=============================================================

Introduction: Why Liquidity Pools Matter in Perpetual Futures

For frequent traders in perpetual futures markets, liquidity pools are more than just a passive income opportunity—they are the backbone of seamless trading execution, risk distribution, and yield optimization. Unlike traditional order books, liquidity pools aggregate capital from multiple participants, enabling smoother transactions and reducing slippage in high-frequency environments. Understanding how to manage and leverage liquidity pools can give traders a decisive edge, especially in volatile cryptocurrency markets where perpetual futures dominate.

This article provides comprehensive liquidity pool tips for frequent traders in perpetual futures, exploring practical strategies, risks, and advanced techniques. Drawing on both industry insights and professional experience, we’ll analyze multiple approaches and recommend best practices for maximizing returns while maintaining stability.

Understanding Liquidity Pools in Perpetual Futures

What Are Liquidity Pools?

Liquidity pools are decentralized reserves of assets locked in smart contracts that facilitate trading without the need for centralized intermediaries. In perpetual futures, liquidity pools provide traders with continuous access to leverage and counterparties, ensuring that trading can occur efficiently regardless of market volatility.

Why Are They Essential for Frequent Traders?

Frequent traders rely on liquidity pools for several reasons:

- Reduced Slippage: Deeper liquidity ensures smoother order execution.

- Stable Funding: Pools balance long and short positions, preventing imbalances.

- Yield Opportunities: Traders can provide liquidity while simultaneously trading.

These benefits make it crucial for active traders to adopt effective liquidity pool strategies to enhance performance.

Core Liquidity Pool Tips for Frequent Traders

Tip 1: Diversify Across Multiple Liquidity Pools

Relying on a single pool can expose traders to concentrated risks such as smart contract vulnerabilities or sudden liquidity shortages. Diversifying across multiple pools—particularly those with varying asset pairings—helps mitigate systemic risk and ensures more stable yields.

