=========================================

The world of electronic trading relies heavily on robust matching engines—the core systems that pair buy and sell orders in milliseconds. For developers building matching engine tools, the task is both technically complex and strategically vital. A well-designed matching engine can define the success of an exchange, a brokerage platform, or even a high-frequency trading operation.

This article explores the architecture, methods, and strategies that developers use when creating matching engine solutions. We’ll compare different design approaches, highlight industry best practices, and provide insights into optimizing performance for modern trading environments.

What Are Matching Engine Tools?

A matching engine is the system at the heart of any trading venue. Its job is simple in theory but complex in execution: match incoming buy and sell orders based on predefined rules such as price-time priority, pro-rata distribution, or hybrid models.

Matching engine tools refer to the software frameworks, APIs, libraries, and infrastructure components that developers use to build, test, and optimize these systems.

- Order Matching Logic: Determines how bids and offers are paired.

- Latency Optimization: Ensures trades execute within microseconds.

- Scalability Features: Supports thousands of concurrent traders.

- Reliability & Fault Tolerance: Guarantees uptime under stress.

Core Requirements for Developers

Developers building matching engine tools must address four critical requirements:

- Low Latency – Execution speed directly affects competitiveness.

- Scalability – The system must handle growing user demand.

- Fairness – Order matching should comply with transparent rules.

- Reliability – No tolerance for downtime in financial markets.

These requirements are consistent whether one is working on retail broker systems or institutional-grade exchanges.

Two Key Strategies for Building Matching Engine Tools

Strategy 1: Event-Driven Architecture

How it works: Every incoming order is treated as an event, processed through queues, and dispatched to matching logic asynchronously.

Advantages:

- High throughput for parallel processing.

- Natural fit for distributed systems.

- Flexible in integrating with external risk management modules.

Disadvantages:

- Higher complexity in design.

- Potential bottlenecks if queues aren’t optimized.

- Debugging can be challenging under heavy load.

Strategy 2: In-Memory Data Structures with Low-Level Optimization

How it works: Orders are stored in in-memory order books using optimized data structures like red-black trees, heaps, or skip lists. Matching occurs directly in memory for ultra-low latency.

Advantages:

- Extremely fast execution times.

- Efficient use of CPU cache.

- Suitable for high-frequency trading environments.

Disadvantages:

- Memory-intensive, requiring strict hardware specifications.

- Harder to scale across distributed systems.

- Limited flexibility compared to event-driven models.

