In today’s fast-paced financial markets, latency has become a critical factor that can make or break trading strategies. Whether you’re trading stocks, cryptocurrency, or engaging in high-frequency trading (HFT), minimizing latency is essential to executing successful trades. In this article, we’ll explore where to find low-latency trading services, how latency impacts your trading, and strategies for optimizing latency for better outcomes.

What is Latency in Trading?

Latency in trading refers to the time delay between a trader’s action (such as placing a buy or sell order) and the market’s response. This delay is usually measured in milliseconds (ms) and can significantly impact the success of a trade. For traders involved in high-frequency trading or algorithmic strategies, even a small delay can result in missed opportunities or increased slippage.

Key Factors Affecting Latency:

- Network Speed: The time it takes for data to travel between your trading system and the exchange.

- Server Location: Physical distance between your trading server and the exchange’s servers.

- Market Data: Delays in receiving market data or executing trades based on outdated data.

- Broker Platforms: The efficiency of the broker’s platform in processing and executing orders.

Why is Low Latency Important in Trading?

For traders who rely on algorithmic trading or high-frequency trading (HFT), low-latency environments are essential. A delay in executing orders can result in significant financial losses, especially in volatile markets or fast-moving assets like cryptocurrencies.

Here are a few reasons why low latency is crucial:

- Faster Execution: In fast-moving markets, speed is paramount. Low latency ensures that trades are executed quickly, allowing traders to take advantage of price movements before they disappear.

- Reduced Slippage: Higher latency can lead to slippage, where orders are filled at prices worse than expected. By reducing latency, traders can minimize the impact of slippage on their trades.

- Improved Execution in High-Frequency Trading: In HFT, where trades occur in microseconds, even a slight delay can result in missed profits.

- Real-Time Data Processing: Low latency enables real-time data processing, which is critical for algorithmic strategies that rely on up-to-the-second information.

Where to Find Low-Latency Trading Services

Finding the right low-latency trading service is essential for executing successful trades in competitive markets. Below are some of the best places where you can find low-latency trading services.

1. Colocated Servers with Exchanges

One of the most effective ways to minimize latency is by colocating your servers with the exchange. Colocation means physically placing your trading infrastructure within the exchange’s data center. This reduces the time it takes for data to travel between your server and the exchange’s matching engine.

Advantages:

- Reduced Network Latency: Colocated servers are located in close proximity to the exchange’s infrastructure, resulting in ultra-low latency.

- Direct Market Access: You can access the exchange’s systems directly, allowing for faster order execution.

- Reduced Network Latency: Colocated servers are located in close proximity to the exchange’s infrastructure, resulting in ultra-low latency.

Disadvantages:

- Cost: Colocation services can be expensive, as they often require substantial setup fees and ongoing maintenance costs.

- Infrastructure Requirements: Setting up your infrastructure in a data center can be complex and resource-intensive.

- Cost: Colocation services can be expensive, as they often require substantial setup fees and ongoing maintenance costs.

Where to find Colocated Servers:

- Major exchanges like CME, NASDAQ, ICE, and Binance offer colocation services.

- Third-party data centers like Equinix, NYI, and China Telecom also provide colocation options for traders.

2. Low-Latency Brokers and Trading Platforms

Some brokers and trading platforms offer low-latency services as part of their offering. These brokers invest in high-performance servers, network optimization, and direct connectivity to exchanges, providing low-latency execution for their clients.

Advantages:

- Affordable Options: Low-latency brokers typically offer competitive pricing compared to colocation services.

- Access to Advanced Tools: Many low-latency brokers offer algorithmic trading tools, fast order routing, and direct market access.

- Affordable Options: Low-latency brokers typically offer competitive pricing compared to colocation services.

Disadvantages:

- Limited Customization: Traders may have less control over infrastructure compared to colocation.

- Limited Exchanges: Some brokers may offer limited access to exchanges or markets with lower latency.

- Limited Customization: Traders may have less control over infrastructure compared to colocation.

Popular Low-Latency Brokers:

- Interactive Brokers: Known for offering low-latency trading services for professional traders.

- TradeStation: Offers fast execution speeds and a powerful trading platform.

- IG Group: Provides low-latency services with access to various global markets.

3. Dedicated High-Speed Data Networks

For those who need even lower latency, using dedicated high-speed data networks can make a big difference. Some firms specialize in providing direct, high-speed connections between traders and exchanges to reduce latency even further.

