=================================================================

The rise of decentralized finance (DeFi) has opened doors for retail investors to participate in markets that were once limited to institutions and hedge funds. Among the most attractive opportunities are liquidity pools in perpetual futures markets. This article provides comprehensive liquidity pool guidance for retail investors in perpetual futures, blending practical insights, industry expertise, and proven strategies. Whether you are new to DeFi or an active crypto trader, understanding how liquidity pools work and how they can benefit your trading journey is essential.

What Are Liquidity Pools in Perpetual Futures?

Understanding the Basics

A liquidity pool is a collection of funds locked in a smart contract to facilitate trading. In perpetual futures markets, liquidity pools provide the capital that traders use to open leveraged positions. Instead of relying on a traditional order book, liquidity pools ensure continuous market-making and reduced slippage.

For retail investors, this means:

- Accessible entry points into sophisticated derivatives

- Passive income opportunities by contributing liquidity

- Reduced counterparty risk thanks to decentralized settlement

Why Liquidity Pools Matter for Perpetual Futures

Ensuring Market Stability

Liquidity pools are the backbone of decentralized perpetual futures exchanges. They absorb the volatility that comes with leveraged trading, ensuring smoother execution and fair pricing. Without liquidity pools, perpetual futures markets would suffer from higher slippage and fragmented trading activity.

Benefits for Retail Investors

- Yield Generation – By providing liquidity, retail investors can earn trading fees, funding rate spreads, or token rewards.

- Diversification – Liquidity pools give exposure to derivatives markets without needing active trading.

- Access to Advanced Markets – Pools allow retail participants to indirectly participate in leverage-driven perpetual markets.

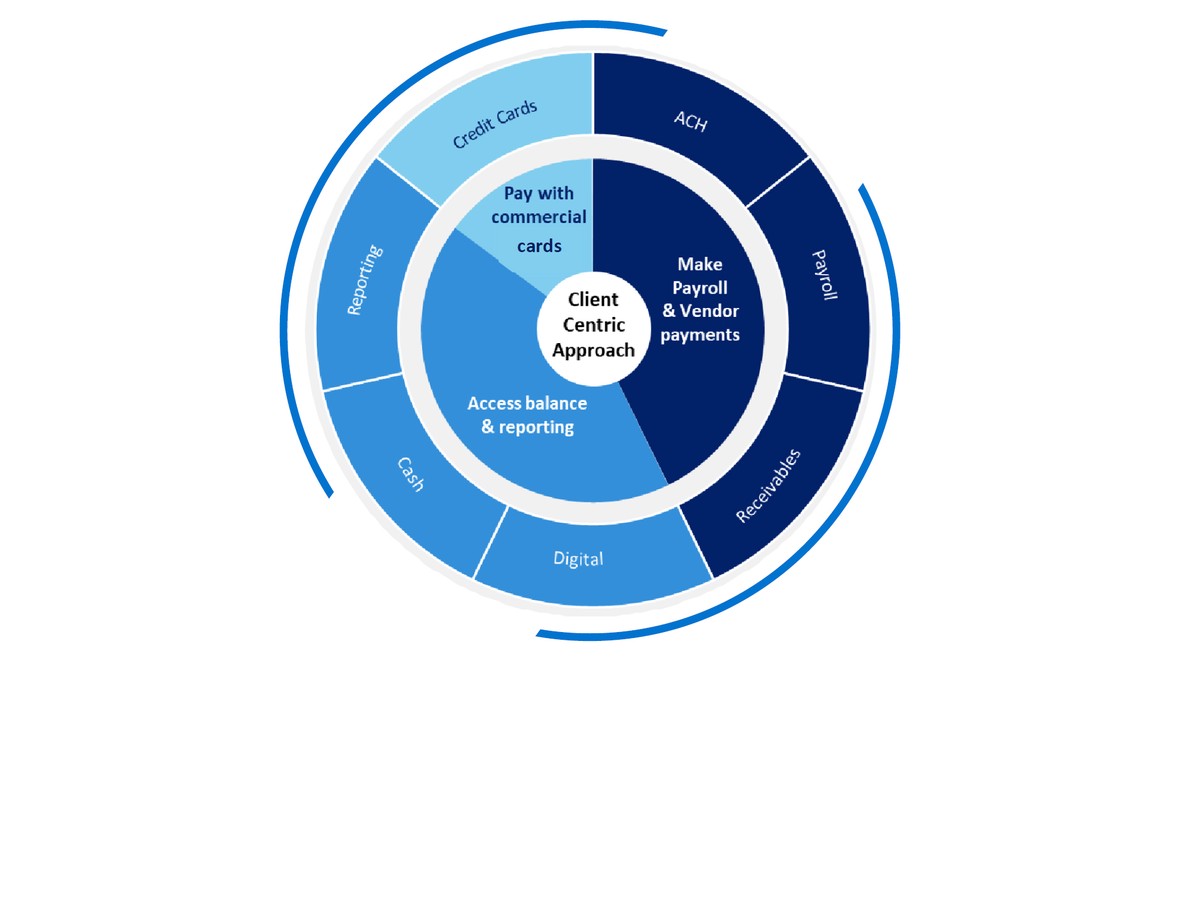

Two Key Approaches to Liquidity Pool Participation

Retail investors can participate in liquidity pools in perpetual futures in multiple ways. Here are two primary strategies:

