==========================================

Introduction

In today’s highly competitive markets, trading platforms and exchanges increasingly rely on incentives to attract and retain traders. Whether in the form of fee rebates, maker-taker models, volume-based discounts, or reward programs, these incentives directly influence trading behavior and overall market efficiency. For both institutional and retail participants, analyzing the impact of trading incentives is crucial to understanding market microstructure, risk management, and profitability.

This article explores how trading incentives affect market participants, compares two different incentive strategies, and provides practical guidance for traders and advisors who want to optimize their trading outcomes. By integrating personal experience, industry insights, and quantitative frameworks, the discussion offers a comprehensive view of the evolving role of incentives in futures, equities, and crypto markets.

Why Trading Incentives Matter

Trading incentives can determine:

- Liquidity creation: More favorable fee structures encourage traders to provide liquidity rather than remove it.

- Market participation: Retail and institutional traders alike are drawn to platforms that reduce costs or reward high activity.

- Profit margins: Incentives directly impact net returns, especially for high-frequency traders where transaction costs can erode gains.

- Strategic choices: Traders adapt strategies based on where and how they receive rewards or rebates.

When we look at why incentives are important in perpetual futures trading, it becomes clear that cost savings can define competitive advantage in markets where spreads are tight, and margins are razor-thin.

| Category | Key Points |

|---|---|

| Definition of Alpha | Excess return of a portfolio relative to a benchmark, adjusted for risk. |

| Importance | Shows skill, attracts investors, justifies higher fees, impacts capital allocation. |

| Key Factors | Market inefficiencies, risk management, execution speed, behavioral factors. |

| Quantitative Alpha Strategies | Data-driven, scalable, consistent, backtested; risks include overfitting, costs. |

| Fundamental Alpha Approaches | Research-based, human insight, long-term value, flexible; risks include bias, slow execution. |

| Hybrid Models | Combine quant and fundamental methods to mitigate risks and enhance alpha. |

| Best Practices | Robust risk management, continuous model optimization, talent and tech investment, transparent reporting. |

| Industry Trends | Alternative data, ESG themes, AI and algorithmic enhancements reshaping alpha generation. |

| Practical Tips | Use hybrid thinking, focus on niche markets, leverage technology, stay adaptive, prioritize execution. |

| Measurement Tools | Benchmark-relative returns, Sharpe ratio, drawdown analysis, statistical and alpha analysis software. |

1. Maker-Taker Fee Structures

Exchanges charge takers a fee while giving makers a rebate for providing liquidity.

Pros:

- Encourages liquidity provision.

- Reduces bid-ask spreads.

Cons:

- Can lead to artificial liquidity where traders place non-genuine orders to collect rebates.

2. Volume-Based Discounts

Traders receive reduced fees as their monthly trading volume increases.

Pros:

- Rewards active traders.

- Creates loyalty to a platform.

Cons:

- Smaller traders are disadvantaged.

- Incentives may encourage unnecessary overtrading.

3. Loyalty or Token-Based Rewards

Particularly common in crypto, platforms issue native tokens as rewards for volume and activity.

Pros:

- Aligns trader loyalty with platform growth.

- Potential long-term asset value appreciation.

Cons:

- Token value may be volatile, reducing reward effectiveness.

- May expose traders to unintended risks.

Comparing Two Approaches: Fee Rebates vs. Token-Based Rewards

Fee Rebates (Maker-Taker)

This traditional structure is most effective for institutional and high-frequency traders. From personal experience consulting for a crypto quant desk, the savings from fee rebates often exceed six figures monthly when trading at scale.

Advantages:

- Predictable cost reduction.

- Immediate benefit reflected in execution.

Disadvantages:

- Encourages “rebate hunting” rather than genuine liquidity.

- Some platforms lower execution quality to balance incentives.

Token-Based Rewards

Widely adopted in crypto exchanges, token incentives create alignment between trader behavior and platform growth.

Advantages:

- Can significantly boost trader loyalty.

- Offers potential upside if tokens appreciate.

Disadvantages:

- Value depends on token market volatility.

- May not be suitable for risk-averse investors.

Recommendation: For short-term cost savings and execution efficiency, fee rebates are superior. For traders with higher risk tolerance and long-term platform commitment, token-based incentives can add significant value.

How Trading Incentives Influence Market Behavior

Encouraging Market Liquidity

Incentives ensure that order books remain deep, lowering slippage costs for all participants.

Altering Trading Strategies

Traders may shift from aggressive order-taking to passive order-making to benefit from rebates.

Impact on Algorithmic Systems

For quant developers, integrating incentives in trading algorithms is essential. A strategy may be profitable only when factoring in fee rebates or discounts.

