===================================================================

Perpetual futures are one of the most popular trading instruments in the crypto market, but they can be complex and risky, especially for novice traders. The key to success in trading perpetual futures lies not only in market analysis and strategy but also in how well you execute your trades. Execution errors can result in significant losses, making it essential to understand and avoid common pitfalls. In this comprehensive guide, we’ll explore the most common execution mistakes that novice traders make in perpetual futures and provide actionable insights to improve your trading performance.

Understanding Perpetual Futures

Before diving into the mistakes to avoid, it’s important to understand what perpetual futures are and why they differ from traditional futures contracts.

What Are Perpetual Futures?

Unlike traditional futures contracts that have expiration dates, perpetual futures are designed to be held indefinitely, with no set expiry. The price of these contracts typically tracks the underlying asset, such as Bitcoin or Ethereum. The key feature of perpetual futures is their funding rate mechanism, which is paid between buyers and sellers to ensure the contract price aligns with the spot market price.

Why Execution is Crucial in Perpetual Futures

Effective execution can make or break a trader’s strategy. In the fast-paced world of perpetual futures trading, where prices can change rapidly, ensuring speed, accuracy, and cost efficiency in your execution is essential. Execution mistakes in this market are costly, particularly given the high leverage available in many crypto exchanges. A minor error in order placement or risk management can lead to massive losses.

Common Execution Mistakes to Avoid

While there are many mistakes that novice traders make, certain execution mistakes are particularly common and impactful in perpetual futures. Below, we’ll discuss some of the most critical ones and how you can avoid them.

1. Failing to Set Proper Stop-Loss and Take-Profit Orders

Many novice traders enter the market without clearly defined exit points, which leads to emotional decision-making and losses. One of the biggest mistakes is failing to set stop-loss and take-profit orders before executing a trade.

Why This Happens:

- Novices might expect the market to move in their favor and delay setting stop-loss orders, thinking they can monitor the trade manually.

- In a volatile market, this often results in increased risk exposure.

Solution:

Always set your stop-loss and take-profit levels before entering a trade. Automated execution tools can ensure your trade exits when the market hits your predefined levels, minimizing the impact of emotional trading.

2. Ignoring Liquidity Constraints

Liquidity refers to how easily an asset can be bought or sold without affecting its price. Perpetual futures markets can be volatile, especially in low-liquidity conditions. Failing to account for this can lead to slippage, where the price you execute your trade at differs significantly from the expected price.

Why This Happens:

- Novice traders often focus on the potential for gains, neglecting to assess the liquidity of the asset.

- In highly volatile markets, low liquidity can exacerbate slippage, leading to less favorable entry and exit points.

Solution:

Before placing a trade, always assess the order book and market depth. If liquidity is thin, consider scaling your position or using a limit order instead of a market order to control your entry and exit prices.

3. Overleveraging Positions

Perpetual futures offer high leverage, meaning that you can control a larger position with a smaller amount of capital. While this can amplify profits, it can also magnify losses, especially for novices who may not fully understand the risks involved.

Why This Happens:

- The allure of amplified profits can encourage traders to use more leverage than they can handle.

- Inexperienced traders might not fully understand how liquidation works in leveraged trades.

Solution:

Use moderate leverage and make sure you understand the risks before employing high leverage. Set appropriate margin levels and monitor your position regularly. It’s essential to never risk more than you can afford to lose.

4. Chasing the Market

Chasing the market occurs when a trader enters a trade after a significant price move, hoping to capitalize on continued momentum. This is a common mistake among novice traders who fail to wait for an ideal entry point.

Why This Happens:

- Emotional trading or fear of missing out (FOMO) causes traders to enter positions too late.

- Novices often misinterpret short-term volatility as long-term trends.

Solution:

Avoid entering trades based on emotional impulses. Instead, wait for the market to consolidate or show clear signs of a trend before entering. Use technical analysis to identify optimal entry points.

5. Lack of Proper Risk Management

In perpetual futures trading, risk management is key. Novices often make the mistake of focusing solely on potential profits, without implementing a clear risk management strategy. This can lead to large losses, especially if the market moves unfavorably.

Why This Happens:

- Lack of experience often leads to underestimating risk.

- Some traders believe that taking on more risk will result in higher rewards.

Solution:

Adopt a disciplined approach to risk management by using risk/reward ratios and position sizing. Never risk more than 2% of your capital on a single trade. Keep a risk management plan in place to ensure long-term profitability.

