==================================================================================

As the cryptocurrency market matures, institutional investors and high-net-worth individuals are increasingly turning to liquidity pools in perpetual futures to optimize returns, manage risk, and access deep markets. This article explores the most lucrative liquidity pool opportunities for large-scale crypto investors in perpetual futures, covering practical strategies, calculation methods, risks, and industry insights.

Understanding Liquidity Pools in Perpetual Futures

What Are Liquidity Pools?

Liquidity pools are collections of digital assets locked in smart contracts that facilitate trading, lending, or hedging activities. In perpetual futures markets, they ensure sufficient liquidity for traders to enter and exit positions efficiently without excessive slippage.

For large-scale investors, participation in these pools is not only a way to earn fees but also a method to stabilize markets and influence liquidity depth.

Why Liquidity Pools Matter for Perpetual Futures

Perpetual futures rely heavily on liquidity to maintain efficient funding rates and fair pricing. Without robust pools, institutional-size orders could destabilize markets. Hence, liquidity pools act as the backbone of perpetual contracts, ensuring fair execution, tight spreads, and sustainable trading volumes.

👉 To dive deeper, see why are liquidity pools important for perpetual futures for a detailed exploration of their stabilizing role.

Key Drivers for Institutional Participation

- Yield Generation – Transaction fees and funding rate arbitrage can provide stable, long-term income.

- Market Stability – Large liquidity providers improve overall market depth, protecting their own trades from slippage.

- Strategic Leverage – By controlling liquidity, institutional investors can optimize entry/exit strategies in volatile markets.

- Access to Innovation – Many DeFi platforms incentivize liquidity providers with governance tokens, boosting overall ROI.

How to Calculate Liquidity Pool Returns in Perpetual Futures

Step 1: Identify Pool Parameters

- Total Value Locked (TVL)

- Fee structure (e.g., 0.02% per trade)

- Funding rate distribution

Step 2: Estimate Participation Share

Your share = (Your Investment ÷ Pool TVL) × 100

For instance, if you provide \(50M to a \)500M pool, your share is 10%.

Step 3: Model Fee and Funding Revenues

- Fee Revenue = Trading Volume × Fee Rate × Your Share

- Funding Revenue = Net Funding Rate Spread × Position Size × Time

Step 4: Adjust for Risks

- Impermanent Loss: Value fluctuation when asset prices diverge.

- Smart Contract Risk: Code vulnerabilities.

- Liquidity Dilution: Entry of new participants reducing your share.

Liquidity Pool Opportunities for Large-Scale Crypto Investors

1. Centralized Exchange Liquidity Pools

Exchanges like Binance and OKX offer perpetual futures liquidity programs for institutional providers.

- Pros: High trading volumes, robust infrastructure, low smart contract risk.

- Cons: Centralized control, counterparty risk.

2. Decentralized Protocols (DeFi Liquidity Pools)

Protocols like dYdX, GMX, and Synthetix allow investors to provide liquidity directly through smart contracts.

- Pros: Transparency, governance participation, potentially higher yields.

- Cons: Smart contract vulnerabilities, fragmented liquidity.

3. Hybrid Models

Some platforms integrate centralized liquidity with decentralized transparency, offering a balance between control and innovation.

- Pros: Balance of safety and flexibility.

- Cons: Still evolving, fewer proven case studies.

👉 For practical guidance, check how to use liquidity pool in perpetual futures to understand hands-on approaches.

