=======================================================

Perpetual futures trading is a dynamic and often volatile market, where rapid price fluctuations can leave traders vulnerable to significant losses. For novice traders, one of the critical challenges in this market is halting—an event where trading is paused due to extreme price movements or liquidity concerns. Implementing effective halting strategies is essential for managing risks, improving decision-making, and ensuring long-term profitability. This guide provides a comprehensive overview of halting strategies specifically tailored for novice perpetual futures traders.

What Is Halting in Perpetual Futures Trading?

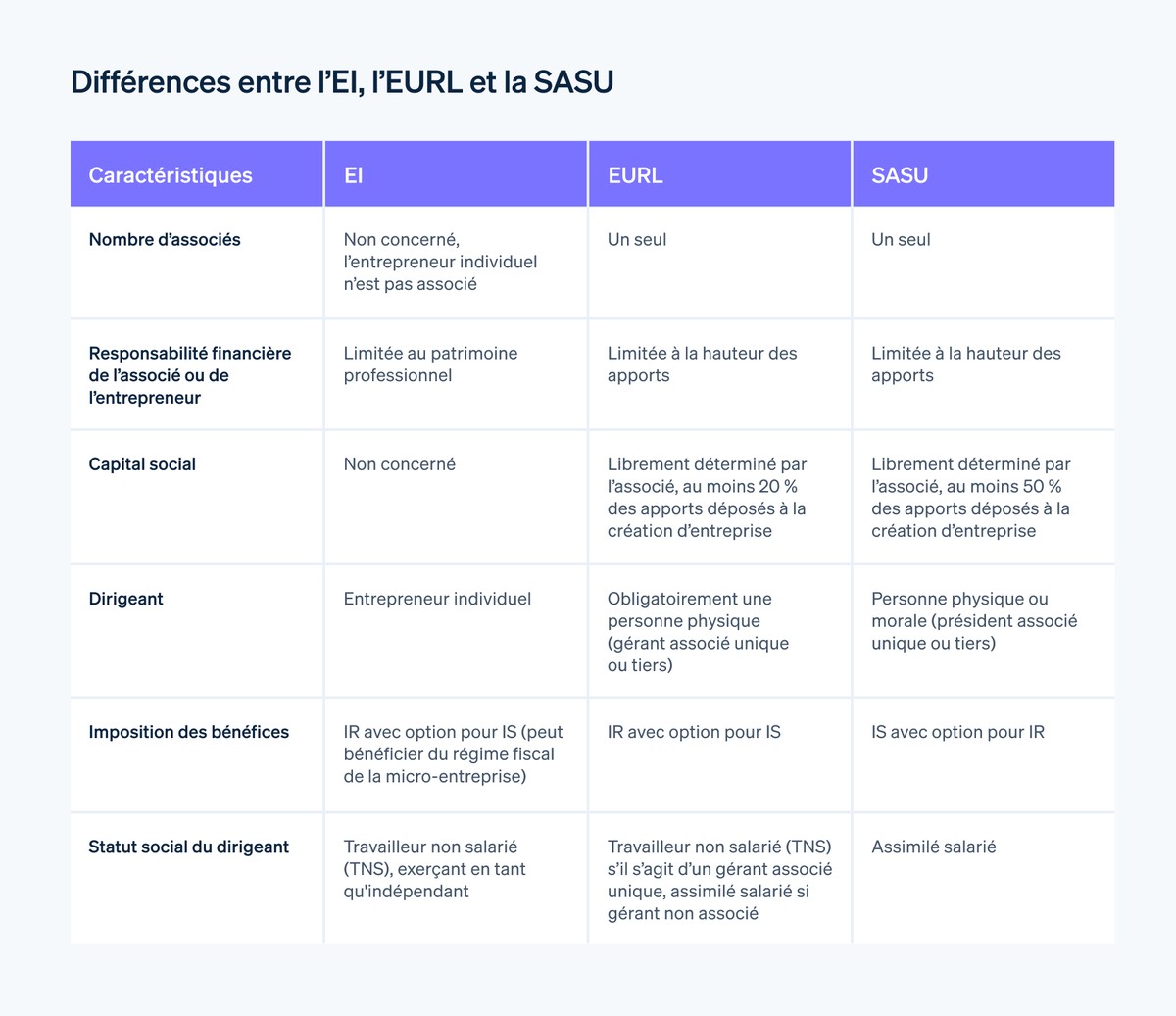

Halting in perpetual futures occurs when trading is temporarily suspended by the exchange due to extreme market conditions. This can be caused by sudden price movements, market manipulation, or other external factors that disrupt normal trading. Halting can occur for a variety of reasons:

- Price Limit Reached: When a market’s price moves beyond a predetermined threshold, trading is paused to prevent excessive volatility.

- Liquidity Imbalance: A sudden drop in market liquidity can trigger a halt, ensuring that traders are not exposed to extreme risk due to insufficient orders.

- Systemic Issues: In cases of technical difficulties, exchanges may halt trading to address system errors or glitches that could disrupt fair market conditions.

Understanding how halting works is crucial for developing strategies that minimize the risks associated with these events. Below, we will explore two main strategies for halting in perpetual futures and how novice traders can use them effectively.