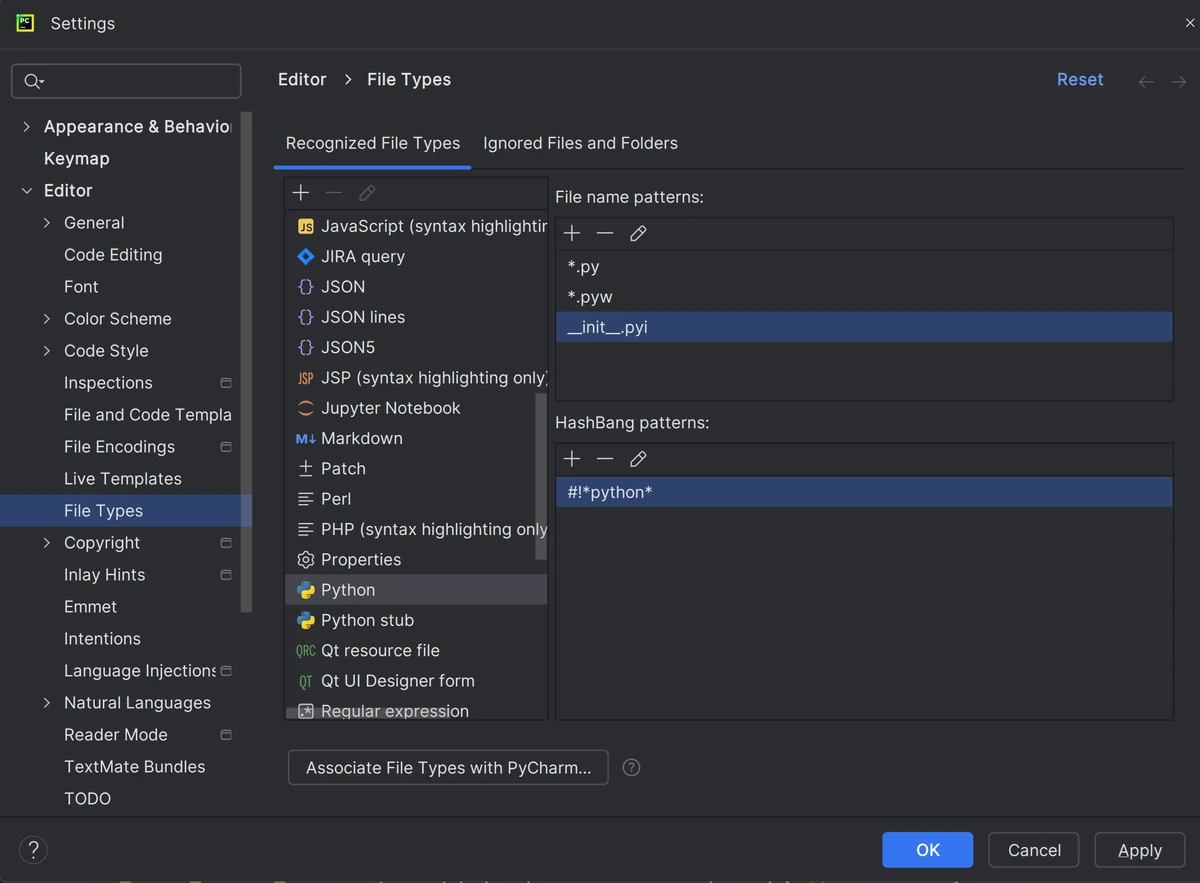

Matching engine design approaches

Recommended Hybrid Approach

The best solution often combines event-driven scalability with in-memory performance. Developers can design the system so that:

- Core order matching runs in-memory for speed.

- Event-driven pipelines handle risk checks, reporting, and auditing.

- Horizontal scaling ensures global availability.

This hybrid model provides both reliability and lightning-fast execution.

The Role of Developers in Market Innovation

Developers building matching engine tools aren’t just writing code—they are shaping how modern financial markets operate. For example:

- Crypto exchanges rely on customizable matching engines to handle diverse asset classes.

- Perpetual futures platforms demand engines optimized for continuous funding calculations and position rollover.

Understanding how does the matching engine work in perpetual futures helps developers adapt core designs to the unique mechanics of derivatives markets, where funding rates and contract perpetuity add layers of complexity.

Key Features Developers Should Integrate

- Latency Monitoring Tools – Real-time performance dashboards.

- Replay Mechanisms – For debugging and post-trade analysis.

- Risk Control Modules – Circuit breakers and margin checks.

- Extensible APIs – For integration with liquidity providers.

- Testing Frameworks – Simulated environments for stress tests.

