Best?

| Strategy | Risk Level | Capital Requirement | Market Type Suitability | Complexity |

|---|---|---|---|---|

| Market-Making | Medium | High | Sideways/High Volume | High |

| Trend-Following | Medium-High | Moderate | Trending Markets | Medium |

| Arbitrage | Low-Medium | High | Volatile/Fragmented | High |

| Machine Learning (ML) | Variable | High | Adaptive/All | Very High |

From practical experience, a hybrid approach works best. For example:

- Use trend-following algorithms to capture big directional moves.

- Deploy market-making strategies when volatility subsides.

- Hedge risks using arbitrage positions.

- Incorporate ML algorithms to dynamically adjust risk parameters.

This layered approach maximizes adaptability and reduces drawdowns.

Risk Management in Algorithmic Perpetual Futures

Position Sizing and Leverage

Algorithms must dynamically size positions based on volatility. For example, when volatility increases, leverage should be reduced automatically to avoid forced liquidation.

Stop-Loss and Take-Profit Systems

Automated trailing stops and adaptive take-profits ensure positions are exited efficiently, without relying on human decision-making during stress.

Monitoring Funding Rates

Algorithms must integrate funding rate data to avoid unexpected costs. As covered in how algorithms impact perpetual futures strategy, neglecting funding payments can erode returns significantly.

Practical Example: Trend-Following with Risk Adjustments

Imagine a BTC perpetual futures algorithm:

- Detects a breakout when BTC closes above its 50-day EMA with high volume.

- Allocates 2% of portfolio per trade, reducing to 1% if volatility spikes.

- Adjusts stop-loss dynamically based on ATR (Average True Range).

- Hedges on another exchange if funding rates are excessively negative.

This framework combines discipline with flexibility, reducing the risk of catastrophic drawdowns.

Industry Trends and Future Outlook

- AI-powered trading bots are becoming mainstream, especially with access to real-time blockchain and sentiment data.

- Decentralized perpetual futures platforms (e.g., dYdX, GMX) demand algorithms that adapt to on-chain liquidity and gas costs.

- Regulatory compliance will play a major role, requiring audit-ready algorithms with transparency in execution.

As more traders adopt automation, competitive edges will depend on innovation, execution speed, and advanced data integration.

FAQ: Comprehensive Algorithm Strategies for Perpetual Futures

1. What is the most reliable algorithm for perpetual futures?

There is no single “best” algorithm. Market-making works in sideways markets, trend-following in trending conditions, and arbitrage when inefficiencies appear. A multi-strategy approach offers the highest reliability across market cycles.

2. How much capital is needed to run perpetual futures algorithms effectively?

It depends on the strategy. Market-making and arbitrage often require six-figure capital to cover inventory risks, while trend-following and ML-based systems can start with smaller allocations. For retail traders, using moderate leverage with strict risk controls is essential.

3. Where can I learn algorithmic trading for perpetual futures?

Resources include specialized algorithmic trading communities, academic papers on derivatives, and practical guides such as how to use algorithm for perpetual futures. Simulated trading on testnets or paper accounts is highly recommended before going live.

Final Thoughts

Building comprehensive algorithm strategies for perpetual futures is about adaptability. No single method dominates in all conditions—success lies in combining multiple frameworks while applying rigorous risk management. Whether you’re a retail trader experimenting with trend-following or an institutional desk deploying high-frequency arbitrage, the key is consistency, discipline, and innovation.

If you found this article useful, share it with your network and drop a comment below—what algorithm strategy do you believe will dominate the future of perpetual futures trading?

Algorithmic Trading Framework for Perpetual Futures