Tip 2: Monitor Funding Rates and Pool Dynamics

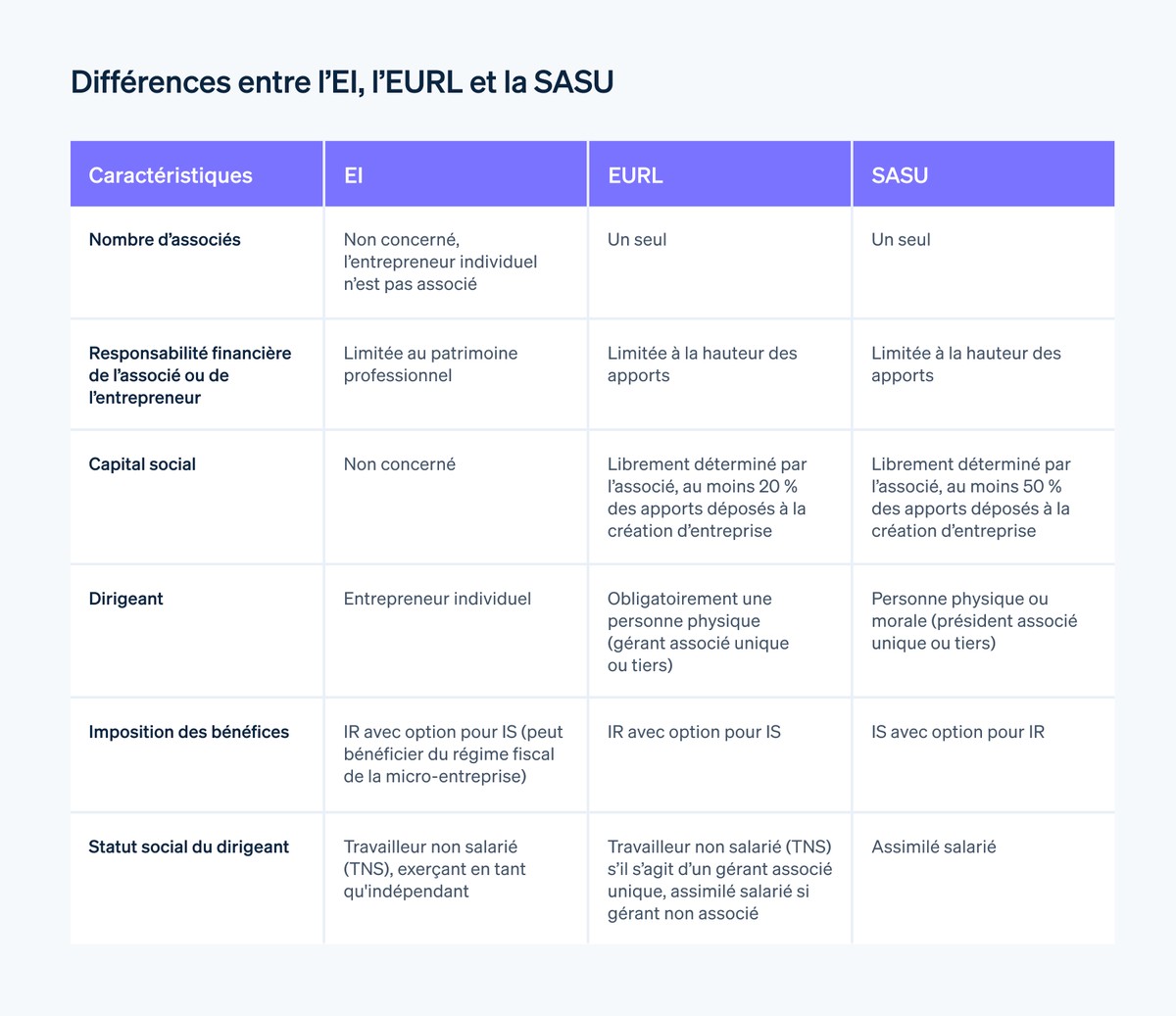

Frequent traders in perpetual futures must track funding rate fluctuations, as they directly affect profitability. Liquidity pools can absorb volatility differently depending on asset allocation. Monitoring pool health metrics like total value locked (TVL), utilization ratios, and open interest balance is vital for making informed trading decisions.

Liquidity pool metrics dashboard used by frequent traders

Tip 3: Use Hedging Strategies to Balance Exposure

Liquidity pools can sometimes expose traders to impermanent loss. For frequent traders in perpetual futures, hedging with opposite directional positions can minimize volatility risks. For example, providing liquidity in a BTC/USDT pool while holding a perpetual short can balance risk and generate steady returns.

Comparing Two Key Liquidity Pool Strategies

Strategy 1: Active Pool Rotation

Active rotation involves moving capital across different liquidity pools based on yield opportunities, TVL stability, and fee rewards.

Pros:

- Optimizes short-term returns.

- Allows traders to capture incentives from new liquidity programs.

- Optimizes short-term returns.

Cons:

- High transaction costs from frequent switching.

- Requires constant monitoring and advanced analytics.

- High transaction costs from frequent switching.

Strategy 2: Long-Term Pool Commitment

Long-term commitment means providing liquidity to established pools (e.g., ETH/USDT or BTC/USDT perpetual markets) and holding for extended durations.

Pros:

- Lower transaction costs.

- More predictable returns from established platforms.

- Lower transaction costs.

Cons:

- Exposure to impermanent loss if market conditions shift dramatically.

- Missed opportunities in short-term incentive programs.

- Exposure to impermanent loss if market conditions shift dramatically.

Recommendation: For frequent traders, a hybrid approach works best—allocating a core portion of capital to stable, long-term pools while rotating a smaller portion into short-term opportunities. This balances risk and yield.

Advanced Liquidity Pool Techniques for Perpetual Futures

Arbitrage Between Pools and Perpetual Exchanges

Frequent traders can exploit price discrepancies between liquidity pools and perpetual futures exchanges. Automated arbitrage bots can execute trades that capitalize on spreads, generating consistent micro-profits.

Leveraged Liquidity Provision

Some platforms allow liquidity providers to leverage their deposits, amplifying potential returns. While profitable in trending markets, this increases risk during volatility spikes, requiring strict risk management.

Utilizing Liquidity Pool Data Analysis

Advanced traders often use specialized tools to analyze pool performance. Platforms offering where to get reliable liquidity pool data for perpetual futures provide dashboards that display yield trends, slippage metrics, and volatility-adjusted returns. These insights can guide frequent traders in optimizing strategies.

Risk Management in Liquidity Pools

Impermanent Loss Mitigation

Frequent traders must understand impermanent loss—when asset prices diverge, the value of pooled funds can decrease compared to simply holding. Hedging, dynamic rebalancing, and choosing pools with stable pairs (e.g., USDC/USDT) can reduce this risk.

Smart Contract and Platform Risk

Since liquidity pools rely on smart contracts, vulnerabilities can expose traders to hacks. Choosing audited platforms and how to evaluate a liquidity pool for perpetual futures based on transparency, community trust, and security audits is essential.

