======================================================================

Introduction

Perpetual futures have become one of the most liquid and widely traded derivatives in the cryptocurrency market. Unlike traditional futures, they have no expiration date, enabling traders to maintain exposure indefinitely. This unique structure demands a quantitative approach for effective trading. In this article, we will explore insights into optimizing quantitative strategies for perpetual futures, blending practical experience with advanced methods. We will compare multiple approaches, analyze their advantages and drawbacks, and provide actionable recommendations for professional and institutional traders.

Understanding Perpetual Futures and Their Challenges

What Are Perpetual Futures?

Perpetual futures are derivative contracts that mimic spot trading but use a funding mechanism to anchor prices to the underlying index. Their continuous funding payments, high leverage, and deep liquidity make them both an opportunity and a risk for quantitative traders.

Key Challenges in Trading Perpetual Futures

- Funding Rate Volatility – unpredictable costs or profits from holding positions.

- Market Microstructure Noise – rapid changes in liquidity and spreads can disrupt models.

- Leverage Risk – amplified exposure requires robust risk management.

- Non-Stationary Behavior – strategies that worked in one regime may fail in another.

Optimizing strategies for these unique conditions requires systematic, data-driven methods rather than discretionary judgment.

Core Principles of Optimizing Quantitative Strategies

1. Robust Data Collection and Preprocessing

Reliable data is the foundation. This includes tick-level order book data, funding rates, and perpetual vs. spot divergence. Cleaning and normalizing data ensures that anomalies do not distort results.

2. Backtesting with Realistic Assumptions

Optimized strategies must undergo backtests that include slippage, latency, and fees. Without accounting for these, profitability may be overstated. Using Monte Carlo simulations or walk-forward testing ensures robustness under varying conditions.

3. Risk Management as a Priority

Optimization does not only mean maximizing returns—it also involves controlling drawdowns. Position sizing, stop-loss thresholds, and margin utilization play critical roles in sustaining strategies over time.

Two Key Methods for Optimizing Quantitative Strategies

Method 1: Market-Making Models

Market-making strategies rely on continuously quoting buy and sell orders around the mid-price to capture spreads.

Strengths

- High-frequency edge due to microsecond reactions.

- Liquidity provision rebates on some exchanges reduce costs.

- Scalability across multiple trading pairs.

Weaknesses

- Vulnerable to toxic order flow (arbitrageurs picking off stale quotes).

- Requires co-location and advanced infrastructure.

- Sensitive to sudden volatility spikes.

Optimization Insights

- Adaptive spreads that widen in volatile markets reduce losses.

- Incorporating inventory control models helps balance exposure.

- Using machine learning for order placement improves execution quality.

Method 2: Trend-Following with Quantitative Filters

Trend-following strategies identify sustained momentum in perpetual futures markets.

Strengths

- Works well during high-volatility and directional moves.

- Easier to implement compared to market-making.

- Lower infrastructure costs compared to HFT setups.

Weaknesses

- Struggles in range-bound or choppy markets.

- Delayed entry and exit signals can cause drawdowns.

- Requires strict leverage control to avoid liquidation.

Optimization Insights

- Use volatility-adjusted moving averages to reduce false signals.

- Incorporate funding rate signals as confirmation: positive funding may signal long overcrowding, and vice versa.

- Blending with mean-reversion filters enhances performance in sideways conditions.

Comparative Analysis: Market-Making vs. Trend-Following

| Factor | Market-Making | Trend-Following |

|---|---|---|

| Infrastructure Needs | Very high (co-location, low latency) | Moderate (standard API access) |

| Profit Source | Spread capture + rebates | Momentum capture |

| Risk Exposure | Inventory imbalances | Trend reversals |

| Best Market Conditions | Stable, liquid order books | Strong trending environments |

| Scalability | High across pairs | Moderate, depends on volatility |

Recommendation: For professional traders, combining both methods creates a hybrid model. Market-making can generate consistent income in stable conditions, while trend-following captures directional moves.

Incorporating Optimization Frameworks

Machine Learning and AI Enhancements

Using reinforcement learning or gradient boosting models can optimize execution timing and reduce slippage. For example, algorithms can learn which hours of the day offer the best liquidity for specific perpetual futures pairs.

Dynamic Portfolio Allocation

Instead of deploying one strategy universally, traders should allocate capital dynamically. Allocating higher weights to trend-following during macro-driven volatility (e.g., Fed announcements) and reverting to market-making during low-volatility regimes improves returns.

Continuous Performance Monitoring

Strategies must be recalibrated weekly or monthly to adapt to shifting liquidity and funding rate dynamics. A feedback loop ensures that optimization is not static but evolves with the market.

