====================================================

Introduction

The rise of perpetual futures has transformed the derivatives market by offering traders unlimited exposure without expiry dates. While the structure itself is attractive, one of the most overlooked aspects that drive participation is trading incentives. Incentives range from fee rebates to liquidity mining rewards, and they play a crucial role in attracting both retail and institutional traders.

In this article, we will dive deep into how do incentives benefit perpetual futures traders, explore different types of incentives, compare their effectiveness, and provide actionable strategies to maximize their value. By combining professional insights, quantitative strategies, and the latest industry trends, this guide will help traders understand how to leverage incentives for better profitability.

What Are Incentives in Perpetual Futures Trading?

Incentives are rewards or benefits offered by exchanges to encourage trader participation and activity. These rewards may include:

- Fee rebates for market makers and high-volume traders

- Liquidity mining rewards distributed in tokens

- Trading competitions with prize pools

- Referral bonuses for onboarding new users

- VIP tier programs based on trading volume

For perpetual futures markets, incentives serve two main purposes: increasing liquidity and ensuring healthy participation across market cycles.

Why Incentives Matter for Perpetual Futures Traders

1. Lower Trading Costs

Fee rebates can significantly reduce costs for active traders, especially high-frequency participants.

2. Boosted Profitability

Rewards in the form of tokens or rebates directly add to net profitability.

3. Encouraged Market Participation

Incentives attract more traders, improving liquidity and tightening spreads, which benefits all participants.

4. Long-Term Engagement

Well-structured incentive programs retain traders, giving them a reason to stay active on a particular platform.

This is why many professionals agree that why are incentives important in perpetual futures trading cannot be overstated—without them, participation could fall drastically.

Types of Incentives in Perpetual Futures

1. Maker-Taker Fee Rebates

- Market makers often receive fee rebates for providing liquidity.

- This encourages deeper order books and stable markets.

Pros: Improves liquidity, reduces slippage.

Cons: Benefits mostly professional traders with large capital.

2. Liquidity Mining Programs

- Exchanges distribute rewards (usually tokens) to traders who maintain trading activity.

- Common in decentralized exchanges (DEXs).

Pros: Provides extra yield for active traders.

Cons: Token rewards can be volatile.

3. Volume-Based VIP Programs

- Traders get reduced fees after reaching certain trading volume thresholds.

- Institutional traders benefit the most.

Pros: Sustainable cost reductions for large traders.

Cons: Hard for retail traders to qualify.

4. Referral and Affiliate Programs

- Rewards given for inviting new traders.

- Works for influencers, communities, and trading groups.

Pros: Additional passive income.

Cons: Not directly tied to trading performance.

How Do Incentives Benefit Perpetual Futures Traders?

1. For Retail Traders

Incentives like fee discounts and token rewards help offset losses or boost profits. Beginners especially benefit from small rebates when learning strategies.

2. For Professional Traders

High-frequency traders and market makers leverage fee rebates to turn slim spreads into significant profits. Their strategies are designed around maximizing incentive payouts.

3. For Institutional Traders

VIP tiering and customized incentive packages allow institutions to reduce costs and improve execution efficiency across large positions.

Two Key Strategies to Leverage Incentives

Strategy 1: Liquidity Provider Model

This strategy involves placing passive orders to capture fee rebates and token rewards.

- Advantages: Low directional risk, consistent small profits.

- Disadvantages: Requires large capital, vulnerable to sudden volatility.

Strategy 2: Incentive-Driven Arbitrage

Traders exploit differences between spot and futures markets while benefiting from fee discounts and reward programs.

- Advantages: Stable profits, incentives enhance returns.

- Disadvantages: Execution complexity, need for automated systems.

Personal Insight: In my experience, incentive-driven arbitrage works best for traders with access to multiple exchanges, while liquidity provision is more suited for professionals with algorithmic infrastructure.

Comparing Incentive Approaches

- Liquidity mining: Best for traders who want passive token income.

- Fee rebates: Best for high-frequency traders.

- Referral programs: Best for influencers and communities.

- VIP programs: Best for institutional desks.

The most effective strategy often involves integrating incentives in trading algorithms, allowing traders to systematically capture fee rebates and token rewards.

Where to Find the Best Incentives

Traders often ask: where to find the best incentives for perpetual futures trading?

- Centralized exchanges (CEXs): Binance, OKX, Bybit, and Deribit offer structured VIP programs.

- Decentralized exchanges (DEXs): dYdX and GMX provide liquidity mining rewards.

- Regional exchanges: Some smaller platforms offer aggressive incentive structures to attract liquidity.

Comparing fee tiers, token rewards, and promotional campaigns is essential to maximizing incentive benefits.

Example: Incentive Impact on Trading Performance

Imagine a trader executes $100 million in monthly perpetual futures volume with a taker fee of 0.05%.

- Without incentives: Fees = $50,000

- With 20% rebate: Fees = $40,000

- With liquidity mining rewards worth $5,000: Net fees = $35,000

By leveraging incentives, the trader saves $15,000 monthly, directly improving profitability.