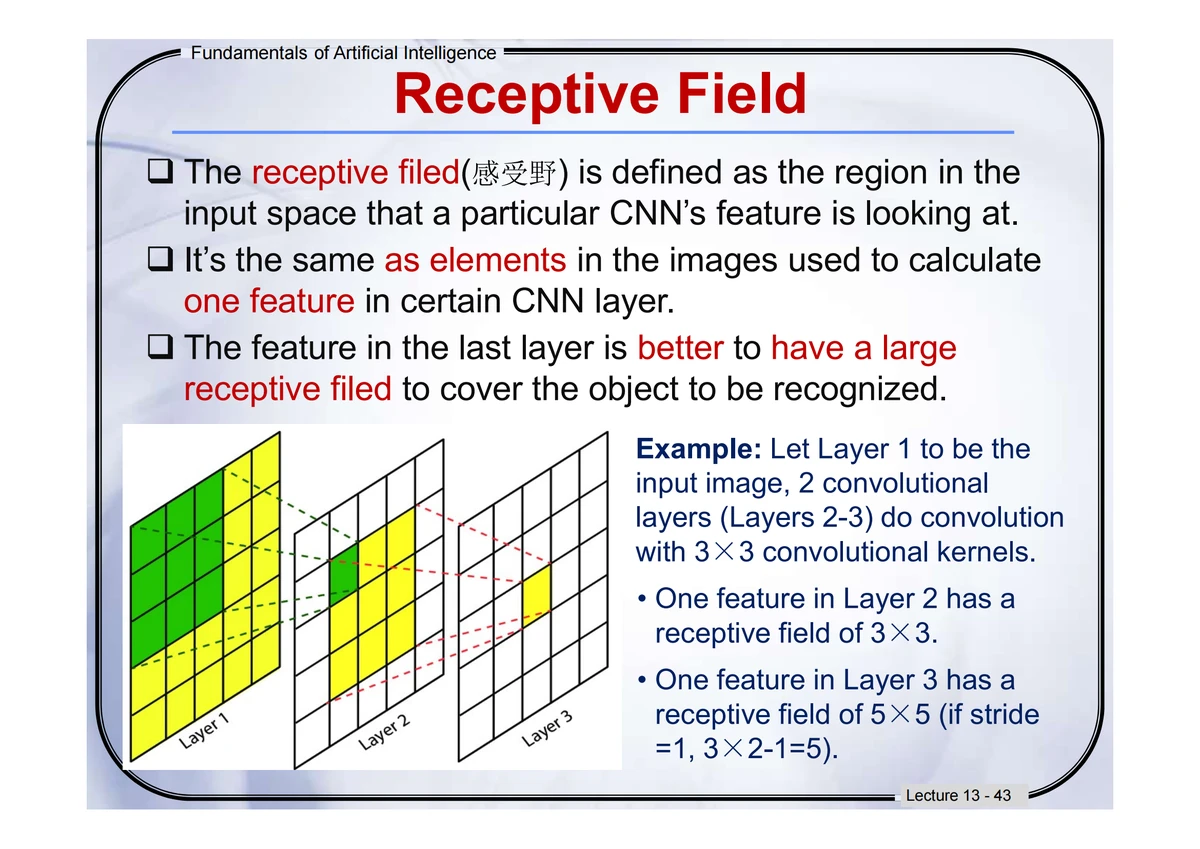

Overexposure Risk

Allocating too much capital to liquidity pools reduces flexibility for trading opportunities. Maintaining a balance between liquidity provision and active trading ensures better overall portfolio performance.

Risk vs reward matrix in liquidity pool strategies

Industry Trends: Liquidity Pools in 2025 and Beyond

- Cross-Chain Liquidity Pools: With interoperability solutions, traders can access pools across multiple blockchains, increasing flexibility.

- AI-Driven Pool Optimization: Machine learning algorithms are increasingly used to predict funding rates, optimize yields, and automate pool rotation strategies.

- Institutional Adoption: Larger funds are entering perpetual futures pools, providing deeper liquidity but also raising competition for yields.

FAQ: Liquidity Pool Tips for Frequent Traders in Perpetual Futures

1. How do liquidity pools affect perpetual futures trading?

Liquidity pools enhance trading efficiency by providing continuous access to capital, reducing slippage, and ensuring that traders can enter and exit positions seamlessly. Without deep liquidity pools, frequent traders face higher transaction costs and execution risks.

2. What is the biggest risk when using liquidity pools in perpetual futures?

The primary risks are impermanent loss and smart contract vulnerabilities. Impermanent loss occurs when asset prices diverge, while smart contract flaws can result in fund losses. Traders should mitigate these by diversifying across pools and using audited platforms.

3. How can frequent traders maximize returns from liquidity pools?

Traders can maximize returns by:

- Combining long-term positions with active pool rotation.

- Monitoring funding rates and volatility metrics.

- Using hedging techniques to offset impermanent loss.

- Leveraging analytics platforms for performance tracking.

Conclusion: Mastering Liquidity Pools in Perpetual Futures

For frequent traders, liquidity pools in perpetual futures are both a profit opportunity and a risk management tool. By diversifying pools, monitoring funding rates, and adopting hybrid strategies, traders can maximize returns while minimizing risks. Advanced techniques like arbitrage and AI-based pool analysis further enhance outcomes.

Whether you’re a retail trader or an institutional participant, liquidity pools will remain a cornerstone of perpetual futures trading. Apply the strategies outlined here, experiment with hybrid approaches, and continuously monitor pool dynamics to stay ahead.

If you found these insights valuable, share this article with fellow traders, comment with your experiences, and join the conversation to refine liquidity pool strategies together.