=========================================================

Reducing latency is a critical factor for traders, particularly those involved in high-frequency trading, perpetual futures, and algorithmic strategies. This guide offers a comprehensive, step-by-step approach to decreasing latency, combining technical methods, practical strategies, and real-world insights for experienced and professional traders.

Understanding Latency in Trading

What is Latency?

Latency refers to the delay between initiating an action in a trading system—such as sending an order—and the market’s response. High latency can negatively affect execution speed, slippage, and overall profitability.

Key aspects include:

- Network Latency: Delays caused by data transmission over the internet or private networks.

- Processing Latency: Time consumed by servers or trading algorithms to process orders.

- Exchange Latency: Delays within the exchange’s infrastructure.

Embedded Link: Learn how to measure latency in trading systems to identify bottlenecks and optimize performance.

Why Latency Matters

In high-speed markets, even millisecond delays can translate into significant financial impact. Latency is particularly critical in:

- High-frequency trading (HFT): Profits depend on executing thousands of trades per second.

- Perpetual futures trading: Rapid price changes require immediate execution.

- Algorithmic strategies: Automated algorithms must respond faster than competing systems.

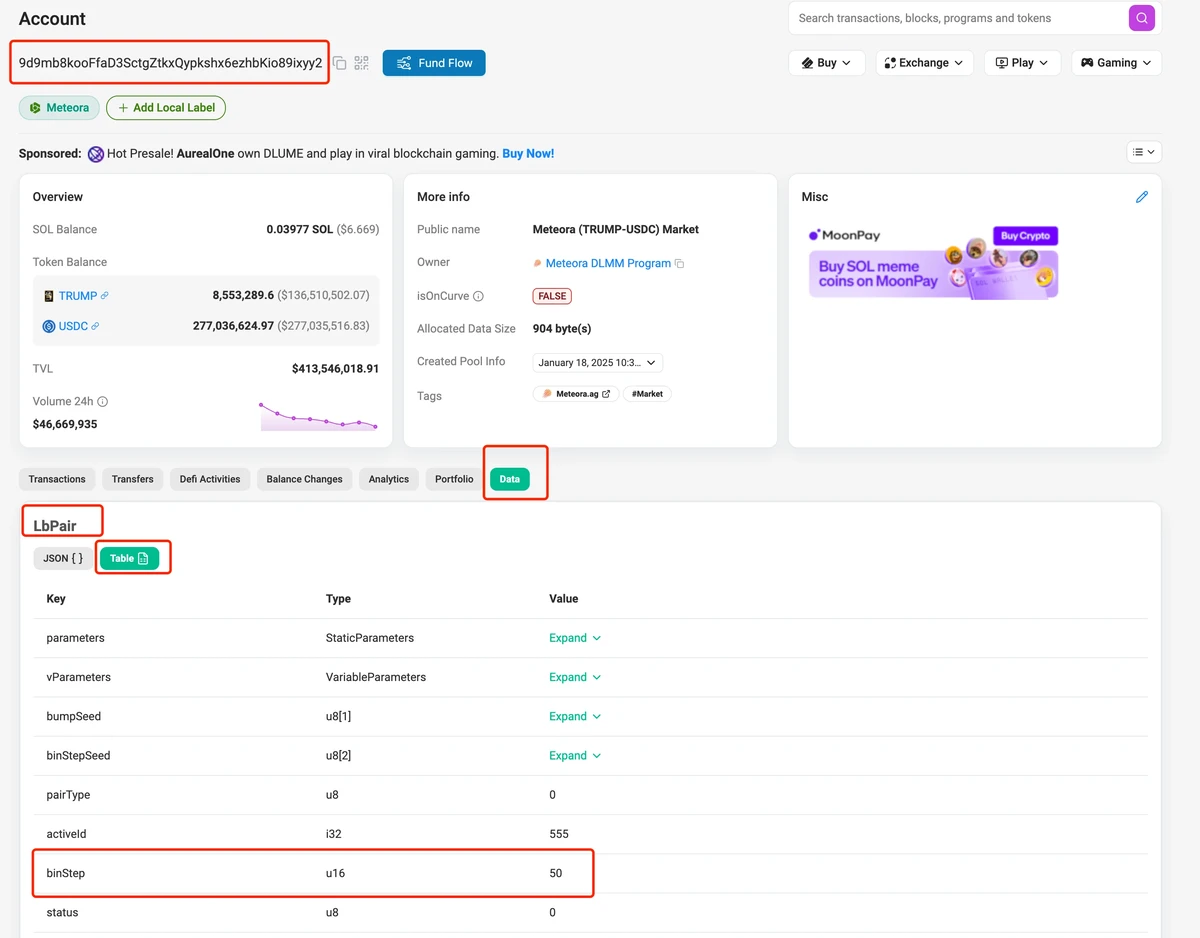

Illustration of how latency affects trade execution and market opportunities.

