=======================================================================

In perpetual trading, where contracts don’t expire and the market operates in a constant cycle, matching engines are crucial components. These systems are responsible for matching buy and sell orders efficiently, ensuring liquidity, and maintaining market stability. For traders, understanding the inner workings of matching engines and the strategies to optimize their use can make a significant difference in trade execution and overall profitability.

This guide will dive deep into matching engine strategies for perpetual trading, discussing their importance, the best practices to enhance performance, and advanced strategies to boost efficiency.

What is a Matching Engine?

A matching engine is the technology that facilitates trade execution by matching buy and sell orders on a trading platform. It uses algorithms to match market orders with limit orders, determining when and at what price a transaction occurs. Matching engines are integral to markets like perpetual futures, where trades are ongoing, and liquidity must be continuously maintained.

Key Features of a Matching Engine:

- Order Matching: Identifies and matches compatible buy and sell orders.

- Price Determination: Ensures trades occur at the best available price based on the order book.

- Trade Execution: Facilitates the execution of trades once orders are matched.

How Does a Matching Engine Work in Perpetual Trading?

In perpetual markets, traders can hold positions indefinitely as long as they maintain sufficient margin. The matching engine works by handling high-frequency, real-time orders and continuously ensuring that there is enough liquidity in the market. It uses sophisticated algorithms to match orders based on several factors like price, time, and order type.

The Process of Order Matching in Perpetual Markets:

- Order Book Creation: The engine starts by creating an order book, which lists all active buy and sell orders in the market.

- Matching Algorithms: When a new order arrives, the matching engine compares it against the order book. It first looks for matching prices, then evaluates the best time priority.

- Trade Execution: Once a match is found, the engine executes the trade by transferring the asset between the buyer and the seller.

- Continuous Update: The order book is constantly updated to reflect the latest trades and orders, keeping the market fluid.

Optimizing Matching Engines for Perpetual Trading

To gain a competitive edge in perpetual trading, it is crucial to optimize matching engines for high-frequency trading (HFT) and low-latency execution. Below are some strategies to enhance the efficiency of a matching engine:

1. Latency Reduction Techniques

Latency is the time delay between sending an order and receiving confirmation of the execution. In perpetual trading, especially in fast-paced markets, reducing latency is critical.

Strategies to Reduce Latency:

- Co-location: Position your servers near the exchange’s servers to minimize data transfer delays.

- Optimized Code: Ensure that the matching engine’s algorithms are highly efficient, utilizing optimized programming techniques.

- Faster Data Transmission: Use low-latency communication channels such as fiber optics or high-speed networks to send data to and from the exchange.

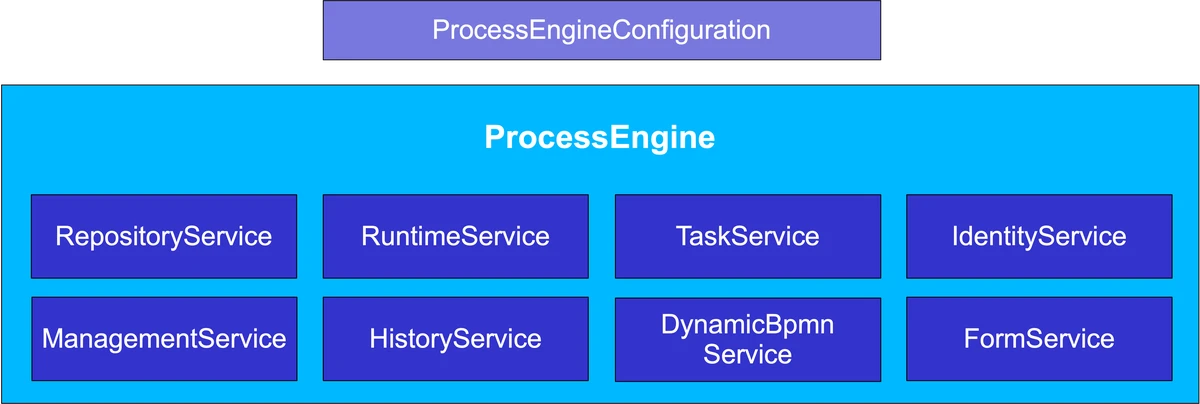

2. Scalable Architecture Design

Scalable matching engines can handle high volumes of orders without significant performance degradation, which is crucial in a highly active perpetual market.

Key Components of Scalable Architecture:

- Distributed Systems: Distribute workloads across multiple servers to ensure consistent performance during peak trading hours.

- Load Balancing: Implement a load balancing system to ensure that traffic is evenly distributed across multiple processors or systems.

- Cloud-based Solutions: Using cloud platforms can dynamically scale resources depending on the market demand.

