======================================================================

Introduction

In the fast-paced world of financial markets, volatility can sometimes spiral out of control. Circuit breakers—mechanisms that temporarily halt trading when price movements exceed certain thresholds—play a critical role in maintaining order. But how circuit breakers influence trading decisions is a question that continues to shape debates among traders, regulators, and academics alike.

Far from being a mere “pause button,” circuit breakers directly affect investor psychology, risk management strategies, and algorithmic trading models. This article will provide a detailed exploration of circuit breakers, their history, their role in shaping trading behavior, and their broader economic implications. We will also compare different strategies that traders adopt in response to these mechanisms, evaluate their strengths and weaknesses, and recommend optimal approaches for professionals and retail investors alike.

Understanding Circuit Breakers

What Are Circuit Breakers?

Circuit breakers are predefined market mechanisms designed to curb extreme volatility by halting trading temporarily. These thresholds may apply at the market-wide level (e.g., halting all trading on an exchange) or at the individual security level (stopping trading of a specific stock or derivative).

For example, in the U.S. equity market:

- A 7% decline in the S&P 500 triggers a Level 1 circuit breaker (15-minute halt).

- A 13% decline triggers Level 2 (15-minute halt).

- A 20% decline triggers Level 3 (market closure for the day).

Why Are Circuit Breakers Necessary?

- Stabilization: They provide a cooling-off period for traders to reassess positions.

- Investor Protection: Prevent panic selling fueled by fear and herd behavior.

- Market Integrity: Reduce systemic risks during turbulent conditions.

How Circuit Breakers Influence Trading Decisions

Impact on Retail Traders

Retail investors often react emotionally during market crashes. Circuit breakers give them time to reassess positions, seek advice, and avoid making impulsive trades. However, these halts can also intensify fear, as some see them as signals of systemic weakness.

Impact on Institutional Traders

Institutional investors use circuit breakers strategically. They may adjust their algorithms to anticipate halts, rebalance portfolios during downtime, or hedge risks using derivatives. For example, hedge funds often recalibrate trading models during pauses to avoid exposure when trading resumes with high volatility.

Impact on Algorithmic and Quant Traders

For algorithmic systems, circuit breakers are not just interruptions—they are variables to be integrated into models. Some quants study how does a circuit breaker work in quant trading to build smarter algorithms that avoid false triggers or exploit opportunities when trading resumes.

Two Strategies for Trading Around Circuit Breakers

Strategy 1: Defensive Positioning

Description

This strategy involves reducing exposure before circuit breakers are likely to be triggered. Traders rely on volatility indicators such as VIX or real-time market depth to anticipate thresholds.

Advantages

- Reduces risk of being caught in a trading halt.

- Allows smoother capital preservation.

- Protects against liquidity traps when markets reopen.

Disadvantages

- May result in premature exits, missing out on potential rebounds.

- Requires constant monitoring and rapid decision-making.

Strategy 2: Opportunistic Re-Entry

Description

Instead of exiting early, some traders hold positions through circuit breaker halts, aiming to profit from sharp rebounds after trading resumes.

Advantages

- Potentially high returns when markets bounce back.

- Suited for traders with high risk tolerance and hedging tools.

Disadvantages

- Risk of deeper losses if declines continue.

- Requires sophisticated hedging instruments (e.g., options, futures).

Recommended Approach

For most investors, the hybrid model—combining defensive exits with selective opportunistic re-entry—is the optimal path. This allows traders to protect capital during steep drops while still capitalizing on recovery opportunities.

Circuit Breakers in Modern Trading Systems

Circuit Breakers in Perpetual Futures

Perpetual futures contracts, widely used in cryptocurrency markets, are highly volatile. Circuit breakers here play a crucial role in preventing liquidation cascades. Traders often explore why circuit breakers are used in perpetual futures to understand how exchanges avoid mass liquidations during extreme swings.

Global Applications

- U.S. Equity Markets: Strict tiered thresholds.

- Asian Markets: Frequent use in China, where single-stock circuit breakers are common.

- Crypto Exchanges: Dynamic margin adjustments and circuit breakers to protect traders.

