=====================================================

Circuit breakers have become a vital component of modern trading infrastructure. Designed to protect markets from extreme volatility, these mechanisms help prevent panic selling and cascading liquidations. For traders, especially those working with perpetual futures and algorithmic strategies, learning how to utilize circuit breakers in trading strategies is not just about compliance—it’s about gaining a competitive edge.

In this guide, we’ll dive into the role of circuit breakers, explore practical methods for integrating them into trading strategies, compare different approaches, and provide actionable insights for risk management.

Understanding Circuit Breakers in Trading

What Are Circuit Breakers?

Circuit breakers are mechanisms that temporarily halt trading when an asset’s price moves beyond a predefined threshold within a short period. They were introduced after the 1987 stock market crash and have since been adopted in equities, derivatives, and increasingly in crypto markets.

Core Objectives of Circuit Breakers

- Stabilize Markets – Prevent panic-driven sell-offs.

- Protect Liquidity – Allow market makers to adjust positions.

- Safeguard Investors – Reduce irrational losses during extreme volatility.

- Enhance Confidence – Reinforce trust in financial markets.

Circuit breaker mechanism in trading

How Circuit Breakers Work in Practice

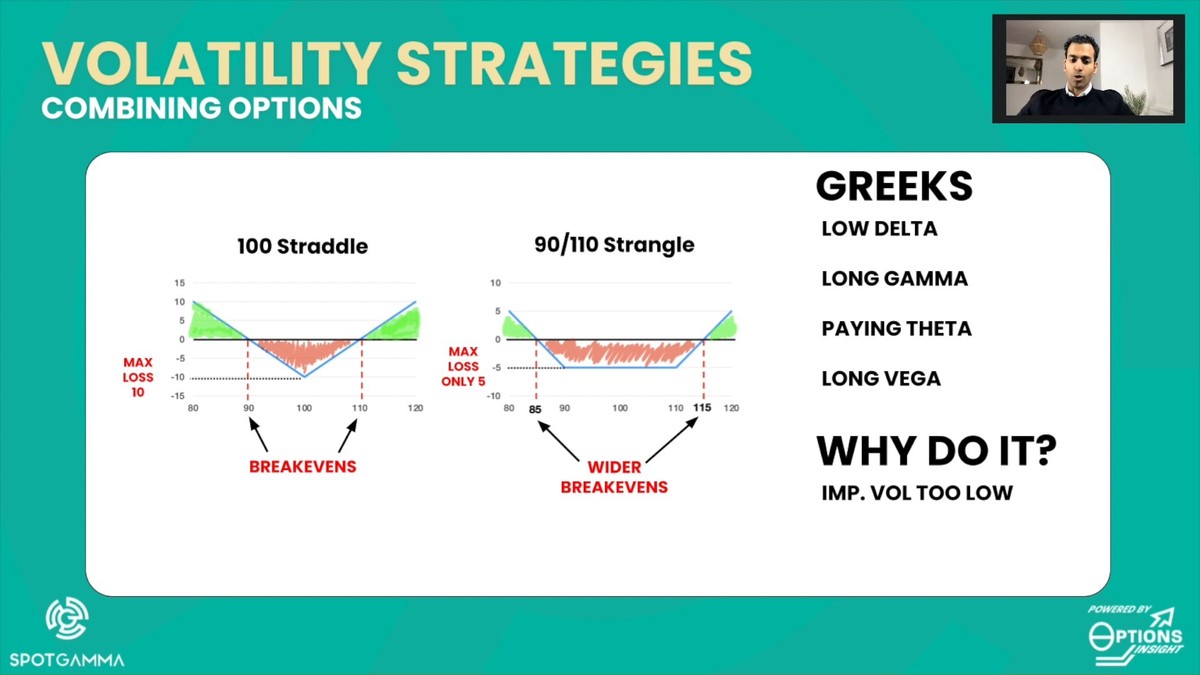

Levels of Circuit Breakers

Most exchanges use tiered triggers, where different thresholds lead to different types of halts:

- Level 1: 5–7% price move → short pause (5–15 minutes).

- Level 2: 10–15% price move → longer halt (15–30 minutes).

- Level 3: 20%+ move → trading suspension for the day.

