=================================================

Rebates in perpetual futures trading are one of the most overlooked yet powerful ways to optimize trading performance. While most traders focus on price movements, leverage strategies, or risk management, effective rebate techniques for perpetual futures can add an entirely new dimension of profitability.

This comprehensive guide explores rebate structures, practical methods to maximize returns, real-world examples, and advanced strategies suitable for retail traders, professionals, and institutions.

Understanding Rebates in Perpetual Futures

What Are Rebates?

A rebate is a reward (usually in the form of reduced fees or even direct payouts) given to traders for providing liquidity or participating in certain exchange programs. In perpetual futures, rebates often come from:

- Maker rebates: Earned by placing limit orders that add liquidity.

- Volume-based rebates: Discounts or payouts based on trading volume thresholds.

- Referral or affiliate rebates: Shared benefits from bringing new traders to an exchange.

Understanding how rebate works in perpetual futures is the first step to turning an often-ignored benefit into a structured trading edge.

Why Rebates Matter for Traders

Even small percentage rebates can dramatically improve realized PnL over time. For example:

- A 0.02% maker rebate on high-frequency strategies can turn breakeven trades into profitable ones.

- Institutional desks using millions in daily volume often view rebates as a key source of annual profit margins.

In short, rebates convert trading activity itself into a revenue stream—particularly valuable during sideways or low-volatility markets.

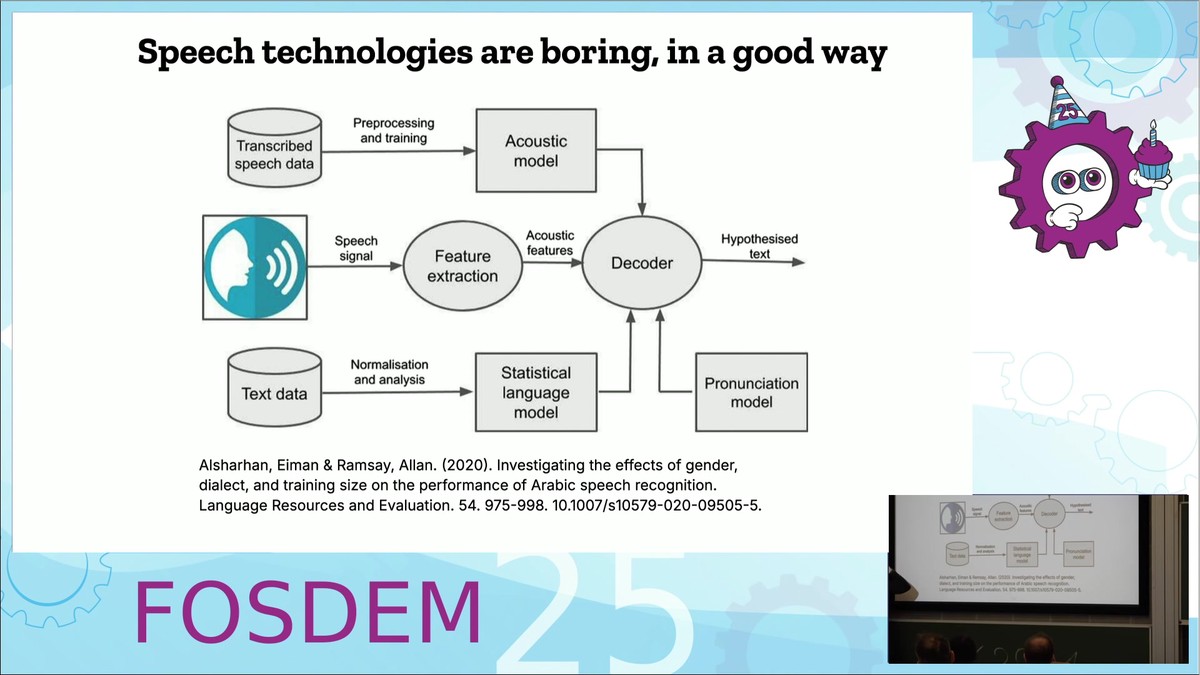

Illustration of rebate mechanics in perpetual futures trading

Core Effective Rebate Techniques

1. Maker-Focused Liquidity Provision

Placing limit orders instead of market orders allows traders to earn rebates instead of paying taker fees.