How to Improve Execution in Perpetual Futures

While avoiding execution mistakes is crucial, improving execution efficiency is equally important. Here are some advanced strategies to help optimize your execution:

1. Automated Trading Tools and Bots

Using automated trading bots can help you execute trades more efficiently. Bots can help with order placement, slippage reduction, and risk management by following predefined rules.

Benefits:

- Reduced emotional impact on decision-making.

- Faster execution, especially during volatile conditions.

- Consistent execution based on predefined strategies.

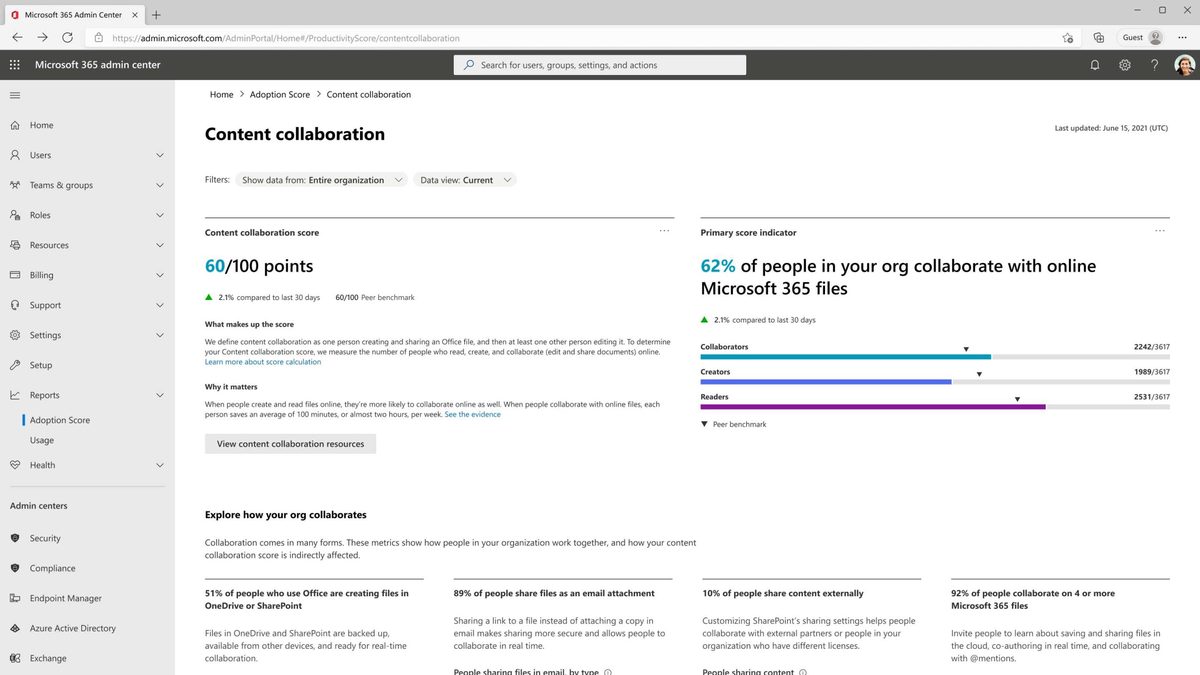

2. Leverage Execution Software

Advanced traders use execution management systems (EMS) that offer real-time data, multiple order types, and optimized routes. These systems help prevent slippage, reduce latency, and ensure that your trade gets executed at the best possible price.

Frequently Asked Questions (FAQ)

1. Why is stop-loss important in perpetual futures trading?

A stop-loss is crucial in limiting potential losses. It automatically closes your position when the price reaches a predefined level, preventing the emotional decision-making that can happen in volatile markets.

2. What’s the best way to avoid slippage?

To avoid slippage, ensure you are trading in highly liquid markets and use limit orders instead of market orders. This gives you more control over the execution price.

3. How much leverage should I use in perpetual futures?

It depends on your risk tolerance and trading strategy. As a novice, it’s advisable to use low leverage, starting at 2x or 3x, until you become comfortable with the volatility and risk involved in perpetual futures.

Conclusion

Executing trades in perpetual futures can be challenging, especially for novice traders. Avoiding common execution mistakes, such as failing to set stop-loss orders, ignoring liquidity, and overleveraging, is crucial to becoming a successful trader. By using proper risk management strategies, automated tools, and focusing on execution speed and accuracy, you can optimize your trading performance and increase your chances of success in the perpetual futures market.

Feel free to share your thoughts in the comments below or share this article with others who might benefit from learning how to avoid these common execution mistakes.