Example in Perpetual Futures

If Bitcoin drops 10% within minutes on a futures exchange, a Level 2 circuit breaker might pause trading, giving traders time to reassess positions and liquidity providers a chance to rebalance order books.

For quant traders, this ties directly to how does a circuit breaker work in quant trading, since algorithmic models must incorporate halt conditions into execution logic.

Strategies for Utilizing Circuit Breakers

1. Defensive Integration into Risk Management

- Method: Incorporate circuit breaker triggers into portfolio risk controls.

- Example: A hedge fund automatically reduces exposure by 50% if a Level 1 halt occurs.

- Advantages: Minimizes drawdowns, ensures capital preservation.

- Disadvantages: May miss recovery opportunities if the market rebounds quickly.

2. Offensive Strategy for Re-Entry Opportunities

- Method: Use halts as opportunities to prepare buy/sell positions.

- Example: Traders set conditional orders to capitalize on rebounds once trading resumes.

- Advantages: Profits from volatility spikes.

- Disadvantages: High risk if volatility persists after trading resumes.

Comparison: Defensive strategies work best for conservative or institutional investors, while offensive strategies suit aggressive day traders and quant models that can react instantly.

Circuit Breakers in Algorithmic Trading

Integration in Automated Systems

Algorithmic traders must account for trading pauses. Without adjustments, bots may fail during halts, leading to missed trades or poor execution.

Practical Implementation

- Pause Algorithms During Halts – Prevents unnecessary execution attempts.

- Recalibrate Models Post-Halt – Adjusts volatility measures once trading resumes.

- Dynamic Risk Parameters – Uses circuit breaker data to recalibrate leverage and exposure.

This highlights why implement circuit breakers in quant models, as they protect automated strategies from systemic shocks.