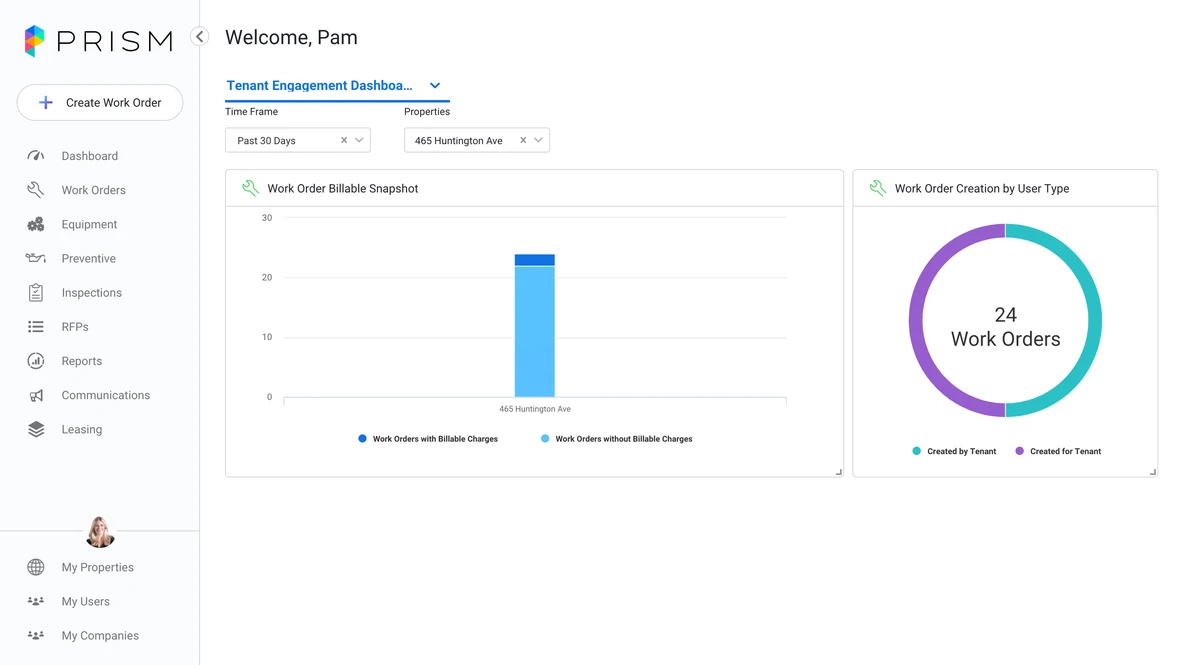

Order matching process visualization

Modern Trends in Matching Engine Development

Cloud-Native Deployment

Developers are increasingly moving matching engines to cloud environments, leveraging Kubernetes and containerization for scalability.

AI-Powered Optimization

Machine learning algorithms analyze order book data to forecast potential bottlenecks and adjust system parameters dynamically.

Open-Source Frameworks

Many startups now begin with open-source matching engine frameworks, customizing them to fit specific market needs.

As discussed in where to learn about matching engines in perpetual markets, open-source communities and research forums have become invaluable for developers seeking cutting-edge knowledge.

Challenges Developers Face

- Latency vs. Complexity Trade-Off: The faster the engine, the harder it is to maintain.

- Security: Matching engines are prime targets for cyberattacks.

- Regulatory Compliance: Must align with financial authorities (e.g., SEC, ESMA, MAS).

- Market Volatility: Engines must survive extreme spikes in trading volume.

Best Practices for Developers

- Prioritize deterministic execution to prevent unfair advantages.

- Use hardware acceleration (e.g., FPGA, RDMA) for microsecond latency.

- Run stress tests under peak load scenarios before production.

- Design modular components for risk, compliance, and monitoring.

- Maintain transparent audit logs to ensure trust and regulatory adherence.

Developer workflow for matching engine testing

FAQ: Developers Building Matching Engine Tools

1. What programming languages are best for building matching engines?

C++ and Rust are the most popular due to their performance and memory management capabilities. Java is also used in some institutional platforms for its balance of speed and ecosystem support.

2. How do developers test matching engine performance?

They simulate real-world order flows using replay frameworks and stress-test scenarios. Developers also monitor latency distributions under heavy market volatility to ensure resilience.

3. Can matching engines be open-sourced?

Yes, several open-source frameworks exist. However, commercial exchanges often modify them heavily to add proprietary logic, security measures, and high-performance optimizations.

Conclusion

For developers building matching engine tools, the challenge lies in balancing speed, scalability, and reliability. By combining event-driven architectures with in-memory optimization, developers can design systems that meet the demands of both retail and institutional traders.

As markets evolve, so too must matching engine technologies. The developers who innovate in this space aren’t just solving technical puzzles—they’re shaping the foundation of future trading ecosystems.

If this deep dive helped you understand the intricacies of matching engine development, share it with your network, drop a comment below, and let’s start a conversation about the future of trading infrastructure. 🚀

Do you want me to also prepare an SEO meta title + meta description for this article, so it’s ready for publication on your website?