Visual Insights

Levels of Circuit Breakers in U.S. Equity Markets

U.S. stock exchange with trading halt thresholds applied

Timeline of Major Market Halts

Historical moments when circuit breakers significantly impacted markets

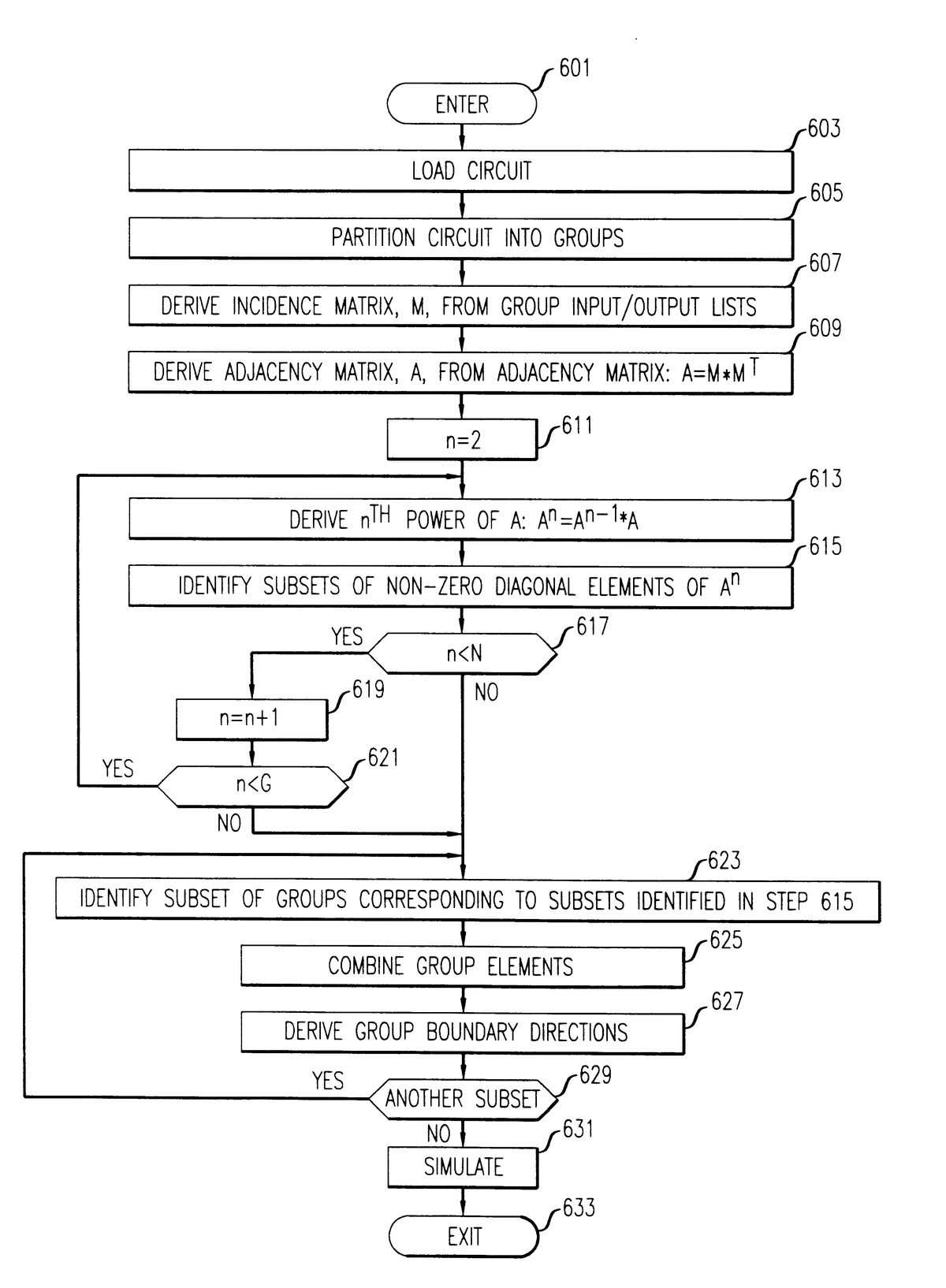

Algorithmic Models and Circuit Breaker Integration

Quant strategies incorporating circuit breaker events

Psychological and Behavioral Effects

- Fear Amplification: Some traders see halts as signals of worse to come.

- Rational Pause: Others use breaks to conduct proper analysis.

- Liquidity Migration: During halts, liquidity often flows to alternative assets or markets not under the same restrictions.

Case Studies

Case Study 1: The COVID-19 Crash (March 2020)

During March 2020, circuit breakers were triggered four times in ten days on the U.S. exchanges. Retail investors panicked, while institutional traders used the halts to reposition portfolios.

Case Study 2: Cryptocurrency Market Sell-Off (May 2021)

Crypto exchanges applied circuit breaker-like mechanisms during cascading liquidations. These prevented Bitcoin from collapsing further in a single session, giving investors time to stabilize.

Frequently Asked Questions (FAQ)

1. How do circuit breakers protect investors?

Circuit breakers prevent irrational panic selling by forcing a pause in trading. This cooling-off period allows investors to assess information, consult advisors, and avoid decisions driven by fear.

2. Do circuit breakers always stop market crashes?

Not always. While they slow down selling pressure, circuit breakers cannot eliminate underlying economic problems. They reduce the pace of decline but do not guarantee recovery.

3. How should algorithmic traders adapt to circuit breakers?

Algorithmic traders must integrate breaker thresholds into their models. This involves adjusting order-routing systems, monitoring volatility metrics, and building hedging functions that can withstand forced halts.

Conclusion: The True Influence of Circuit Breakers on Trading Decisions

Circuit breakers are more than market safeguards—they are catalysts that influence decision-making at every level, from retail investors to hedge fund managers. By shaping strategies, affecting psychology, and influencing liquidity, they are integral to modern market design.

Understanding how circuit breakers influence trading decisions is essential for anyone serious about investing. The most effective strategy combines defensive capital protection with selective re-entry opportunities, supported by robust risk management systems.

Final Note: Share and Engage

If you found this guide insightful, share it with fellow traders, discuss your experiences in the comments, and help others better understand how circuit breakers shape today’s financial landscape. Together, we can build a smarter and more resilient trading community.