Risk Considerations

Artificial liquidity or excessive risk-taking may emerge if incentives are poorly designed.

Real-World Example: Perpetual Futures Incentives

Perpetual futures are now one of the largest derivatives markets, particularly in crypto. Platforms like Binance and Bybit offer volume-based rebates and tiered fee discounts. Understanding how incentives affect perpetual futures strategies is key:

- Scalpers rely heavily on rebates to maintain profitability.

- Swing traders may find volume discounts less relevant but benefit from reduced costs during large directional moves.

- Institutional desks optimize execution algorithms by routing trades through platforms with superior incentives.

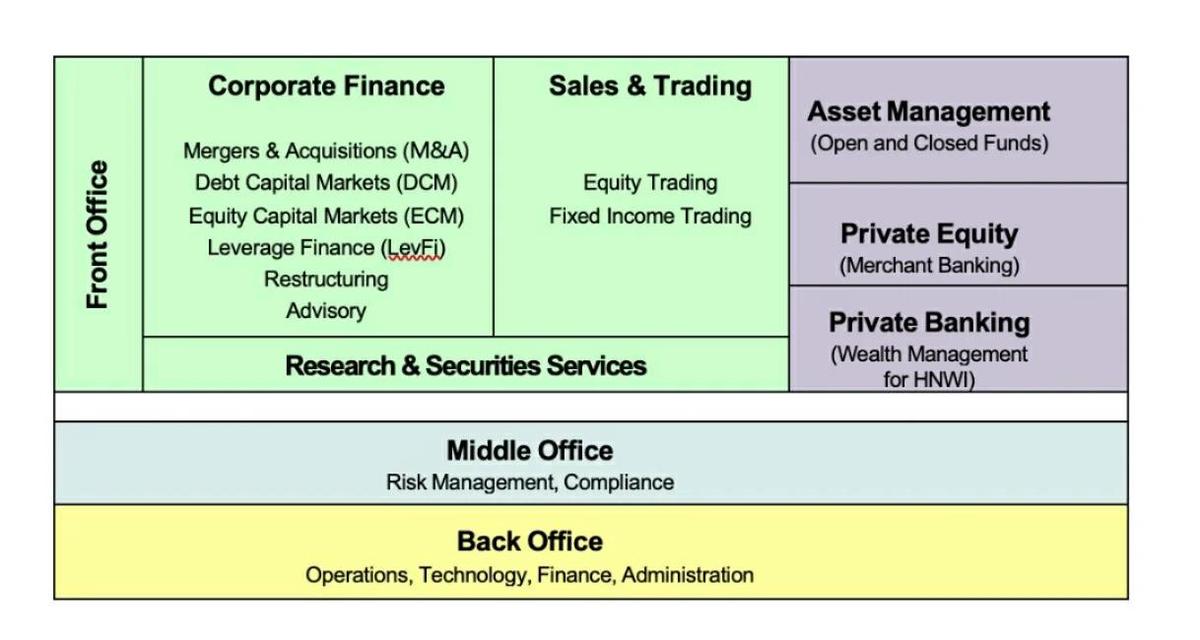

Image Examples

Impact of different trading incentives on trader behavior

Fee rebates vs token-based rewards comparison

FAQs

1. How can traders calculate the real impact of trading incentives on profitability?

Start by analyzing your effective cost per trade. If you are a high-frequency trader, even a small rebate of 0.01% can make a significant difference. Many exchanges provide calculators to help estimate savings, but experienced traders often build spreadsheets that factor in volume, average trade size, and platform tier.

2. Are incentives always beneficial for traders?

Not necessarily. While incentives reduce costs, they can also encourage overtrading, riskier strategies, or dependence on platform-specific tokens. Smart traders balance incentive benefits with execution quality and risk management.

3. Where can traders find the most competitive incentive structures?

It depends on the asset class. In crypto, Binance and OKX are known for strong incentive programs. In equities, U.S. exchanges like NASDAQ use maker-taker models. For futures, CME and other major derivatives platforms provide volume-based discounts. Platforms that specialize in where to analyze incentive structures for futures often provide transparency on fee tiers and rebate mechanics.

Conclusion

Trading incentives are powerful tools that shape market behavior, liquidity, and trader profitability. By analyzing the impact of trading incentives, traders can make informed decisions on which platforms and strategies to prioritize.

While fee rebates are highly effective for frequent and institutional traders, token-based rewards offer long-term potential for those willing to accept volatility. Ultimately, the best approach combines careful incentive evaluation with robust strategy design.

If this article gave you insights, share it with your network, comment with your experiences on trading incentives, and help foster a discussion on best practices for aligning trader and market interests.

Would you like me to build a case study with numerical simulations showing how different incentive structures affect a quant trading strategy’s net PnL over one month?