=========================================================

Introduction

The rise of perpetual futures trading in cryptocurrency markets has introduced new challenges and opportunities for liquidity providers (LPs) and institutional investors. Unlike spot markets, perpetual contracts rely heavily on liquidity pools to maintain fair pricing, minimize slippage, and support leverage-based trading. Effective management of these liquidity pools is therefore critical for both profitability and market stability.

In this comprehensive guide, we will explore the concept of effective liquidity pool management for perpetual futures, discuss real-world strategies, compare their advantages and disadvantages, and provide actionable insights for traders, investors, and institutions.

Understanding Liquidity Pools in Perpetual Futures

What Are Liquidity Pools?

Liquidity pools are reserves of digital assets locked into smart contracts that facilitate decentralized trading. In perpetual futures, these pools allow traders to open leveraged positions without requiring direct counterparties.

Why Are Liquidity Pools Important?

Liquidity pools ensure:

- Efficient price discovery by matching orders quickly.

- Reduced slippage for large trades.

- Stable funding rates by balancing long and short positions.

Many traders ask, “How do liquidity pools affect perpetual futures trading?” The answer lies in their ability to provide depth, absorb volatility, and enhance execution speed, making them indispensable to modern derivative markets.

Core Principles of Effective Liquidity Pool Management

1. Capital Allocation Efficiency

LPs must decide how much capital to allocate across different trading pairs and perpetual contracts. Misallocation can lead to high impermanent loss or underutilized assets.

2. Risk Hedging

Managing exposure to extreme market moves is essential. Liquidity pools often face risks when funding rates diverge or when one side of the market (longs or shorts) dominates.

3. Incentive Alignment

To keep pools healthy, platforms must balance liquidity provider rewards (through trading fees and funding rates) with sustainable tokenomics.

4. Continuous Monitoring

Real-time data monitoring is necessary to prevent liquidity shortages. Knowing where to get reliable liquidity pool data for perpetual futures helps LPs adjust strategies proactively.

Case Study 1: Balanced Liquidity Pool in ETH Perpetual Futures

An exchange implemented a liquidity pool for ETH perpetual contracts that dynamically adjusted fees based on demand.

- Outcome: Reduced volatility in funding rates and attracted long-term LPs.

- Key Lesson: Dynamic incentives improve pool stability and reduce imbalances.

Case Study 2: Overexposed Pool in BTC Perpetual Futures

A BTC perpetual pool faced significant imbalance during a bull run, as traders overwhelmingly went long. LPs bore heavy losses when funding rates became unsustainable.

- Outcome: LP capital depletion and liquidity crunch.

- Key Lesson: Hedging mechanisms and diversification across multiple assets are vital.

Strategies for Effective Liquidity Pool Management

Strategy 1: Passive Market-Making in Liquidity Pools

Method: LPs deposit assets into a pool and earn fees from perpetual futures traders.

Pros:

- Simple setup for beginners.

- Consistent income from trading fees.

- No need for complex active strategies.

Cons:

- Exposed to impermanent loss.

- Vulnerable to market imbalances in bullish or bearish extremes.

Strategy 2: Active Risk-Managed Liquidity Pooling

Method: LPs hedge pool exposure using derivatives such as options or opposing futures contracts.

Pros:

- Lower risk during extreme volatility.

- Preserves capital while still earning fees.

- More control over exposure.

Cons:

- Requires active monitoring and trading skills.

- Higher operational costs.

Recommended Approach

For long-term success, active risk-managed pooling outperforms passive strategies. While passive pooling works for retail investors, institutions should adopt advanced methods such as hedging, AI-driven risk assessment, and multi-asset diversification.

Advanced Techniques for Liquidity Pool Optimization

Dynamic Fee Adjustment

Platforms adjust fees based on volatility to reward LPs more during unstable markets.

Cross-Margin Pooling

Liquidity shared across multiple perpetual pairs reduces risk concentration.

Algorithmic Liquidity Rebalancing

AI and quantitative models automatically reallocate liquidity to under-served pools, improving efficiency.

Example of Application

Many advanced traders explore how to maximize returns from liquidity pools in perpetual futures by combining algorithmic rebalancing with automated risk hedging, allowing them to capture yield while minimizing downside.

Industry Trends in Liquidity Pool Management

- Rise of Institutional Participation: Large funds seek the best liquidity pools for institutional investors in perpetual futures to enhance returns.

- Decentralized Exchanges (DEXs) integrating perpetual contracts now dominate retail-driven markets.

- AI-Driven Monitoring Tools: Real-time analytics platforms offer predictive modeling to anticipate liquidity shortages.