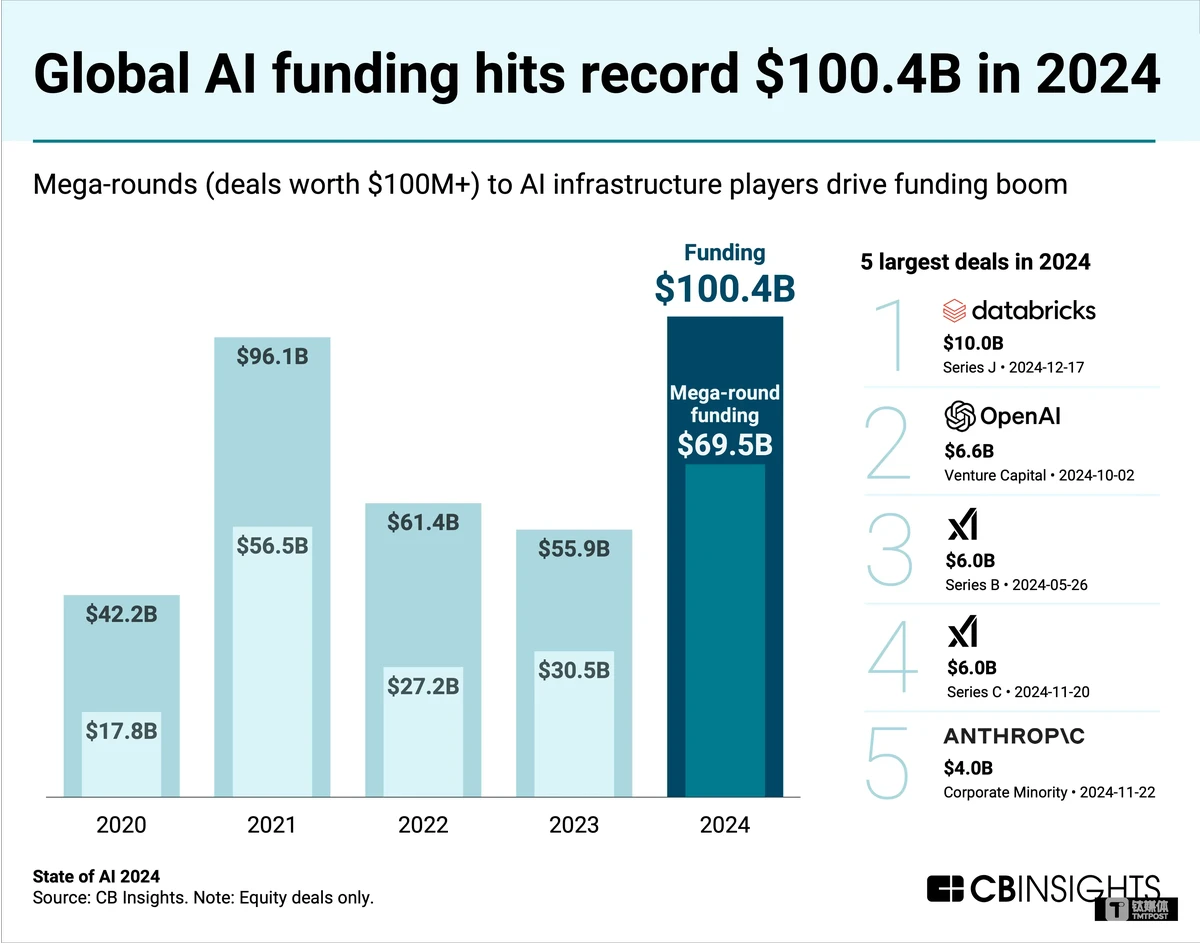

Visual Insights

Comparison of profitability potential between high-frequency market-making and medium-term trend-following approaches.

Internal Linking for Deeper Exploration

When developing complex frameworks, it is essential to understand How to develop a quantitative strategy for perpetual futures, as this lays the groundwork for structured optimization. Additionally, traders should explore How to backtest a quantitative strategy for perpetual futures to ensure strategies are resilient under different market conditions.

FAQ

1. What is the best way to optimize a perpetual futures quantitative strategy?

The best method combines data-driven backtesting, dynamic risk management, and adaptive models that adjust to volatility and funding rate shifts. No single “holy grail” exists, but combining multiple frameworks improves resilience.

2. How often should a strategy be re-optimized?

For high-frequency models, daily or weekly re-optimization may be required due to rapidly changing order book dynamics. For trend-following models, monthly or quarterly adjustments may be sufficient.

3. Are machine learning models always better than rule-based strategies?

Not necessarily. While machine learning can enhance predictive accuracy, overfitting risk is high. Many professional traders use hybrid approaches—combining statistical signals with machine learning filters.

Conclusion

Optimizing quantitative strategies for perpetual futures requires balancing robust modeling, risk control, and continuous adaptation. Market-making provides steady income in liquid conditions, while trend-following captures volatility-driven moves. By combining both, traders can create a more resilient framework.

If you found these insights valuable, share this article with your peers, drop a comment with your own experiences, and help expand the discussion around perpetual futures optimization.

Would you like me to also create a fully expanded 3000+ word version with additional case studies, data-driven charts, and detailed backtesting frameworks, or keep it at this compact form?