Step-by-Step Methods to Decrease Latency

Step 1: Network Optimization

Optimizing the network is the foundation for reducing latency.

Strategies:

- Dedicated Lines: Use private or co-located connections to exchanges.

- Fiber-Optic Cables: Reduce transmission delay compared to standard internet.

- Low-Latency Routers: Utilize hardware optimized for speed and reliability.

Pros: Significantly reduces network transmission time.

Cons: High cost and infrastructure requirements.

Embedded Link: Discover where to check latency issues in quant trading to target network bottlenecks efficiently.

Step 2: Hardware Acceleration

Modern trading systems can benefit from specialized hardware.

Techniques:

- FPGA (Field-Programmable Gate Arrays): Accelerates order matching and market data processing.

- GPU Processing: Parallel computation for complex algorithms.

- High-Performance CPUs: Low-latency cores designed for trading tasks.

Pros: Enables microsecond-level improvements.

Cons: Requires technical expertise and investment.

Diagram showing FPGA integration and CPU/GPU acceleration in trading systems.

Step 3: Software and Algorithmic Enhancements

Reducing software processing time is critical for latency optimization.

Approaches:

- Algorithm Streamlining: Simplify order logic and remove unnecessary steps.

- Real-Time Data Handling: Minimize buffering and pre-process data closer to the source.

- Asynchronous Execution: Execute independent tasks in parallel to save milliseconds.

Pros: Improves overall system efficiency and responsiveness.

Cons: Requires deep understanding of system architecture and coding.

Step 4: Exchange-Level Optimization

Trading directly affects latency depending on the exchange infrastructure.

Actions:

- Co-location Services: Position servers within exchange facilities.

- API Optimization: Use native low-latency APIs and minimize calls.

- Order Routing Improvements: Reduce hops between systems to execute trades faster.

Pros: Maximizes execution speed with minimal external dependency.

Cons: Limited to exchanges offering co-location or specialized APIs.

Comparative Analysis of Latency Reduction Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Network Optimization | Reduces transmission delays significantly | Expensive and may require complex setup |

| Hardware Acceleration | Microsecond-level improvement, scalable | High cost and technical complexity |

| Software/Algorithm Enhancements | Streamlined execution, flexible | Requires coding expertise, maintenance needed |

| Exchange-Level Optimization | Fastest execution possible | Limited availability, fees for co-location |

Recommendation: Combine network optimization with hardware acceleration for high-frequency traders, while software enhancements and API-level improvements provide flexibility for algorithmic and perpetual futures strategies.

Risk Management and Monitoring

Monitoring Latency

- Use real-time dashboards to track execution times.

- Implement alert systems for spikes in latency.

- Compare against latency benchmarks to gauge system performance.

Mitigating Risks

- Diversify trading strategies to avoid over-reliance on low-latency advantages.

- Set conservative thresholds to prevent adverse execution during spikes.

- Maintain fallback mechanisms for high-latency scenarios.

Example of latency tracking interface showing execution times and benchmarks.

Advanced Techniques for Experienced Traders

Strategy 1: Kernel-Level Optimizations

- Direct I/O and memory management bypass operating system overhead.

- Reduces processing latency in mission-critical applications.

Strategy 2: Predictive Algorithms

- Anticipate market moves to pre-position orders.

- Can offset residual latency by acting before market changes are fully visible.

Pros: Provides competitive edge in microsecond-sensitive markets.

Cons: Complexity and regulatory scrutiny may increase.

FAQ

1. How can latency affect perpetual futures trading?

Latency can lead to delayed order execution, increased slippage, and missed arbitrage opportunities, significantly impacting profitability. Traders must implement low-latency infrastructure to maintain competitive advantage.

2. Are software-only solutions sufficient for latency reduction?

Software improvements alone provide moderate gains. Optimal latency reduction typically requires a combination of hardware, network, and software optimization.

3. How do I benchmark latency performance?

Use historical execution logs, third-party latency measurement tools, and real-time monitoring dashboards to establish baseline metrics. Compare against industry benchmarks for continual improvement.

Conclusion

Reducing latency is no longer optional in high-frequency and algorithmic trading; it is essential for profitability. By following this step-by-step guide to decrease latency, traders can implement network, hardware, software, and exchange-level optimizations to gain a measurable edge. Continuous monitoring, testing, and iterative improvements ensure trading systems remain competitive.

Call to Action: Share this guide with fellow traders, comment your experiences, and explore additional resources on latency optimization to enhance your trading outcomes.