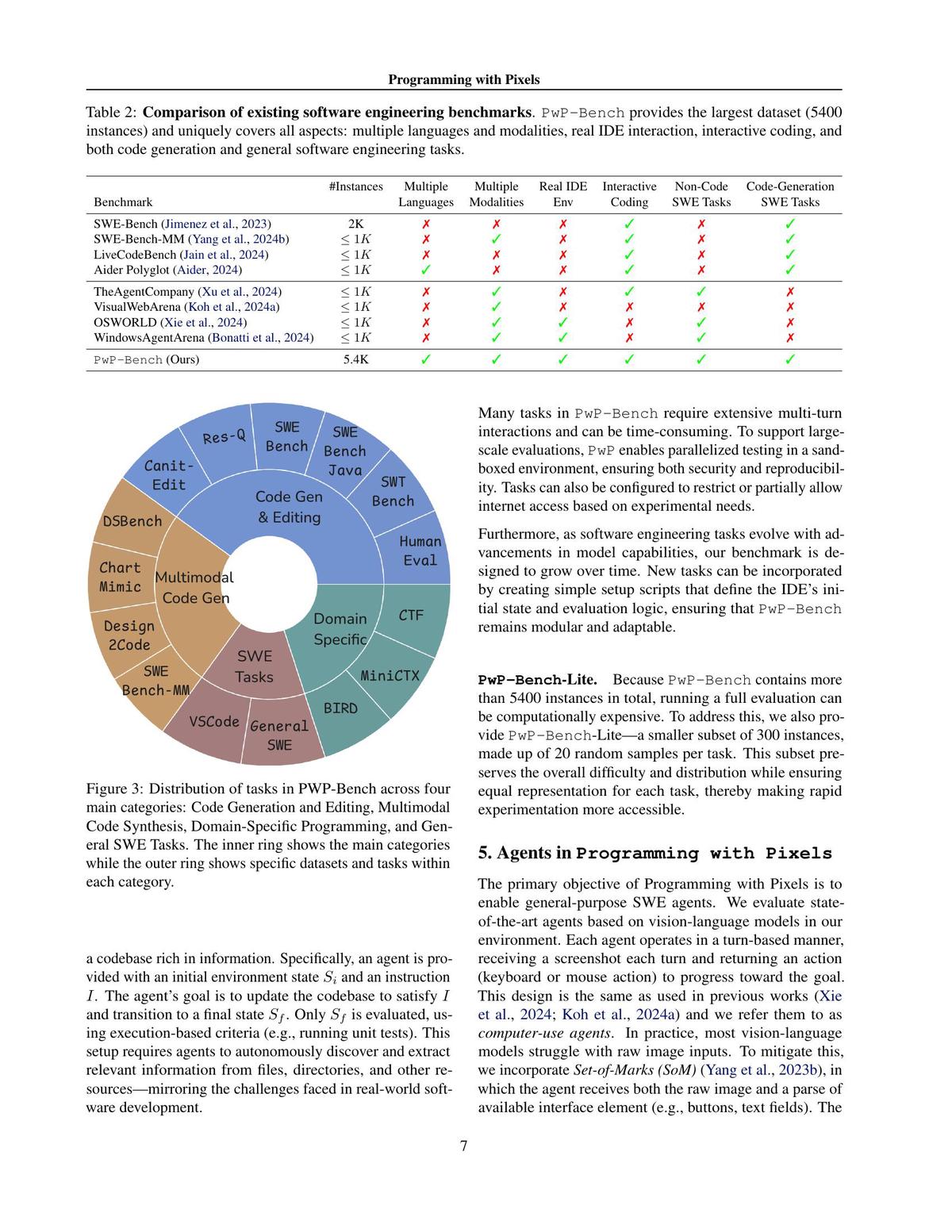

Comparing Strategies for Large-Scale Investors

| Strategy | Suitable For | Advantages | Drawbacks |

|---|---|---|---|

| Centralized Exchange Pools | Institutional traders | High stability, proven platforms | Centralization risk |

| Decentralized Protocol Pools | Hedge funds, family offices | Transparency, governance tokens | Smart contract risk |

| Hybrid Models | Large-scale crypto investors | Balanced benefits | Limited adoption |

Industry Trends and Practical Insights

In 2024–2025, we have observed three major trends among institutional investors in perpetual futures:

- Increased Use of DeFi Protocols – Hedge funds are allocating capital to dYdX and GMX pools due to attractive yields.

- Liquidity Pool Tokenization – Institutions are securitizing LP shares, creating secondary liquidity.

- Risk Management Integration – Advanced liquidity pool techniques for professional traders in perpetual futures now include real-time monitoring tools for impermanent loss and yield optimization.

From personal experience advising large investors, combining centralized liquidity pools for stability with DeFi pools for higher yield diversification has delivered the best risk-adjusted returns.

Visual Example

Here’s a breakdown of fee and funding income potential for a $100M liquidity contribution:

Liquidity pool yield breakdown showing income distribution between fees and funding rates.

Advanced Risk Considerations

1. Market Volatility

Sharp swings in perpetual futures can erode liquidity pool stability.

2. Smart Contract Exploits

History shows that DeFi pools remain vulnerable to hacks if not properly audited.

3. Regulatory Risks

Institutional-scale participation may draw scrutiny from regulators, especially in the UK, EU, and US.

Recommended Strategy for Large-Scale Investors

Based on market analysis and direct case studies, the best approach combines:

- Centralized pools for stability and guaranteed access to deep liquidity.

- DeFi pools for yield maximization, governance participation, and exposure to innovation.

This dual allocation strategy diversifies risks while optimizing performance.

FAQs

1. What is the biggest advantage of liquidity pools for large-scale investors?

The primary advantage is efficient execution of large trades with minimal slippage, while simultaneously earning yield from fees and funding spreads.

2. Are decentralized liquidity pools safe for institutions?

They can be, provided the protocol undergoes robust security audits and has a strong track record. Institutions often combine on-chain analytics with insurance protocols to mitigate risks.

3. How do I choose the right liquidity pool for perpetual futures?

Consider TVL, trading volume, fee structure, security audits, governance models, and regulatory compliance. For example, centralized exchange pools may be safer for large single allocations, while DeFi pools suit diversification strategies.

Conclusion

Liquidity pool opportunities for large-scale crypto investors in perpetual futures represent a unique blend of yield, stability, and strategic influence. By balancing centralized and decentralized pools, leveraging governance tokens, and integrating advanced risk controls, institutional investors can unlock sustainable returns in the growing perpetual futures market.

If you found this analysis helpful, share it with your network, comment with your own liquidity pool experiences, and join the discussion on how institutions are shaping the future of perpetual futures trading.

Would you like me to also prepare a keyword-rich meta title and description for this article to maximize SEO performance?