Why Halting Is Significant for Novice Traders

For novice traders, halting events can seem like a massive disruption to their trading activities. However, understanding why halting occurs—and how it affects the market—can give traders the tools they need to react more effectively.

1. Managing Volatility

Halting helps to contain extreme volatility, which can be disastrous for traders who are unprepared. For novice traders, halting serves as a protective measure, preventing further destabilization of the market and ensuring that prices are not manipulated.

2. Risk Management

Halting also acts as a risk management tool. By pausing trading, exchanges allow traders time to reassess the situation, make informed decisions, and mitigate potential losses. In highly volatile markets, especially with perpetual futures contracts, halting can prevent significant adverse price movements that could wipe out positions.

3. Predicting Market Behavior

Halting is a signal of underlying market instability. Novice traders can use this information to adjust their strategies accordingly. If a halt is caused by excessive price movement, it often suggests that the market is overextended, which could present opportunities for reversal strategies or more conservative risk-taking.

Key Halting Strategies for Novice Perpetual Futures Traders

Novice traders should have a well-defined halting strategy in place, ensuring they are prepared for potential halting events. Below are two primary strategies to handle halting situations effectively:

1. Preemptive Risk Mitigation and Position Sizing

Preemptive Strategy Overview

A preemptive halting strategy involves managing risk before a halting event occurs. Traders can use position sizing, stop-loss orders, and volatility analysis to predict and protect themselves from excessive risk during volatile market conditions.

How It Works

- Position Sizing: By adjusting the size of a position, traders can reduce their exposure to price swings. A smaller position size means that the financial impact of a halting event will be less significant.

- Stop-Loss Orders: Implementing stop-loss orders ensures that positions are automatically closed once the market moves against the trader by a certain amount. This helps limit losses in the event of extreme price movements that lead to a halt.

- Volatility Analysis: Traders can use volatility indicators, such as the Average True Range (ATR), to assess when the market might be prone to large price movements. If volatility is increasing, a preemptive risk mitigation strategy might involve tightening stop-loss levels or reducing position size.

Benefits for Novice Traders

- Minimizes the chance of large losses during periods of high volatility.

- Provides more control over risk exposure, allowing novice traders to manage their trades more effectively.

- Reduces emotional decision-making by setting clear parameters and rules for trade management.

2. Post-Halting Recovery Strategy

Post-Halting Strategy Overview

Once a halt occurs, novice traders must have a strategy in place to capitalize on potential opportunities when trading resumes. The key is to stay informed, remain patient, and wait for market conditions to stabilize.

How It Works

- Waiting for Confirmation: After a halting event, prices can remain unstable for a period of time. Traders should wait for confirmation of the new trend or price level before entering new trades.

- Trend Reversal Opportunities: In many cases, after a halt, the market can experience a trend reversal as it tries to find equilibrium. Novice traders can use technical analysis, such as moving averages or support/resistance levels, to identify potential reversal points.

- Liquidity Assessment: When trading resumes, it’s important to assess the liquidity of the market. If liquidity remains low, the risk of further volatility increases. Traders should avoid entering large positions until market conditions stabilize.

Benefits for Novice Traders

- Helps novice traders avoid impulsive decisions immediately following a halting event.

- Provides an opportunity to enter the market at more favorable prices once the initial volatility subsides.

- Allows traders to focus on long-term trends rather than reacting to short-term market fluctuations.

Advanced Techniques for Halting in Perpetual Futures

As traders become more experienced, they may start using more advanced halting strategies, such as halting alerts and real-time volatility tracking. These tools help traders stay ahead of potential halting events and make more informed decisions. However, for novice traders, it’s advisable to keep things simple and focus on risk management and post-halting recovery strategies first.

FAQ: Halting Strategies for Novice Perpetual Futures Traders

1. How do halting events affect perpetual futures prices?

Halting events often cause significant price swings when trading resumes. This happens because halts are typically triggered by sharp price movements, and when the market reopens, these movements continue or reverse, creating volatility. Novice traders should be prepared for these fluctuations and avoid overexposure during these periods.

2. How can I predict halting events in perpetual futures?

While predicting halting events is not always possible, you can use volatility indicators, like the ATR, to gauge when markets are becoming more unstable. Additionally, keeping an eye on news events, large market orders, and price movements can help you anticipate market halts.

3. Why is halting important in perpetual futures trading?

Halting acts as a safeguard against excessive price movements, protecting traders from catastrophic losses. It allows the market to pause and recalibrate, providing traders with an opportunity to reassess their positions and strategies.

Conclusion

Halting strategies are essential for novice perpetual futures traders who want to navigate the volatility and risks of the market effectively. By understanding halting events and implementing strategies such as preemptive risk mitigation and post-halting recovery, traders can minimize their exposure to sudden market movements and capitalize on opportunities when trading resumes. As with all trading strategies, continuous learning, risk management, and patience are key to achieving long-term success in the highly dynamic perpetual futures market.

Suggested Image Placements:

- Halting Event Graph: A visual representation of a halting event and its impact on price movements.

- Preemptive Risk Management Chart: An example of how adjusting position size and using stop-loss orders can mitigate risk during volatile periods.