Pros:

- Rebates compound with every trade.

- Works well in high-frequency and arbitrage strategies.

Cons:

- Higher chance of unfilled orders during volatile markets.

- Requires patience and capital to maintain open positions.

2. Volume-Based Tier Optimization

Exchanges often provide progressive rebate tiers where traders receive larger benefits as their monthly volume increases.

Technique:

- Structure trading to meet or slightly exceed volume thresholds.

- Split execution across fewer accounts to concentrate volume.

Pros:

- Larger savings once thresholds are hit.

- Excellent for day traders and institutions.

Cons:

- May encourage overtrading.

- Requires strong risk management.

3. Referral and Affiliate Programs

Some exchanges reward traders for bringing in new participants, sharing fee reductions or direct payouts.

Pros:

- Passive income alongside trading.

- Scales well with community building.

Cons:

- Not a direct trading edge.

- Relies on external marketing efforts.

4. Cross-Exchange Arbitrage with Rebates

Arbitrage strategies become even more profitable when combined with rebate opportunities across multiple exchanges.

Example:

- Trader buys futures on Exchange A and sells on Exchange B.

- Rebates from both exchanges enhance the arbitrage spread.

5. Institutional-Level Negotiated Rebates

Large-volume traders can negotiate custom rebate structures with exchanges.

- Tailored fee schedules.

- Access to hidden or exclusive programs.

This is often the most lucrative but requires institutional-scale volume.

Comparing rebate strategies across trading profiles

Comparing Two Rebate Techniques

Technique 1: Maker Liquidity Rebates

- Strengths: Reliable, transparent, and directly linked to order type.

- Weaknesses: Can reduce trade execution probability during fast moves.

Technique 2: Volume-Based Rebates

- Strengths: Significant long-term savings, especially for high-volume traders.

- Weaknesses: May tempt traders into unnecessary trades to reach thresholds.

Recommendation:

For retail traders, focus on maker rebates by improving limit order discipline. For institutions and high-frequency traders, optimize for volume-based rebates—and combine both whenever possible.

Step-by-Step Guide to Applying Rebate Techniques

- Review rebate terms: Always read exchange policies carefully (see where to understand rebate terms in perpetual futures).

- Choose the right order types: Prioritize limit orders when possible.

- Track trading volume: Align monthly activity with rebate tiers.

- Use rebate calculators: Estimate expected monthly benefits.

- Monitor realized PnL with rebates included: Always integrate rebate income into performance metrics.

- Continuously optimize execution: Avoid chasing rebates at the cost of strategy discipline.

Real-World Example

A crypto day trader executes $50 million monthly volume with an exchange offering:

- 0.02% maker rebate

- 0.05% taker fee

By focusing on maker orders, the trader not only avoids taker fees but also earns rebates worth $10,000 monthly—transforming an otherwise marginal strategy into a profitable one.

Workflow for integrating rebate strategies into trading systems

Common Pitfalls in Rebate Optimization

- Overtrading: Chasing volume rebates at the cost of unnecessary risk.

- Ignoring hidden costs: Spreads, slippage, and execution failures can outweigh rebates.

- Not tracking properly: Many traders underestimate how rebates impact their net results.

FAQ: Effective Rebate Techniques for Perpetual Futures

1. How do I qualify for rebates on perpetual futures?

Qualification depends on exchange rules. Most require either:

- Using limit (maker) orders.

- Reaching specific monthly trading volume thresholds.

Always verify with your platform’s rebate program.

2. Are rebates worth it for small retail traders?

Yes. Even small rebates compound over time. For example, saving 0.02% per trade on hundreds of trades monthly adds up significantly.

3. Can rebates turn losing strategies into profitable ones?

Not entirely. Rebates improve margins but cannot replace sound risk management or strategy design. Think of rebates as profit boosters, not profit generators.

Final Thoughts

Effective rebate techniques for perpetual futures are a hidden alpha source often overlooked by traders. By combining liquidity provision, volume optimization, and advanced arbitrage, traders can unlock thousands in additional monthly gains.

The key is discipline: rebates should enhance your trading, not dictate it.

If you found value in this deep dive into rebate strategies, share it with your trading community and comment below with your experiences. Which rebate programs have worked best for you?

Would you like me to also prepare a rebate optimization checklist infographic (step-by-step visual guide) that traders can download and use during active trading?