Strategy 1: Passive Liquidity Provision

This approach involves depositing tokens into a liquidity pool and earning a share of fees from perpetual futures traders.

Pros:

- Low time commitment

- Steady yield potential

- Good for beginners

Cons:

- Exposure to impermanent loss if asset prices diverge

- Dependence on the trading volume of the protocol

Strategy 2: Active Liquidity Management

In this method, investors actively manage their pool contributions, shifting between pools, adjusting exposure, and optimizing returns.

Pros:

- Potential for higher yields

- Flexibility to adapt to market conditions

- Opportunity to exploit funding rate arbitrage

Cons:

- Requires constant monitoring

- Higher risk if mismanaged

- More suitable for experienced traders

Liquidity pool strategies in perpetual futures

How to Choose the Right Liquidity Pool

When deciding where to find the best liquidity pools for perpetual futures, retail investors should consider the following factors:

Liquidity Depth

The larger the pool, the more resilient it is to price swings. Platforms like GMX and dYdX are known for deep liquidity and robust perpetual markets.

Fee Structures

Examine how trading fees, funding rates, and rewards are distributed to liquidity providers. A protocol with transparent and fair fee models is ideal.

Risk Management

Smart contract audits, insurance funds, and robust liquidation mechanisms are crucial for protecting liquidity providers against losses.

How Liquidity Pools Affect Perpetual Futures Trading

Liquidity pools influence the entire market ecosystem. From reducing slippage to stabilizing funding rates, they are central to the user experience. Understanding how liquidity pools affect perpetual futures trading helps retail investors assess whether contributing liquidity aligns with their goals.

- For traders: Deeper liquidity equals better execution.

- For liquidity providers: More trading activity means more fees earned.

- For the market: Pools create a healthier balance between longs and shorts.

Recommended Best Practices for Retail Investors

Diversify Across Pools

Never allocate all your funds to a single liquidity pool. Diversification reduces risk exposure to protocol-specific failures.

Start Small

For beginners, it’s best to allocate a modest portion of capital to test the waters before scaling up.

Monitor Funding Rates

Perpetual futures rely on funding mechanisms. High funding volatility can impact returns for liquidity providers.

Liquidity pool performance metrics for retail investors

Industry Trends: What’s Next for Liquidity Pools?

With perpetual futures trading volumes in DeFi steadily rising, liquidity pools are evolving to include:

- Cross-chain liquidity solutions for better scalability

- Dynamic fee models that adjust based on volatility

- Enhanced risk controls to protect liquidity providers

As protocols innovate, retail investors will have more opportunities to participate in safer, more profitable liquidity ecosystems.

FAQ: Common Questions About Liquidity Pools in Perpetual Futures

1. Are liquidity pools in perpetual futures safe for retail investors?

Safety depends on the protocol. Leading platforms undergo third-party audits and maintain insurance funds, but risks such as smart contract vulnerabilities and extreme market volatility remain. Always diversify and do due diligence.

2. How much can retail investors earn by providing liquidity?

Earnings vary by pool, trading volume, and market conditions. On average, retail liquidity providers may see yields ranging from 10% to 40% APY, but these returns are not guaranteed.

3. What’s the minimum amount needed to participate in a liquidity pool?

Many protocols allow participation with as little as \(50–\)100. However, higher allocations may be necessary to cover transaction fees and maximize fee-sharing opportunities.

Conclusion: Practical Liquidity Pool Guidance for Retail Investors

Liquidity pools have transformed perpetual futures trading, giving retail investors the chance to earn yields and participate in advanced derivatives markets. From passive liquidity provision to active management strategies, there are multiple ways to engage depending on risk appetite and experience.

When choosing a pool, retail investors should prioritize liquidity depth, transparent fee structures, and risk management safeguards. With the right approach, liquidity pools can provide stable returns while diversifying exposure to the fast-growing DeFi derivatives market.

Get involved in the discussion:

Have you contributed to a liquidity pool in perpetual futures? What strategies have worked best for you? Share your insights below and forward this article to other investors exploring DeFi liquidity opportunities!