How Can Fundamental Signals Improve Leverage Trading?

Leverage trading has become one of the most powerful tools for modern traders seeking amplified returns. However, it also magnifies risks, which means relying solely on technical charts or short-term sentiment often leads to overexposure. This is where fundamental signals come in. By integrating core economic, corporate, and market data into leveraged strategies, traders can build a more balanced and sustainable approach to high-risk trading. In this article, we’ll explore in depth how fundamental signals improve leverage trading, compare different methods, and provide actionable strategies supported by real-world experience.

What Are Fundamental Signals in Leverage Trading?

Fundamental signals are data-driven indicators derived from the intrinsic value of assets, macroeconomic conditions, or company performance. Unlike purely technical signals, they reflect underlying forces that drive long-term price trends.

Examples of Fundamental Signals

- Macroeconomic indicators: GDP growth, inflation rates, interest rates.

- Corporate data: Earnings reports, revenue growth, profit margins.

- Sectoral trends: Commodity cycles, industry regulations, technology adoption.

- Geopolitical events: Trade wars, elections, monetary policy shifts.

When applied to leverage trading, these signals guide traders in selecting positions with stronger conviction, lowering the probability of margin calls caused by sudden volatility.

Fundamental vs technical analysis in leverage trading

How Can Fundamental Signals Improve Leverage Trading?

The integration of fundamental signals enhances leveraged strategies in several ways:

- Risk Reduction: By aligning leveraged positions with macro trends, traders reduce exposure to random short-term swings.

- Better Timing: Fundamental data can help identify whether high leverage is justified or whether caution is needed.

- Informed Position Sizing: When fundamentals strongly support a trade, traders can responsibly increase leverage.

- Sustainable Growth: Unlike purely speculative bets, fundamental-backed leverage trades aim for consistency.

In short, fundamentals act as a safety net and conviction booster, allowing traders to hold leveraged positions with more confidence.

Two Key Strategies for Using Fundamental Signals in Leverage Trading

1. Macro-Driven Leverage Trading

This strategy relies on global economic indicators to guide leveraged decisions.

How It Works

- Monitor interest rate announcements, inflation reports, and unemployment data.

- Anticipate central bank actions and align trades accordingly.

- Use leverage in markets where macro trends create strong directional bias (e.g., USD strengthening when the Fed raises rates).

Pros

- Strong long-term reliability.

- Works well in forex, commodities, and indices.

Cons

- Slower to react than technical setups.

- Requires constant news monitoring.

2. Earnings and Sector-Specific Leverage Trading

This approach uses corporate fundamentals and sectoral performance to guide leveraged stock or CFD trades.

How It Works

- Analyze quarterly earnings reports and forward guidance.

- Compare results against analyst expectations.

- Enter leveraged trades where fundamentals suggest continued growth or decline.

Pros

- Direct link between corporate performance and stock movement.

- Great for equities and sector ETFs.

Cons

- Requires detailed company-level research.

- Earnings surprises can trigger unexpected volatility.

Comparing Fundamental vs Technical Approaches in Leverage Trading

| Feature | Fundamental Signals | Technical Indicators |

|---|---|---|

| Focus | Long-term drivers of value | Short-term price movements |

| Best Use Case | Identifying strong directional trades | Optimizing entry/exit points |

| Risk Management | Helps avoid leverage misuse | Provides stop-loss precision |

| Drawback | Slower adaptation to fast price swings | Can fail without underlying fundamental bias |

The best practice is combining both approaches. Technical indicators refine timing, while fundamentals confirm direction and justify leverage levels.

