===============================================================

Introduction

Perpetual futures have rapidly grown into one of the most important derivatives in crypto trading. Unlike traditional futures, they do not expire, making them a versatile tool for speculation, hedging, and arbitrage. However, their complexity requires structured approaches that go beyond simple discretionary trading. This is where quantitative strategies come into play.

In this comprehensive guide to mastering quantitative strategies in perpetual futures, we will explore fundamental concepts, advanced methodologies, practical frameworks, and proven tactics. We will also compare two widely used strategies, analyze their pros and cons, and highlight the best approach for different types of traders.

By the end, you will understand not only why perpetual futures require a quantitative strategy but also how to develop a quantitative strategy for perpetual futures that fits your trading style, risk appetite, and long-term objectives.

Understanding Quantitative Strategies in Perpetual Futures

What Are Quantitative Strategies?

Quantitative strategies are systematic, rules-based trading approaches built on mathematical models, historical data analysis, and algorithmic execution. Instead of relying on emotions or intuition, traders use data-driven frameworks to identify opportunities and manage risk.

Why Use Quantitative Strategies in Perpetual Futures Trading?

Perpetual futures are highly liquid and trade around the clock. Their funding rate mechanism creates unique arbitrage and hedging opportunities that discretionary traders often miss. Quantitative methods provide:

- Consistency: Eliminates emotional biases.

- Scalability: Allows automation across multiple markets.

- Precision: Incorporates advanced risk management tools.

Key Elements of Quantitative Strategies in Perpetual Futures

1. Market Data Analysis

Quantitative trading depends on high-quality data, including price feeds, funding rates, and open interest. Tools like Python-based APIs and trading terminals make this possible.

2. Signal Generation

Signals may be based on technical indicators (e.g., moving averages, stochastic oscillators), statistical models, or machine learning predictions.

3. Execution Algorithms

Trading bots and algorithmic order routing systems ensure minimal slippage and latency, critical for high-frequency or arbitrage strategies.

4. Risk Management

Greeks, Value at Risk (VaR), and stress testing help traders balance leverage while avoiding liquidation.

Two Common Quantitative Strategies in Perpetual Futures

Strategy 1: Statistical Arbitrage with Funding Rate Exploitation

This strategy focuses on exploiting the funding mechanism of perpetual futures. When funding rates are positive, longs pay shorts; when negative, shorts pay longs.

How It Works: Enter a hedged position (long spot, short perpetual) to collect funding payments.

Pros:

- Low directional risk.

- Works well in sideways markets.

- Low directional risk.

Cons:

- Requires large capital for meaningful returns.

- Returns shrink when funding rates stabilize.

- Requires large capital for meaningful returns.

Strategy 2: Momentum-Based Quantitative Models

Momentum strategies rely on price trends and breakout signals. Algorithms enter positions when momentum is strong and exit on reversal signals.

How It Works: Uses moving averages, volatility filters, and breakout levels to automate trades.

Pros:

- Captures strong directional moves.

- Suitable for trending markets like crypto.

- Captures strong directional moves.

Cons:

- High drawdowns in choppy conditions.

- Requires adaptive risk controls.

- High drawdowns in choppy conditions.

Comparison: Which Strategy Is Best?

- Statistical Arbitrage is more defensive and ideal for risk-averse or institutional traders.

- Momentum Models are aggressive and better suited for retail or professional traders seeking high growth.

From personal experience, a hybrid strategy often performs best—using arbitrage for stability and momentum for capturing explosive moves.

Step-by-Step Guide to Building a Quantitative Strategy

Step 1: Define Objectives

Are you targeting steady returns or high-risk/high-reward growth?

Step 2: Choose Your Data Sources

Use reliable APIs from exchanges like Binance, OKX, or Bybit.

Step 3: Design and Test the Strategy

Leverage frameworks such as Python, R, or MATLAB. If unsure, explore where to learn quantitative strategies for perpetual futures via online courses or institutional resources.

Step 4: Optimize Parameters

Adjust leverage, entry thresholds, and position sizes. This is where you apply how to optimize a quantitative strategy for perpetual futures by analyzing drawdowns and Sharpe ratios.

Step 5: Backtest and Forward Test

Use historical datasets and paper trading before committing capital.

Industry Trends in Quantitative Strategies for Perpetual Futures

Machine Learning & AI

Traders are integrating reinforcement learning models to dynamically adjust strategies.

Cross-Market Arbitrage

Quantitative systems now monitor multiple exchanges simultaneously to exploit mispricing.

Institutional Adoption

Hedge funds are scaling perpetual futures exposure through custom quantitative strategies for institutional perpetual futures investors.