Advantages:

- Ultra-Low Latency: Dedicated networks provide near-instantaneous data transmission between traders and exchanges.

- Reliability: These networks often have redundancy and failover systems in place to ensure continuous low-latency connections.

- Ultra-Low Latency: Dedicated networks provide near-instantaneous data transmission between traders and exchanges.

Disadvantages:

- High Costs: Dedicated high-speed networks can be quite expensive, especially for retail traders.

- Complex Setup: Setting up and maintaining a dedicated high-speed network can be complex and resource-intensive.

- High Costs: Dedicated high-speed networks can be quite expensive, especially for retail traders.

Providers of High-Speed Networks:

- Race Communications: Offers high-speed, low-latency data services tailored to financial traders.

- Xilinx: Specializes in low-latency hardware solutions and FPGA technology for ultra-fast data processing.

4. Latency Optimization Tools and Software

For traders who already have a trading infrastructure in place, optimizing latency through software and tools can help improve performance. These tools optimize data transmission, enhance the speed of order execution, and provide real-time latency monitoring.

Advantages:

- Cost-Effective: Software tools are generally more affordable than colocation services or dedicated networks.

- Ease of Use: Many latency optimization tools are easy to integrate with existing trading platforms.

- Cost-Effective: Software tools are generally more affordable than colocation services or dedicated networks.

Disadvantages:

- Limited Impact: Software tools may not provide the same dramatic reductions in latency as colocation or dedicated networks.

- Dependence on Other Factors: Latency optimization software may only address certain factors, and other parts of your trading infrastructure could still introduce delays.

- Limited Impact: Software tools may not provide the same dramatic reductions in latency as colocation or dedicated networks.

Popular Latency Optimization Tools:

- Solarflare: Offers software and hardware solutions to reduce latency in trading systems.

- OneTick: Provides tools for real-time data analysis and latency optimization in trading environments.

Strategies for Minimizing Latency in Trading

While choosing the right service is critical, there are several strategies traders can use to minimize latency further:

1. Optimize Your Trading Algorithms

Algorithmic trading strategies are highly sensitive to latency. By optimizing your algorithms to execute trades more efficiently, you can reduce latency and increase your chances of success. This may involve streamlining code, optimizing order routing, and using faster data structures.

2. Use Direct Market Access (DMA)

Direct Market Access (DMA) allows traders to interact directly with the order book, bypassing intermediaries like brokers. DMA offers faster execution speeds, as orders are routed directly to the exchange’s matching engine.

3. Utilize Co-Location for HFT

For high-frequency traders (HFT), co-locating servers in the same data centers as the exchanges offers the most effective way to reduce latency. This allows traders to access real-time market data and execute trades with minimal delay.

FAQ: Low-Latency Trading Services

1. What is the difference between low-latency trading and high-frequency trading?

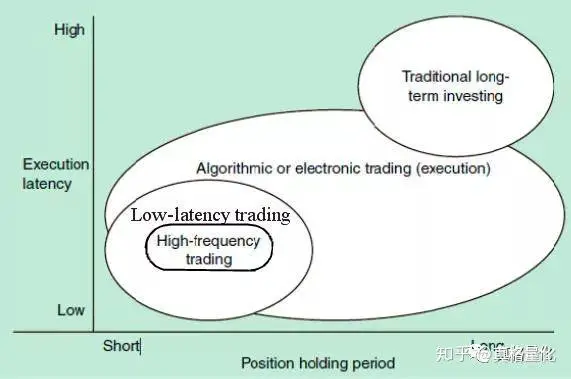

Low-latency trading refers to reducing the time it takes for a trader to place and execute an order, while high-frequency trading (HFT) involves executing a large number of orders in a very short period. HFT typically requires extreme levels of latency optimization to maintain competitive advantages.

2. Can I reduce latency without colocation?

Yes, using low-latency brokers, high-speed data networks, and latency optimization tools can help reduce latency without the need for colocation. However, colocation remains the most effective method for ultra-low latency.

3. How do I measure latency in my trading system?

Latency can be measured using specialized tools and software that track the time it takes from placing an order to its execution. Tools like Solarflare and OneTick can help measure and monitor latency in real-time.

Conclusion

Finding low-latency trading services is crucial for anyone involved in fast-paced markets or algorithmic trading. By choosing the right broker, colocation provider, or data network, traders can optimize their execution speeds and minimize the risks associated with latency. Whether you’re an institutional trader or a retail trader, investing in the right infrastructure can significantly improve your trading outcomes.