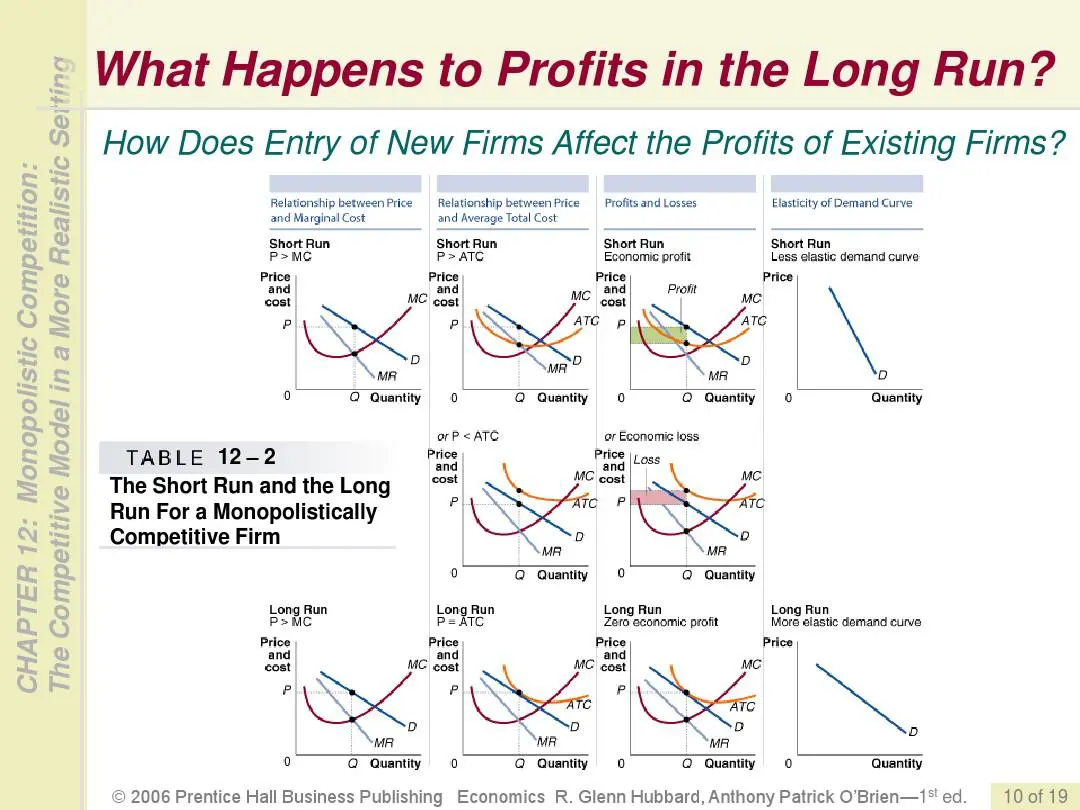

Economic calendar data as a source of fundamental trading signals

Where Traders Find and Apply Fundamental Signals

Modern leverage traders rely on diverse resources:

- Economic calendars for macro announcements.

- Earnings calls and reports for stock-specific trades.

- Industry research for commodity cycles.

- Regulatory filings for early warnings.

This illustrates where to find fundamental data for leverage trading, which remains essential for applying insights effectively.

At the same time, it’s crucial to understand why fundamental analysis is important for leverage traders—because leverage magnifies mistakes, making accurate signals even more critical.

Advanced Use of Fundamental Signals in Leveraged Strategies

- Pair Trading with Fundamentals

Go long on a fundamentally strong asset while shorting a weaker peer, amplifying returns with leverage.

- Event-Driven Leverage Plays

Trade around scheduled events (earnings, interest rate meetings) with higher leverage to capture volatility.

- Hedging with Fundamentals

Use leveraged instruments to hedge portfolios against macro risks, such as inflation hedges with gold futures.

These advanced tactics allow seasoned traders to maximize returns while mitigating structural risks.

Cost-Benefit Analysis of Using Fundamentals in Leverage Trading

| Consideration | Benefit | Risk/Cost |

|---|---|---|

| Research time | Stronger conviction in trades | Requires significant effort and expertise |

| Capital efficiency | Better leverage allocation | Opportunity cost of missed fast trades |

| Risk control | Helps avoid margin calls | May underperform in purely speculative runs |

Overall, fundamentals provide a risk-adjusted edge that makes leverage trading more sustainable.

Frequently Asked Questions (FAQ)

1. How do leverage traders interpret fundamental indicators?

Leverage traders combine economic reports and company data with their leverage strategies. For example, a strong jobs report could justify leveraged USD long positions, while poor earnings could signal a leveraged short on a specific stock.

2. Can fundamental analysis protect against liquidation in leverage trading?

Yes. While no strategy eliminates risk, strong fundamental convictio