Example: Funding Rate Arbitrage in Practice

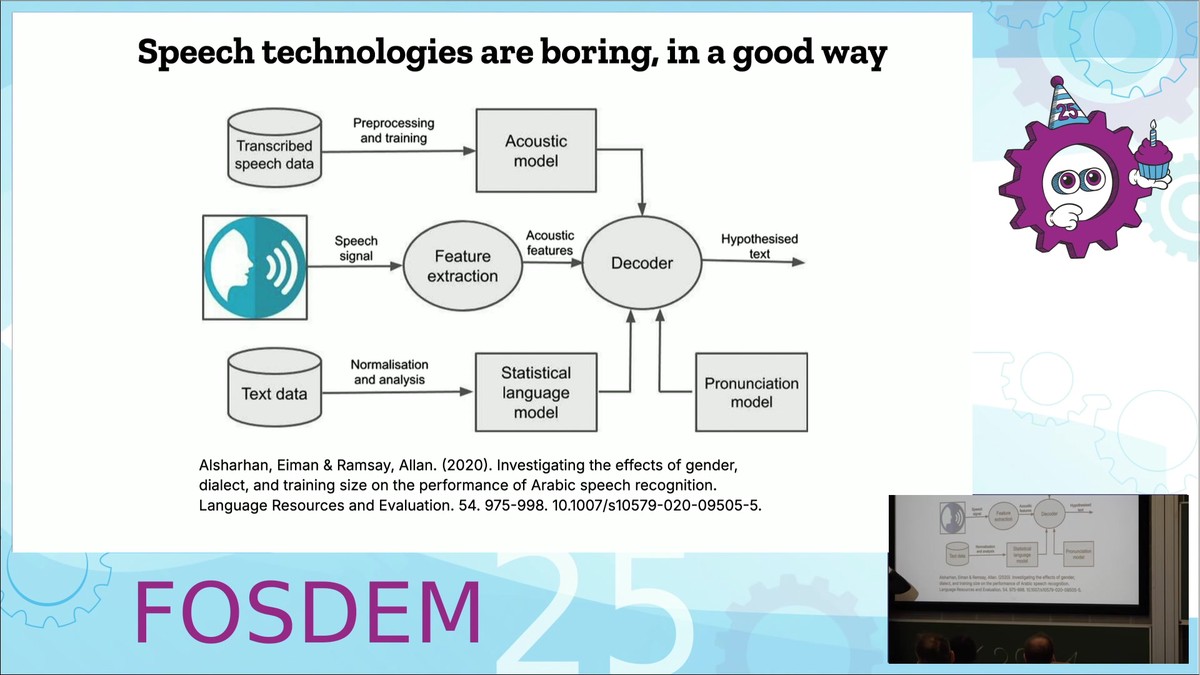

Visual representation of arbitrage in derivatives trading

Tools for Developing Quantitative Strategies

- Programming Languages: Python (Pandas, NumPy, Backtrader), R, Julia.

- Trading Platforms: QuantConnect, MetaTrader, TradingView Pine Script.

- Data Sources: Exchange APIs, Kaiko, Glassnode, CryptoQuant.

- Execution Tools: FIX API, low-latency bots, co-location servers.

Challenges in Mastering Quantitative Strategies

1. Overfitting Models

Backtests may show unrealistic profits. Solution: use out-of-sample validation.

2. Latency Risks

Milliseconds can determine profits in arbitrage. Solution: invest in fast infrastructure.

3. Liquidity Constraints

Some perpetual markets have shallow order books. Solution: focus on high-volume pairs.

FAQ Section

1. How do I start building a quantitative strategy for perpetual futures?

Begin with simple frameworks like moving averages or funding rate arbitrage. Study how to develop a quantitative strategy for perpetual futures and backtest thoroughly before scaling capital.

2. What is the most reliable data source for perpetual futures strategies?

Exchange APIs are the most direct, but for advanced traders, institutional providers like Kaiko offer clean, consolidated historical data essential for robust backtesting.

3. Can beginners succeed with quantitative strategies in perpetual futures?

Yes, but start small. Focus on quantitative strategy for beginner perpetual futures traders, such as simple momentum systems, before moving into complex AI-driven models.

Conclusion: The Path to Mastery

Mastering quantitative strategies in perpetual futures requires a combination of technical knowledge, data-driven execution, and disciplined risk management. The most successful traders blend defensive approaches like arbitrage with aggressive trend-following models, creating a diversified framework that adapts to different market regimes.

If you found this guide insightful, please share it with your network, comment your experiences, and engage with other traders. By exchanging ideas, we can push the boundaries of what’s possible in quantitative perpetual futures trading.

Would you like me to also create a visual strategy blueprint infographic (showing how to go from idea → backtesting → optimization → live trading) to make the framework even clearer for readers?