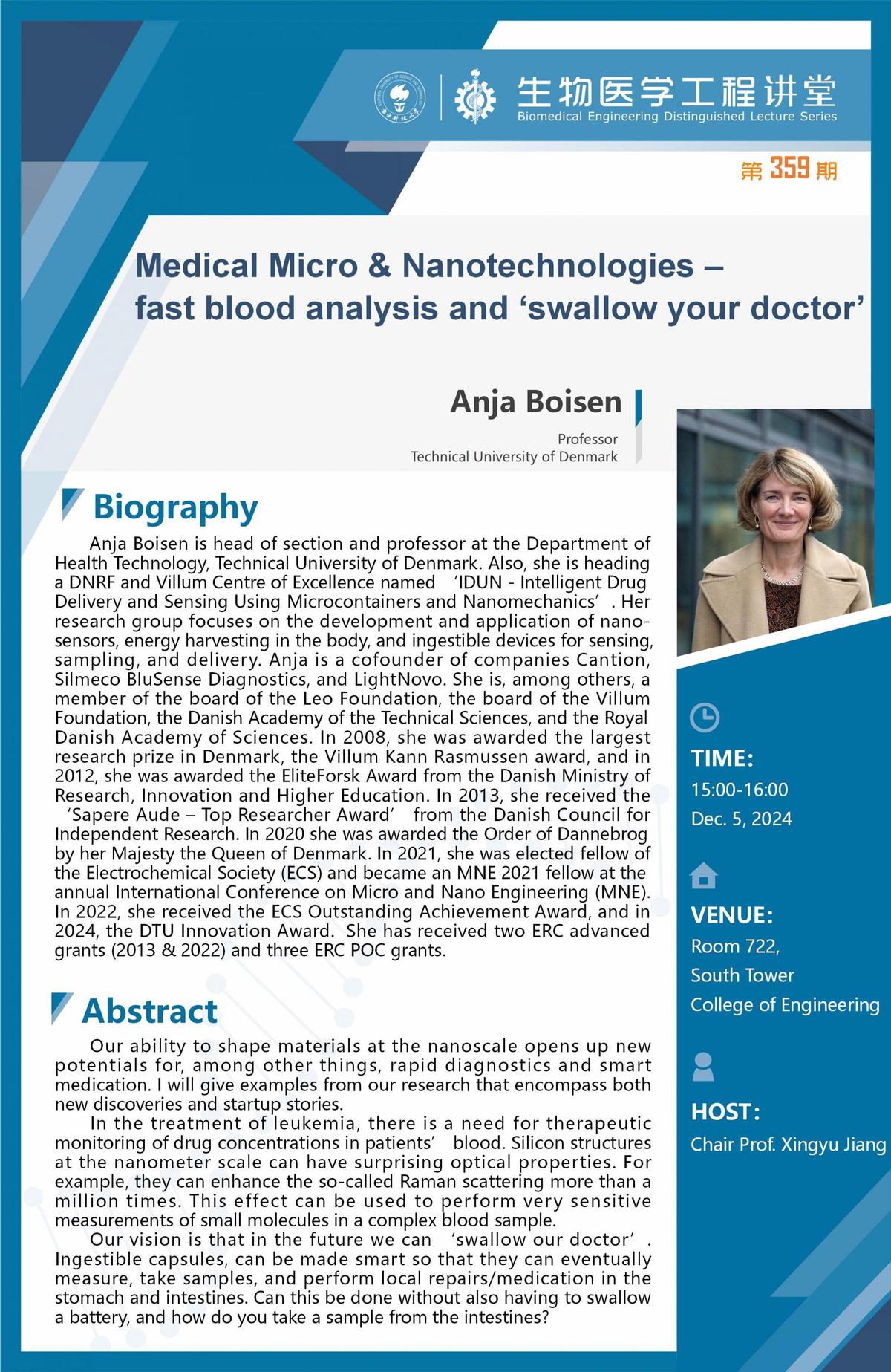

Visual Illustration

Incentives structure in perpetual futures trading: rebates, rewards, and volume tiers

Frequently Asked Questions (FAQ)

1. Can incentives turn a losing strategy profitable?

Not directly. Incentives reduce costs and add rewards, but they cannot fix a fundamentally flawed strategy. They are best used to enhance profitable trading systems.

2. Do retail traders really benefit from incentives?

Yes, but the scale is smaller. For example, small rebates may not be life-changing, but they help reduce costs over time and encourage consistent trading discipline.

3. Are incentive programs sustainable?

It depends on the exchange. Established platforms often run long-term incentive programs, while smaller exchanges may offer short-lived promotions to attract liquidity.

Conclusion

Incentives are far more than marketing tools—they are a structural component of perpetual futures trading that benefits retail, professional, and institutional traders alike. From fee rebates to liquidity mining, they enhance profitability, reduce costs, and encourage active participation.

Understanding how do incentives benefit perpetual futures traders is key to maximizing trading outcomes. For retail traders, small rebates provide cost savings; for professionals, they form the foundation of high-frequency strategies; and for institutions, tailored packages drive efficiency at scale.

By carefully analyzing where incentives are most effective and integrating them into trading strategies, traders can achieve superior returns and long-term market engagement.

Final Thoughts

If you’ve benefited from incentives in your trading journey, share your experience in the comments! Let’s build a community where traders exchange insights on maximizing rewards. Don’t forget to share this article with others who want to understand how incentives can transform their perpetual futures strategies.

Would you like me to also create a comparison table of incentives across top exchanges so readers can easily evaluate which platform offers the best trading benefits?