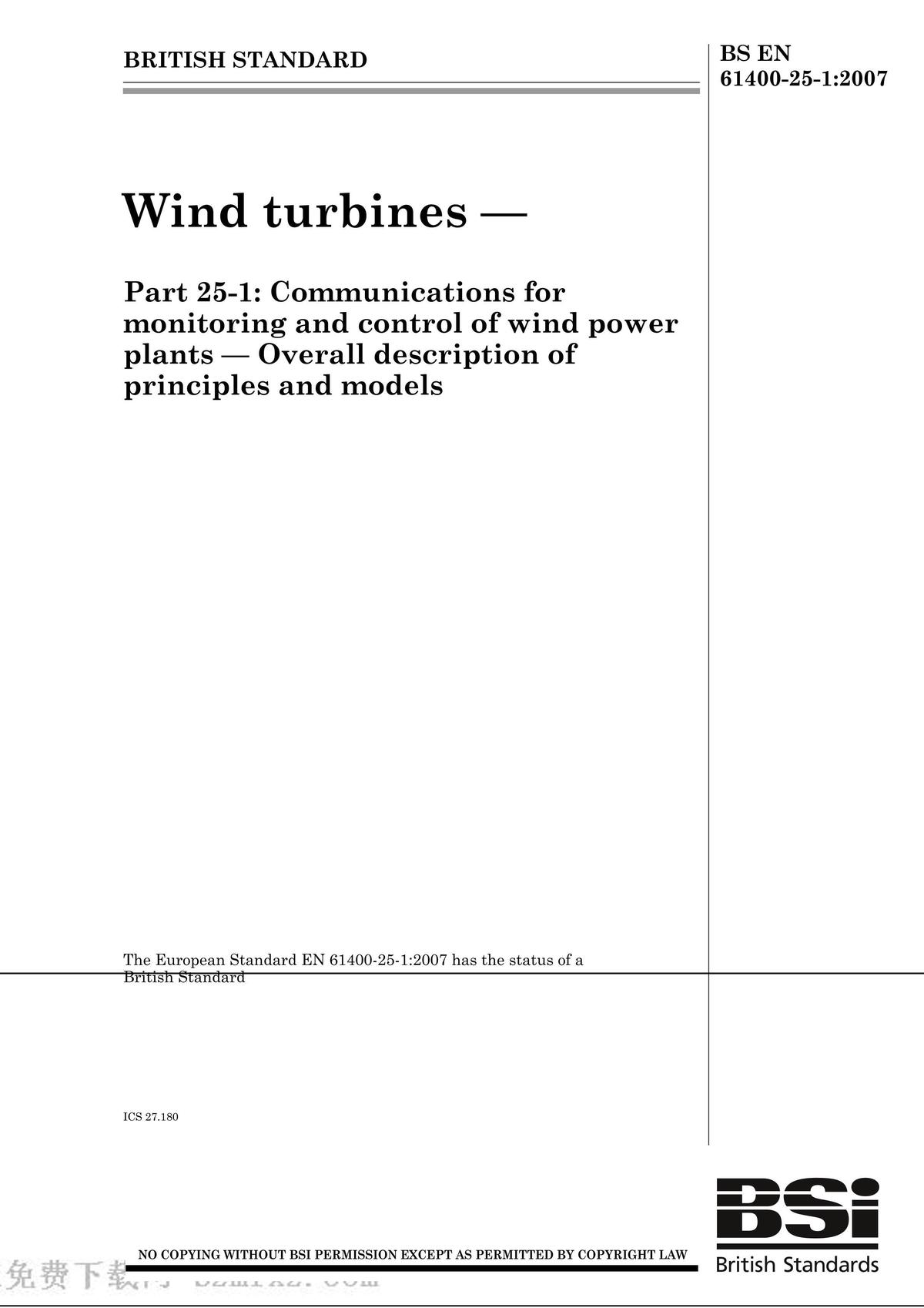

Case Study: Circuit Breakers in Crypto Markets

Unlike traditional equities, crypto markets trade 24⁄7 without centralized regulation. Some exchanges, however, have adopted circuit breaker-like systems to prevent flash crashes.

- Example: A perpetual futures platform triggers a temporary halt if ETH drops more than 12% within 10 minutes.

- Outcome: Prevented cascading liquidations during a market-wide panic.

- Lesson: Even in decentralized markets, safeguards improve long-term stability.

Crypto market volatility protection with circuit breakers

Benefits of Circuit Breakers for Traders

- Risk Control – Reduces catastrophic portfolio losses.

- Market Analysis Insight – Halts provide signals of systemic stress.

- Trading Opportunities – Well-prepared traders can capitalize on post-halt rebounds.

- Confidence in Execution – Encourages traders to hold positions with reduced fear of extreme volatility.

Potential Downsides of Circuit Breakers

- False Security: Halts cannot prevent long-term bear trends.

- Liquidity Shocks: Pauses may widen spreads when trading resumes.

- Opportunity Cost: Traders may miss strong rallies if overly cautious.

The key is balance: traders should use circuit breakers as safety nets, not crutches.

Practical Guide: How to Utilize Circuit Breakers in Trading Strategies

- Identify Market Rules – Learn each exchange’s specific halt thresholds.

- Build Conditional Orders – Prepare buy/sell orders ahead of halts.

- Incorporate into Algorithms – Ensure automated systems pause/restart smoothly.

- Develop a Post-Halt Plan – Set predefined actions for re-entry.

- Backtest Scenarios – Use historical halt data to simulate strategies.

For perpetual futures traders, it’s also crucial to know where to find circuit breaker information for perpetual futures, since different exchanges publish rules differently.

FAQ: Circuit Breakers in Trading

1. Do circuit breakers eliminate risk in trading?

No. Circuit breakers reduce short-term volatility risk but cannot prevent longer-term losses. Traders still need diversification, hedging, and disciplined risk management.

2. How do circuit breakers impact algorithmic trading?

Algorithms must recognize halts and adapt automatically. Failure to account for them may cause execution errors or missed trades. Professional quants integrate circuit breaker triggers into their models.

3. Are circuit breakers effective in crypto trading?

Yes, but implementation varies by exchange. Some platforms use liquidation limits instead of full halts. Traders must study each exchange’s framework before developing strategies.

Conclusion

Circuit breakers are more than just market safeguards—they are powerful tools traders can integrate into their strategies. By understanding how to utilize circuit breakers in trading strategies, traders can reduce risks, identify opportunities, and maintain confidence even in volatile markets.

Whether you’re a retail trader or a quant professional, using circuit breakers effectively means aligning them with your risk tolerance, trading style, and automation systems.

If this guide gave you new insights, share it with your network and leave a comment: Do you see circuit breakers more as risk management tools or trading opportunities? Let’s discuss! 🚀

Would you like me to create a visual comparison chart of different exchanges’ circuit breaker rules so traders can quickly compare thresholds across platforms?