- Cross-Chain Liquidity: Emerging protocols allow liquidity pooling across multiple blockchains, expanding market depth.

Images for Visualization

Liquidity pools facilitate leveraged perpetual futures trading by providing depth and stability.

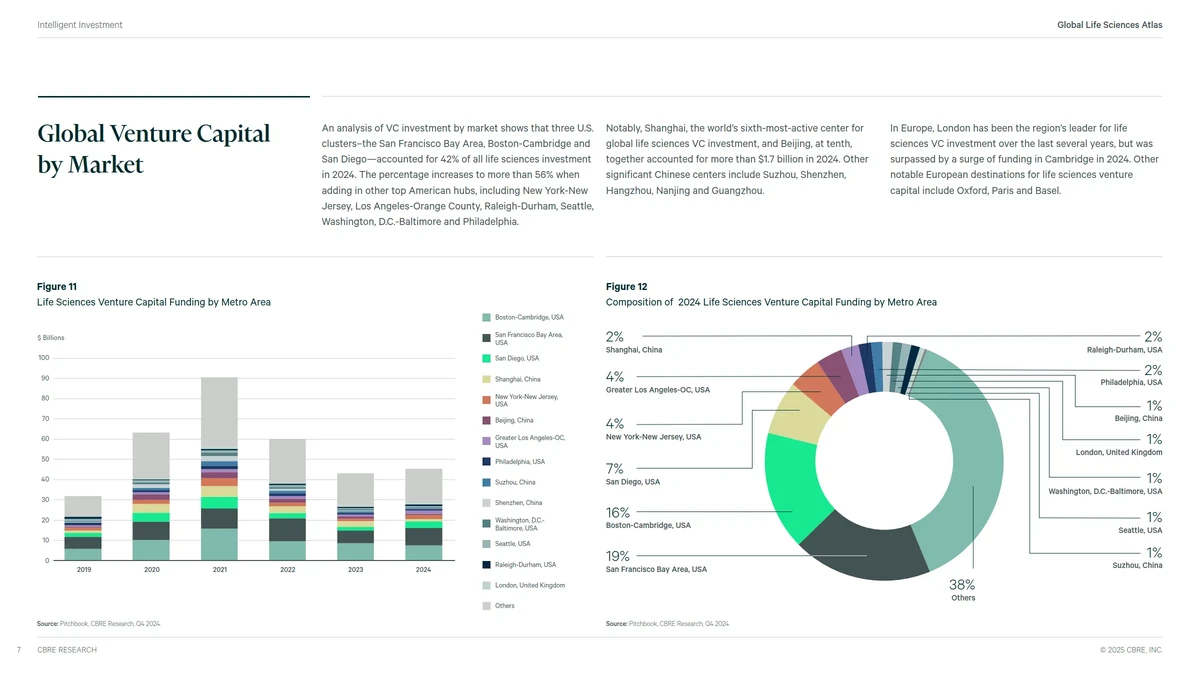

Effective liquidity pool management requires balancing returns with hedging against volatility.

Institutions optimize liquidity pool returns using structured strategies and advanced analytics.

Frequently Asked Questions (FAQ)

1. How do liquidity pools provide stability in perpetual futures?

Liquidity pools absorb market orders, ensuring reduced slippage and smoother funding rates. By maintaining depth on both long and short sides, they stabilize perpetual futures markets even during high volatility.

2. What risks do liquidity providers face in perpetual futures pools?

The main risks include:

- Impermanent loss due to price fluctuations.

- Liquidity imbalances when one side dominates.

- Protocol risks such as smart contract vulnerabilities.

3. How can investors maximize returns from liquidity pools?

- Choose pools with high trading volume but balanced exposure.

- Utilize hedging tools to offset impermanent loss.

- Consider dynamic strategies that adapt to changing funding rates.

Conclusion

Effective liquidity pool management is the backbone of sustainable perpetual futures trading. From simple passive pooling to advanced hedging strategies, liquidity providers must adapt to evolving market conditions.

For beginners, passive strategies offer a straightforward entry point. However, institutional investors and professionals benefit most from active, risk-managed approaches that combine hedging, dynamic allocation, and AI-driven optimization.

As decentralized finance continues to evolve, liquidity pools will play a pivotal role in ensuring market stability and profitability. The key lies in proactive management, constant monitoring, and innovative strategies that turn liquidity provisioning from a challenge into a long-term advantage.

If you found this article helpful, share it with your peers, leave a comment with your experiences, and help others master the art of effective liquidity pool management for perpetual futures.