===================================================================

Introduction

In the world of crypto derivatives, pair trading solutions for perpetual futures have emerged as one of the most powerful market-neutral strategies. Unlike speculative approaches that rely on predicting price direction, pair trading focuses on relative value between two correlated assets. By going long one perpetual futures contract and short another, traders can profit from price divergences while minimizing exposure to overall market risk.

In this article, we’ll explore what pair trading is, why it’s effective in perpetual futures markets, compare different strategies, and provide practical insights based on real-world trading experiences and the latest industry trends.

What is Pair Trading in Perpetual Futures?

Definition

Pair trading in perpetual futures involves simultaneously taking opposing positions in two correlated futures contracts. The goal is to profit when their relative prices converge or diverge, regardless of whether the broader market goes up or down.

Example

A trader notices that BTC and ETH perpetual futures typically move in tandem. If ETH futures lag while BTC surges, the trader may go long ETH perpetuals and short BTC perpetuals. When prices revert to historical norms, profits are realized.

Why Pair Trading is Effective in Perpetual Futures

Perpetual futures differ from traditional futures because they have no expiry and are kept in balance using funding rates. This creates unique opportunities:

- Market Neutrality: Exposure to overall crypto volatility is reduced.

- Leverage Efficiency: Futures allow flexible margin use for both legs of the trade.

- Funding Arbitrage: Traders can capture yield when funding rates differ across assets.

This is why institutional and retail traders alike emphasize why pair trading is effective in perpetual futures as part of their core strategies.

Key Pair Trading Solutions for Perpetual Futures

1. Statistical Arbitrage Pair Trading

Method: Uses correlation and cointegration models to identify mispricing.

Process:

- Select two correlated assets (e.g., BTC/ETH, SOL/ADA).

- Run regression analysis to confirm cointegration.

- Enter long/short positions when price deviates from the mean.

- Select two correlated assets (e.g., BTC/ETH, SOL/ADA).

Pros: Robust, data-driven, scalable.

Cons: Requires advanced modeling and monitoring.

2. Funding Rate Arbitrage

Method: Exploits differences in funding rates between two perpetual futures contracts.

Process:

- Go long the contract with a negative funding rate.

- Go short the contract with a positive funding rate.

- Go long the contract with a negative funding rate.

Pros: Generates yield even in sideways markets.

Cons: Profits can be small; requires high leverage and careful risk management.

3. Cross-Exchange Pair Trading

- Method: Trades the same pair across different exchanges when prices diverge.

- Example: Long ETH perpetual on Binance, short ETH perpetual on Bybit if spreads widen.

- Pros: Profits from inefficiencies across venues.

- Cons: Execution speed and fees are critical.

Comparing Pair Trading Strategies

| Strategy Type | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Statistical Arbitrage | Quantitative traders | High accuracy, mean reversion | Requires advanced analytics |

| Funding Rate Arbitrage | Yield-seeking investors | Stable income potential | Small spreads, high leverage |

| Cross-Exchange Arbitrage | Active professional traders | Exploits market inefficiency | Execution risk, exchange fees |

From personal experience, statistical arbitrage remains the most sustainable solution in 2025, especially when combined with automation. However, funding rate arbitrage is appealing for investors seeking low-risk passive income.

How to Implement Pair Trading Solutions

Step 1: Asset Selection

Choose assets with historical correlation (BTC-ETH, SOL-ADA).

Step 2: Statistical Testing

Apply correlation coefficients, ADF tests, or cointegration analysis.

Step 3: Entry Rules

Define thresholds for entering long/short positions when spreads widen.

Step 4: Execution System

Automate orders using APIs to reduce slippage and latency risks.

Step 5: Risk Management

- Use stop-losses on both legs.

- Limit leverage exposure.

- Monitor funding costs and liquidity.

For traders exploring automation, it’s crucial to understand how to automate pair trading strategies in perpetual futures to optimize execution speed and accuracy.