3. Improved Order Matching Algorithms

Order matching is the core function of a matching engine. Optimizing the algorithms used for matching orders can help increase efficiency and speed.

Best Practices for Order Matching:

- Price-Time Priority: Implement algorithms that prioritize matching based on price first and then time, ensuring fairness and transparency.

- FIFO Matching: Use First-In-First-Out (FIFO) matching logic for orders to ensure that earlier orders are executed first.

- Algorithmic Optimizations: Enhance the matching algorithm to account for specific market conditions, such as volatility or spread.

Advanced Matching Engine Strategies

For institutional and professional traders, advanced strategies can further enhance performance, reduce risk, and optimize profits.

1. Smart Order Routing (SOR)

Smart order routing is a technique used to automatically route orders to the best available matching engine or exchange based on price, liquidity, and other factors.

How Smart Order Routing Works:

- Multiple Venues: Orders are sent to various exchanges or liquidity pools to find the best price and execution speed.

- Real-time Decision Making: The SOR system makes real-time decisions based on factors like price slippage, market depth, and liquidity.

2. Market Making Algorithms

Market making involves placing both buy and sell orders on the order book to provide liquidity. Market makers earn profits from the spread between the buy and sell prices.

How Market Making Improves Liquidity:

- Continuous Liquidity: Market makers continuously offer buy and sell orders, ensuring that the market remains liquid even in volatile conditions.

- Spread Management: By adjusting the spread between buy and sell orders, market makers can optimize their profitability while providing stability to the market.

3. Algorithmic Trading with Matching Engines

Algorithmic traders use complex algorithms to analyze market conditions and execute orders automatically. Integrating algorithms with matching engines can improve execution speed and accuracy.

Key Features of Algorithmic Trading:

- High-Frequency Trading (HFT): Algorithms can make decisions in milliseconds, allowing traders to capitalize on tiny price discrepancies.

- Backtesting: Algorithmic traders can backtest their strategies using historical data to ensure their strategies perform well in live trading.

How to Choose a Matching Engine for Perpetual Trading

When selecting a matching engine for perpetual trading, it’s essential to consider factors like speed, scalability, and security. Below are some important considerations:

1. Speed and Latency

Speed is the most critical factor in a matching engine, especially in high-frequency and perpetual markets. A low-latency matching engine allows faster trade execution and better responsiveness to market changes.

2. Scalability

Ensure that the matching engine can handle the increasing volume of trades as your trading activity grows. A scalable solution will prevent slowdowns or system failures during periods of high market activity.

3. Security Features

Security is a key consideration, particularly when dealing with high-value assets and large trading volumes. A matching engine should have robust encryption, fraud detection, and risk management features.

4. Customization and Integration

The ability to customize the matching engine and integrate it with other trading tools or algorithms is vital for advanced traders and institutions.

Troubleshooting Common Matching Engine Issues

Matching engines, while powerful, can sometimes experience technical issues that affect trade execution. Here are some common problems and solutions:

1. Slow Trade Execution

Slow trade execution is often caused by system overloads or inefficient algorithms. Solutions include optimizing the matching engine’s code, using faster network connections, or employing distributed systems.

2. Order Book Imbalances

Order book imbalances can occur if there is insufficient liquidity. To mitigate this, use market-making strategies or smart order routing to balance the order book.

3. Slippage

Slippage occurs when there is a difference between the expected price and the executed price due to high volatility. Minimizing slippage involves improving order matching speed and using limit orders to control execution prices.

FAQ: Matching Engine Strategies for Perpetual Trading

1. How do matching engines affect trade execution in perpetual markets?

Matching engines directly impact trade execution speed and liquidity. In perpetual markets, where trades occur 24⁄7, efficient matching ensures that orders are filled quickly and accurately, minimizing price slippage and enhancing the overall trading experience.

2. Why do perpetual traders need to optimize their matching engines?

Optimizing matching engines allows perpetual traders to execute orders faster, reduce latency, and improve trade accuracy. This is especially critical in high-frequency trading, where delays can result in significant losses.

3. What is the best strategy for reducing latency in matching engines?

Reducing latency can be achieved by optimizing the matching engine’s algorithms, using co-location services, and employing high-speed communication networks to ensure quick order execution.

Conclusion

Matching engines are at the heart of perpetual trading, playing a crucial role in the seamless execution of trades. By understanding the various strategies for optimizing and troubleshooting matching engines, traders can gain a competitive edge in this fast-paced market. Whether you’re a retail trader or an institutional investor, mastering matching engine strategies can significantly improve your trading outcomes and market efficiency.

Feel free to share your experiences or ask questions in the comments below, and don’t forget to share this guide with others who are looking to enhance their perpetual trading strategies!