Matching engines are the backbone of modern trading platforms, ensuring rapid, reliable, and fair execution of orders. For traders—from retail investors to institutional quants—understanding where to find best matching engine settings and how to optimize them is critical for minimizing latency, maximizing execution efficiency, and enhancing trading performance. This comprehensive guide dives into matching engine principles, practical settings, optimization strategies, and industry best practices.

Understanding Matching Engines

What Is a Matching Engine?

A matching engine is software that pairs buy and sell orders in financial markets, such as stocks, crypto, or perpetual futures. Its performance directly impacts order execution speed, market liquidity, and price discovery.

Key functions include:

- Order Matching: Pairing compatible buy and sell orders

- Price-Time Priority: Executing orders based on price and submission time

- Order Book Management: Maintaining a live ledger of market orders

- Trade Execution: Recording completed transactions accurately

This relates closely to how does the matching engine affect trade execution, as engine performance directly determines whether orders are filled efficiently or delayed.

Why Matching Engine Settings Matter

The correct configuration of a matching engine can:

- Reduce Latency: Faster order execution for high-frequency traders

- Enhance Reliability: Prevent system failures and order mismanagement

- Optimize Liquidity: Improve market depth and trading opportunities

- Enable Custom Strategies: Tailor algorithms for specific trading needs

Overview of a matching engine workflow from order submission to trade confirmation.

Core Settings for Matching Engine Optimization

Setting 1: Order Prioritization Rules

Order prioritization determines which trades are executed first. Common rules include:

- Price-First, Time-Second (PFTS): Most common in equity and crypto markets

- Pro-Rata Allocation: Distributes trades proportionally among large orders

- Custom Algorithmic Priorities: Useful for market-making or high-frequency trading

Advantages:

- Ensures fairness and predictable order execution

- Supports diverse trading strategies

Disadvantages:

- Complex prioritization rules can increase engine load

- Misconfigured rules may delay critical trades

Setting 2: Tick Size and Price Increments

Tick size determines the smallest allowable price movement for an asset. Correct settings affect liquidity and volatility management.

Best Practices:

- Smaller ticks improve precision for algorithmic trading

- Larger ticks reduce microstructure noise but may limit fine-grained trading

Setting 3: Latency and Throughput Tuning

High-frequency traders require minimal latency and maximal throughput. Optimizing network paths, CPU prioritization, and memory management can significantly enhance performance.

Key Parameters:

- Queue Size: Prevents order bottlenecks

- Batch Processing: Balances throughput and latency

- Parallel Execution Threads: Increases simultaneous order handling

Latency optimization techniques for high-frequency trading, showing reduced execution delay using parallel processing.

Methods to Find Best Matching Engine Settings

Method 1: Vendor and Platform Documentation

Most professional trading platforms provide detailed guides and recommended configurations:

- Pros: Official, reliable, and tailored for the platform

- Cons: May not account for unique trader strategies

Method 2: Community and Research Resources

Trading communities, forums, and quantitative research papers often discuss optimal settings for various market conditions.

- Pros: Insights from real-world traders and quants

- Cons: Requires careful validation to avoid untested advice

For those seeking deeper understanding, where to learn about matching engines in perpetual markets offers comprehensive tutorials and training on engine configurations and optimizations.

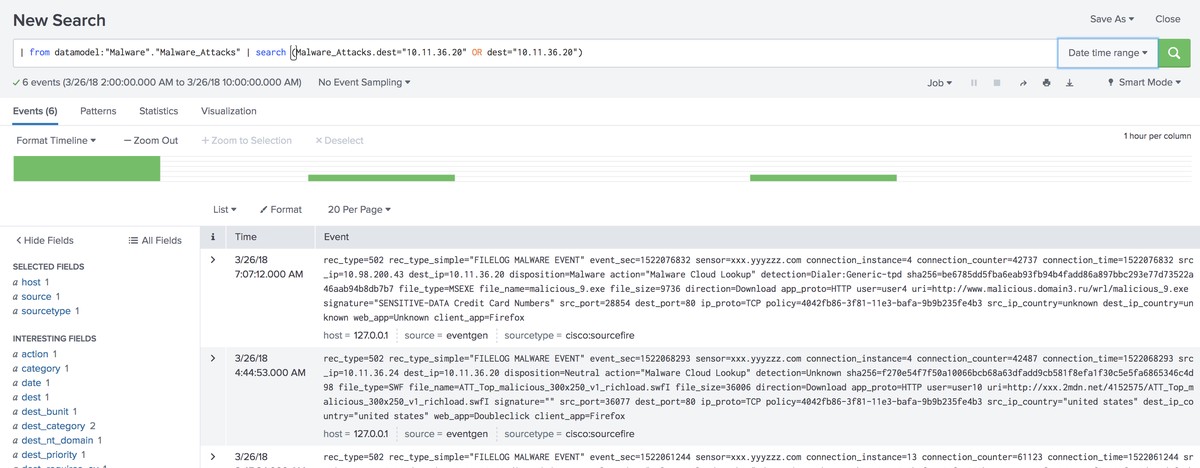

Method 3: Backtesting and Simulation

Backtesting matching engine settings with historical data ensures configurations are effective before deployment. Key steps:

- Simulate order flows using historical price and volume data

- Test latency, prioritization rules, and tick size variations

- Evaluate performance metrics: order fill rate, latency, and slippage

Advanced Matching Engine Strategies

Strategy 1: Custom Algorithmic Tuning

Algorithmic traders can modify matching engine behavior for specific strategies:

- Market-making: Reduce queue latency for frequent micro-orders

- Arbitrage: Optimize price priority to capture fleeting opportunities

- Trend following: Adjust batch execution timing to align with market trends

Benefits: Higher efficiency and strategy-specific performance

Risks: Increased complexity and potential for misconfiguration

Strategy 2: Scalable Architecture Design

Modern matching engines can benefit from scalable designs to handle peak loads:

- Horizontal Scaling: Multiple engine instances to manage high traffic

- Load Balancing: Distribute orders evenly across servers

- Cloud Integration: Flexible scaling without hardware constraints

Advantages: Reliable performance during market surges

Disadvantages: Requires robust monitoring and system redundancy

Illustration of a scalable matching engine architecture with load balancing and redundancy features.

Best Practices for Traders

- Regularly Monitor Engine Metrics: Track latency, throughput, and order fill rates

- Backtest Settings: Simulate configurations using historical market data

- Update for Market Changes: Adjust settings for volatility spikes or new trading instruments

- Leverage Vendor Recommendations: Use platform guides for baseline settings

- Engage in Peer Learning: Join forums and communities for continuous improvement

FAQ

1. How do I know if my matching engine settings are optimal?

Monitor latency, fill rates, and execution reliability. Conduct backtesting and compare metrics against benchmarks.

2. Can retail traders benefit from advanced matching engine settings?

Yes. Even small-scale traders can optimize execution speed and order priority by using platforms that allow configurable engine settings.

3. What risks are involved with custom engine configurations?

Misconfigured settings can lead to missed trades, increased slippage, and system overload during high market volatility. Always validate in a simulated environment first.

Conclusion

Finding the best matching engine settings is a mix of technical knowledge, testing, and strategic insight. By combining vendor guidance, community research, and backtesting, traders can optimize execution speed, reliability, and performance across various markets. Implementing best practices ensures not only efficiency but also resilience in volatile conditions, enhancing overall trading outcomes.

Engage with this guide by sharing your experiences or strategies for configuring matching engines, helping other traders optimize their trading performance.