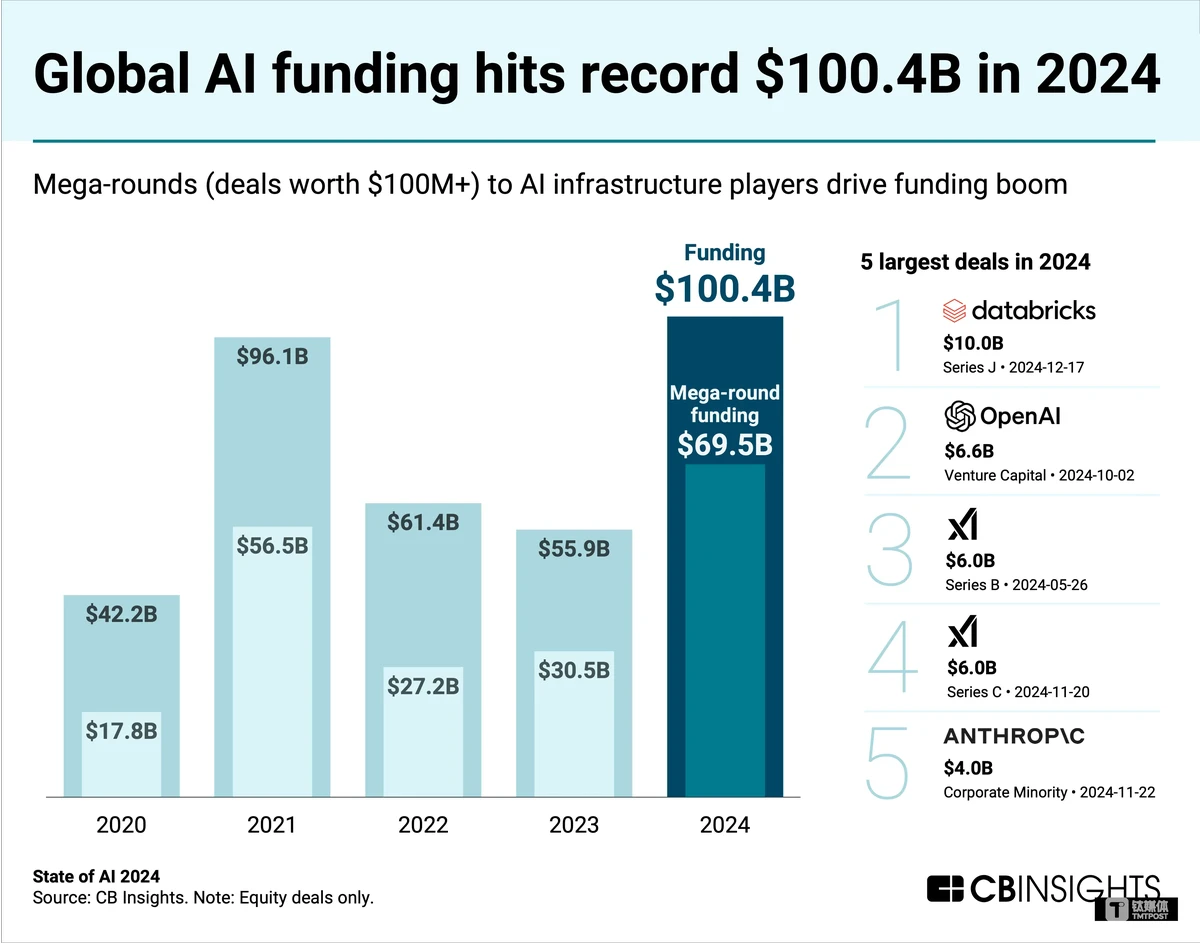

Industry Trends in 2025

AI-Powered Pair Selection

- Machine learning models identify optimal asset pairs dynamically.

- Machine learning models identify optimal asset pairs dynamically.

On-Chain Data Integration

- Funding rates and liquidity signals from DeFi platforms enhance decision-making.

- Funding rates and liquidity signals from DeFi platforms enhance decision-making.

Cross-Market Pair Trading

- Combining perpetuals with spot markets, options, or ETFs for hybrid strategies.

- Combining perpetuals with spot markets, options, or ETFs for hybrid strategies.

Institutional Adoption

- Hedge funds deploy pair trading systems for perpetual futures to diversify risk-neutral strategies.

- Hedge funds deploy pair trading systems for perpetual futures to diversify risk-neutral strategies.

Images for Better Understanding

Visual representation of long-short pair trading strategy in perpetual futures

Using statistical models to identify trading opportunities between correlated futures

Risk analyst managing long/short exposure in perpetual futures pair trades

FAQs on Pair Trading Solutions for Perpetual Futures

1. What is the minimum capital required for pair trading perpetual futures?

It depends on the exchange margin requirements. Typically, traders need \(1,000–\)5,000 to start, but institutional strategies may require millions for scalability.

2. Can pair trading in perpetual futures be automated?

Yes. Many traders use Python, C++, or proprietary platforms to run pair trading algorithms in perpetual futures. Automation reduces human error, increases execution speed, and allows 24⁄7 trading.

3. What risks should traders be aware of?

- Correlation Breakdown: Pairs may decouple during high volatility.

- Exchange Risk: Downtime or liquidation issues may impact both legs.

- Funding Costs: Unexpected rate changes can erode profits.

Conclusion

Pair trading solutions for perpetual futures have become essential for both retail and institutional traders. By using strategies like statistical arbitrage, funding rate arbitrage, and cross-exchange trading, investors can capture relative value opportunities in volatile crypto markets while managing downside risks.

In 2025, the most effective approach combines quantitative modeling with automation. For traders aiming to build sustainable long-term alpha, pair trading provides a balance of profitability, risk management, and adaptability.

If you found this guide useful, share it with fellow traders, leave your insights in the comments, and join the conversation on innovative pair trading solutions for perpetual futures.